Image: Visa continues to rake in the free cash flow. Though its outlook is clouded somewhat by recovering cross-border travel transaction volumes, we still like its asset-light, free-cash-flow rich business model.

By Brian Nelson, CFA

It’s easy to lose sight of everyday life when we hear stories about the latest and greatest cryptocurrency or the next iteration of yet another ETF that centers on one theme or another, but when we take a step back, almost all of us are still using and continuing to use one of a few payment options. Maybe it’s your Visa (V) Card, your Mastercard (MA), Discover (DFS) Card, American Express (AXP) Card, Capital One Financial (COH) Card or perhaps PayPal (PYPL), Stripe, or Square (SQ), or another variation or supporting technology thereof. Maybe you’re even using cold hard cash.

From our perspective, we’re a long-time away from cryptocurrency going mainstream, if it ever does. For one, most consumers don’t know how to purchase Bitcoin (even if they wanted to), whether to call it Ether or Ethereum, the silly origins of Dogecoin or Shiba Inu coins, or even how to set up a “crypto wallet.” For many that do know all about crypto, one still can’t simply go to the gas station to purchase gasoline with it, or go to the grocery store to use it to pay for milk and bread.

I own a little Bitcoin and some BITO to learn the in’s and out’s of the crypto business, but I think many traditional financial technology (“fintech”) companies are far more attractive. For starters, many of the fintech companies are working hard to integrate crypto into their services, so while speculators are hoping for the next “greater fool” to buy the next “coin” that is “pumped” on social media, we view many fintech plays as having “call options” on future crypto adoption without the risk of betting the farm on any one token’s success, or even widespread crypto adoption at all.

For example, a couple of our favorite fintech plays that we include in the Best Ideas Newsletter portfolio are Visa and PayPal. Both of these entities have rock-solid foundations with respect to their existing businesses and likely won’t be disrupted by crypto innovation as they embrace the technologies, themselves. For example, in July 2021, Visa noted that it would partner “with over 50 crypto companies to allow clients to spend digital currencies,” while earlier this year in March, PayPal launched “Checkout with Crypto.” The cryptocurrency markets may be fast-moving, but Visa and PayPal are paying very close attention.

Visa’s Quarterly Results Not Bad

On Tuesday, October 26, Visa reported excellent fourth-quarter results for fiscal 2021 (ends September 30), with net revenues advancing 29% and GAAP net income increasing to $1.65 per share, both figures exceeding the consensus forecast. On a full-year basis, net revenues increased 10%, while GAAP net income leapt 13%. ‘Payments Volume’ and ‘Processed Transactions’ accelerated in the fourth quarter versus the full-year numbers, which came in at 16% and 17%, respectively. Overall, we thought Visa did a pretty good job during a fiscal year with many ups and downs. Here’s what CEO Alfred F. Kelly, Jr. had to say about the results in the press release:

In a relatively tumultuous fiscal 2021, Visa delivered strong fourth quarter and full-year results, with double-digit net revenue, net income and EPS growth. Our performance was driven by the continuation of the recovery in many global economies and the increased diversification of our revenue with new flows and value added services. Looking ahead, Visa is even better positioned for the future as cross-border travel recovers and we continue to drive the rapid growth of digital payments and enable innovation in money movement globally.

Though we liked the quarterly results at Visa, the company noted on the conference call that while cross-border travel is recovering well, progress is rather slow and that it will likely not reach levels of 2019 until the summer of 2023. The market didn’t like the news, sending the fintech space lower after the report, with many growing even more cautious following Mastercard’s third-quarter financial results, released a couple days later. Mastercard noted “solid growth in cross-border spending which has recently returned to pre-pandemic levels,” but also reiterated that cross-border travel is only about 77% of 2019 levels. It’s possible Visa is just being conservative with its timetable.

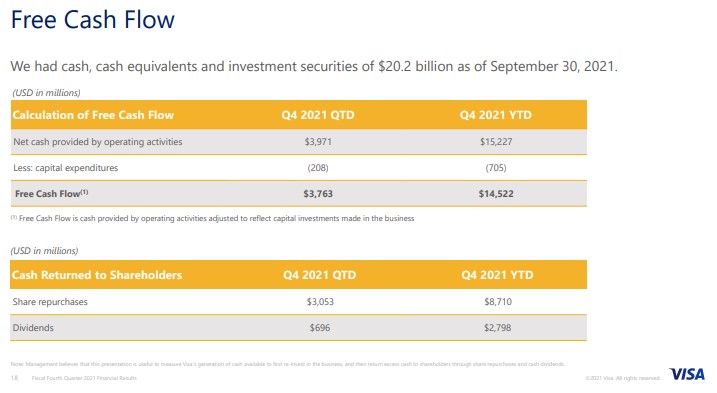

Visa ended its fiscal 2021 with ~$16.5 billion in cash and cash equivalents, another ~$0.9 billion in restricted cash, and ~$3.7 billion in investment securities against long-term debt of ~$20 billion and current maturities of debt of ~$1 billion. Though Visa does have a modest net debt position, we continue to like its tremendous free cash flow generation and asset-light business model. For example, during fiscal 2021, capital spending dropped to $705 million from $736 million, while operating cash flow surged to $15.2 billion from $10.4 billion a year-ago.

Concluding Thoughts

Cryptocurrency trading is all the rage these days, but when it comes down to it, the average consumer isn’t using crypto to pay for everyday goods and services. We believe fintech is a great way to play the firm foundations of asset-light, free-cash-flow generating entities that are exposed to crypto adoption but not pure plays to crypto’s success, which is far from guaranteed. Cloudy outlooks between Visa and Mastercard regarding cross-border travel activity have many fintech investors somewhat cautious heading into 2022, but we couldn’t be bigger fans of the group. Visa and PayPal remain two of our favorite fintech ideas.

Tickerized for V, MA, DFS, AXP, COF, PYPL, SQ, ADS, SYF, FISV, GPN, GBTC, BITO, BTF, COIN, BKKT, BKNG, TRIP, EXPE

———-

Image Source: Value Trap

———-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.