Image Source: Fastenal Company – Third Quarter of 2021 IR Earnings Presentation

By Callum Turcan

On October 12, Fastenal Company (FAST) reported third quarter 2021 earnings that beat top-line consensus estimates and matched bottom-line consensus estimates. The company’s latest earnings report reinforces our thesis that the US economy is continuing to recover from the worst of the coronavirus (‘COVID-19’) pandemic. In 2020, Fastenal generated over 85% of its total sales in the US. Fastenal provides products and services in the decentralized maintenance, repair & operation (‘MRO’) industry, a space where the company attempts to gain an advantage over distribution by locating its operations as close as possible to the economic point of contract with its customers.

Earnings Update

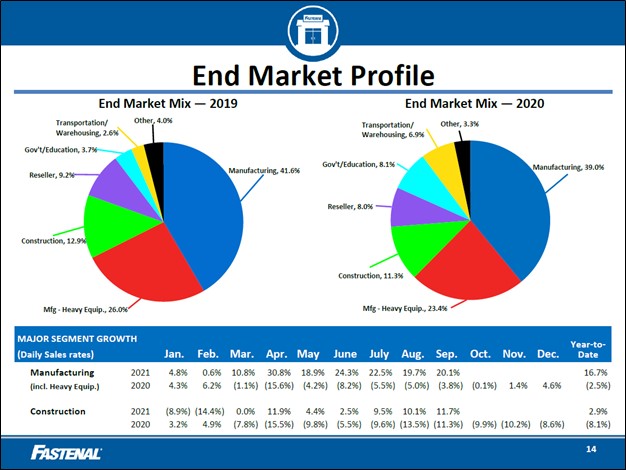

Within its earnings press release, Fastenal reported that underlying demand for construction and manufacturing equipment and supplies came in quite strong. Fastenal’s GAAP revenues grew 10% year-over-year, hitting roughly $1.55 billion last quarter. However, demand for personal protective equipment (‘PPE’) and related offerings in the wake of the COVID-19 pandemic last year surged, though this demand appears to be cooling off in the wake of widespread vaccine distribution efforts. Management had this to say during Fastenal’s third quarter earnings call (emphasis added, lightly edited):

“As indicated, our sales were up 10% in the third quarter of 2021, which includes up 11.1% in September. The period still had some difficult COVID-related comparisons with government customers down 40.4% and safety and janitorial products being down 2.9% and 15.4% respectively in the third quarter of 2021. As a result, we believe that total growth for the quarter understates the strength we are experiencing in our traditional manufacturing and construction customers…

On the product side, this is also well demonstrated by our 20.2% growth in fasteners, with sales of our other product segment, excluding janitorial, was also up 16.8%. In safety, sales of vented safety products, which removes from both periods direct shipped, typically COVID-related, products were up 28.5%. National account sales were up 16.8%. And while our smaller accounts were only up 2.2%, if we adjust for the government, our remaining customers would have been up 11.7%.

So bottom line, we continue to experience broad strength in our traditional markets, consistent with macro data points, such as PMI and industrial production. Pricing contributed 230 to 260 basis points to growth in the third quarter of 2021, up from 80 – 110 basis points in the second quarter.” — Holden Lewis, Executive Vice President and CFO of Fastenal

Fastenal noted that cost inflation headwinds from rising material costs (including steel prices) and transportation expenses (with an eye towards rising fuel expenses and overseas shipping rates) were being offset via pricing increases and greater labor efficiency (particularly compared to year-ago levels when the pandemic stymied its operational performance). Last quarter, Fastenal’s GAAP gross margin rose by ~100 basis points year-over-year, hitting approximately 46.3%. Rising healthcare and travel costs were cited as additional concerns on the inflationary front. Improving economies of scale lent support to its margin performance last quarter.

The firm is doing a solid job navigating inflationary headwinds and logistical hurdles while maintaining its financial performance. Fastenal’s GAAP gross margin expansion helped the company to keep its GAAP operating margin broadly flat year-over-year at 20.5% last quarter, as its GAAP operating income climbed higher 10% year-over-year. Looking ahead, Fastenal’s management team noted that “further price actions may also be necessary for the fourth quarter of 2021” during the firm’s latest earnings call. As it concerns its own supply chain and internal inventory management activities, Fastenal’s management team recently noted that the firm “expect[s] an inflow of imported products in the fourth quarter of 2021, and the first quarter of 2022” which will support the company’s ability to meet demand in the near term.

Operational Update

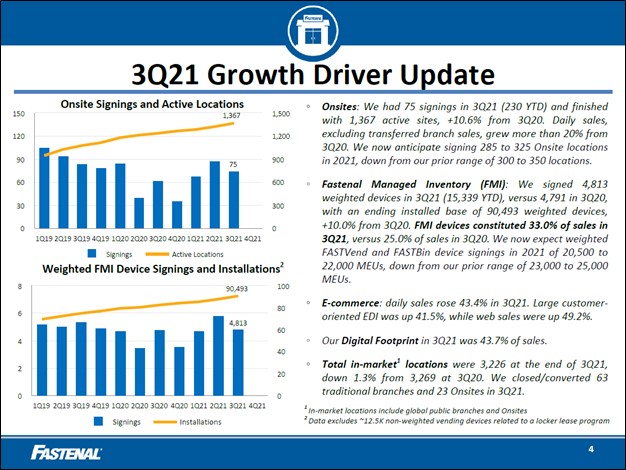

Fastenal noted that its daily e-commerce sales rose over 43% year-over-year in the third quarter of 2021, which “includes sales made through an electronic data interface (‘EDI’) with our customers or through the web.” The company’s e-commerce business represented roughly 14% of its total sales last quarter. As it concerns Fastenal’s more expansive ‘Digital Footprint’ which also factors in sales generated via its Fastenal Managed Inventory (‘FMI’) platform, its Digital Footprint represented just under 44% of its total sales last quarter.

Fastenal’s past digital initiatives are paying off, though we want to stress that a core part of the company’s offering rests on being located close to its customer and offering a portal that provides its customer base with a one-stop shop experience in a highly decentralized and complex industry. The firm’s ‘Onsite’ locations are a prime example of this strategy in action. In short, its Onsite offering involves allocating a dedicated team to meet a customer’s supply chain needs by integrating that team within its customer’s operations. Last quarter, Fastenal signed 75 new Onsite locations. During the first three quarters of 2021, the firm signed 230 new Onsite locations. At the end of September 2021, Fastenal had over 1,365 Onsite locations with room for upside.

While Fastenal modestly lowered its projected Onsite signings for all of 2021 (down to 285-325 from 300-350 previously) in conjunction with its latest earnings report, the firm still expects to add ~70 new Onsite locations to its operations this quarter at the midpoint of guidance. The company has also done a stellar job growing the footprint of its FMI offering, as one can see in the upcoming graphic down below.

Image Shown: Fastenal’s reach continues to grow as it further integrates its supply chain solutions and MRO offerings with the operations of its customer base. Image Source: Fastenal – Third Quarter of 2021 IR Earnings Presentation

During the first nine months of 2021, Fastenal generated $0.5 billion in free cash flow and spent roughly the same amount covering its dividend obligations (Fastenal’s free cash flows fully covered its dividend payouts with a negligible amount of “excess” free cash flow to spare during this period). Fastenal exited September 2021 with a net debt load of $0.1 billion (inclusive of short-term debt). We view its debt burden as manageable given its solid cash flow generating abilities, keeping in mind its net operating cash flows were weighed down by negative working capital movements during the first three quarters of this year.

Concluding Thoughts

We recently updated our cash flow models covering the Industrials universe, and those updated models can be viewed here. Our updated fair value estimate for Fastenal sits at $53 per share and the top end of our fair value estimate range sits at $66 per share. After Fastenal’s latest earnings report, shares of FAST initially climbed higher, and we see room for further capital appreciation upside. The company’s Dividend Cushion ratio sits well above parity (at 1.5), earning Fastenal a “GOOD” Dividend Safety rating, and we view its payout growth trajectory quite favorably, earning it a “GOOD” Dividend Growth rating. As of this writing, shares of FAST yield ~2.1%.

Downloads

Fastenal’s 16-page Stock Report >>

Fastenal’s 2-page Dividend Report >>

—–

Industrial Leaders Industry – MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Also tickerized for holdings in the XLI.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT) and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Long put options on the SPDR S&P 500 ETF Trust (SPY) with an expiration date of December 31, 2021, and strike price of $412 are included in both the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.