Image Shown: Visa Inc is a stellar free cash flow generator and is included as an idea in our Best Ideas Newsletter portfolio. Image Source: Visa Inc – Third Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

We’re huge fans of the payment processing and payment solutions space. This industry is supported by secular growth tailwinds due to the global shift away from cash-to-card and card-not-present (e.g. online purchases) purchase options, and the ongoing proliferation of e-commerce. Furthermore, companies in this space benefit immensely from the network effect, which creates an economic moat for their business.

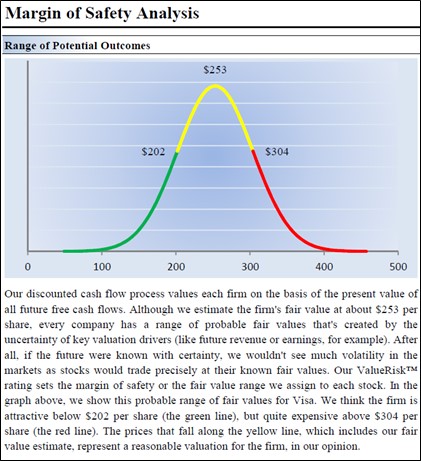

These companies are incredibly lucrative with relatively high operating margins and impressive free-cash-flow generating abilities, aided by their relatively modest capital expenditure requirements to maintain a certain level of revenues. We include payment networks giant Visa Inc (V) as a “top-weighted” idea in the Best Ideas Newsletter portfolio and view its capital appreciation upside quite favorably, with the top end of our fair value estimate range sitting at $304 per share of Visa.

Image Shown: Our fair value estimate for Visa sits at $253 per share with room for upside as the top end of our fair value estimate sits at $304 per share.

Financial and Operational Snapshot

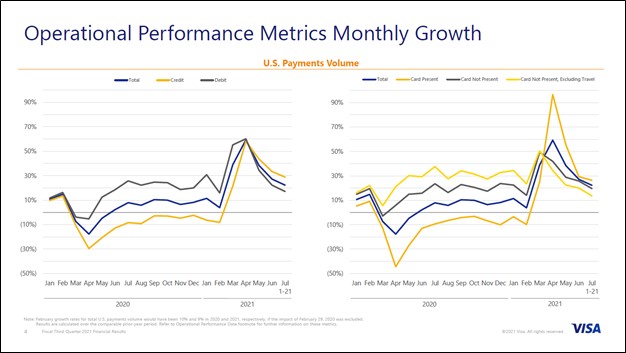

During the first three quarters of Visa’s fiscal 2021 (period ended June 30, 2021), the company’s GAAP revenues and GAAP operating income both grew roughly 5% year-over-year as its business steadily recovered from the worst of the coronavirus (‘COVID-19’) pandemic. In the upcoming graphic down below, Visa highlights the improvements in its US payment volumes seen since the start of its fiscal 2021 (which began back in October 2020) with growth at its debit and credit card businesses coming in quite strong of late.

Image Shown: Visa’s domestic payment volumes have staged an impressive recovery over the past several months. Image Source: Visa – Third Quarter of Fiscal 2021 IR Earnings Presentation

Please note that its recovering domestic credit card payment volumes speak favorably towards Visa’s future financial performance, as this part of its business is more lucrative than its debit card business. Furthermore, growth at Visa’s domestic card-not-present payment volumes continue to come in strong, while its card-present volumes have staged an impressive comeback since the early part of calendar year 2021 in the wake of lockdown measures easing. This indicates Visa is performing well across both physical and digital store platforms.

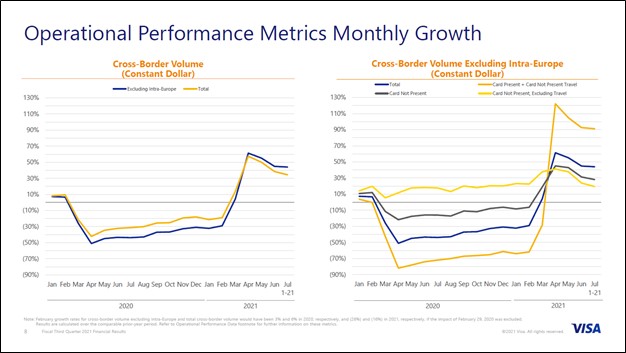

On a cross-border basis, Visa’s business is steadily recovering on this front, too, as one can see in the upcoming graphic down below. Variants of the COVID-19 pandemic and the chance for renewed lockdowns loom large over this segment of Visa’s business, which is one of its most lucrative, though widespread vaccine distribution efforts should eventually see cross-border travel resume in earnest (including business and leisure travel). A recovery in cross-border travel in Europe would go a long way in bolstering Visa’s financial and operational performance, as would a resumption of business conferences worldwide.

Image Shown: Visa’s international and cross-border business is steadily recovering, though headwinds from variants of the COVID-19 pandemic remain. Image Source: Visa – Third Quarter of Fiscal 2021 IR Earnings Presentation

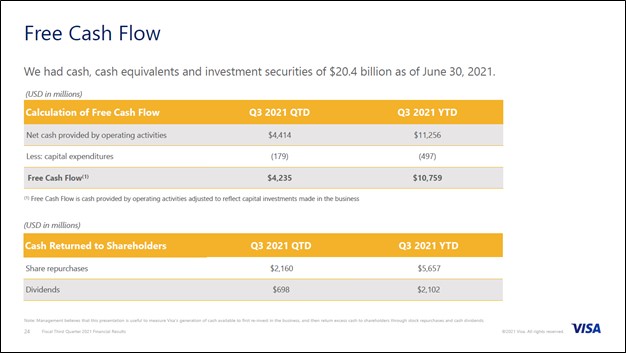

Visa generated $10.8 billion in free cash flow during the first three quarters of fiscal 2021, up from $7.8 billion during the same period the prior fiscal year, while spending $2.1 billion covering its dividend obligations and another $5.7 billion buying back its Class A common stock during this period. We will stress that Visa’s capital expenditure requirements to maintain a certain level of revenues are rather low as it spent just $0.5 billion on its capital expenditures while generating $11.3 billion in net operating cash flow and $17.5 billion in GAAP revenues during the first three quarters of fiscal 2021.

At the end of June 2021, Visa had a net debt load of ~$0.6 billion (exclusive of restricted cash, inclusive of both its current and non-current ‘investment securities’ line-items which are represented by cash-like assets) and no short-term debt on the books. The company’s cash and cash-like position stood at $20.4 billion at the end of June 2021, providing Visa with ample financial firepower to continue boosting its dividend while buying back its stock going forward. We view Visa’s share repurchases, on both a historical and forward-looking basis, quite favorably given that shares of V have been trading well below our fair value estimate for some time and continue to do so as of this writing.

Installment Payment Considerations

The rise of the “buy-now, pay-later” (‘BNPL’) trend will have mixed effects on Visa’s business but overall, in our view, we see the proliferation of BNPL installment payment plans as a net positive of the company. Here, we must stress that Visa is a payment network operator and does not take on credit risk, meaning the credit risk of BNPL offerings does not affect Visa in a meaningful or direct way.

In the event BNPL options prompt consumers to make purchases that they might not otherwise make, that could support Visa’s outlook by providing a tailwind for its payment processing volumes. Additionally, if consumers make larger purchases that they might not otherwise make, that could support Visa’s outlook as well assuming these transactions are conducted through its payments network.

The only real downside here comes potential payment processing opportunities gravitating towards fintech companies that offer BNPL options and manage their own payment networks, particularly in the event those firms require users that want to take advantage of their installment payment plans to use their payment networks instead of Visa’s. However, we will stress that this risk remains highly marginal and does not have a material impact on our view towards Visa.

Concluding Thoughts

Due to uncertainties created by the COVID-19 pandemic, Visa is not providing guidance for fiscal 2021 at this time. The company’s outlook still appears quite bright given its exposure to the proliferation of e-commerce and the upside created by the gradual reopening of the global economy, and most importantly, the eventual resumption of cross-border travel. We continue to be huge fans of Visa and its immense capital appreciation upside. Shares of V yield ~0.6% as of this writing, and its modest dividend offers incremental upside to its capital appreciation potential.

On a final note, we remain huge fans of PayPal Holdings Inc (PYPL) and include shares of PYPL as an idea in our Best Ideas Newsletter. To read more about why we like PayPal, please check out this article here.

Visa

Visa’s 16-Page Stock Report >>

Visa’s Two-Page Dividend Report >>

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for AFTPY, PYPL, SQ, V, MA, COIN, FIS, BILL, GPN, FISV, GBTC, PNQI, IYJ, IPAY, FINX

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.