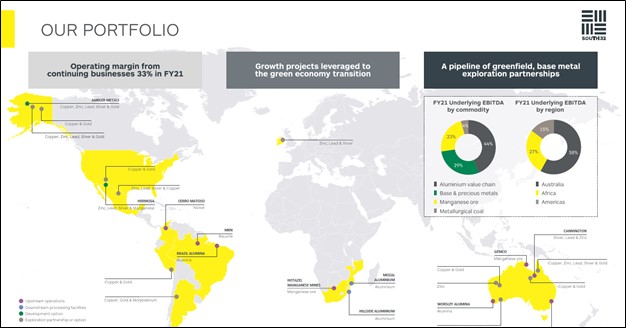

Image Shown: An overview of South32’s global asset base. We are big fans of the Australian miner. Image Source: South32 – Fiscal 2021 IR Earnings Presentation

By Callum Turcan

Back in 2015, the mining giant BHP Group Ltd (BHP) spun off South32 (SOUHY). Since then, South32 has seen some major changes to its asset base through a combination of acquisitions, divestments, and organic investments. We include shares of South32’s American depository receipts (‘ADRs’) as an idea in the new ESG Newsletter portfolio (more on that here). Each ADR represents five ordinary shares of South32.

South32 is based in Perth, Australia, and we’re huge fans of its pristine balance sheet, stellar free cash flow generating abilities, top-notch asset base, and bright growth outlook. The miner pays out a variable dividend and offers investors meaningful capital appreciation upside potential as well.

Financial Snapshot

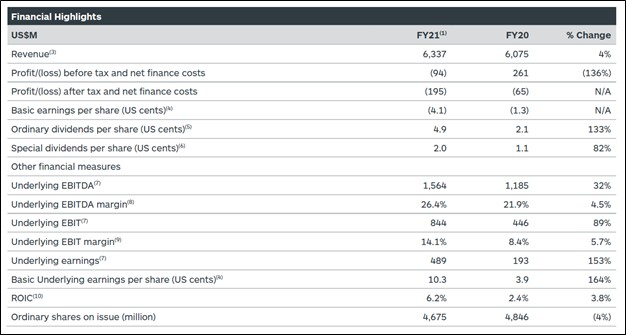

Keeping in mind the company’s fiscal year ends in June, South32 posted a strong rebound in its financial performance in fiscal 2021 versus fiscal 2020 as the company put the worst of the coronavirus (‘COVID-19’) pandemic behind it, as one can see in the upcoming graphic down below. Its return on invested capital (‘ROIC’) metric more than doubled year-over-year, albeit off a low base, as its underlying EBIT and EBITDA margin improved considerably during this period.

Image Shown: South32’s financial performance improved considerably in fiscal 2021 versus fiscal 2020 levels. Image Source: South32 – Fiscal 2021 Results and Outlook IR Presentation

Looking forward, recent improvements in South32’s asset base combined with elevated commodity prices of late should help the miner’s financial performance continue to trend in the right direction, aided by fading headwinds from the pandemic. Please note that the firm’s revenues only grew modestly in fiscal 2021 on a year-over-year basis, as operational improvements were key to facilitating the company’s financial turnaround. The prices for commodities such as aluminum, manganese, lead, zinc, and other raw materials have surged higher during the past year and that speaks quite favorably towards South32’s outlook.

In fiscal 2021, South32 generated ~$0.85 billion in free cash flow (defining capital expenditures as purchases of PPE plus net exploration expenditures) while spending $0.3 billion buying back its stock along with $0.1 billion covering its dividend obligations. Back in fiscal 2020, South32 generated ~$0.65 billion in free cash flow. One of the things we really appreciate about this miner is that South32 has the capacity to generate sizable free cash flows in almost any operating environment. The company expects its capital expenditures across its business and equity investments will be broadly flat in fiscal 2022 versus fiscal 2021 levels, supporting its near term free cash flow outlook.

Please note that should South32 move forward with its major growth developments in Arizona and Alaska, which we will cover later in this article, that would pressure its free cash flow generating abilities in the medium-term due to the related increases in its capital expenditure expectations.

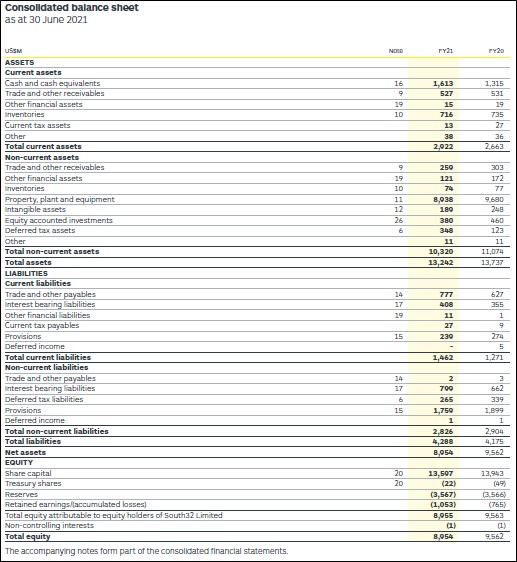

Image Shown: We are impressed with South32’s free cash flow generating abilities. Image Source: South32 – Fiscal 2021 Annual Report

At the end of fiscal 2021, South32 had a net cash position of $0.4 billion (inclusive of short-term debt). We would like to stress that given the inherently volatile nature of the mining industry, having a net cash position is a major source of strength in any operating environment, especially as many of South32’s peers are heavily indebted (i.e. have large net debt positions).

Image Shown: South32 has a pristine balance sheet. Image Source: South32 – Fiscal 2021 Annual Report

Operations Overview

South32 exited the thermal coal space by effectively agreeing to pay Seriti Resources $0.2 billion over the next decade to cover environmental liabilities; it also sold its South Africa Energy Coal unit and set up a $0.05 billion facility to help fund the restructuring of certain uneconomical mining operations. The divestment closed in June 2021, a couple years after South32 announced the asset sale back in 2019 in return for a portion of the future cash flows of the business over a given period. South32 is not looking back.

The company now focuses on producing bauxite, alumina, aluminum, metallurgical coal (used in the steel making process), manganese, nickel, silver, lead, and zinc. For reference, bauxite is a sedimentary rock that has a relatively high aluminum content, and a meaningful amount of gallium content as well. Gallium is primarily used in semiconductors, electronic circuits, and light-emitting diodes (‘LED’). South32 is well-positioned to capitalize on the rise of electric vehicles (‘EVs’), with an eye towards its bauxite, alumina, aluminum, manganese, and nickel operations.

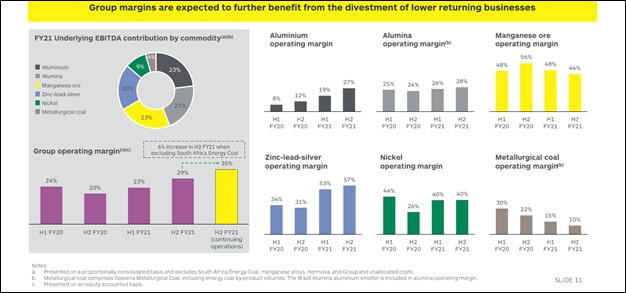

Image Shown: An overview of the operating margin performance of South32’s various divisions over the past two fiscal years. Image Source: South32 – Fiscal 2021 IR Earnings Presentation

Aluminum is a lightweight metal used in the chassis and other structural components of EVs to keep the weight of these vehicles down versus similar offerings made from steel, which in turn supports the travel range of EVs. Nickel is a key component in the lithium-ion batteries that power EVs, and Tesla Inc (TSLA) has more recently been placing a great emphasis on utilizing manganese in EV batteries going forward. Aluminum is also used in some EV battery designs and related components.

South32 continues to optimize its asset base. That strategy included divesting its economic stake in Tasmanian Electro Metallurgical Company’s (‘TEMCO’) manganese alloy smelter through a deal announced back in August 2020. Additionally, South32 also sold off a package of mineral royalties, namely gold royalties, to Elemental Royalties Corp (ELEMF) in a cash-and-stock deal announced back in November 2020. In South Africa, South32 has placed its Metalloys manganese alloy smelter on care and maintenance.

Outlook

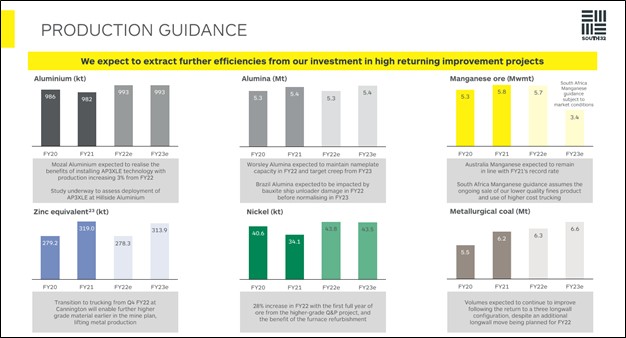

Looking ahead, the miner expects its aluminum, alumina, and nickel production will remain stable or grow through fiscal 2023. Its metallurgic coal output is expected to move significantly higher as steel remains the backbone of modern society, with an eye towards expected demand growth in South and Southeast Asia over the coming years and decades. Recent reductions in Chinese steel production have largely been due to the country seeking to contain its emissions, though the country’s steel production remains up year-over-year from January-August 2021. As it concerns its manganese production, South32 has communicated that it intends to shed less profitable operations to improve its financial performance, though its Australian manganese production is expected to come in strong over the coming years.

Image Shown: South32’s production outlook over the next couple of fiscal years. Image Source: South32 – Fiscal 2021 IR Earnings Presentation

Two Key Projects

Beyond its production operations and the tailwind elevated commodity prices should provide the company’s financial performance, South32 has two key projects on which to capitalize. South32’s long-term growth runway is underpinned in part by the resources these two projects may extract over the coming decades.

In 2018, South32 spent $1.3 billion acquiring the remaining stake in Arizona Mining that it did not already own to gain access to the Hermosa project in Arizona. This project aims to develop the Taylor and Clark deposits that are home to ample zinc, manganese, and silver oxide resources.

South32 formed a joint venture with Trilogy Metals Inc (TMQ) in 2020 by exercising its right to acquire a 50% economic interest in the Upper Kobuk Mineral Projects in Alaska’s Ambler metals region and contributing ~$0.15 billion to the venture. This project is targeting vast copper, zinc, and some gold resources.

We are intrigued by the upside both projects offer South32, though please note that neither endeavor has been sanctioned yet. Here is what South32’s management team had to say on these two projects during the miner’s latest earnings call:

“In terms of our future developments, hope that at Hermosa, work continues to progress the studies for both Taylor and Clark. At Ambler Metals, we committed to summer field sales and drilling program and continued the [pre-feasible study] for the Arctic deposit.” — Graham Kerr, CEO of South32

South32 possesses the financial capacity to move forward with these projects should the company decide to do so. First assay results from its exploration program in the Ambler metals region is expected during the first half of South32’s fiscal 2022.

Concluding Thoughts

South32 is a top-tier miner with a stellar asset base, pristine financials, and great growth outlook. There is a lot to like about South32, and the company has extensive exposure to the proliferation of EVs and the “green energy revolution,” while also having exposure to the global rebound in the industrial economy from the worst of the COVID-19 pandemic.

We like shares of SOUHY as an idea in the new ESG Newsletter portfolio. On a final note, South32 recently committed to cutting its emissions (Scope 1 and Scope 2 specifically) substantially through 2035 from 2021 levels and achieving net zero emissions by 2050, which should make South32 more appealing to funds focused on investment opportunities in the realm of sustainability and green energy.

—–

Mining & Chemicals Industry – APD, DD, EMN, ECL, LYB, PPG, BHP, FCX, NEM, RIO, VALE, WPM, CMP, AA, KALU, MLM, VMC, NUE, CSL, SON, ALB, FUL, ATR, GGG, SHW

Tickerized for BHP, SOUHY, ELEMF, TMQ, TSLA, RIO, VALE, FCX, BVN, HBM, GLCNF, GLNCY, AAUKF, NGLOY, FQVLF, ANFGF, FSUMF, TECK, AA, X, MT, TX, NUE, STLD, SCHN, TS, CLF, SCCO, CDE, HL, CENX, ARNC, COPX, CPER, JJCTF, JJC, JJN, XLB

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today