Image Source: Albemarle Corporation – May 2021 IR Presentation

By Callum Turcan

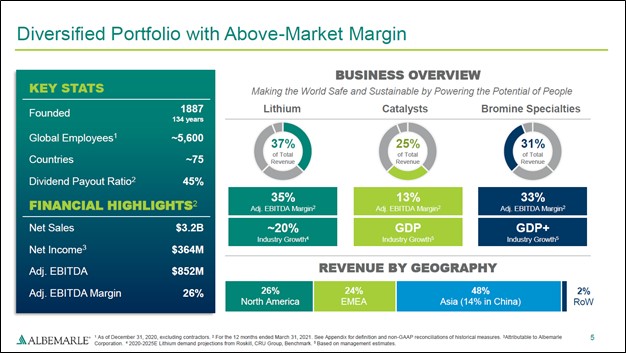

Dividend Aristocrat Albemarle Corporation (ALB) is a specialty chemicals company with three core business operating segments; ‘Lithium’ (primarily used for battery storage solutions), ‘Catalysts’ (primarily used in the oil refining industry), and ‘Bromine Specialties’ (primarily used as flame retardants). The company is focused on aggressively growing its lithium derivatives operations going forward, Albemarle’s largest in terms of revenues and most profitable in terms of non-GAAP adjusted EBITDA performance. Let’s learn more about this fascinating company.

Image Shown: An overview of Albemarle’s business profile. Image Source: Albemarle – May 2021 IR Presentation

Lithium Prices Are on the Rise

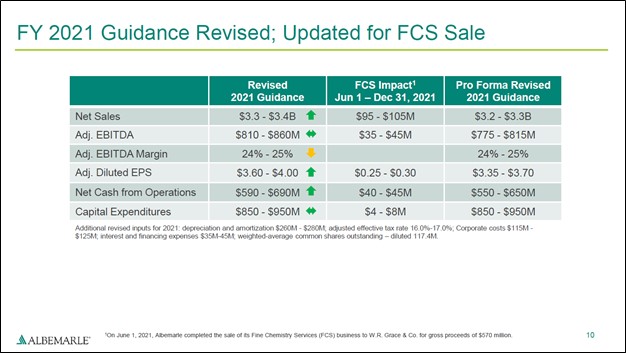

During the final quarter of 2020, Albemarle sold its economic stake in the Saudi Organometallic Chemicals Company LLC (‘SOCC’) for ~$0.01 billion in cash proceeds (and recorded a modest gain on the sale). In June 2021, Albemarle completed the sale of its Fine Chemistry Services (‘FCS’) business to W. R. Grace and Company (GRA) for $0.6 billion in total considerations (including a $0.3 billion cash component and $0.3 billion component consisting of preferred equity in a subsidiary of W. R. Grace). Back in 2018, Albemarle sold off its polyolefin catalysts and components portion of its Performance Catalysts Solutions (‘PCS’) business for $0.4 billion in cash to W. R. Grace.

On the acquisition front, Albemarle acquired a 60% interest in Mineral Resources Limited’s (MALRF) Wodgina spodumene mine in Western Australia in 2019 for $0.8 billion in cash and the transfer of a 40% economic interest in two lithium hydroxide conversion trains that Albemarle is building in Western Australia. The total value of the deal with Mineral Resources was pegged at roughly $1.3 billion. Spodumene is utilized as an ore for lithium and represents a key part of the electric vehicle (‘EV’) battery supply chain.

Prices for lithium hydroxide and lithium carbonate (lithium derivatives) have surged higher during the past several months, according to data cited by the WSJ from Benchmark Minerals in early September 2021 and data from Refinitiv Eikon cited by Reuters in June 2021.

According to management commentary given during Albemarle’s second-quarter 2021 earnings call, construction at the first Australian facility (Kemerton I) is expected to be completed by the end of 2021 and construction at the second (Kemerton II) is slated to be completed by the end of the first quarter of 2022. Commercial production from these facilities is expected to commence in 2022, and 100% of the output will be marketed by Albemarle (the firm has a 60% economic interest in the venture).

Albemarle had slowed development activities to preserve capital when the coronavirus (‘COVID-19’) pandemic emerged in 2020, though it has since resumed development activities in earnest, prioritizing the Kemerton I facility to bring it online at a time when lithium derivatives prices are quite dear.

Image Shown: Albemarle has major lithium developments in Australia and Chile that when completed, are expected to drive its lithium derivatives production volumes significantly higher. Image Source: Albemarle – Second Quarter of 2021 IR Earnings Presentation

Another key lithium development Albemarle is working on includes the La Negra III/IV lithium carbonate production facilities in Chile. Construction activities have been completed and the facilities are expected to begin commercial production in the first half of 2022. Back in 1984, Albemarle began to produce lithium carbonate at the site and by 1998, a lithium chloride plant was brought online in the area. Since then, Albemarle has continued to invest heavily in the region, and its operations in the area produce lithium derivatives from brine in the Salar de Atacama salt flat.

Financial Update

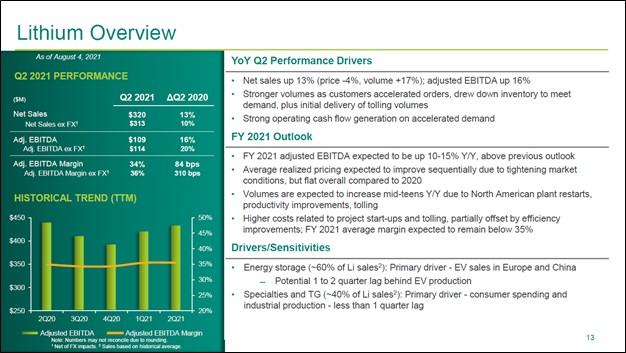

Prices for lithium derivatives plummeted in 2020 and have only more recently begun to recover in earnest, meaning that weaker prices weighed on Albemarle’s financial performance during the first half of 2021 (particularly when it comes to year-over-year comparisons). Looking ahead, rising lithium derivatives pricing combined with higher production volumes seen of late supports the financial outlook of Albemarle’s lithium business, and should provide a major catalyst to its company-wide financial performance going forward.

Image Shown: The financial performance of Albemarle’s lithium segment is expected to stage a meaningful recovery this year versus 2020 levels, aided volume growth and more favorably pricing for lithium derivatives seen of late. Image Source: Albemarle – Second Quarter of 2021 IR Earnings Presentation

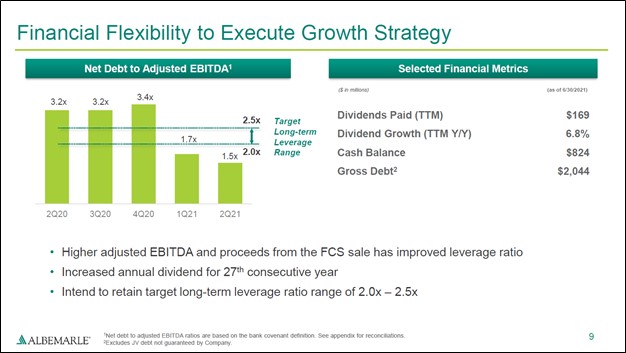

In February 2021, Albemarle raised $1.5 billion through a secondary equity offering to fund its growing capital expenditure expectations in the coming years while keeping in line with its long-term leverage ratio of 2.0-2.5x (defined as net debt to non-GAAP adjusted EBITDA). With these cash proceeds and its recent divestment proceeds, Albemarle has the funds to invest heavily in its capital-intensive lithium business.

Albemarle expects to spend $0.85-$0.95 billion on its capital expenditures in 2021 (up somewhat from the approximately $0.85 billion spent on capital expenditures in both 2019 and 2020) while generating $0.55-$0.65 billion in net operating cash flow on a pro forma basis (taking recent divestment activity into account). The company is guiding to generate a moderate amount of negative free cash flow this year.

Image Shown: Albemarle’s financial position is supported by cash proceeds raised from a secondary equity offering and a recent divestment, providing the firm with the funds to bulk up its capital-intensive lithium business going forward. Image Source: Albemarle – Second Quarter of 2021 IR Earnings Presentation

Albemarle has already identified numerous lithium projects that the company intends to develop over the coming years. The trajectory of lithium derivatives prices will be key as Albemarle and other lithium players were burned when the previous lithium boom cycle went bust in 2018.

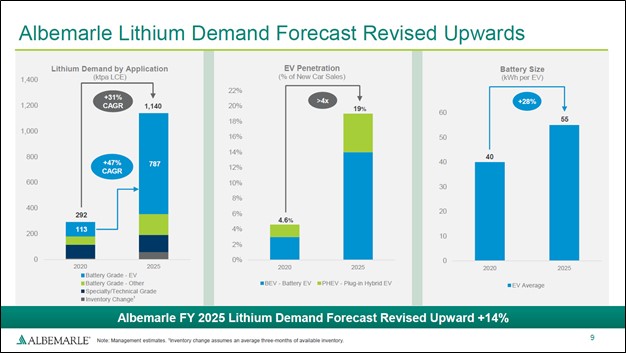

Image Shown: Albemarle’s lithium derivatives business is supported by its long growth runway, though the company’s ambitions on this front are subject to the inherent boom-bust cycle of commodities. Image Source: Albemarle – May 2021 IR Presentation

Outlook for Lithium Market

Over the coming years, Albemarle expects demand for lithium to surge higher on the back of rising demand for battery storage solutions (lithium-ion batteries in particular) that are used in EVs. During the January 2021 to August 2021 period, the vice minister of China’s Ministry of Industry and Information Technology estimated China sold 1.7 million new energy vehicles (‘NEVs’) according to comments at a recent industry conference cited by Reuters. That was up from 0.6 million in the same period a year-ago, and for reference, China’s total auto sales in unit volume terms were estimated to grow by 10% during this period. NEVs includes EVs and plug-in hybrids along with vehicles powered by hydrogen fuel cells.

Image Shown: Albemarle forecasts that demand for lithium will boom through the mid-2020s decade and beyond. Image Source: Albemarle – May 2021 IR Presentation

Albemarle, citing third-party data, estimates that 0.6 million EVs were produced in 2015, which rose to 3.4 million in 2020, and by 2025, believes that figure will rise to 15.3 million. Investments in EV charging infrastructure will be essential in making this growth trajectory possible, as will driving down production costs as government subsidies and other benefits will eventually fade.

Image Shown: Albemarle’s lithium growth ambitions are underpinned by the booming EV market. Image Source: Albemarle – May 2021 IR Presentation

Farther out, utilities (XLU) with large renewable energy power generation operations represent another major source of potential demand growth for lithium derivatives. Wind and solar power plants need battery storage solutions to keep supplying power to consumers when the wind isn’t blowing, and the sun is not shining, as these are intermittent sources of power. Utility-scale battery storage solutions are prohibitively expensive in many instances, though economies of scale and future technological innovations should help drive down prices over time.

Dividend Aristocrat

Albemarle is a Dividend Aristocrat that as of 2021 has boosted its annual payout the past 27 consecutive years, though shares of ALB yield a modest ~0.7% as of this writing. The company’s stock price has surged higher 150%+ the past year as of this writing. The top end of our fair value estimate sits at $247 per share of ALB, slightly above where shares of Albemarle are trading as of early September 2021. While management is prioritizing Albemarle’s investments in its business, we still expect the firm to steadily boost its dividend in the coming years, though at a modest pace.

We caution that Albemarle’s Dividend Cushion ratio is rather weak (near 0.0) due to its sizable capital expenditure expectations and net debt load. The company will need to retain access to capital markets to fund its dividend obligations, refinancing needs, and capital investment ambitions going forward. At the end of June 2021, Albemarle had a net debt load of $1.2 billion (inclusive of negligible short-term debt, exclusive of long-term ‘Investments’ that are primarily represented by strategic assets). The company generated a modest amount of negative free cash flow during the first half of 2021, highlighting why Albemarle tapped equity markets earlier this year.

During Albemarle’s second quarter of 2021 earnings update, management raised the company’s full-year 2021 guidance for several items (save for its expected non-GAAP adjusted EBITDA margin performance). Supply chain hurdles and headwinds from raw material pricing increases weighed somewhat on its guidance boost, which was largely offset by stronger expected performance from its Lithium business segment along with lower interest expenses and tax rates. However, there is a significant amount of noise here due to its recent divestment activity and the volatile nature of the commodities and chemicals business in general. As noted previously, Albemarle expects to generate negative free cash flows in 2021, though we forecast that the firm’s free cash flow generating abilities should improve in the coming years.

Image Shown: A look at Albemarle’s updated guidance as of the second quarter of 2021. Image Source: Albemarle – Second Quarter of 2021 IR Earnings Presentation

Here is what Albemarle’s management team had to say regarding the outlook for the firm’s Lithium business segment during the company’s second-quarter 2021 earnings call (emphasis added):

“Adjusted EBITDA for lithium is expected to increase by 10% to 15% over last year, an improvement from our previous outlook. Lithium volume growth is expected to be in the mid-teens on a percentage basis, mostly due to higher tolling volumes, as well as the restart of North American plants at the beginning of the year and improvements in plant productivity. Our pricing outlook is unchanged. We continue to expect average realized pricing to increase sequentially over the second half of the year, but to remain roughly flat compared to full year 2020.

We also continue to expect [adjusted EBITDA] margins to remain below 35%, owing to higher costs related to project start-ups and incremental tolling costs. Margin should improve, as the plants ramp up commercial sales volumes.” — Scott Tozier, Executive Vice President and CFO of Albemarle

We appreciate that Albemarle expects its lithium derivatives business to enter 2022 on the upswing. Management expects Albemarle’s realized lithium derivatives pricing will be flat in 2021 versus 2020, as relatively weak realized pricing during the first half of 2021 is offset via much stronger realized pricing in the second half. Furthermore, Albemarle expects to realize $75 million in productivity improvements in 2021 according to recent management commentary (the firm plans to build on this momentum in the coming years).

A combination of significant volume increases as its lithium developments in Australia and Chile achieve commercial production and stronger realized lithium derivatives prices, assuming the current trajectory holds, should provide Albemarle’s financials a powerful boost next year. Economies of scale, productivity gains, and the steady ramp in the production volumes of lithium derivatives should provide a further boost to Albemarle’s financial performance in the 2023+ period, though please note its business remains exposed to the boom-bust cycle of commodities pricing.

Concluding Thoughts

We are keeping an eye on the lithium industry as demand for battery storage solutions continues to soar. Lithium derivatives prices have surged higher in recent months, which is largely why shares of Albemarle have more than doubled over the past year. Albemarle offers investors a way to play both the ongoing EV boom and the recovery in global refined petroleum product demand (via its Catalysts business operating segment) as the world slowly emerges from the worst of the COVID-19 pandemic.

The company is getting ready to host its 2021 Investor Day event on September 10, and we expect management will provide further details on how Albemarle intends to grow its lithium operations over the coming years along with other key strategic updates. We, at Valuentum, are getting ready for the inaugural edition of our ESG Newsletter this September 15 and are incredibly exciting about the launch of this new product (more on that here).

Categories Member Articles