Image Shown: An overview of Chevron Corporation’s performance in the second quarter of 2021. We include shares of Chevron as an idea in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios and continue to be huge fans of the name as the global energy complex continues to recover from the worst of the coronavirus (‘COVID-19 pandemic). Image Source: Chevron Corporation – Second Quarter of 2021 IR Earnings Presentation

By Callum Turcan

We added shares of Chevron Corporation (CVX) as an idea to both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios back on June 27, 2021 (link here). The outlook for the global energy complex continues to improve significantly from the worst of the coronavirus (‘COVID-19’) pandemic, seen through the sharp increases in raw energy resources pricing year-to-date and the ongoing recovery in demand for refined petroleum products (such as gasoline and diesel) and various petrochemical products (includes plastics, lubricants, and many other products that are the building blocks for modern economies).

Additionally, with concerns over inflation growing (though we think these concerns, while valid, are a tad overblown), Chevron is well-suited to navigate a scenario where inflationary headwinds are sustained over the coming quarters and years. As of this writing, shares of CVX yield a nice ~5.3%. In our view, dividend growth opportunities represent the best way for investors to navigate potential inflationary hurdles going forward.

Earnings Update

On July 30, Chevron reported second quarter 2021 earnings that beat both consensus top- and bottom-line estimates. As noted previously, Chevron was a major beneficiary of the ongoing recovery in the global energy complex. In the second quarter of 2021, Chevron produced ~3.1 million barrels of net oil equivalent per day, broadly flat versus first quarter levels and up ~5% from levels seen in the second quarter of 2020.

Please note Chevron completed its all-stock acquisition of Noble Energy in October 2020, which had an enterprise value of ~$13 billion. This positively impacted its upstream production levels last quarter (upstream operations are responsible for extracting raw energy resources from the ground). As an aside, Chevron completed its acquisition of Noble Energy Midstream Partners LP in May 2021. In our Chevron’s Promising Cash Flow Growth Outlook article published July 13 (link here), we covered how Chevron’s acquisition of Noble Energy was expected to unlock significant synergies going forward (~$0.6 billion in run-rate before-tax synergies, double its previous guidance).

Capital Allocation Priorities and Balance Sheet Strength

Chevron also announced that it was resuming share repurchases during its latest earnings update, at an expected pace of $2.0-$3.0 billion per year. Our fair value estimate for Chevron under our “base” case scenario sits at $115 per share of CVX, comfortably above where Chevron is trading at as of this writing, with room for upside as the top end of our fair value estimate range sits at $144 per share of CVX. We view Chevron’s share repurchase strategy, in moderation, quite favorably given that shares of CVX are trading below their intrinsic value as of this writing.

However, we would also like to see Chevron’s balance sheet strength improve, and management noted during the firm’s latest earnings call that deleveraging activities were still a top priority. Specifically, management mentioned that in light of crude oil prices hovering north of $70 per barrel (likely a reference to Brent, the premier international crude oil pricing benchmark), Chevron would aim to drive its net debt-to-capitalization ratio down below its long-term target of 20%-25% in response to an analyst’s question on the subject during Chevron’s latest earnings call.

At the end of June 2021, Chevron’s net debt-to-capitalization ratio stood at ~21% according to recent management commentary. Chevron did not provide its latest balance sheet statement within its earnings press release, and we will have more to say on the firm when it publishes its 10-Q SEC filing covering the second quarter of 2021. The company did provide a cash flow statement in its earnings press release. Chevron generated $5.2 billion in free cash flow during the second quarter of this year while spending $2.6 billion covering its dividend obligations and $2.5 billion paying down its debt on a net basis. The company’s cash flow growth outlook is quite bright, in our view.

During the first half of 2021, Chevron generated $7.2 billion in free cash flow and spent $5.0 billion covering its dividend obligations. Over the past several years, Chevron has placed a great emphasis on controlling both its capital expenditures and its operating expenses, and those efforts are now starting to be reflected in its financial performance. The company recently lowered its capital expenditure expectations for 2021 which we appreciate, citing “lower spending at TCO [a upstream major development in Kazakhstan that Chevron participates in via its 50% stake in the joint-venture Tengizchevroil, abbreviated TCO] and greater capital efficiency across the portfolio” as the key reasons for the forecast revision.

Image Shown: Chevron’s past cost structure improvements and fiscal discipline are starting to have a powerful impact on its financials, seen through its performance of late. Image Source: Chevron – Second Quarter of 2021 IR Earnings Presentation

Chevron’s GAAP operating income more than doubled on a sequential basis in the second quarter of 2021, in part because of strong performance at its upstream divisions. Its US upstream unit posted $1.4 billion in segment-level profit last quarter, up from $0.9 billion in the first quarter, while its international upstream unit posted $1.7 billion in segment-level profit last quarter, up from $1.4 billion in the first quarter. However, we would like to stress that there is more to the story here.

The fading negative effects of the severe February 2021 Winter Storm Uri, which hit Texas and the surrounding region quite hard, also benefited Chevron last quarter. The company’s US downstream unit (refinery and petrochemical plant operations) posted segment-level profit of $0.8 billion in the second quarter of 2021, a significant improvement from the $0.1 billion segment-level loss incurred in the first quarter. Segment-level earnings at Chevron’s international downstream unit declined to less than $0.1 billion in the second quarter versus over $0.1 billion in the first quarter, as this part of its business contended with rising input prices, among other factors.

Permian Update

Stretching across southeastern New Mexico and West Texas, the prolific Permian Basin region is one of the largest upstream “plays” in the world. Chevron is a major player here, and its footprint got even larger after acquiring Noble Energy last year (we covered our thoughts on that acquisition in this article here). Management aims to keep Chevron’s oil and gas production in the region broadly flat this year versus 2020 levels, a sign of Chevron’s fiscal discipline (i.e. not chasing crude oil prices higher via sharp capital expenditure increases).

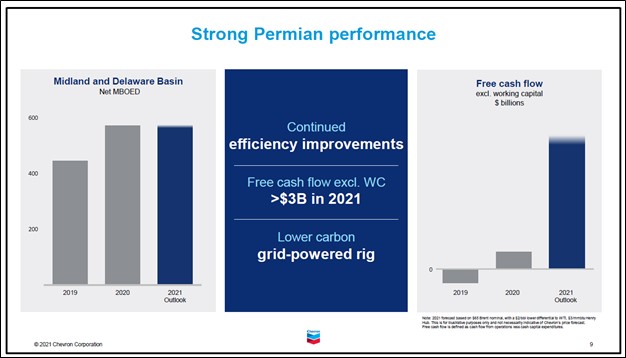

In turn, this strategy is expected to help Chevron produce in excess of $3.0 billion in segment-level free cash flow from its upstream Permian Basin operations this year (before taking working capital adjustments into account). As one can see in the upcoming graphic down below, that represents a major improvement over the asset’s free cash flow performance in both 2019 and 2020.

Image Shown: Chevron’s upstream Permian Basin operations are finally going to become serious free cash flow cows this year, aided by the company’s fiscal discipline, assuming the company’s guidance is ultimately close to its actual performance. Image Source: Chevron – Second Quarter of 2021 IR Earnings Presentation

During Chevron’s second quarter earnings call, management had this to say regarding the firm’s Permian operations and broader strategy (emphasis added, lightly edited):

“Turning to the Permian, we continue to incorporate greater efficiency into our activities. Even with our reduced activity levels, production is expected to be comparable to last year.

Consistent with the guidance we shared in March, we’re adding rigs and completion crews in the second half of this year, delivering an expected production rate of over 600,000 Barrels a day by year-end. For 2021, we expect free cash flow, excluding working capital, to exceed $3 billion assuming an average [crude oil] price of $65 a barrel.

We’re committed to lowering the carbon intensity of our Permian operations. One recent example is our shift from diesel fuel to electricity, and natural gas to power drilling rigs and completion spreads. This reduces emissions, reduces well costs, and takes trucks off the roads. Which results in higher returns and lower carbon.” — Jay Johnson, Executive Vice President, Upstream, at Chevron

We are glad to see that Chevron’s upstream Permian Basin operations are starting to become free cash flow cows. The increased development activity slated to occur during the second half of 2021 sets Chevron up nicely as we draw closer to 2022, though such a move is clearly a bet that the rally in raw energy resources pricing has long legs. Please note that the increased development activity is also in part due to Chevron aggressively scaling back its drilling and completion activities in the face of the COVID-19 pandemic last year (meaning part of the reason for the increased activity is to maintain its production base in the region, given the sharp decline rates wells brought online in this region via “fracking” activities generally experience during the first few years of production).

Management noted during Chevron’s latest earnings call that “the preponderance of our capital, 60% and more, is going to be going into shorter-cycle higher-return projects, which are very quick to bring new production on” in response to a question from an analyst concerning the company’s capital expenditure guidance and Chevron’s Permian Basin footprint. Chevron had five drilling rigs operational in the Permian Basin as of late-July 2021 according to recent management commentary, with plans to add one or two additional drilling rigs late this quarter or in the fourth quarter. Looking ahead, Chevron intends to continue prioritizing investments in its upstream Permian Basin unit (on a moderated basis, given the firm needs raw energy resources pricing to cooperate here as well).

Concluding Thoughts

The global energy complex continues to recover from the worst of the COVID-19 pandemic, and that speaks quite favorably to Chevron’s outlook. Management is committed to improving the company’s balance sheet strength going forward, which we really appreciate. Chevron’s free cash flow performance in the second quarter highlights the incredibly powerful positive effect the recovery is having on its financial performance. Share buybacks, in moderation, represent a good use of capital in our view (based on where shares of CVX are trading at as of this writing). With all of this in mind, we would like to stress that Chevron remains committed to its dividend (the firm moderately boosted its quarterly dividend during the second quarter of 2021 by ~4% sequentially). We continue to like Chevron as an idea in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

Downloads

Chevron’s 16-page Stock Report > >

—–

Oil and Gas Complex Industry – BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Related: BNO, PBR, RDS.A, RDS.B, USO, XLE, XOP

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.