Image Shown: Philip Morris International Inc’s IQOS offering, a heated tobacco unit product (also classified as a “reduced risk product” by the company) that seeks to replicate the experience of traditional cigarettes for smokers in a bid to get those users to switch over to an offering the company views as relatively “safer,” has continued to post solid user base growth of late. We are big fans of Philip Morris and its ongoing transformation and include shares of PM as an idea in the High Yield Dividend Newsletter portfolio. Image Source: Philip Morris International Inc – Second Quarter of 2021 IR Earnings Presentation

By Callum Turcan

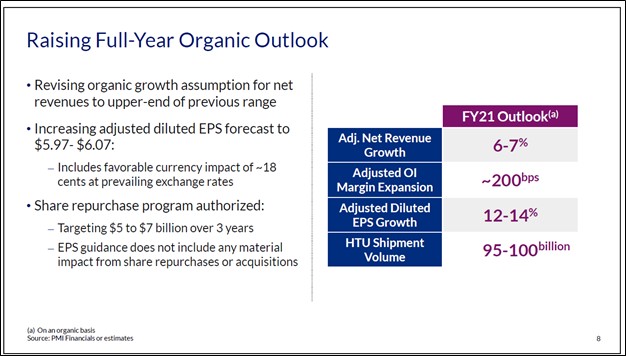

On July 20, the company behind the Marlboro cigarette brand (excluding sales of the cigarette brand in the US) and the smokeless IQOS nicotine offering Philip Morris International Inc (PM) reported second quarter 2021 earnings. The company missed consensus top-line estimates but beat consensus bottom-line estimates and boosted its full-year guidance for 2021 in conjunction with the report. Now Philip Morris expects to generate (the following are non-GAAP metrics) organic net revenue growth of 6%-7% (up from 5%-7% previously) and adjusted diluted EPS growth of 12%-14% (up from 11%-13% previously) on an annual basis in 2021 as its business steadily recovers from the worst of the coronavirus (‘COVID-19’) pandemic.

Image Shown: Philip Morris boosted its full-year guidance for 2021 during its second quarter earnings report. Image Source: Philip Morris – Second Quarter of 2021 IR Earnings Presentation

Shares of PM sold off initially after its second quarter earnings were published, potentially due to the guidance boost being smaller than what the market was looking for, though there is a good chance Philip Morris’ current guidance is still conservative. We continue to be big fans of Philip Morris and include shares of PM as an idea in the High Yield Dividend Newsletter portfolio. As of this writing, shares of PM yield ~5.1%.

Financial and Operational Update

During the second quarter of 2021, Philip Morris’ GAAP net revenues climbed higher by 14% year-over-year and its GAAP gross profit expanded by 17% year-over-year as its business continues to rebound. The firm’s GAAP operating income grew by 15% year-over-year in the second quarter as Philip Morris reinvested some of its gross profit growth back into the business in the form of increased marketing, administration, and research expenses. Sales volumes of its traditional cigarette offerings grew by 3% year-over-year while sales volumes of its heated tobacco unit (‘HTU’) offerings grew by 30% year-over-year in the second quarter. Philip Morris also refers to some of its non-traditional nicotine offerings as reduced risk products (‘RRPs’).

As it concerns its traditional cigarette unit volumes, Philip Morris reported strength at its European Union, Middle East & Africa, South & Southeast Asia, and Latin America & Canada geographical segments last quarter. The company’s HTU offerings experienced widespread unit volume growth across the board in the second quarter. In the US, Philip Morris has an exclusive licensing agreement with Altria Group Inc (MO) to sell its IQOS HTU offering. Pivoting to China, Philip Morris has had licensing agreements in the past, though very little information is publicly available on the subject (including in its latest 10-K SEC filing).

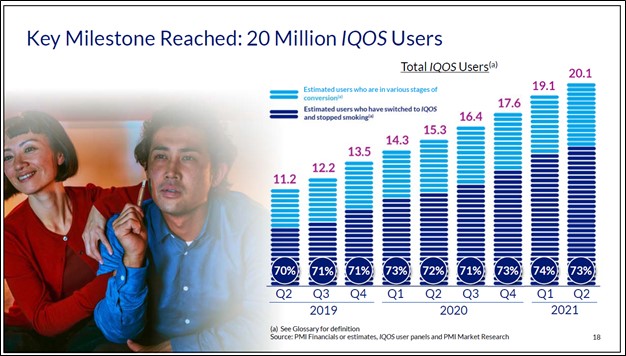

When excluding the US and China, Philip Morris views its market share of the cigarette and HTU industry standing at 27.3% in the second quarter of 2021. Furthermore, Philip Morris views its IQOS offering as having a user base of 20.1 million at the end of June 2021, with 14.7 million of those users represented by former smokers of traditional cigarettes that have since made the switch and stopped smoking traditional cigarettes. Its IQOS user base has grown at a steady clip of late with ample room for additional upside, in our view and the view of Philip Morris.

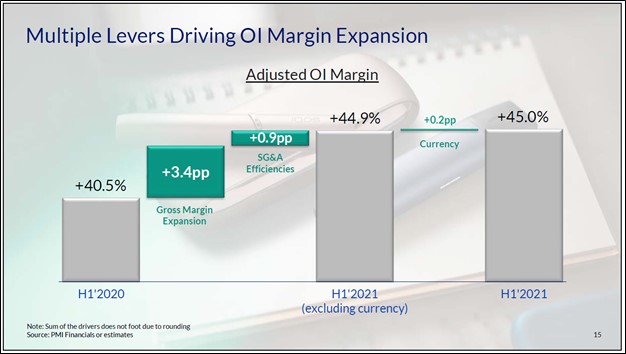

This year, Philip Morris aims to sell 95 billion – 100 billion HTUs, led by its IQOS offering. Scale at its HTU business combined with a rebound at its traditional cigarette business is expected to support its margins going forward. Now Philip Morris forecasts that it will see its total cigarette and HTU volumes either come in flat or grow by 2% this year, versus previous guidance that called for a decline of 1%-2% in its cigarette and HTU volumes. On an organic basis, Philip Morris aims to grow its non-GAAP adjusted operating margin by 200 basis points this year.

Image Shown: A look and what is driving Philip Morris’ adjusted non-GAAP operating margin higher. Image Source: Philip Morris – Second Quarter of 2021 IR Earnings Presentation

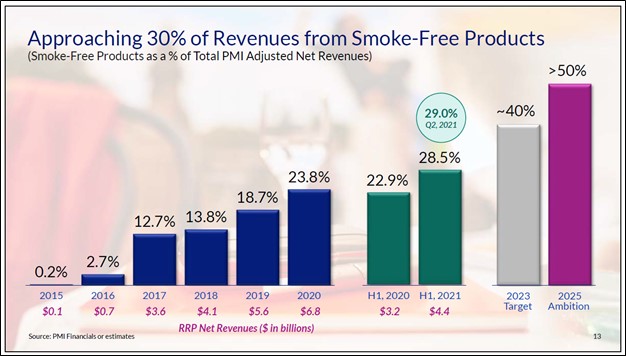

In the second quarter of 2021, smoke-free products represented 29% of Philip Morris’ net revenues. The launch of IQOS ILUMA in Japan in August 2021 is expected to help keep the momentum going on this front. Philip Morris aims to generate the majority of its net revenues from smoke-free products over the coming years. It also expects to invest more in its business, with an eye towards research and new product launches, during the second half of 2021 compared to the first half which will create short-term headwinds for its margins. However, we view this strategy quite favorably as it better positions the company over the long haul as Philip Morris’ long-term revenue growth outlook continues to improve.

Image Shown: Philip Morris aims to aggressively grow the net revenues from its RRPs, such as its HTU offerings led by its IQOS products, over the coming years. Image Source: Philip Morris – Second Quarter of 2021 IR Earnings Presentation

During Philip Morris’ big investor day update in February 2021, the firm noted it intended to roll out its IQOS offering in 100 markets by the end of 2025 versus 64 markets at the end of 2020. Additionally, the firm forecasted it will generate mid-to-high single-digit annual adjusted diluted EPS growth through 2023 (aided by its annual HTU unit volumes hitting 140 billion – 160 billion by 2023). By 2023, roughly 40% of Philip Morris’ revenues is expected to come from smoke-less products, which is expected to grow to over half by 2025. We are impressed by Philip Morris’ past performance and goals on this front.

Image Shown: Philip Morris continues to innovate, seen through its planned new product launches. Image Source: Philip Morris – Second Quarter of 2021 IR Earnings Presentation

Other than its upcoming IQOS ILUMA launch, Philip Morris is working towards launching its IQOS VEEV product (an e-vapor product built using its MESH technology, more on that here) in over 20 markets this year. We are intrigued by Philip Morris’ focus on innovation. As the company scales up this part of its business, its margins should steadily improve over time.

Image Shown: Philip Morris is building on the success of its IQOS offering while also making investments in technologies that will make it easier to comply with regulatory and societal requirements as it concerns nicotine use. Image Source: Philip Morris – Second Quarter of 2021 IR Earnings Presentation

Capital Allocation Priorities Update

Philip Morris also announced during its latest earnings report that it had initiated a share buyback program with up to $7.0 billion in share repurchasing authority. The firm plans to repurchase $5.0-$7.0 billion of its stock over the next three years starting in the third quarter of 2021. Here, we would like to stress that this move represents a material change from Philip Morris’ past capital allocation priorities given the firm has not repurchased a meaningful amount of its stock for some time (historically, Philip Morris has prioritized dividend obligations and investing in its business). Our fair value estimate for Philip Morris sits at $99 per share with the top end of our fair value estimate range sitting at $119 per share.

We view the company’s nascent share repurchase strategy favorably if done in moderation, given that Philip Morris is a tremendous free cash flow generator. A cash flow statement was not included in its latest earnings press release, though the company is guiding to generate around $11.0 billion in operating cash flow this year (subject to working capital adjustments and foreign currency fluctuations) while its capital expenditure forecast for 2021 sits at just $0.8 billion (given its relatively asset-light business model, which we are big fans of). Those operating cash flow and capital expenditure forecasts were unchanged versus the forecasts the firm put out during the first quarter of 2021.

Philip Morris had a net debt load of ~$24.2 billion (inclusive of short-term debt) at the end of June 2021, with its $4.9 billion cash and cash equivalents position supporting its near-term financing needs. The company retains solid access to capital markets (both debt and equity markets) and had a reasonable net debt to adjust EBITDA ratio of 1.74x at the end of June 2021.

Adjacent Opportunities

Philip Morris understands over the years and decades to come, its traditional cigarette business will continue to represent a much smaller part of its overall operations. While the firm can lean on its brand power and pricing strength to offset those headwinds (at least to a degree), eventually headwinds from reduced sales volumes will become nearly impossible to meaningfully offset via pricing increases alone. Traditional cigarette sales volumes across the globe are in secular decline and there is nothing that can change that, in our view. Its IQOS offering is one way Philip Morris is adapting to the changing landscape, but it is not the only card the company has up its sleeve.

Another way that Philip Morris is adapting is by seeking growth in what the firm views as adjacent industries. On July 1, Philip Morris announced it was acquiring privately-held Fertin Pharma through a deal with an enterprise value of ~$0.8 billion. Fertin Pharma is billed as “a leading developer and manufacturer of innovative pharmaceutical and well-being products based on oral and intra-oral delivery systems” with over 850 employees across Denmark, India, and Canada. In 2020, Fertin Pharma generated approximately $0.15 billion in revenue and the transaction values the firm at roughly 15x its 2020 EBITDA according to the press release. The deal is expected to close in the fourth quarter of 2021.

On July 9, Philip Morris announced it was acquiring Vectura Group (VEGPF) through a deal with an enterprise value of ~$1.2 billion. Vectura “is a provider of innovative inhaled drug delivery solutions that enable partners to bring their medicines to patients” and “has thirteen key inhaled and eleven non inhaled products marketed by major global pharmaceutical partners, as well as a diverse portfolio of partnerships for drugs in clinical development” according to the press release. Vectura generated approximately $0.25 billion in revenue in 2020 and the transaction values the firm at roughly 14x its 2020 EBITDA, with the deal expected to close in the second half of 2021.

Please note that certain funds managed by Carlyle Group Inc (CG) have also placed a bid to purchase Vectura, which was announced before Philip Morris’ bid. After the news of Philip Morris’ bid broke, Carlyle Group’s relatively new Murano Bidco entity put out a press release noting that it “is considering its options and a further announcement will be made in due course.” We are keeping an eye on the development.

The goal is for Philip Morris to utilize these acquisitions to build up a sizable “Beyond Nicotine” business, as the company puts it, that by 2025 will be capable of generating at least $1.0 billion in annual net revenues (according to the firm’s forecasts). Philip Morris intends to use cash on hand, its access to capital markets (particularly debt markets), and impressive free cash flow generating abilities to fund these acquisitions and its endeavors in this arena.

We are intrigued, though these are still early days, as it appears Philip Morris is focusing on the licensing side of this space. If successful, having a sizable licensing business in the realm of life sciences and consumer health can be quite the lucrative endeavor, and Philip Morris has the financial capacity to make material R&D investments towards these goals. Here is what management had to say on the subject during the firm’s latest earnings call (lightly edited, emphasis added):

“The proposed acquisition of Fertin Pharma and Vectura can enable us to more rapidly expand our development capabilities in innovative, in health, and oral product formulation while continuing to grow their respective CDMO [contract development and manufacturing organization] activities. Fertin has a range of promising oral delivery technology, including pouches, gum, and lozenges, which can be applied in both the Modern Oral Nicotine and Beyond Nicotine areas, notably for self-care wellness product.

With Vectura, we would gain access to differentiated proprietary technology and pharmaceutical development expertise to deliver a broad range of complex inhaled therapies. Vectura has highly complementary human capital, technology, high quality infrastructure, and deep know-how of inhalable formulation and device design development and analysis, drug device combination, and pharmaceutical management processes and system.

These proposed acquisitions would fully leverage PMI’s [Philip Morris] existing capability in life science, product innovation, and clinical expertise related to inhalation. Such acquisitions can also enhance our progress on important sustainability priorities. Firstly, building our capabilities in Modern Oral is a key enabler of broadening the reach and access of our smoke-free alternative to other smoker[s] around the world.

And secondly, building a strong Beyond Nicotine business is a major objective as we strive to develop commercially successful product with a net positive impact on society.On ESG and sustainability, more broadly, we are firm believers in the power of investor engagement to drive positive change.” — Emmanuel Babeau, CFO of Philip Morris since May 2020

As a relevant aside, Philip Morris announced in June 2021 that it was moving its US corporate headquarters (which handles its Americas and other global operations) from New York to Connecticut, while keeping its ‘Operations Center’ in Lausanne, Switzerland. The new US corporate headquarters is expected to be operational by the summer of 2022.

Philip Morris’ relatively new CEO, Jacek Olczak, noted in the June 2021 press release that “we are amid a profound transformation at [Philip Morris]” and that “our new base in Connecticut will serve to accelerate our progress. Beyond replacing cigarettes with better alternatives, we intend to draw on our expertise in life and medical sciences to develop solutions in areas that include respiratory drug delivery and botanicals.” We are intrigued by the news, and its recent acquisition activity provides greater color on why the company decided to move its corporate headquarters.

Image Shown: An overview of the rationale behind Philip Morris’ pending acquisitions of Fertin Pharma and Vectura. Image Source: Philip Morris – Second Quarter of 2021 IR Categories Member Articles