Europe is overbanked with too much capacity, which means little or no earnings power for many of the players involved, including Santander Europe. We’re paying close attention to the key banking players in Europe to assess the likelihood of a global financial contagion that may accompany the global pandemic that has become COVID-19.

By Matthew Warren

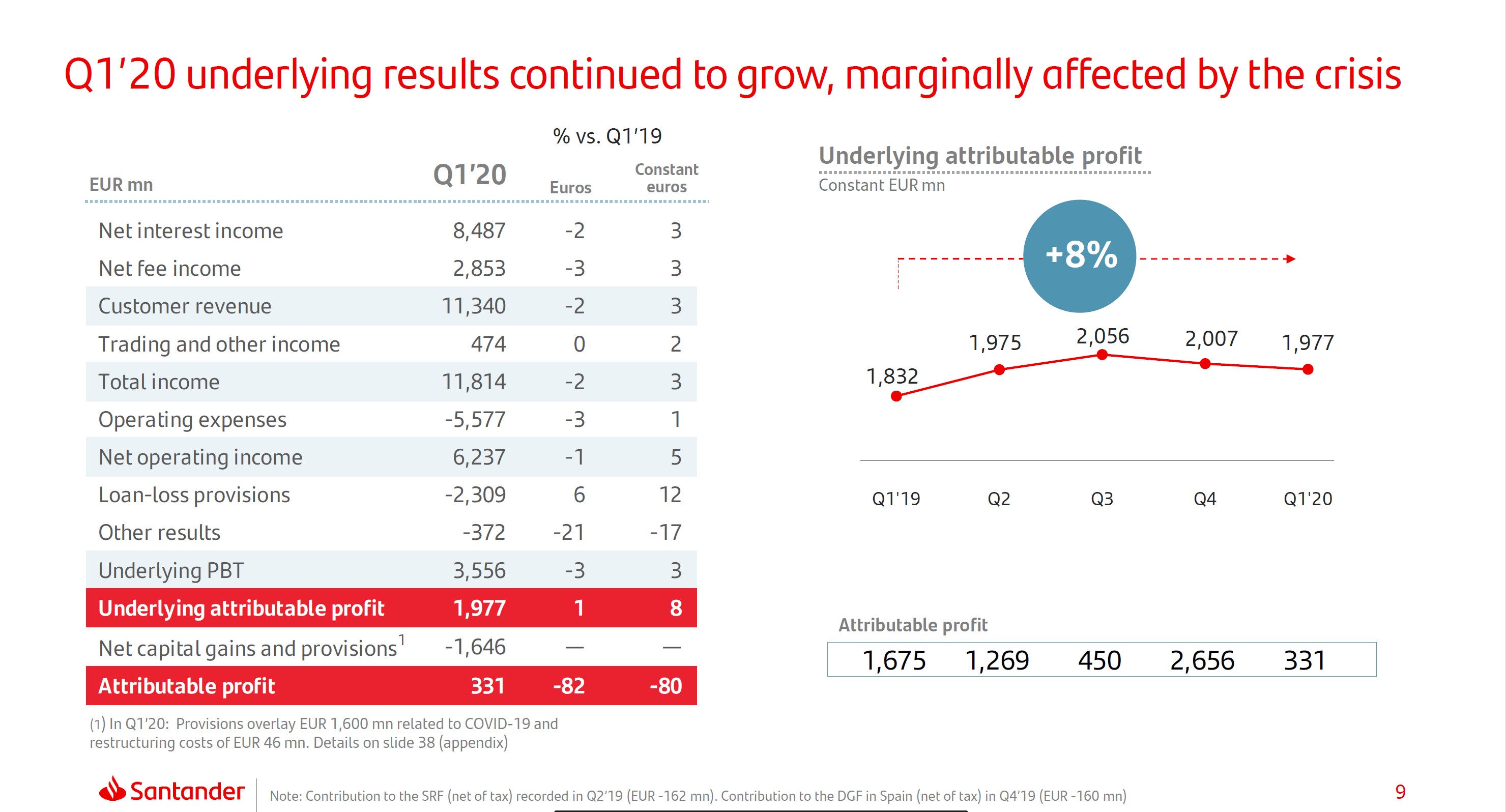

Banco Santander (SAN) reported tough first-quarter results April 28, with total income (the IFRS equivalent of GAAP revenue) down 2% and attributable profit down 82% to EUR 331 million. Profit before the provision build would have been up 1%, so clearly the expectations for upcoming bad debts are what really sunk the quarterly results, which one can see in the below graphic.

Image Source: Santander S.A. 1Q2020 Earnings Presentation

Sticking with the “underlying attributable profit” described in the above graphic (excluding the large provision build), one can see in the below graphic that North and South America are driving underlying profit growth as well as return on tangible equity for the overall bank.

Image Source: Santander S.A. 1Q2020 Earnings Presentation

Europe (EUFN) is overbanked with too much capacity, which means little or no earnings power for many of the players involved, including Santander Europe. One can also see in the results the legacy of the Great Financial Crisis and Euro Crisis of the past decade, with a non-performing loan (NPL) ratio of 6.88% in Spain (EWP) and 3.19% for Europe (VGK) as a whole. We are very skeptical that it might be papering over European bad loans and rolling them over.

Importantly, the bank is well capitalized, though the common equity Tier I ratio dropped from 11.65% at the end of the year to 11.58% at the end of this quarter. The problem is if provisions climb from current levels and earnings go negative. Then, the bank would be faced with deteriorating capital levels (resulting from losses), which is a very difficult scenario under which to raise additional capital.

The other problem that could emerge for European banks would be if sovereign credit quality were once again called into question. Because banks are large owners of sovereign debt, this could be a real problem for periphery banks, in particular, but due to counterparty exposure, these risks can travel quickly between banks and across border. This is a key risk to watch and the sovereign spreads are the tell.

Related: SCGLF, CRARF, UNCFF, BNPQF, DB, ING, UBS, CS, BBVA, SC, ALIZF, BPESF, BSAC, EUFL

—

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.