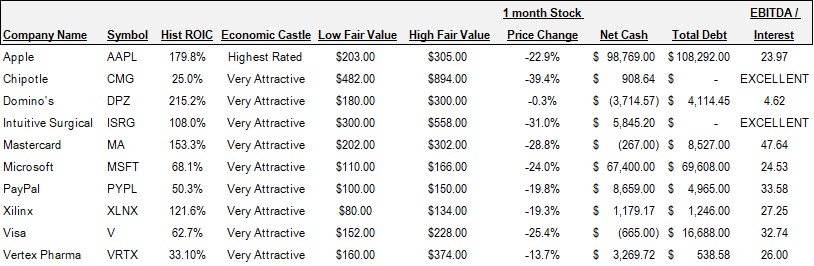

Image: Key metrics of ten of the top ideas investors might start considering given the massive declines in the equity markets of late. Source: Valuentum calculations, SEC Filings, Yahoo! Finance, Morningstar.

By Callum Turcan

The novel coronavirus (‘COVID-19’) pandemic continues to sweep the world, and governments are shutting down business activity, driving most of the global economy to a screeching halt. In such an environment, we don’t think investors should go bottom-fishing on some of the worst businesses that have been beaten up the most during this crisis, but rather, we think this crisis is giving investors the opportunity to consider positions in some of the strongest companies out there. In this members-only article, we cover ten high quality, “moaty” names with strong balance sheets, capital-light operations, great shareholder value creation (attractive “castles’), and ones that have business models that we think can better withstand the novel coronavirus (‘COVID-19’) pandemic. What’s more, most of these companies are 20%-30% off their most recent pricing highs! Dig in.

In Alphabetical Order by Ticker: AAPL, CMG, DPZ, ISRG, MA, MSFT, PYPL, XLNX, V, VRTX

Apple Inc (AAPL)

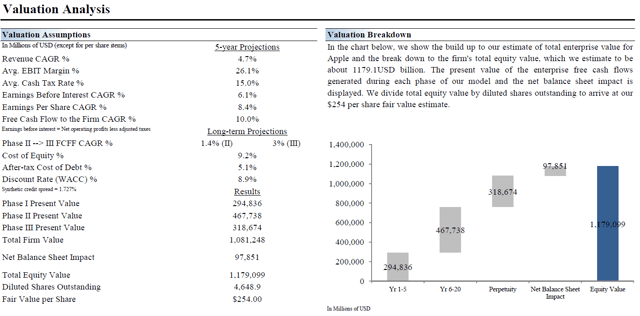

Shares of AAPL have taken a beating after the company was forced to close its stores in China and now the US and elsewhere. The firm is trading near its fair value estimate of $254 per share and carries a “Highest Rated” Economic Castle rating, which means the spread between Apple’s future expected return on invested capital (‘ROIC’) ex-goodwill over its estimated weighted-average cost of capital (‘WACC’) over the next five full fiscal years is expected to come in at a magnitude that’s top-rated within our coverage universe. We appreciate Apple’s strong net cash position and high quality free cash flow profile, keeping in mind we removed shares of Apple from our newsletter portfolios back in January 13, 2020 (link here), when AAPL was trading north of $300 per share. We may add shares back to both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, however, at the right price (the low end of our fair value estimate range on improving share-price momentum).

Image Shown: A look at the key valuation assumptions used in our “base case” discounted cash flow model covering Apple.

Chipotle Mexican Grill Inc (CMG)

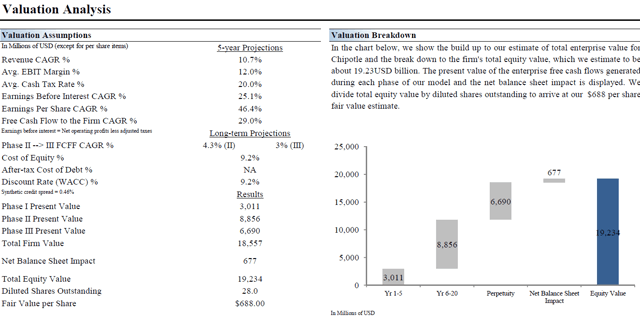

Chipotle has moved aggressively into the food delivery space which has helped maintain its popularity in the US. In addition to recovering from food-quality related issues of the past, new initiatives have been enough to materially help its revenue growth during the past couple years. Still, they may not be enough to prevent the downside posed by a slowdown of US economic activity for the foreseeable future (a product of the measures taken to contain the ongoing COVID-19 pandemic). While shares of CMG have fallen significantly below our fair value estimate, the bottom range of our fair value estimate range indicates shares could fall further before potentially stabilizing. When the pandemic shows signs of containment, a rebound in US consumer activity could then potentially get underway, with shares of CMG likely rapidly beginning to recover some lost ground. The company is one for the watch list.

Image Shown: A look at the key valuation assumptions used in our “base case” discounted cash flow model covering Chipotle.

Domino’s Pizza Inc (DPZ)

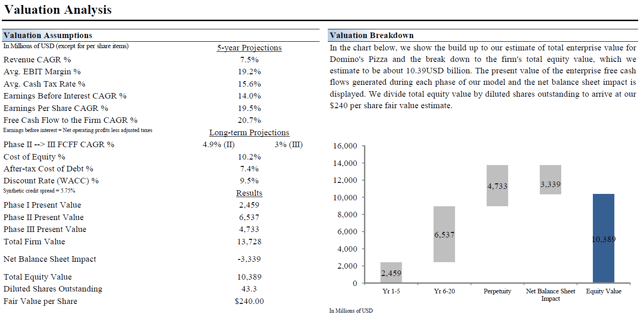

The strength of Domino’s comes from its asset-light franchise business model. The firm has one of the most attractive Economic Castles in our coverage, and while business may slow in the near term, Domino’s is dominating the pizza-delivery space, augmented by savvy menu innovations and digital prowess. Major investments in technology have reaffirmed the pizza delivery franchise’s leadership in food delivery, and shares of DPZ are trading just below the high end of its fair value estimate range as of this writing. The company aims to have 25,000 stores operating and ~$25.0 billion in revenue worldwide by 2025, two estimates we think are achievable once COVID-19 is behind the firm. As of early-March, the Domino’s franchise had opened its 17,000th store. Shares of DPZ haven’t given much of their pricing gains back from this decline, however.

Image Shown: A look at the key valuation assumptions used in our “base case” discounted cash flow model covering Domino’s.

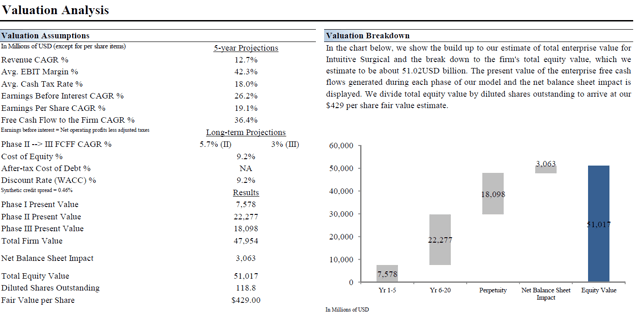

Intuitive Surgical Inc (ISRG)

Intuitive Surgical is best known for its da Vinci robotic assisted surgical systems, which have been shown to meaningful improve patient outcomes. The goal has always been for Intuitive Surgical to build out a large installed base of its da Vinci surgical systems, which then allows for the company to generate meaningful recurring revenues via customer service agreements. As of this writing, shares of Intuitive Surgical are trading below their fair value estimate, and this one could be interesting for those seeking medical-device exposure in a diversified portfolio of ideas.

Image Shown: A look at the key valuation assumptions used in our “base case” discounted cash flow model covering Intuitive Surgical.

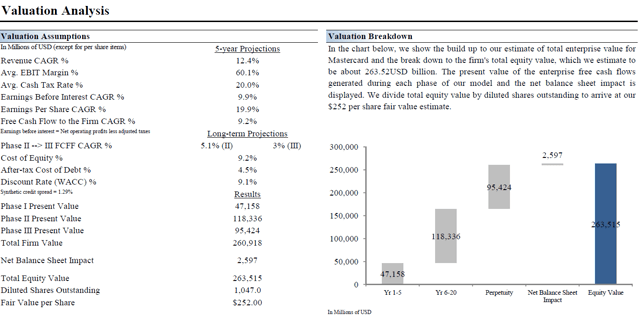

Mastercard Inc (MA)

We really like the payment processing and financial technology space as the industry is supported by powerful secular growth tailwinds, with a lot of room for international growth. The network effect creates a virtuous cycle that supports the long-term growth outlook for Mastercard’s free cash flows. While shares of MA traded well above the top end of our fair value estimate range for some time, Mastercard’s share price has since come back down to what we view as more reasonable levels and trades just below its fair value estimate as of this writing. We think either Visa or MasterCard could make sense as a part of any equity portfolio.

Image Shown: A look at the key valuation assumptions used in our “base case” discounted cash flow model covering Mastercard.

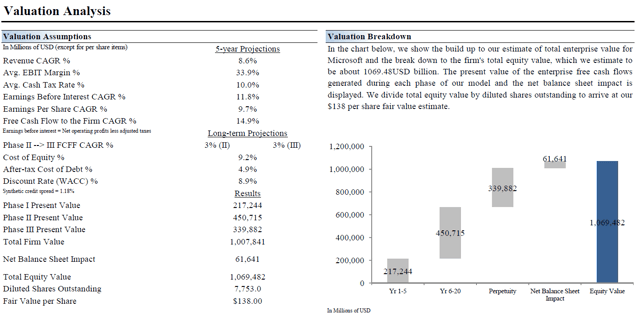

Microsoft Corporation (MSFT)

Microsoft’s pristine balance sheet and top-quality free cash flow profile makes this former Dividend Growth Newsletter portfolio holding a firm to watch. Shares of MSFT were removed from the Dividend Growth Newsletter portfolio on February 24, 2020 (link here), back when they was trading north of $170 per share. However, since then Microsoft’s stock price has come back down close to its fair value estimate as of this writing. Going forward, strength at its Azure cloud-based offering supports its promising long-term growth outlook. This one could find its way back into the Dividend Growth Newsletter portfolio.

Image Shown: A look at the key valuation assumptions used in our “base case” discounted cash flow model covering Microsoft.

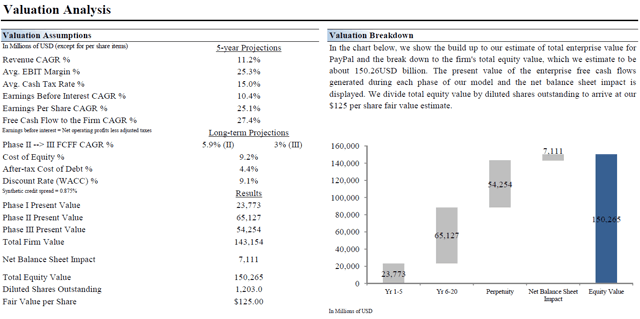

PayPal Holdings Inc (PYPL)

In our Best Ideas Newsletter portfolio, we increased our PYPL weighting back on January 13, 2020 (link here), given the firm’s growing total payment volumes (‘TPV’) and the tremendous amount of success PayPal has had with its peer-to-peer payment app Venmo. The payment processing and financial tech company has only just begun to monetize Venmo, and we view the firm’s growth outlook as stellar. Its recently announced acquisition of Honey for ~$4.0 billion, a very popular internet browser extension, will further augment PayPal’s growth trajectory by allowing the firm to gather tremendous amounts of data on the purchasing habits of consumers (which should enable PayPal to better connect consumers with merchants that use its platform, thus boosting its TPVs and ultimately free cash flows). Our fair value estimate for shares of PYPL stands at $125 per share.

Image Shown: A look at the key valuation assumptions used in our “base case” discounted cash flow model covering PayPal.

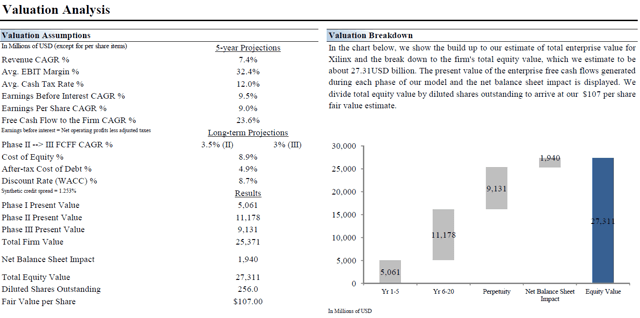

Xilinx Inc (XLNX)

Xilinx is betting big on the coming rollout of 5G services through its Zynq UltraScale+ radio platform, which caters to a wide variety of consumers. As of this writing, shares of this semiconductor are trading below the low end of our fair value estimate range (which sits at $80 per share). The success of Xilinx will depend on its ability to outmaneuver key competitors in this space and the speed at which 5G technology is adopted worldwide. Once a holding in the Dividend Growth Newsletter portfolio, we could look to add back this free-cash-flow rich and asset-light enterprise.

Image Shown: A look at the key valuation assumptions used in our “base case” discounted cash flow model covering Xilinx.

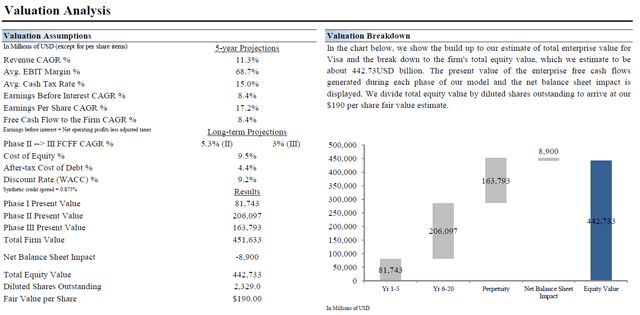

Visa Inc (V)

We like Visa as a top-weighted holding in our Best Ideas Newsletter portfolio because the firm has a capital-expenditure light business model, greatly benefits from the network effect, has a quality balance sheet, and its free cash flow growth outlook is supported by solid secular growth tailwinds. Visa recently announced it was acquiring Plaid for ~$5.3 billion, which is a software firm that connects financial apps to bank accounts (Venmo is one of Plaid’s biggest customers, at least as things stand today), to further bolster its growth outlook. Our fair value estimate stands at $190 per share, and we won’t be parting with Visa anytime soon.

Image Shown: A look at the key valuation assumptions used in our “base case” discounted cash flow model covering Visa.

Vertex Pharmaceuticals Inc (VRTX)

Three of Vertex Pharma’s biggest drugs (all have been approved) include Orkambi (for cystic fibrosis in patients aged two and older), Kalydeco (for cystic fibrosis in patients aged six months and older), and Symdeko (for cystic fibrosis in patients aged six and older). These products, combined, treat a little under half of all the cystic fibrosis patients in North America, Europe, and Australia. Shares of VRTX trade at a nice discount to their fair value estimate as of this writing and are supported by Vertex Pharma’s quality free cash flow profile. Please note a lot of the intrinsic value of Vertex Pharma’s equity comes from the mid-cycle period as we model very strong free-cash-flow growth during this phase of its business life. This one makes the list as a high-beta biotech for the risk-seeking investor.

Image Shown: Vertex Pharma’s share-price performance since the beginning of 2019.

We hope you have enjoyed this supplemental list of ideas to the newsletter portfolios. We’re available for any questions.

—–

Related: AAPL, CMG, DPZ, ISRG, MA, MSFT, MORN, PYPL, XLNX, V, VRTX

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. PayPal Holdings Inc (PYPL) and Visa Inc (V) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.