Image:Image: Sam’s Club (Crystal Lake, IL), March 14. Water and toilet paper continue to be completely sold out at most big box retailers as COVID-19 panic buying of consumer goods continues to spread. Fear-induced purchases in the US have also helped drive up investor sentiment toward consumer staples names with a large domestic presence. We caution, however, that near-term earnings bumps emanating from “stockpiling” have little impact on a company’s intrinsic value, which is derived more from normalized conditions, and in most cases, the panic buying of consumer goods is merely pulling demand forward.

“You know what’s disappearing from the supermarket shelves? Toilet paper…There’s an acute shortage of toilet paper in the United States.” – Johnny Carson, in 1973, causing a month-long shortage of toilet paper in the US at the time. The spread of COVID-19 is creating a similar panic as consumers stock up on just about everything from toilet paper to canned goods to hand sanitizer.

By Callum Turcan

We hear it all over of the world these days. Consumers rushing to fill their pantries with necessary consumer items from canned goods to white rice and beyond as a result of the aggressive spread of the novel coronavirus. Our recent channel checks in more remote areas of the Northwest suburbs of Illinois indicate that panic buying of food items is even occurring outside large metropolitan limits. We would expect the panic buying of consumer necessities to continue for some time, as fear continues to grip the populace. In this article, we wanted to highlight how such events, as in panic buying of consumer staples, generally accounts for little impact on the equity values of major retail outlets, despite making major news headlines.

Discounted cash flow analysis, or more commonly referred to as enterprise valuation, seeks to obtain the intrinsic value or fair value of equities by modeling out the expected future financial/fundamental performance of a company under reasonable assumptions. This is what we like to call our “base case” scenario. Additionally, we also like to model out a “pessimistic case” scenario and a “optimistic case” scenario to highlight how a firm’s intrinsic value would change should it outperform or underperform, again under reasonable assumptions. Before getting into our equity valuation process, let’s set the stage for our members.

The novel coronavirus, officially abbreviated as ‘COVID-19’ as per the US Centers for Disease Control and Prevention (‘CDC’) and the World Health Organization (‘WHO’), has started to spread across the US and according to media reports, that’s beginning to freak consumers out for very justifiable reasons. The WHO upgraded COVID-19 to a global pandemic on March 11, highlighting the severity of the situation. In the spirit of Donald Rumsfeld, it isn’t necessarily the known unknowns that has people freaked out all over the world and the US, it’s the unknown unknowns and what that could entail (one theoretical example; could widespread quarantines come to the US?). US consumers have flocked to major retail outlets such as Walmart (WMT), Costco (COST), Target (TGT), and Kroger (KR), along with smaller stores like Best Ideas Newsletter portfolio holding Dollar General (DG), during the past few weeks.

How COVID-19 Fits in With Discounted Cash Flow Analysis

There are a number of different ways to analyze and attempt to ascertain the “true” value of equities (otherwise known as the intrinsic value or fair value estimate, as noted previously). However, the only real way to properly gauge the value of equities is through discounted cash flow analysis (i.e. enterprise valuation), in our view. Using ambiguous metrics such as price-to-earnings or price-to-sales ratios (whether on a historical or forward-looking basis) doesn’t tell the investor how much future free cash flows a firm is expected to generate.

Such multiples also do not take into consideration the balance sheet of the equity. For example, one might expect a company with a large net debt position to have a lower earnings multiple than a company with a large net cash position. A company with a ton of sales such as J.C. Penney (JCP), for example, but is heading to bankruptcy, may have a small price-to-sales ratio, but that ratio would tell you little about whether your equity position would get wiped out in coming quarters. Even EV/EBITDA falls short as it represents just a snapshot in time and fails to consider growth expectations long into the future.

We generally define traditional free cash flow as net operating cash flow less all capital expenditures (we make a number of further adjustments for enterprise free cash flows, but the gist is the same). When evaluating a company’s intrinsic value or its dividend coverage (we always look at dividend coverage on a forward-looking basis), we also take balance sheet considerations into account. When it comes to intrinsic value estimation, the balance sheet can either be a huge source of intrinsic value (net cash position) or a huge reduction from intrinsic value (net debt position).

As it relates to dividend considerations, a net cash balance is also a source of financial flexibility/strength (can be used to cover future dividend obligations) while a net debt position can compete with dividends for future free cash flows. We also consider pension liabilities and other tangible factors in both intrinsic-value estimation and dividend analysis (legal liabilities, environmental liabilities, etc.). In regards to the “discounted” part of the discounted cash flow models we use, that’s referred to as the weighted average cost of capital (‘WACC’) to take the time-value of money into account (a dollar today is more valuable than a dollar one year from now).

With that in mind, please note that the vast majority of an equity’s intrinsic value (in most but not all circumstances) comes from the mid-cycle and perpetuity part of the business cycle. Learn more about the distribution of equity value in the book Value Trap. By that we mean, generally speaking, the forecasted discounted free cash flows of businesses over the next five years represents at most ~25% of a firm’s intrinsic value, in most cases. Rising retail sales over a quarter or two can generate catchy headlines and create volatile trading activity, and that certainly has been the case of late, but that doesn’t move the needle much when it comes to mid- to long-term considerations, and intrinsic value.

An Example

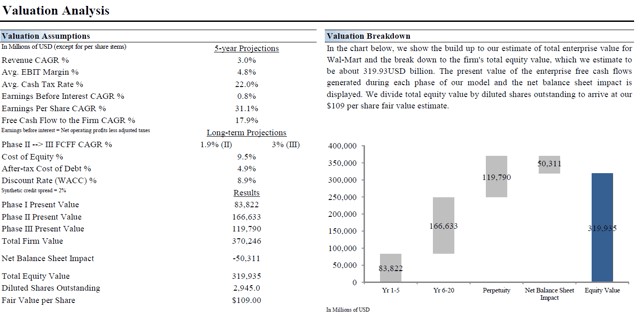

Let’s use Walmart as an example. Our fair value estimate for shares of WMT sits at $109 currently under our base case scenario. Shares of WMT trade near ~$114 as of this writing. In the event Walmart were to outperform our base case assumptions, the top end of our fair value range estimate sits at $131 per share. Conversely, in the event Walmart were to underperform our base-case assumptions, the low end of our fair value range estimate sits at $87 per share. We always like to look at valuation as a range of probable fair value outcomes, not a point estimate.

In the upcoming graphic below, the vast majority of Walmart’s intrinsic value comes from the ‘Year 6 to Year 20’ and ‘Perpetuity’ periods. Only ~24% of the intrinsic value of shares of WMT comes from the ‘Year 1 to Year 5’ period, under our base-case scenario. While the boost from panic buying of consumer goods stemming from the ongoing COVID-19 pandemic could see Walmart’s very near-term financial performance get a significant boost, that doesn’t change much as it relates to its intrinsic value. What is more important to our estimate of Walmart’s intrinsic value is the duration of such panic buying, and whether consumer purchasing patterns have changed over the long haul as a result of COVID-19, something yet to be determined.

Image Shown: Most of Walmart’s forecasted discounted free cash flows comes from the mid-cycle and perpetuity part of its business cycle, and not from its near- and medium-term performance.

Concluding Thoughts

Equities are long-duration financial instruments, meaning the vast majority of their intrinsic value, and therefore their prices, comes from long-run expectations. While there may be a minor bump in near-term financial performance at retail outlets as a result of panic buying of consumer goods, the impact on their respective intrinsic value estimates as a result of this activity is relatively minor.

However, if the boost in retail sales ends up being very temporary in nature (pulling forward demand), but the disruption to supply chains becomes a longer duration story, fair values of even retail outlets could be ratcheted lower if the ongoing COVID-19 pandemic doesn’t get contained soon.

That being said, we continue to like shares of Dollar General in our Best Ideas Newsletter portfolio given its promising long-term growth trajectory and solid operational performance of late. We view Dollar General as an idea for all economic environments, one that steadily grows during economic upswings, showcases recession-resilient characteristics during downturns, and benefits from unfortunate situations such as COVID-19.

Comment: Panic buying of consumer goods could continue for longer than people expect. Who remembers Johnny Carson’s joke about a toilet paper shortage in the United States in 1973 that sent consumers scrambling to buy toilet paper across the country, creating a month-long shortage? Read about the “Great Toilet Paper Scare of 1973”

—-

Beverages – Alcoholic: BF.B BUD DEO SAM STZ TAP

Beverages – Nonalcoholic: CCEP KO KDP MNST FIZZ PEP

Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT

Food Products (Small/Mid-Cap): CALM FLO FDP HAIN HRL JJSF LANC MKC SJM THS TSN

Food Products (Large/Mid-Cap): ADM BG CPB CAG GIS HSY K KHC MDLZ NSRGY UL UN

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

Household Products: CHD, CL, CLX, ENR, HELE, KMB, JNJ, PG

Related: SPY, AMZN, SFM, SVU, WMK, NGVC, VLGEA, IMKTA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.