Image Source: Lockheed Martin Corporation – Third Quarter Fiscal 2019 Earnings Presentation

By Callum Turcan

On January 13, 2020, we announced (link here) we were making some major changes to our newsletter portfolios and that included adding major defense contractor Lockheed Martin Corporation (LMT) to the Dividend Growth Newsletter portfolio with a modest 2.5% – 3.5% weighting. Lockheed Martin is the lead contractor on the massive F-35 fighter jet program, has an expansive slate of weapon systems offerings (including the Javelin and Paragon systems), owns helicopter company Sikorsky (which sells aircraft for military, governmental, and civilian purposes), and offers a wide range of other defense related products and services (radar, sensors, etc.). The company is also the lead contractor on NASA’s Orion project, which is being designed for deep space exploration.

Shares of LMT yield ~2.2% as of this writing, and we like the firm’s 1.8x Dividend Cushion ratio, which allows for a solid dividend growth trajectory. Our fair value estimate for LMT is $432 per share with room for upside as the top end of our fair value range estimate sits at $529 per share. Shares have been supported by favorable technicals of late, in part due to rising geopolitical tensions around the world (i.e. US and Iran).

Please note the company reported earnings for the fourth quarter of its fiscal 2019 (which ends on December 31, however, its quarterly periods don’t exactly mirror the calendar year quarterly periods during the year). Lockheed Martin beat both top- and bottom-line consensus estimates, which we appreciate.

Defensive Name

One of the appealing things about defense contractors is the recession resistant nature of the financials of the companies operating in the space. Given how frothy US equity markets have gotten, we thought it was prudent to become slightly more defensive when also considering how late we are in the business cycle.

The US defense budget is quite large and generally speaking stable, seen through the latest increase that was approved at the end of calendar year 2019. For the US federal government’s fiscal 2020, the US defense budget calls for base level spending of $658.4 billion along with $71.5 billion in overseas contingency operations (often referred to as the “war budget”), up a combined ~$29 billion from fiscal 2019 levels. This budget also created a Space Force, a new military service that will help prepare the US for the future of warfare and space exploration more generally. President Trump has already signed this iteration of the National Defense Authorization Act (‘NDAA’) into law.

Financial Overview

From fiscal 2016 to fiscal 2018, Lockheed Martin generated $3.8 billion in free cash flow on average per fiscal year. Annual dividend obligations and share repurchases averaged $2.2 billion and $1.9 billion, respectively, during this period. In fiscal 2019, Lockheed Martin generated $5.8 billion in free cash flow and spent $2.6 billion and $1.2 billion on its dividend obligations and share buybacks, respectively.

As of the end of Lockheed Martin’s fiscal 2019, the firm was sitting on over $1.5 billion in cash and cash equivalents versus a little under $12.7 billion in total debt (inclusive of $1.25 billion in short-term debt). Please note that Lockheed Martin’s net debt position improved from $13.3 billion at the end of fiscal 2018 to $11.1 billion at the end of fiscal 2019.

Lockheed Martin’s outstanding diluted share count has been steadily trending lower over the years, falling from 303.1 million on a weighted average diluted basis in fiscal 2016 down to 286.8 million in fiscal 2018. That fell further in fiscal 2019, hitting 283.8 million. Considering LMT has historically been trading below its intrinsic value, we see share buybacks as a good use of shareholder capital.

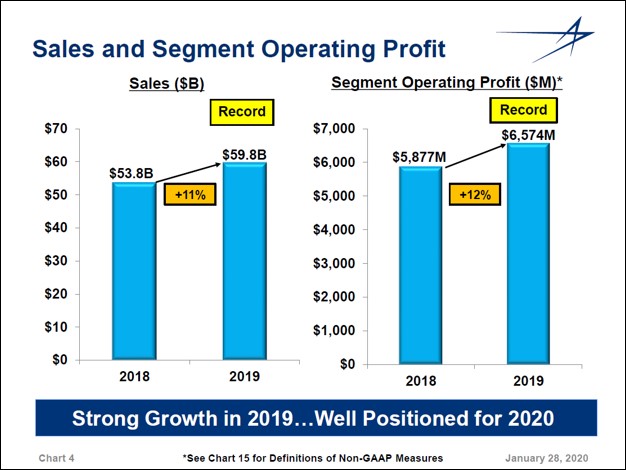

The defense contractor’s GAAP revenues jumped from $47.3 billion in fiscal 2016 to $53.8 billion in fiscal 2018, assisted by rising US defense spending levels and greater overseas defense spending. In fiscal 2019, that growth trajectory continued with Lockheed Martin posting $59.8 billion in GAAP revenues (beating both internal and consensus estimates). Lockheed Martin’s GAAP operating profit jumped from $5.9 billion in fiscal 2016 to $7.3 billion in fiscal 2018, allowing for the firm’s GAAP operating margins to rise by almost 120 basis points during this period. Economies of scale and synergies were key here. In fiscal 2019, Lockheed Martin’s GAAP operating profit rose further, hitting $8.5 billion. That saw Lockheed Martin’s GAAP operating margin climb by an additional 65 basis points. Management cited higher volumes as a big reason for the margin improvement.

Assisted by a sharply lower corporate income tax expense, Lockheed Martin’s diluted GAAP EPS from continuing operations grew from $12.08 in fiscal 2016 to $17.59 in fiscal 2018. In fiscal 2019, Lockheed Martin’s diluted GAAP EPS came in at $21.95 and that wasn’t due to sharply lower corporate income tax expense (which rose year-over-year) but was a product of Lockheed Martin expanding its margins and growing its revenues.

Growing the Business

We see Lockheed Martin’s net debt load as manageable, with the company actively paring down that burden which was built up after acquiring Sikorsky Aircraft for ~$9.0 billion back in calendar year 2015 from United Technologies Corporation (UTX). The subsidiary is now known as just Sikorsky, and as an aside, one might hear about the company after the horrible tragedy in California that took the life of basketball legend Kobe Bryant and eight others after a S-76 helicopter crashed, potentially due to poor visibility and fog. Our heart goes out to the victims and their families.

In calendar year 2016, Lockheed Martin increased its stake in the joint venture that manages the United Kingdom’s nuclear deterrent, which is known as Atomic Weapons Establishment (‘AWE’) and the joint venture running AWE is known as AWE Management Ltd. Lockheed Martin was able to increase its stake from 33% to 51% in the equity of AWE Management “in exchange for our assuming a more significant role in managing the operations of the venture” and now the unit is classified under Lockheed Martin’s Space Systems business segment.

Divesting an Asset

Back in October 2019, Lockheed Martin agreed to sell part of its energy solutions business to engineering consulting firm TRC Companies (owned by alternative asset management company New Mountain Capital). That business caters to the commercial utility space (specifically, electric and natural gas utilities), and didn’t quite fit in with Lockheed Martin’s strategy. While Lockheed Martin will continue to offer energy solutions to governmental entities, it’s exiting the commercial energy solutions space. The unit is dubbed the “Distributed Energy Solutions group” and financial terms weren’t disclosed. We appreciate that Lockheed Martin is focusing on its core markets and growing in areas that are more in-line with its longer-term goals.

Guidance and Performance

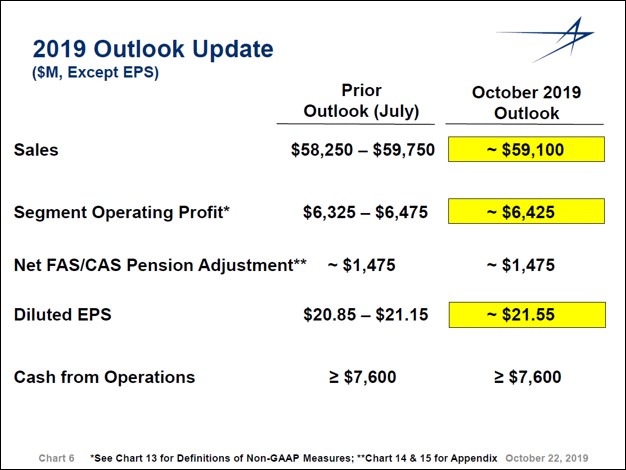

Lockheed Martin upgraded its forecast for fiscal 2019 in October 2019, once again raising its forecast for the full fiscal year. Management raised guidance for the midpoint of Lockheed Martin’s expected sales and segment operating profit for fiscal 2019, while also increasing the firm’s diluted EPS guidance to $21.55 (from $20.85 – $21.15 previously). After reporting its fourth quarter earnings for fiscal 2019 on January 28, please note Lockheed Martin ended up exceeding its internal guidance for the full fiscal year (even after taking the latest upward revisions into account). The only realm Lockheed Martin didn’t exceed its internal guidance for fiscal 2019 was its net operating cash flow, however, that was largely due to working capital builds (particularly seen through Lockheed Martin paying down its accounts payable and income taxes payable and building up some inventory).

Please note Lockheed Martin increased its guidance for fiscal 2019 back in April 2019 and July 2019 as well (from its initial guidance), which is something we can really appreciate. Companies that are continuously increasing guidance are companies that have a very high level of confidence in their near-term performance, which can translate into stronger mid-cycle performance if the strategies/processes used to deliver the historical outperformance are maintained. That appears to be the case given Lockheed Martin’s outperformance in fiscal 2019 and management’s guidance for fiscal 2020, which calls for strong financial performance to continue.

Image Shown: Lockheed Martin increased its guidance for fiscal 2019 back in October 2019, following increases during its previous two quarterly earnings cycles. After reporting earnings for the fourth quarter of fiscal 2019, please note Lockheed Martin exceeded the above guidance on most counts. Image Source: Lockheed Martin – Third Quarter Fiscal 2019 Earnings Presentation

In the below graphic, Lockheed Martin provides an overview of its actual financial performance in fiscal 2019.

Image Shown: An overview of Lockheed Martin’s actual performance in fiscal 2019. Image Source: Fourth Quarter and Fiscal Year 2019 Earnings Presentation

Here’s what management had to say during Lockheed Martin’s fourth quarter of fiscal 2019 conference call (emphasis added):

“Notably, for the second year in a row, all four of our business areas grew sales, earnings, and backlog with each contributing to our record cash from operations. Sales in the fourth quarter exceeded last year’s fourth quarter by 10% and pushed 2019 growth to 11% over our 2018 results.

Missiles and Fire Control had the highest overall growth in 2019, exceeding the prior year by 20%. Deliveries of tactical and strike weapons, development work on new hypersonic and classified programs, and PAC-3 missile production were the strongest contributors to the increase.

Aeronautics also saw strong sales growth in the quarter and year with 2019 annual sales finishing 12% above 2018, led by our F-35 program which grew 14% in 2019. In space, the next-generation Overhead Persistent Infrared or next-gen OPIR contract, the GPS III satellite production program, and recent hypersonic wins continue to provide increased sales volume as the business area exceeded their 2018 topline by 11%. And Rotary and Mission Systems finished the year 6% over 2018, driven by increases in shipbuilding, radar and logistics programs.

Our segment profit grew nearly $700 million year-over-year, resulting in a segment profit margin of 11% and earnings per share of $21.95, which was another high watermark for the corporation.”

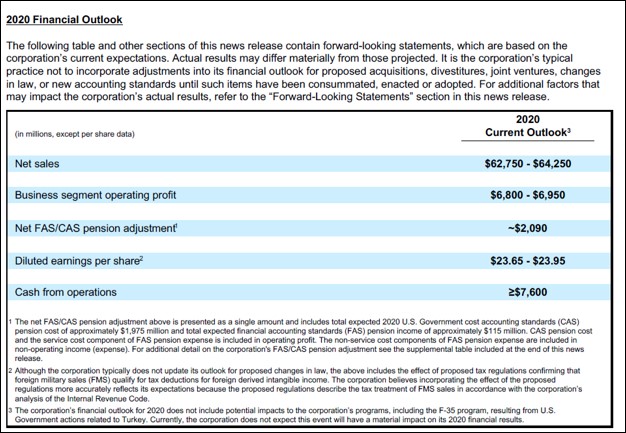

Furthermore, Lockheed Martin issued out guidance for fiscal 2020 that’s quite decent. Management expects the firm’s sales will continue to increase and that its cash flow from operations will climb modestly higher on an annual basis in fiscal 2020. The company plans to continue buying back its stock going forward, and that will help grow its diluted EPS (with material annual growth expected in fiscal 2020 on this front as you can see in the graphic below).

Image Shown: A look at Lockheed Martin’s guidance for fiscal 2020. Image Source: Lockheed Martin – Fourth Quarter Fiscal 2019 8-K SEC Filing

Large Project Backlog

Lockheed Martin very recently received some good news when NATO member Poland announced it would sign a deal to acquire 32 F-35 jet fighters from Lockheed Martin for $4.6 billion. Deliveries are expected to start in calendar year 2024. Before that impending decision was made public, please note that Lockheed Martin’s total backlog stood at $144.0 billion at the end of fiscal 2019, up from $130.5 billion at the end of its fiscal 2018. The business segment ‘Aeronautics’ represented the largest portion of that backlog, followed by ‘Rotary and Mission Systems’, ‘Space’, and ‘Missiles and Fire Control’. All four business segments reported year-over-year growth in their respective backlogs in fiscal 2019.

Having a large project backlog is part of the reason why Lockheed Martin tends to perform well financially through thick and thin. Lockheed Martin is also in the process of increasing its sales of the F-35 to Singapore and other nations that are friendly with NATO, the US, and Western powers at-large.

Concluding Thoughts

We see a lot to like in Lockheed Martin as a top quality defensive dividend growth play and in our view, shares of LMT offer both significant income growth and capital appreciation upside. While we caution that ongoing geopolitical tensions between NATO members, with US and various Europe countries on one side and NATO member Turkey on the other, could impact one of Lockheed Martin’s material overseas client for the F-35 program (Turkey), that can be offset by securing deals elsewhere (such as with Poland) and through domestic increases in defense spending. The creation of a Space Force offers long-term upside that Lockheed Martin is very well positioned to capitalize on, given its ongoing work with NASA and the US defense apparatus at-large.

Prime Aerospace & Defense Industry – BA FLIR GD LMT ROC RTN

Conglomerates Industry – MMM DHR GE HON UTX

Aerospace Suppliers Industry – ATRO HEI HXL TDY TXT SPR

Related: XAR

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Categories Member Articles