“We are raising our fair value estimate of JPMorgan to $160 per share to reflect higher sustainable growth than we’d previously been expecting.” — Matt Warren

By Matthew Warren

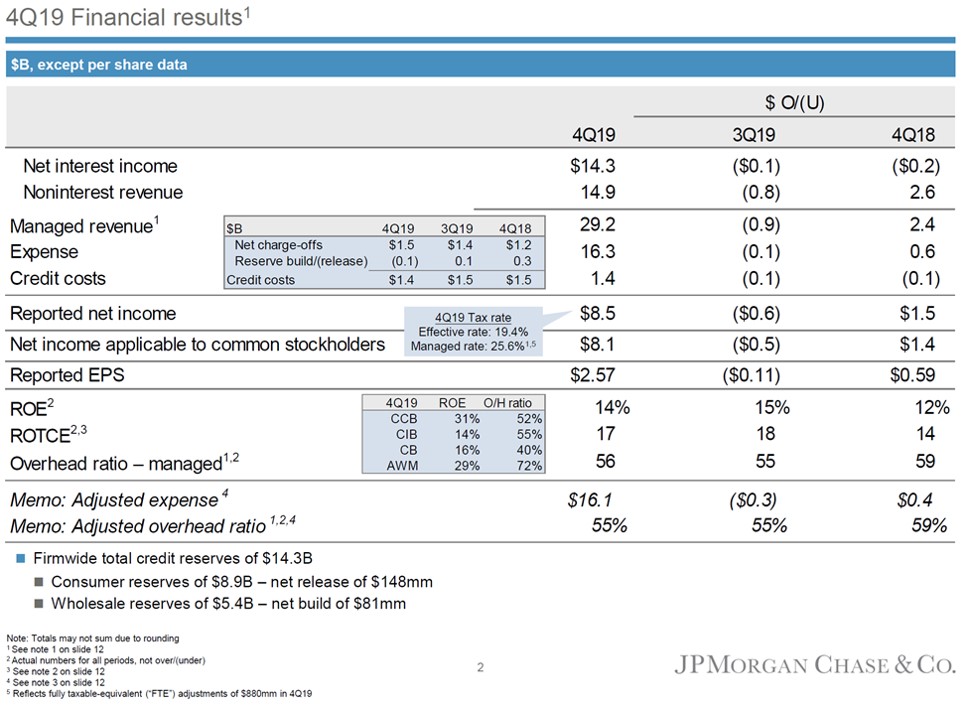

JPMorgan Chase & Co (JPM) reported an impressive set of results, and in fact, a record fourth quarter, with managed net revenue up 9% and net income up 21%, beating on both the top and bottom lines versus analyst consensus estimates. The bank continues to churn out best-in-class return on tangible capital for the money center banks at 17% in the quarter. JPMorgan’s efficiency ratio came in at an impressive 56%, or 55% on an adjusted basis. For a bank with such a sizable i-bank and capital markets business (where efficiency ratios are naturally higher), this figure is stellar. As you can see in the below graphic, the Commercial and Consumer Bank and the Asset and Wealth Management businesses stand out when it comes to return on capital.

Image Source: JPMorgan Earnings Presentation

Regarding segments, the Consumer & Community Banking segment grew revenue by 3% and net income by 5%, as 5% deposit growth helped offset net interest margin (NIM) pressure from lower interest rates. Credit card sales were up 10% and merchant processing volume was up 7%, reflecting the strong consumer and probable (ongoing) share gains.

The Corporate & Investment Bank put up the largest growth, due to the fact that it was lapping a very weak quarter as compared to the market selloff in 4Q 2019. Revenue was up 31% and net income was up a whopping 48%, highlighting the volatility of this business segment. This is also a lower return on capital segment, so volatile and lower quality earnings than at the rest of the bank. It certainly boosted results this quarter, though! Fixed income Markets was the standout with 86% revenue growth as compared to last year’s weak quarter.

Commercial Banking put up 3% revenue growth and 9% net income growth, and an ROE of 16%. The efficiency ratio in this segment of 40% shows just how efficient a money center bank can be with sizable commercial account. Much better than other segments and as compared to smaller regional banking peers. The Asset & Wealth Management Segment proved its operating leverage and ties to ever higher asset prices with 8% revenue growth and 30% net income growth. Return on equity was an outstanding 29% in the quarter in this segment. This is simply a great business and one that benefits from cross sell, so a real testament to the universal banking model.

Despite paying out 98% of earnings over the last 12 months, JPMorgan retains a “fortress balance sheet,” with a 12.4% common equity Tier 1 ratio. While loans were down 1% year over year thanks to sales of mortgages, 7% overall deposit growth shows that the bank is deepening its relationships organically, a sign of rude health for the business. We are raising our fair value estimate of JPMorgan to $160 per share to reflect higher sustainable growth than we’d previously been expecting. [Please expect this update to be live in the stock table on the website this weekend as data is refreshed.]

Related: XLF, VFH, XFO

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.