Image Shown: Tupperware Brands Corporation suspended its dividend in November 2019, a pitfall investors could have avoided by utilizing Valuentum’s proprietary Dividend Cushion ratio.

We plan to refresh our report on Tupperware after members get a chance to digest this analysis to better understand how to use the Dividend Cushion ratio.

By Callum Turcan

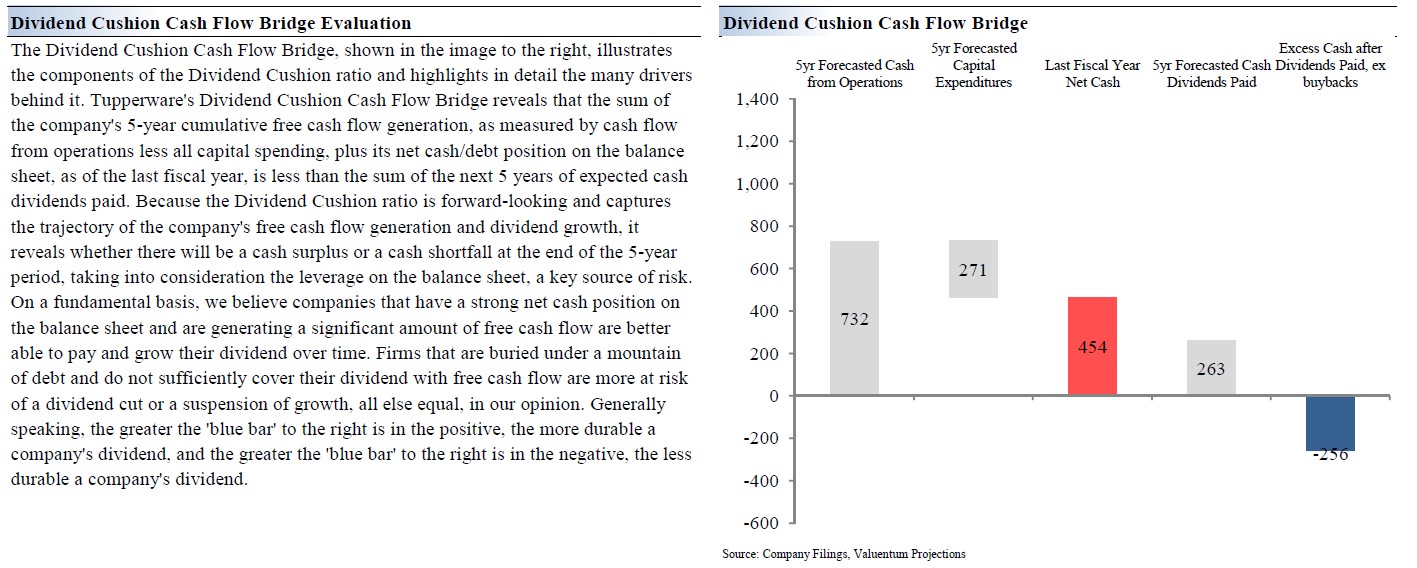

Our Dividend Cushion ratio can be a very useful tool for income seeking investors that wish to avoid payout cuts and the likely capital depreciation that follows. The Dividend Cushion ratio is based on our forecast of the firm’s future free cash flows over the next five full fiscal years, less its net debt or plus its net cash position, divided by its expected dividend obligations during this period. We view this as a powerful gauge of a company’s true dividend coverage, as compared to EPS payout ratios which are backward looking and flawed when evaluating the ability to cover future dividend obligations.

This metric has been successful in warning investors about numerous dividend cuts and potential value traps over the years, including recently with packaging company Tupperware Brands Corporation (TUP). The company sells anything from plastic kitchen storage containers under its Tupperware brand to beauty products under its NaturCare and other brands. The Dividend Cushion also most recently warned about the cut at Core Labs (CLB), too.

Avoiding Value Traps

Investors could have avoided Tupperware’s dividend suspension that was announced on November 8 by noting its Dividend Cushion ratio stood near zero before the suspension. The efficacy of the Dividend Cushion ratio has been remarkable since inception. We break down Tupperware’s pre-suspension Dividend Cushion ratio in the graphic below, from our two-page Dividend Report (can be accessed here).

Image Shown: A look at Tupperware’s weak dividend coverage pre-dividend suspension, and why the Dividend Cushion ratio can be a very useful tool for income seeking investors.

At the end of Tupperware’s third-quarter of fiscal 2019 (period ended September 28, 2019), the firm was sitting on $122 million in cash and cash equivalents while facing $325 million in debt coming due within a year along with $602 million in long-term debt and finance lease obligations. Tupperware’s near-term maturities are concerning. From fiscal 2016 to fiscal 2018, Tupperware’s annual free cash flows averaged ~$126 million and came in below the firm’s ~$139 million in average annual dividend obligations during this period. A hefty net debt load and weak dividend coverage forced Tupperware to fold and suspend the dividend, there wasn’t much else the company could do. The company had been taking on debt to keep making good on those payouts, and that compounds the problem.

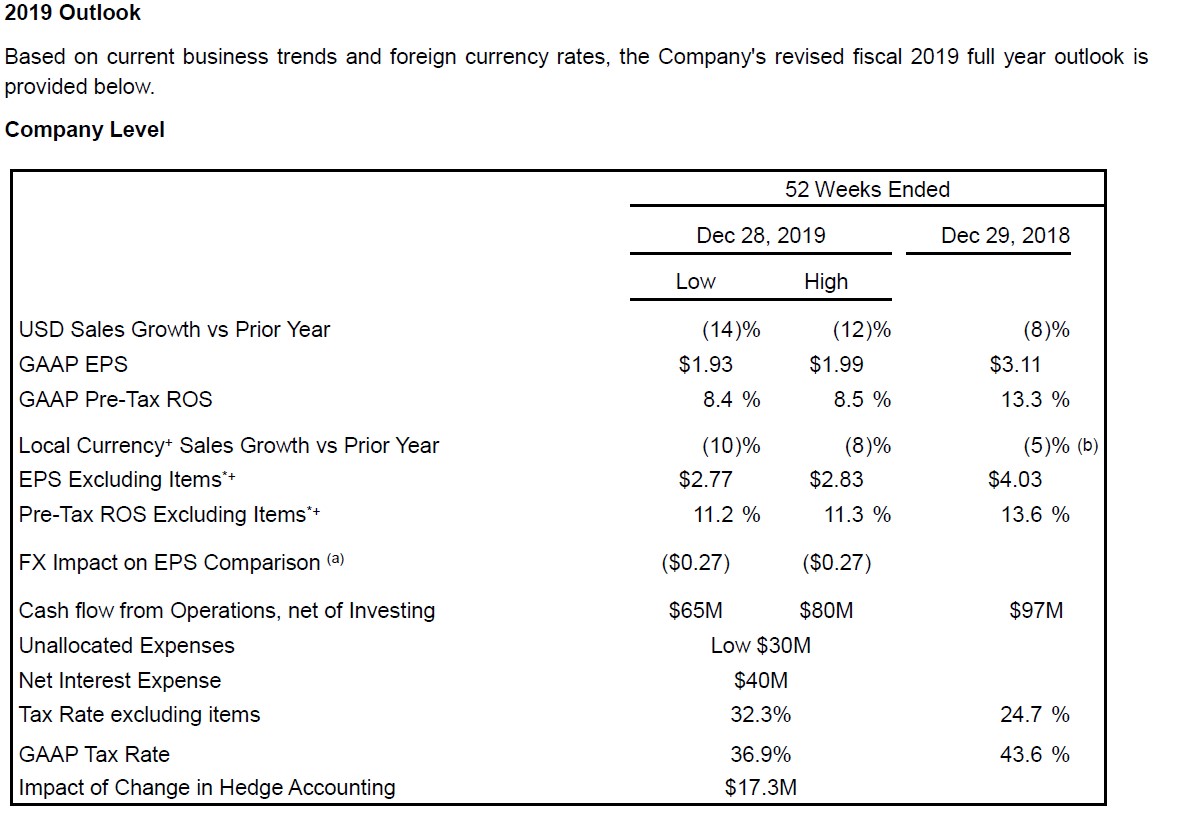

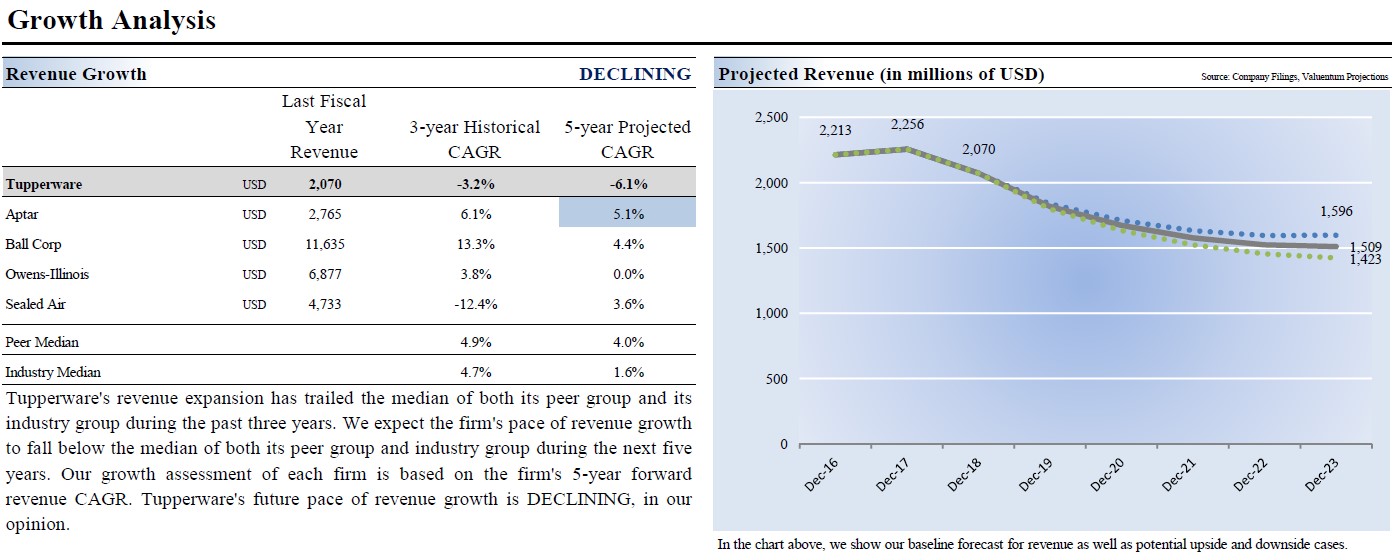

Tupperware has plenty of problems. Its business model is largely out of date in the developed world, and while the firm is seeking international upside, a strong US dollar is making that significantly harder. Tupperware’s revenues have been on a downward trajectory over the past couple of years, declining (on a GAAP basis) from $2.3 billion in fiscal 2017 to $2.1 billion in fiscal 2018. Management expects this decline will continue into fiscal 2019 as you can see in the graphic below. Furthermore, management reduced Tupperware’s guidance for fiscal 2019 multiple times in calendar year 2019 (a big red flag), which included reductions given during the firm’s second and third quarter earnings reports of fiscal 2019.

Image Shown: Tupperware cut its guidance for fiscal 2019 multiple times in calendar year 2019. Image Source: Tupperware – Third Quarter Fiscal 2019 Earnings Press Release

With limited growth opportunities, we view Tupperware’s revenue outlook as bleak. Under our base case scenario, we expect Tupperware’s sales will continue to decline over the next few years as you can see in the graphic below from our 16-page Stock Report (can be accessed here). Even when factoring out foreign exchange headwinds, Tupperware’s sales performed terribly in Asia, Europe, and the Americas during the first three quarters fiscal 2019 (declining across the board year-over-year). The firm’s “party method” of selling products just isn’t relevant in the 21st Century.

Image Shown: Tupperware’s outdated business model is starting to pressure its top-line performance in a very serious way.

Concluding Thoughts

The Dividend Cushion ratio is a very useful tool for income investors that seek to avoid dividend cuts and the pitfalls of a value trap. Historically, Tupperware’s high yield might have seen enticing, but that payout was unstainable and supported only by the company’s ability to continue taking on debt. By avoiding value traps and dividend cuts, investors can also avoid situations where material capital depreciation is often the case. Using the Dividend Cushion ratio is a good place to start when considering whether a potential income generating opportunity’s yield is “too good to believe” and better left alone. Furthermore, the Dividend Cushion ratio is a great tool for discovering companies with both solid payout coverage and room to grow their dividends per share.

Containers & Packaging Industry – ATR BLL CCK IP OI PKG SEE SLGN TUP WY

We plan to refresh our report on Tupperware after members get a chance to digest this analysis to better understand how to use the Dividend Cushion ratio.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.