Image Source: FLIR Systems Inc – November 2019 IR Presentation

By Callum Turcan

An appealing aspect of the defense industry is that it’s largely counter-cyclical, especially for companies that do a lot of business with the US Department of Defense (‘DoD’). The National Defense Authorization Act (‘NDAA’) that covers fiscal 2020 allows for a base budget level of $658.4 billion and an additional $71.5 billion has been allocated to overseas contingency operations. Noteworthy aspects of the NDAA covering fiscal 2020, which was signed into law by President Trump in December 2019, include the creation of a Space Force, a 3.1% pay increase for troops, and paid family leave for all federal workers. With a budget of $738 billion, up $21 billion from defense spending levels Congress enacted for fiscal 2019, growth in US defense spending remains resilient.

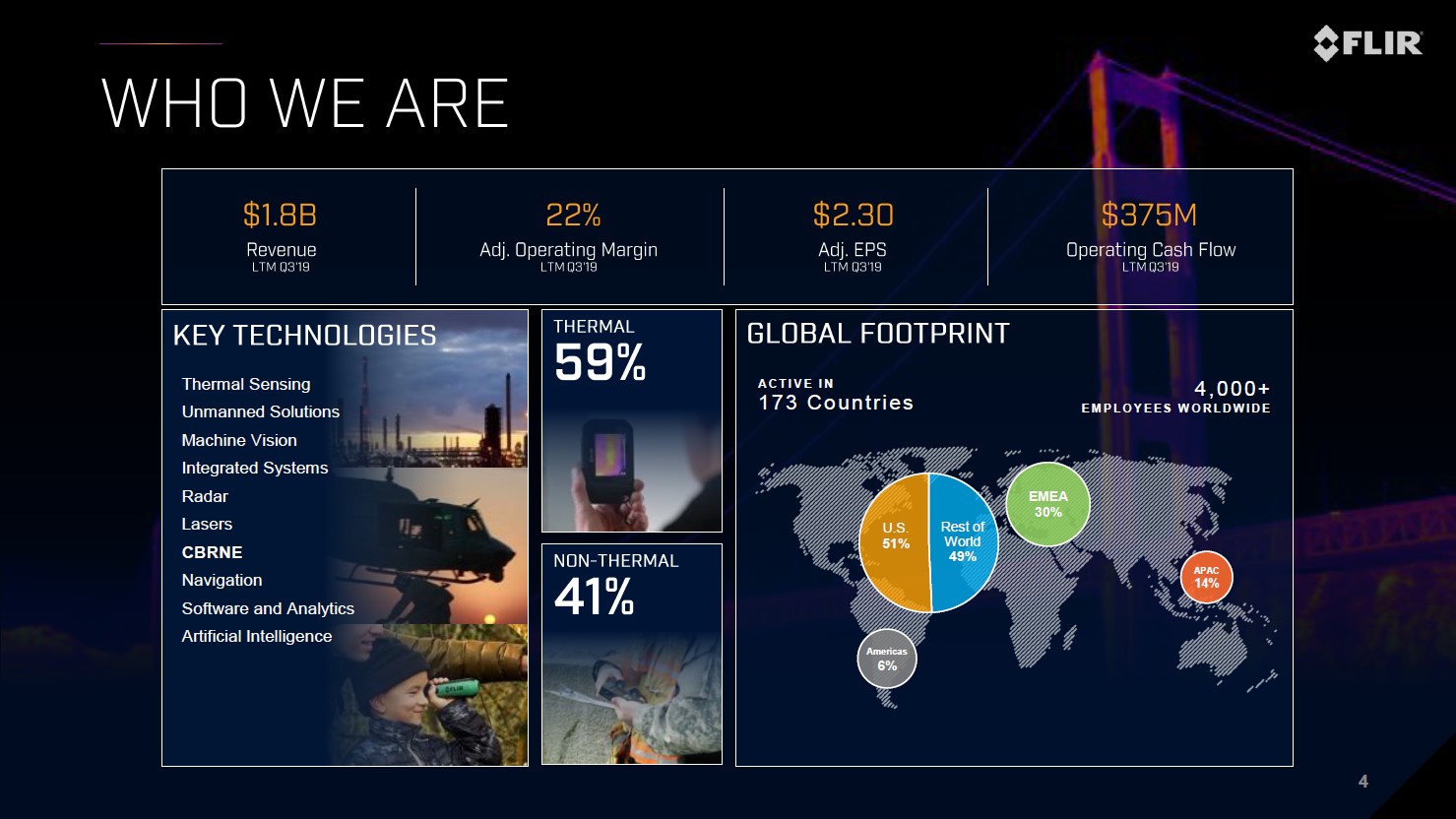

FLIR Systems Inc (FLIR) is a mid-sized defense contractor and industrial firm that designs, manufactures, and markets thermal sensors, threat detection systems, unmanned aerial systems (‘UAS’), and unmanned ground vehicles (‘UGV’). Those offerings are marketed to government and defense buyers (i.e. militaries, police forces), industrial firms (including construction and manufacturing companies), and consumers. FLIR Systems has been reinventing itself over the past few years, transforming from a company that sells thermal imaging products and threat detection systems to a company that provides comprehensive solutions to militaries and large industrial firms all over the world.

Image Shown: An overview of FLIR Systems’ asset base and global operations. Image Source: FLIR Systems – November 2019 IR Presentation

Key Acquisitions

Back in November 2016, FLIR Systems announced it had acquired Prox Dynamics for $134 million in cash (all acquisition figures in this segment are the cash price FLIR System’s paid after closing adjustments according to its SEC filings). Prox Dynamics manufactured nano-class UAS “for military and para-military intelligence, surveillance, and reconnaissance applications” and the deal marked FLIR Systems directly entering the UAS business. The transaction had plenty of logical synergies as FLIR Systems could add its thermal imaging and threat detection technology to Prox Dynamics’ UAS offerings to begin offering more comprehensive solutions. FLIR Systems has performed quite well since late-2016 due in part to the firm directly entering the UAS market and broadening its solutions for large government, military, and industrial buyers.

In January 2019, FLIR Systems completed its acquisition of privately-held Aeryon Labs for $206 million in cash. Aeryon develops and sells UAS offerings, including its quad-copter models, to “the global military, public safety, and critical infrastructure markets” which includes the US DoD. The deal allowed FLIR Systems to extend its reach beyond nano-class UAS offerings, particularly for military applications. Aeryon’s SkyRanger UAS offerings are rucksack portable, can be deployed by a single operator within a few minutes, and are able to operate in a wide variety of tough environmental conditions (i.e. wind, snow, and rain).

A couple months later, FLIR Systems acquired Endeavor Robotic Holdings from the middle-market-focused private-equity firm Arlington Capital Partners for $386 million in cash. The deal closed in early-March 2019. Endeavor Robotic Holdings develops tactical UGVs and has customers in over 55 countries. According to the press release, Endeavor Robotic Holdings is one of the largest UGV providers to the US DoD. Please note iRobot Corporation (IRBT) sold its “Defense and Security” business to Arlington Capital Partners in February 2016 for up to $45 million in cash (depending on future payouts contingent on the business hitting certain milestones). This move further cemented FLIR Systems’ push into comprehensive defense solutions for soldiers and unmanned vehicle offerings.

Recent Events

In early-December 2019, FLIR Systems announced its UGV Kobra offering had been chosen by the US Army’s Common Robotic System-Heavy (‘CRS-H’) program. That deal is worth up to $109 million as FLIR Systems has been charged with building up to 350 UGVs over the course of five years, with shipments expected to begin in the second quarter of 2020. Please note that due to its purchase of Endeavor Robotic Holdings, FLIR Systems is currently delivering the Centaur UGV to the US Army under the Man Transportable Robotic System Increment II (‘MTRS Inc II’) contract awarded in 2017. That total contract value is worth up to ~$159 million.

Financial Status

At the end of September 2019, FLIR Systems had $295 million in cash and cash equivalents on its books versus $12 million short-term debt and $645 million in long-term debt. The firm’s net cash position at the end of 2018 flipped to a net debt position due primarily to FLIR Systems’ acquisitions this year. For reference, FLIR Systems’ free cash flows averaged $298 million per year from 2016-2018 while its annual dividend obligations averaged $79 million over this period. Furthermore, FLIR Systems repurchased a significant amount of its stock in 2016 ($66 million) and 2018 ($244 million), but not in 2017 ($0 million).

FLIR Systems’ business model is light on capital expenditures, allowing for a quality free cash flow profile assuming FLIR Systems can continue winning key contracts. The company generated $245 million in free cash flow during the first nine months of 2019, spent $69 million on its dividend obligations, and repurchased $125 million of its stock. While its total shareholder return strategy was fully covered by free cash flow during this period, the two key acquisitions completed in 2019 required FLIR Systems to draw on its cash balance and issue debt.

Please keep in mind that the upcoming figures are likely to shift around somewhat going forward due to FLIR Systems’ acquisition activity. During the first nine months of 2019, FLIR Systems generated 56% of its $1.4 billion in GAAP revenues in the US. Roughly one-third of its sales during this period came from the US government. Additionally, 42% of the company’s sales were derived from its ‘Government and Defense’ segment, another 39% was derived from its ‘Industrial’ segment, and ‘Consumer’ sales made up the remainder during this period.

Here’s some comments from management covering FLIR Systems’ 2019 outlook, given during the firm’s latest quarterly conference call:

“Expanding a bit more on our 2019 outlook… we expect full year revenue of approximately $1.9 billion, which represents year-over-year growth of 7%, including organic growth of 2%. At the bottom line, we anticipate full year adjusted earnings per share of approximately $2.30, which was the low end of our original guidance range. As communicated on prior calls, our 2019 adjusted EPS guidance includes approximately $0.06 of dilution from the Aeryon Labs and Endeavor Robotics acquisitions. Through the first 9 months of the year, we have revised nearly all of that dilution and expect these acquired businesses to scale sequentially from the third to the fourth quarter.”

What We Think

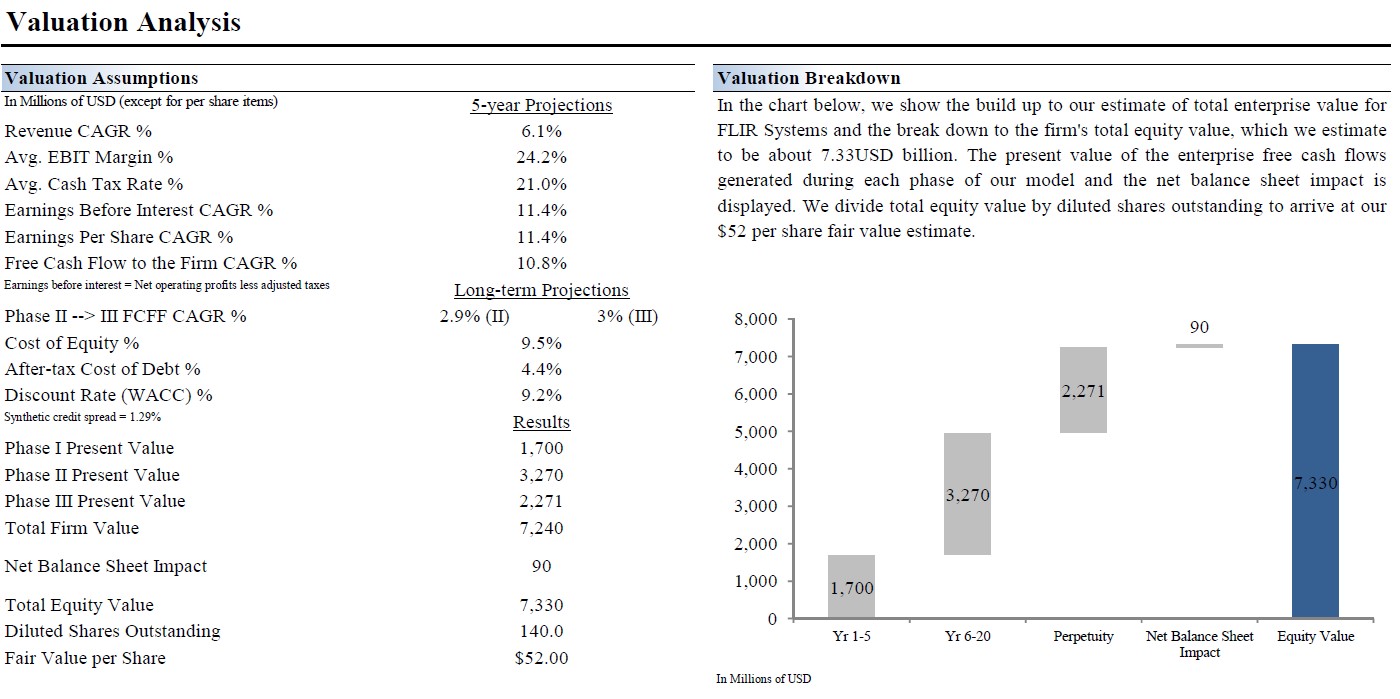

Our fair value estimate for FLIR stands at $52 per share, right about where shares are trading at as of this writing. The company’s fair value range estimate goes up to $62 per share at the high end, and shares of FLIR could justify an intrinsic value north of $60 if FLIR Systems properly integrates its new operations into its company-wide portfolio.

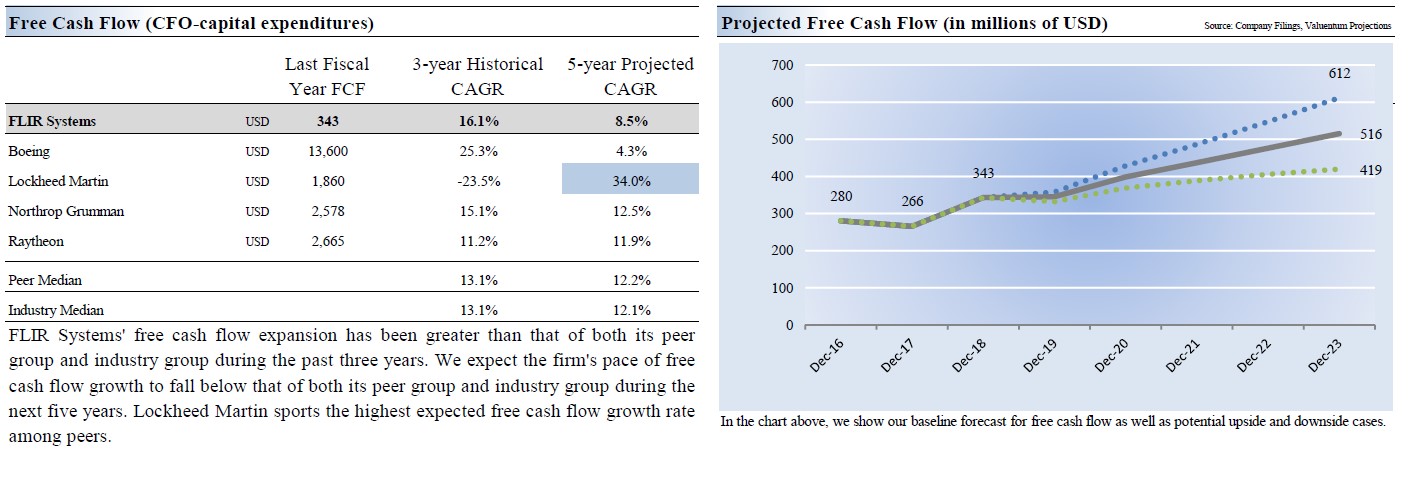

FLIR Systems’ Dividend Cushion ratio sits at a stellar 3.9x, albeit in part due to the company’s low payout ratio. Shares of FLIR yield 1.3% as of this writing. We like the growth trajectory of FLIR Systems’ dividend payout, which we caution will have to contend with share buybacks and potential future acquisitions going forward. That trajectory is supported by its strong forecasted free cash flows as you can see in the graphic below, from our 16-page Stock Report covering FLIR Systems (can be accessed here).

Image Shown: The transformation in FLIR Systems’ business profile since 2016 and its pivot towards more comprehensive offerings, particularly for the US and other Western militaries, supports its strong expected free cash flow growth going forward. Should FLIR Systems exceed the valuation assumptions used in our base case scenario, FLIR could march up towards $62 per share.

Here’s a look at our base case scenario valuation assumptions for FLIR Systems, also from our 16-page Stock Report.

Image Shown: Shares of FLIR appear fairly valued based on our base case valuation assumptions as of this writing, with the market potentially needing greater clarity on the status of the firm’s ongoing acquisition integration process to provide momentum in either direction.

Concluding Thoughts

US equity indexes continue to march upwards, and as of this writing, are at or near all-time highs. We couldn’t be more pleased with the performance of our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Our team continues to sift through Valuentum’s coverage universe to find top quality investment opportunities and we are taking a deeper look at the defense industry in light of its counter-cyclical and (somewhat) recession-resistant qualities.

Prime Aerospace & Defense Industry – BA, FLIR, GD, LMT, NOC, RTN

Related: IRBT, ITA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.