Image Source: Broadcom Inc – November 2019 IR Presentation

By Callum Turcan

On December 12, Broadcom Inc (AVGO) reported fourth quarter earnings for its fiscal 2019 (period ended November 3, 2019). While GAAP revenues for the full fiscal year were up 8% year-over-year, hitting $22.6 billion, please note that includes the uplift from Broadcom acquiring CA Technologies. Shares of AVGO initially traded down 2%-3% on December 13, as investors digested the firm’s guidance for fiscal 2020. As of this writing, shares of AVGO yield 3.4%.

Overview of Recent Events

Management expects the company’s revenues in fiscal 2020 will come in at ~$25.0 billion (give or take $0.5 billion in either direction) while Broadcom’s adjusted EBITDA is forecasted at ~$13.75 billion (give or take $0.5 billion in either direction). Broadcom generated $12.6 billion in adjusted EBITDA in fiscal 2019, up almost 14% year-over-year, but again we caution that the firm’s growth rates are materially impacted by inorganic activity.

Back in June 2019, we published a note (link here) highlighting why on an organic basis (non-GAAP), Broadcom’s revenues were expected to contract in fiscal 2019 versus fiscal 2018 levels (which ultimately ended up being the case, confirmed by Broadcom’s latest quarterly report). Here’s an excerpt:

Fast forward to the fiscal second quarter FY2019 (ended May 5, 2019), however, and things start to look a lot less rosy. Before getting into the guidance cut for FY2019, note that Broadcom generated $20.8 billion in GAAP revenue in FY2018 with an adjusted non-GAAP operating margin of 50.0%. After its latest earnings report, management now sees Broadcom’s FY2019 sales coming in at $22.5 billion, down $2.0 billion from its previous forecast.

However, note that the firm’s $18.9 billion all-cash purchase of CA Technologies closed during the first day of FY2019. At the time of closing, management stated in the press release:

The transaction is expected to drive Broadcom’s long-term Adjusted EBITDA margins above 55% and be immediately accretive to Broadcom’s non-GAAP EPS. On a combined basis, Broadcom expects to have last twelve months non-GAAP revenues of approximately $23.9 billion and last twelve months non-GAAP Adjusted EBITDA of approximately $11.6 billion.

Using that as a baseline for FY2018, Broadcom’s adjusted revenue is actually expected to decline in FY2019 [this ended up being the case].

At the start of Broadcom’s fiscal 2020, the semiconductor and infrastructure software giant completed its acquisition of Symantec Corporation’s enterprise security business, with the remaining company renamed to NortonLifeLock Inc (NLOK). That will support Broadcom’s top-line growth going forward, but keep in mind the company’s net debt load has been growing of late. From the end of fiscal 2018 to the end of fiscal 2019, Broadcom’s total debt load (inclusive of short-term debt) grew from $17.5 billion to $32.8 billion while its cash and cash equivalents position grew by just $0.8 billion to $5.1 billion during this period.

Broadcom’s cash flow profile is impressive, generating $9.3 billion in free cash flow in fiscal 2019, up from $8.2 billion in fiscal 2018. The company’s dividend payments in fiscal 2019 totaled $4.2 billion but note another $5.4 billion was spent on its share repurchase program (shares were also repurchased for tax withholding purposes). We view Broadcom’s net debt load as manageable, keeping in mind that this burden will grow substantially by the end of the first quarter of fiscal 2020 due to the aforementioned acquisition.

Concluding Thoughts

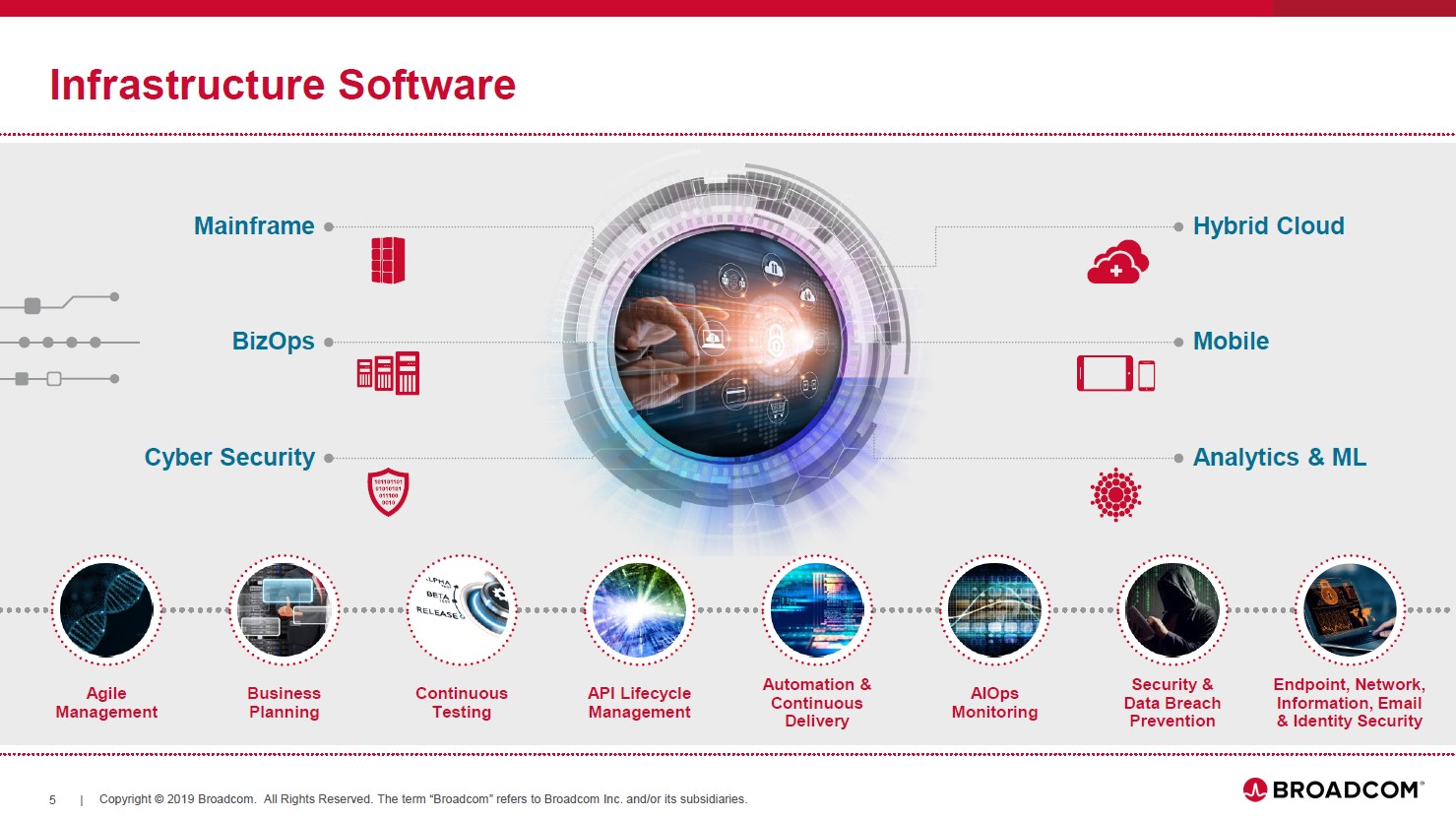

We don’t include Broadcom in our newsletter portfolios as we prefer Intel Corp (INTC) as our favorite semiconductor idea. Broadcom’s push into infrastructure software is an interesting move, in our view, and we think there’s plenty of potential for growth here. However, integration risks remain material as Broadcom enters new markets it has substantially less expertise in. Additionally, Broadcom’s desire to grow is coming at the price of its balance sheet. Going forward, we caution that Broadcom’s net debt load needs to be closely monitored. Members that want to read more on the semiconductor industry should check out why we like Intel here—->>>>

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Software Security Industry – CHKP FEYE IMPV PANW PFPT SYMC VRSN

Related: MU

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Intel Corporation (INTC) is included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.