Image Shown: Shares of Procter & Gamble have been on an epic run since mid-2018, and we think shares have gotten ahead of themselves here.

By Callum Turcan

Consumer staples giant Procter & Gamble (PG) is a solid company that generates sizable and consistent free cash flows. However, in our view, shares of PG have gotten way ahead of themselves due to a “flight to quality” that has seen the market bid up P&G’s share price from the low $70s in April 2018 to almost $120 as of this writing. Shares of PG now yield 2.5% as of this writing and trade well above the top end of our fair value estimate range of $101 per share. Please note P&G has paid out a dividend for 129 consecutive years and the company has increased its payout over the past 63 consecutive years, earning it the coveted status of ‘Dividend Aristocrat’.

Quality Cash Flow Profile

From fiscal 2017 to fiscal 2019 (ended June 30, 2019), P&G generated ~$10.8 billion in annual free cash flows on average. Annual dividend payouts averaged ~$7.3 billion during this period, which were fully covered by free cash flows. We caution that share repurchases were funded in part by the balance sheet, as stock buybacks averaged $5.7 billion per year on average during this period. As a consumer staples company, P&G is better positioned than most to weather a slowing global economy as its products will still be in high demand given the significance of hygiene and healthcare offerings in everyone’s daily lives.

On October 22, P&G reported first quarter fiscal 2020 earnings (three month period ended September 30). Its free cash flows came in at $3.1 billion last quarter, easily covering $1.9 billion in dividend payouts but falling short of fully covering $3.0 billion in share repurchases. We would prefer that the company starts keeping more cash on the balance sheet to pare down its net debt load and enhance its dividend coverage given ongoing geopolitical tensions.

Likely Overvalued

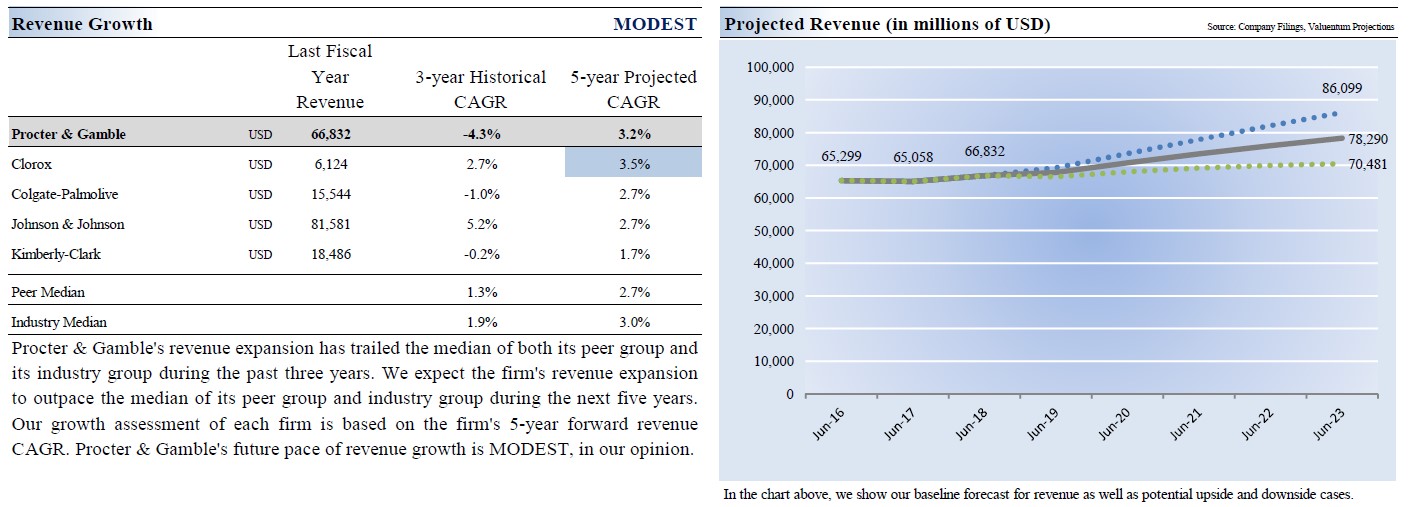

In the graphic below, from our 16-page Stock Report covering P&G (can be accessed here), we highlight our forecast assumptions for the company’s future financial performance under our base case scenario. To achieve an intrinsic value well north of $100 per share, an investor would have to believe P&G will grow its top-line consistently at rates well above what we view as reasonable over the medium- and long-term.

Image Shown: The “flight to safety” has seen shares of P&G run ahead of themselves, in our view.

From 2016-2018, the average revenue growth rate in the industry was below 2% CAGR. Given the ongoing slowdown in the growth rate of global economic activity (some regions are knocking on the door of a recession), it’s unlikely P&G would be able to maintain a revenue CAGR well north of ~3-4% over the coming years in our view. While we expect companies active in the consumer staples sector (particularly large US-based companies with significant overseas sales that have been contending with a strong US dollar for some time now) to see their top-line growth pick up a bit going forward, we see industry revenue growth rates largely matching global GDP growth over the coming years as you can see in the graphic below.

Image Shown: The organic growth rates of the revenue streams of large consumer stables companies based in the US generally track global GDP growth rates.

What We Think

Here’s a concise view of our thoughts as it relates to the strength of P&G’s dividend coverage, from our two-page Dividend Report (can be accessed here):

Procter & Gamble retains its coveted name that has been a part of corporate history for the past ~180 years, but it is a shell of its former self. Once boasting a portfolio of ~200 brands, P&G is now more concentrated with just ~65. In our view, the company still has a lot to prove to show that it packs the punch of a Dividend Aristocrat that has raised its dividend in each of the past 60+ years. Free cash flow averaged ~$10.8 billion during the past three fiscal years (2017-2019), ahead of annual run-rate cash dividend obligations (~$7.3 billion), so we have no immediate concerns with the payout. The recent acquisition of Merck KGaA’s Consumer Health business suggests more inorganic growth could be in store, especially if organic growth stagnates.

The ~$4.2 billion purchase of German-based Merck KGaA’s consumer health business, which closed in November 2018, added vitamin and supplement brands Seven Seas, Femibion and Neurobion to P&G’s portfolio among other additions. That acquisition will help support P&G’s growth trajectory as its over-the-counter offerings for certain consumer health needs expands. This expansion also provides for greater scale in the space, potentially leading to modest synergies. Pivoting to the potential weakness in P&G’s dividend coverage, from our two-page Dividend Report:

One thing is certain: Procter & Gamble is not afraid of change. Innovation remains the lifeblood of its operations, and management feels that it has a better chance of winning with ~65 leading brands across 10 businesses and industry-based sectors instead of ~200. The jury is still out, however, and though we are giving management the benefit of the doubt for now, we are closely monitoring its progress. Despite material revenue declines in recent years, operating cash flow has held up over the past three full fiscal years.

P&G has sold a number of long-term, value-creating brands, in our view, and the company may have moved too quickly through the divestment/transformation process. Total debt of $29.5 billion at the end of September 2019, modestly offset by $9.3 billion in cash and cash equivalents, weighs on its Dividend Cushion ratio. That being said, P&G’s Dividend Cushion ratio currently stands at 1.7x, earning the firm a GOOD Dividend Safety rating.

Concluding Thoughts

Procter & Gamble is a great company, but we just can’t justify its share price at current levels. While its first quarter fiscal 2020 performance was impressive with an eye towards revenue and margin expansion, exogenous headwinds will make it hard for P&G to keep living up to the market’s lofty expectations going forward. We are not considering adding P&G to our newsletter portfolios at this time.

Household Products Industry – CHD, CL, CLX, ENR, HELE, JNJ, KMB, PG

Related: TEVA, MNK, ENDP, CAH, MCK, ABC

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) is included in Valuentum’s simulated Dividend Growth Newsletter and Best Ideas Newsletter portfolios. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.