Valuentum’s November Dividend Growth Newsletter!

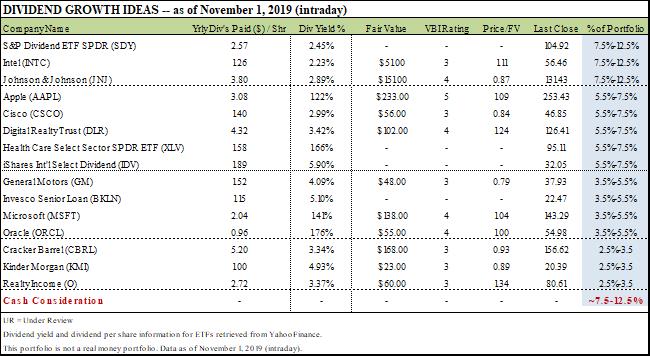

Image shown: Valuentum’s Dividend Growth Newsletter portfolio. Since inception, the newsletter portfolio has *never* had a constituent that experienced a dividend cut. We moved to weighting ranges beginning in 2018.

—

—

Today is Dividend Growth Newsletter day!

—

As I think back over the many years we’ve managed the Dividend Growth Newsletter portfolio, it has been an incredibly rewarding experience to be able to help so many dividend growth investors, not only in finding big winners, but also in avoiding big losers. If you recall, many dividend growth investors were swept away by the MLP craze years ago, and we saved our membership, perhaps in impeccable fashion. Who remembers?

—

From “getting out” of General Electric (GE) near $30 per share, to warning about ConocoPhillips’ (COP) and Kinder Morgan’s (KMI) dividend cuts far in advance years ago, we’ve been focused intensely on gaining your trust each and every day. Of course we’ve had some huge winners, too, some of them no longer in the newsletter portfolio such as Hasbro (HAS), Procter & Gamble (PG), Medtronic (MDT), names we may add back into the future at the “right price,” near the low end of our fair value estimate range on the “way up.”

—

How can we forget some of the big winners still in the newsletter portfolios! Big tech has been on fire of late with Intel (INTC) and Microsoft (MSFT) approaching new all-time highs. You may recall these two companies were among the first stocks to ever register a 9 or 10 on the Valuentum Buying Index in 2011/2012, and their respective Dividend Cushion ratios have been fantastic for years, accompanied by strong dividend growth. How can we forget about Apple (AAPL)? What a call that one has turned out to be — shares of the iPhone maker closed at ~$256 today! Microsoft is now a mid-$140 stock!

—

A number of years ago, we traveled the country sharing our thoughts on Microsoft, pounding the table on its undervaluation and strong dividend growth prospects, saying it epitomized what Valuentum looks for in dividend growth ideas at the time. This presentation from our September 2015 trip to the Silicon Valley AAII was one of my favorites. Download that presentation to learn how we looked at Microsoft through the lens of the Dividend Cushion ratio, “Value-Focused, Momentum-Based Dividend Growth Investing (pdf).” Please go ahead. The Dividend Cushion ratio is worth the price of any membership.

—

I’m so very proud of the Valuentum team, its methodologies, Value Trap, and what we’ve been able to do for investors all these years, especially dividend growth investors. I’m so grateful for you. You found us, tuned out the noise, and hopefully have made so much money these many years. Without tearing up on any further nostalgia, please download the November edition of the Dividend Growth Newsletter here (pdf). You’ve earned it. I hope you enjoy this edition greatly, and thank you so much!

—

Upcoming releases

—

This evening, November 1: High Yield Dividend Newsletter

Saturday, November 9: The Exclusive

—

In case you missed it, “The Critical Importance of Fair Value Estimates” below.

—

Kind regards,

—

Brian Nelson, CFA

President, Investment Research

Valuentum Securities, Inc.

brian@valuentum.com

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.