Image Shown: Weyerhaeuser Company – Second quarter 2019 IR Presentation

By Callum Turcan

One very interesting space of the REIT investing world includes the timber industry. Weyerhaeuser Company (WY) is a Seattle-based timber REIT that controls and owns ~12 million acres of timberland in the US, along with managing ~14 million acres in Canada via long-term licenses. The company commenced operations way back in 1900, and shares of WY yield 4.6% as of this writing. Most of Weyerhaeuser’s adjusted EBITDA comes from its ‘Timberlands’ and ‘Wood Products’ segments; however, its ‘Real Estate, Energy, and Natural Resources’ segment has become more relevant of late. Our fair value estimate for WY stands at $30 per share, roughly where Weyerhaeuser is trading at as of this writing. We aren’t interested in shares of Weyerhaeuser at current levels given the various problems the REIT’s contending with which includes its deteriorating financial performance, hefty debt load, and troubled past.

Overview

With a decent Dividend Cushion ratio, Weyerhaeuser is a stone’s throw away from seeing its Dividend Safety rating upgraded. This is partially a product of management’s ongoing asset optimization program at Weyerhaeuser. However, we caution that Weyerhaeuser has cut its dividend payout in the past and remains capital-market dependent. During the Great Financial Recession, Weyerhaeuser cut its quarterly dividend payout per share down to $0.05, versus $0.60 in 2008. While its dividend payout has since recovered to $0.34 per share on a quarterly basis, Weyerhaeuser is clearly susceptible to downturns in cyclical markets.

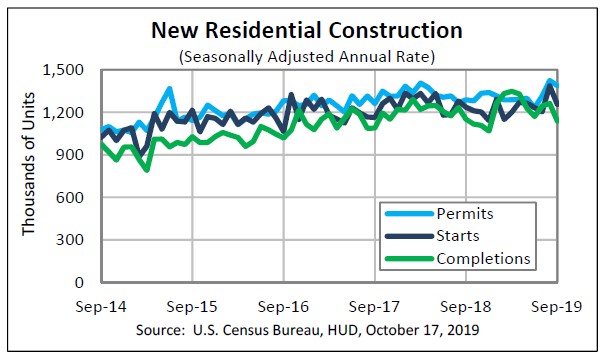

The state of North American new residential construction activity, particularly in the US and Canada, has had an outsize influence on lumber prices. According to the USDA, one third of all US lumber is used to build new homes or apartment buildings. In the graphic below, note the steady increase in new US residential construction over the past several years, with growth seen in new housing permits, starts, and completions. Very recently, all three indicators have turned lower as slowing industrial activity in the US starts to filter through the rest of the economy.

Image Shown: The US residential housing construction market has performed well over the past several years. Image Source: US Census Bureau website

Going forward, exogenous shocks to the North American economy could see new residential construction in the US and Canada slow materially. In such an event, that would likely depress lumber prices and thus Weyerhaeuser’s financial performance in the short- to medium-term, pressuring its potential free cash flows. We caution that Weyerhaeuser has already seen its financial performance deteriorate over the past few quarters.

However, should a combination of global monetary-easing policies kicking it up (yet) another notch and the potential for emergency spending packages (with an eye towards China, the Eurozone, and the UK) advert a more serious global slowdown in economic growth, any potential slowdown in US and Canada new residential construction would likely be relatively modest and short-lived. This is because household formation in the US has exceeded new housing supply with the 1.25 million new housing units completed in 2017 falling short of the expected 1.62 million annual increase in new housing demand according to Freddie Mac (FMCC).

We’ve seen this dynamic play out in major North American metropolises, particularly those in high-growth areas on the Western and Eastern Coasts of the US, with home prices shooting through the roof since falling precipitously during the Great Recession. Some cite problems getting building permits; others cite labor shortages; but whatever the reason, the US is still in need of significant new residential housing supply, which bodes well for lumber demand. In turn, that bodes well for Weyerhaeuser’s longer term growth trajectory, keeping in mind that significant short-term headwinds remain in the form of weakening macroeconomic data, trade wars and questions over whether the United States-Mexica-Canada Agreement (better known as the “revised NAFTA” accord negotiated by the Trump administration) will pass the US Congress as it stands today.

Heavily Indebted

Please note that on September 16, Weyerhaeuser announced it was selling roughly 0.55 million acres of Michigan timberlands to a privately-held entity for $0.3 billion in cash. Weyerhaeuser expects to record a gain and no tax liability in conjunction with this transaction. At the end of June 2019, the REIT had a net debt load of $6.4 billion when including its short-term debt. That hefty burden is in part a product of Weyerhaeuser’s purchase of Plum Creek through a deal completed in February 2016. At the time, the company owned more than ~13 million acres of timberland in the US which has since shifted lower as Weyerhaeuser divested some of its operations.

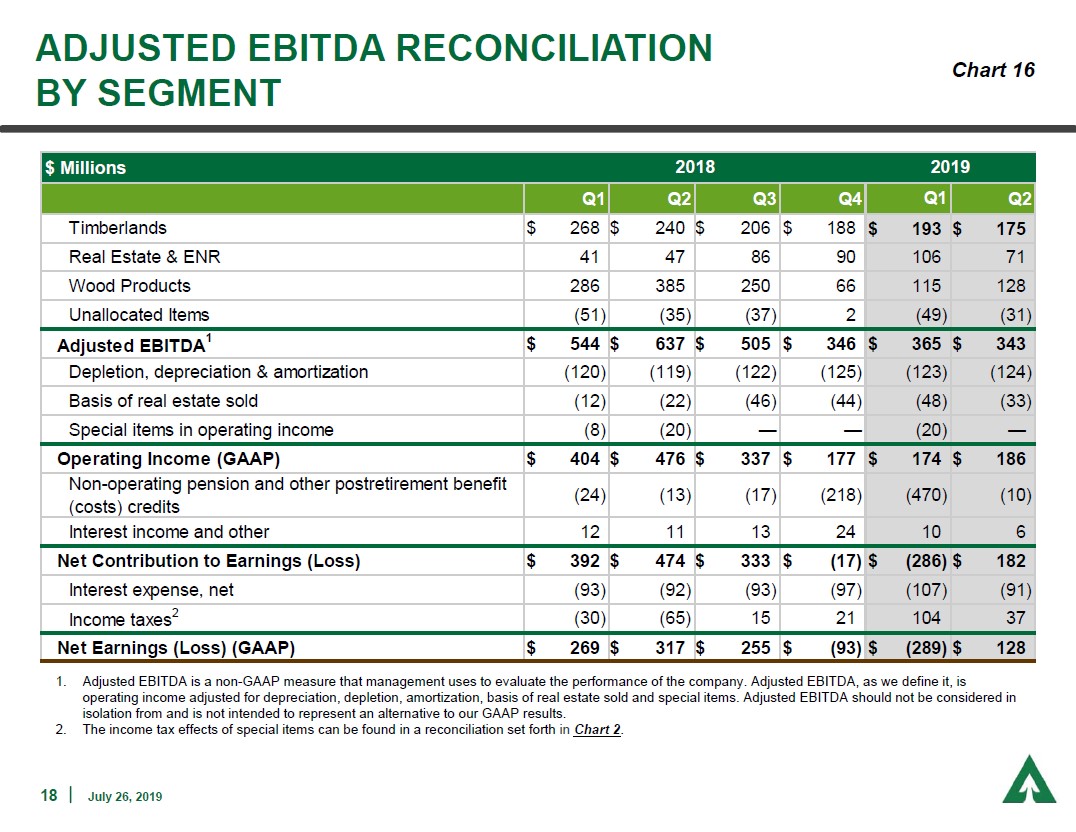

On a trailing-twelve month basis as of the second quarter of 2019, the REIT’s net-debt-to-adjusted-EBTIDA ratio stood at ~4.25x. That’s quite high, in our view, for a lumber REIT. Weyerhaeuser’s financial performance has come under intense pressure of late as you can see in the graphic below, with both its non-GAAP adjusted EBITDA and GAAP operating income slipping materially during the first half of 2019 versus its performance in the same period last year. Management mentioned during Weyerhaeuser’s second-quarter 2019 conference call that “I think we’re just going to see a slow year this year” in regards to lumber sales, and that the company had been contending with a “soft” pricing environment during the first half of the year. Weyerhaeuser went on to highlight expectations for higher lumber/lumber product prices and a turnaround during the second half of 2019.

Image Shown: Weyerhaeuser’s financial performance is deteriorating, which is concerning given its large net debt load. Weakness at its ‘Wood Products’ segment has been very pronounced. Image Source: Weyerhaeuser – Second quarter 2019 IR Presentation

From 2016 to 2018, Weyerhaeuser generated ~$0.6 billion in annual free cash flows while spending ~$1.0 billion on its annual dividend payments on average. Even when factoring out Weyerhaeuser’s weak 2016 performance from the picture, the REIT still clearly needs to tap capital markets to fund its dividend commitments. Weyerhaeuser buys back a moderate amount of its stock to offset dilution from stock-based compensation (which came in at $42 million in 2018), including spending $0.4 billion in 2018 to repurchase 11 million of its shares. A new $0.5 billion share buyback program was approved by the company in February 2019, replacing the old program from 2016. Weyerhaeuser’s outstanding share count has shifted lower over the past few years as the REIT prefers to use debt to cover its cash flow outspend.

Concluding Thoughts

Weyerhaeuser carries too much leverage on the books for us to be interested in shares of WY at this time, especially when considering the recent weakness in its financial performance. Given rising near-term headwinds, we think there are better high-yielding opportunities out there with safer payouts. Management intends on posting Weyerhaeuser’s third quarter 2019 financial performance on Friday October 25 before the market opens.

Containers & Packaging Industry – ATR BLL CCK OI IP PKG SEE SLGN TUP WY

Related – CUT WOOD, LL

Note: On October 31, we updated the note for a correction to the company’s net-debt-to-adjusted-EBITDA ratio to ~4.25x (was ~10x previously).

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.