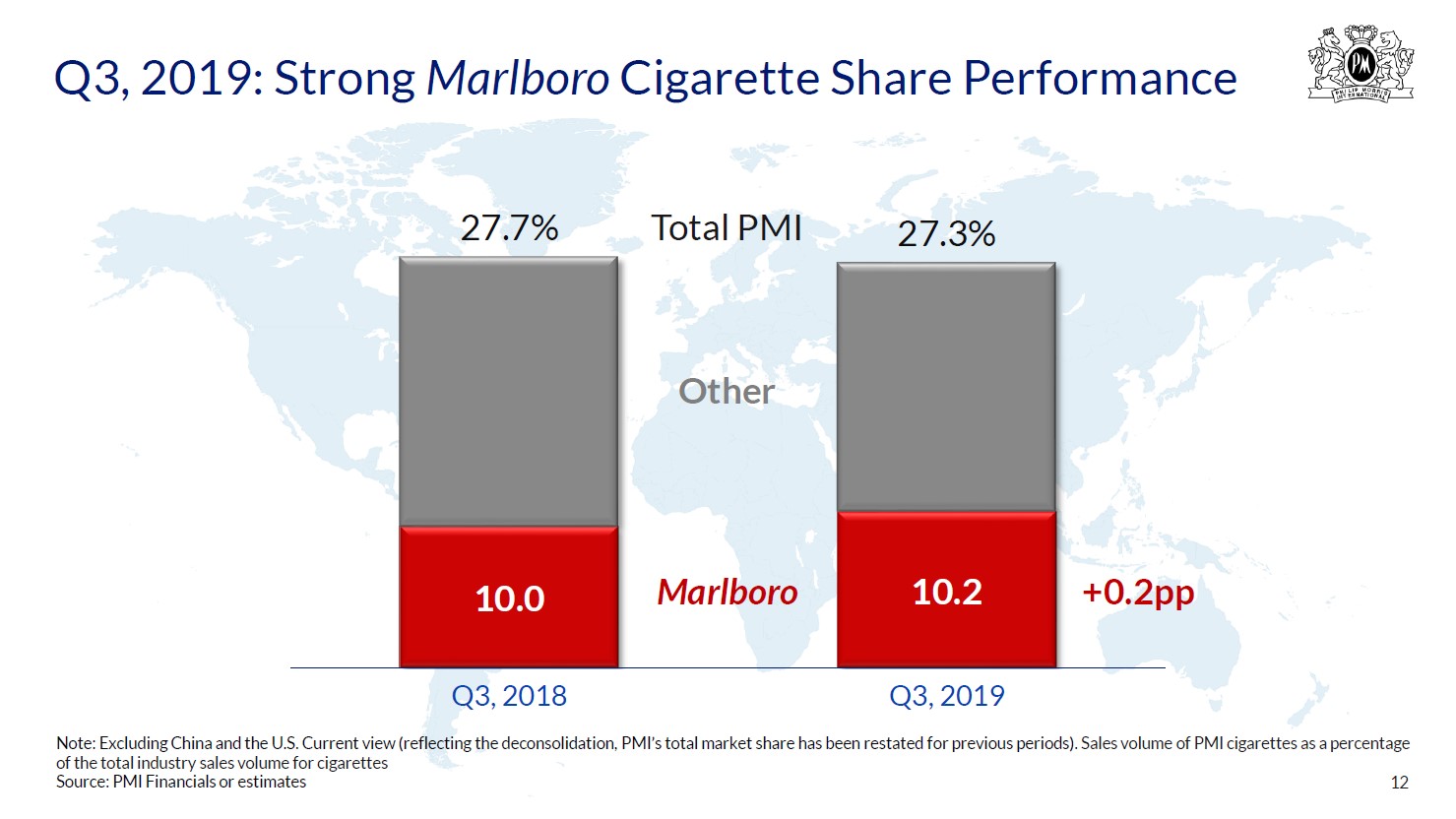

Image Shown: Philip Morris International’s Marlboro cigarette brand remains very popular worldwide. Pricing power is essential to offsetting declines in traditional cigarette sales volumes as the company positions itself for alternative tobacco products to become a larger part of its revenue streams. Image Source: Philip Morris International – Third quarter 2019 earnings presentation

By Callum Turcan

Philip Morris International (PM) posted third quarter 2019 earnings on October 17. As of this writing, Philip Morris International yields 5.8%, and we include shares of PM in our simulated High Yield Dividend Newsletter portfolio. While the company cut its full-year forecast for 2019 partially due to a tax charge, the deconsolidation of a subsidiary, and foreign currency headwinds, Philip Morris International is still guiding to generate an enormous amount of free cash flows this year. As of this writing, shares of PM are trading up on October 17 and now sit modestly above our fair value estimate. The upper end of our fair value estimate range sits at $92 per share, indicating there’s room for PM to move higher still.

Financial Update

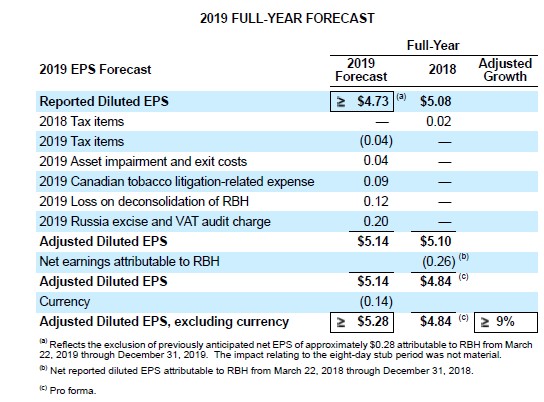

During its latest quarterly update, the company reduced its GAAP EPS forecast for 2019 to $4.73 from $4.94 previously. That’s partially due to a special tax charge in Russia regarding a VAT tax audit (involving the firm’s Russian-affiliate PM Izhora during the 2015-2017 period) that is expected to shave $0.20 off the firm’s expected 2019 EPS, an issue that has since been resolved with authorities. Additionally, foreign currency headwinds at prevailing exchange rates are expected to cut $0.14 from the firm’s expected EPS this year. The other big factor influencing Philip Morris International’s 2019 financials on a non-adjusted basis is the deconsolidation of its Canadian subsidiary Rothmans, Benson & Hedges from its financial statements.

Image Shown: A look at Philip Morris International’s updated adjusted EPS forecast for 2019. Image Source: Philip Morris International – Third quarter 2019 earnings press release

Management is guiding for Philip Morris International’s same-store constant-currency revenues to grow at least 6% this year while its (non-GAAP) constant-currency adjusted EPS is expected to climb by 9% this year to $5.28 (up from $4.84 in 2018). While the company is now guiding to generate $9.2 billion in net operating cash flows this year, down from $9.5 billion previously, capital expenditures are expected to come in at just $1.0 billion, down from $1.1 billion previously. Management does not expect the company to repurchase a meaningful amount of shares this year, leaving those free cash flows to cover the firm’s dividend payouts.

We’ll have more to say when Philip Morris International publishes its 10-Q filing for the third quarter of 2019, but using its first half performance as a guide (~$3.55 billion in dividends paid out during this period), the firm expects to spend ~$7.1 billion on dividends on an annualized basis while generating $8.2 billion in free cash flows this year. According to the firm’s earnings press release, the company had a net debt load of $25.3 billion at the end of September 2019 along with a net debt to adjusted EBITDA ratio of 2.03x. Given its strong free cash flows, we see Philip Morris International as supporting good adjusted dividend coverage.

While the company’s Dividend Cushion Ratio stands at 0.8x, please keep in mind we make adjustments to our Dividend Safety ratings from time to time when there are other factors at play (such as when the industry the firm in question operates in has very inelastic demand for its core products). Philip Morris International’s free cash flow profile is rock solid (very stable net operating cash flows, relatively low capital expenditures) and the firm maintains quality investment grade credit ratings.

Back in August 2016, Moody’s Corporation (MCO) reaffirmed Philip Morris International’s A2 senior unsecured credit rating with the firm noting that price increases were offsetting the impact volume declines at its traditional cigarette brands were having. Moody’s gives the firm a stable outlook. S&P Ratings changed Philip Morris International’s outlook to stable from negative in March 2018, and maintained the firm’s A-rated investment grade credit rating.

We would like to highlight that Philip Morris International’s alternative tobacco offerings have a promising growth trajectory ahead of them. Over time, alternative tobacco products will represent an ever growing slice of the total tobacco market.

Market Share and IQOS Update

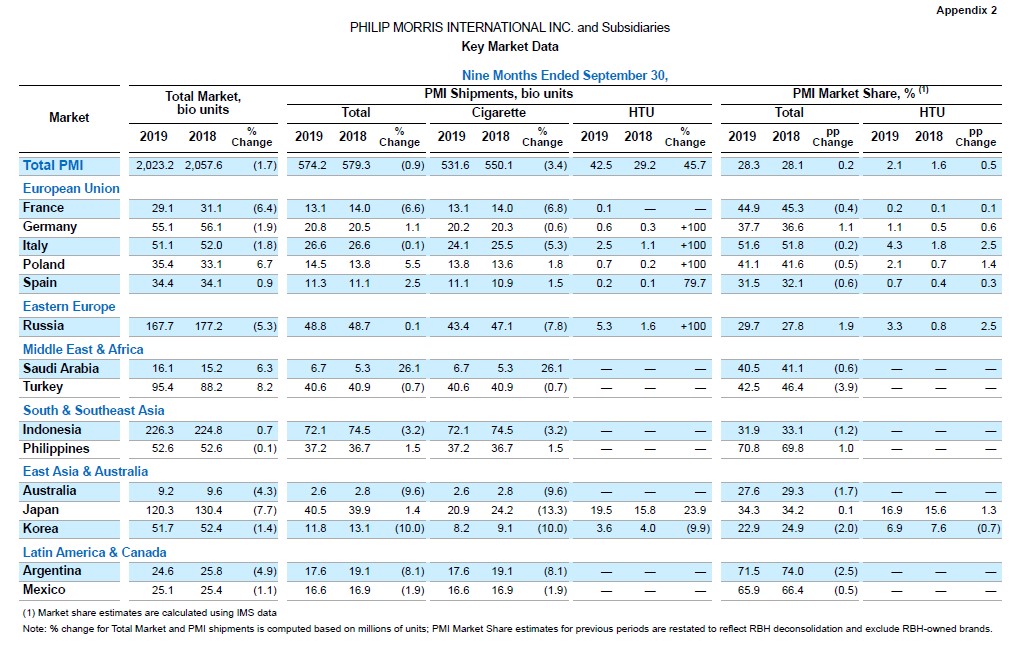

During the first nine months of 2019, Philip Morris International’s market share by unit volume in the global cigarette industry (excluding China and the US) fell by 20 basis points versus the same period last year to 26.9%. When including heated tobacco unit volumes (which are growing) and traditional cigarette unit volumes (which are shrinking), Philip Morris International’s cigarette volumes took up 26.2% of the global cigarette and heated tobacco market by unit volume during the first three quarters of 2019, down 30 basis points from the same period last year.

However, Philip Morris International’s heated tobacco market share by volume as a percent of total worldwide cigarette and heated tobacco unit sales grew by 50 basis points year-over-year to 2.1%. Please note that this isn’t the firm’s market share in the heated tobacco space as a standalone industry but reflects the firm’s market share in the heated tobacco space as a percent of the total worldwide cigarette and tobacco industry volumes. This segment is supported by growing demand for the company’s IQOS heated tobacco offering; sales first started in Japan and Italy back in 2014.

As a crucial aside, it’s important to keep in mind the IQOS product was approved by the FDA (press release here) for US sales earlier this year. Juul Labs, partially owned by Altria Group Inc (MO), sells very popular but controversial vaping products and those products haven’t been approved yet by the FDA. Altria is marketing the IQOS product in the US under a marketing and technology sharing agreement with Philip Morris International.

The rollout of IQOS in the US has already begun, with stores in Atlanta, Georgia, becoming the first to start selling these products. Unlike vaping products (i.e. Juul), the IQOS heated tobacco offering closely simulates the traditional cigarette experience in terms of taste and length of “smoking” time. As the tobacco isn’t burned, the IQOS offering can’t be used for smoking other substances (at least not easily).

Juul Labs announced on October 17 that the company is ending the sale of most of its flavored vaping products in the US to get ahead of likely federal action (given how the FDA is coming after Juul Labs, and we mean coming after them with a vengeance in light of vaping amongst those under the age of 18 reportedly rising significantly in the US). The company now only sells tobacco, mint, and methanol flavors in US markets, but that still may not be enough to appease regulators (namely the FDA).

In contrast, IQOS was created only to appeal to traditional smokers of cigarettes (something that’s embedded in the product’s very design as it tastes and feels like a normal cigarette, instead of being some flavored fruity “treat” if you will). Philip Morris International, and through its partnership with the company Altria, isn’t attempting to appeal to any other demographic other than those that it can legally sell this product to. Given the ongoing controversies regarding Juul Labs, we feel it’s very important to make that distinction here.

It will take time to see how well IQOS will perform in the US, given the controversies of late regarding the sales of vaping products and alternative tobacco products in general. We think the IQOS product’s approval by the FDA combined with Altria’s marketing prowess supports a sales trajectory built on solid ground as the nascent offering attempts to win over traditional cigarette smokers. Additionally, please note Philip Morris International wasn’t previously selling traditional cigarettes to these consumers (as is often the case in international markets, depending on the brand the traditional cigarette consumer in question smoked before trying IQOS).

Putting this all together, Philip Morris International’s market share of total worldwide cigarette and heated tobacco unit volumes (excluding China and the US) rose by 20 basis points to 28.3% during the first nine months of 2019 versus the same period last year. We really appreciate Philip Morris International’s ability to use its heated tobacco offerings on top of the brand power of its traditional cigarette sales to maintain a dominant market share position in the global tobacco industry.

Image Shown: Philip Morris International has a dominant market position in key European, Latin American, and Southeast Asian tobacco markets. This data reflects the deconsolidation of Canadian subsidiary Rothmans, Benson & Hedges Inc from Philip Morris International’s results. Image Source: Philip Morris International – Third quarter 2019 earnings press release

IQOS is now available in a few dozen countries around the world as you can see in the graphic below, with plenty of room to expand deeper into Latin American, Asian, African, and Middle Eastern markets. We see the momentum behind the IQOS offering as being quite strong, which supports the trajectory of Philip Morris International’s free cash flows going forward.

Image Shown: Philip Morris International’s IQOS offering has room to expand further into Asian, Australian, African, Latin American, Middle Eastern, and European markets. This growth trajectory supports its free cash flows profile. Image Source: Philip Morris International – Third quarter 2019 earnings presentation

Here’s what management had to say about the IQOS offering through prepared remarks:

“…we estimate that there were approximately 12.4 million IQOS users as of quarter-end. We further estimate that 71% of the total — or some 8.8 million IQOS users — have stopped smoking and switched to IQOS, with the balance in various stages of conversion… IQOS is now commercially available in 51 markets, following recent launches in Belarus, the United Arab Emirates and the U.S…

We are particularly excited by the launch of IQOS in the U.S. through our commercial arrangement with Altria. The first IQOS retail store has opened in the initial lead market of Atlanta, Georgia, marking an historic milestone in providing better alternatives to the 40 million men and women in the U.S. who smoke. IQOS is currently the only heat-not-burn product on the market authorized through the U.S. Food and Drug Administration’s PMTA pathway as “appropriate for the protection of public health.”

Say Goodbye to the Altria-Philip Morris International Tie-Up Reports

Furthermore, the company noted that:

“As you are aware, the merger discussions with Altria have ended. Although this chapter is definitively closed, we have an ongoing relationship with Altria, and both companies will focus on maximizing the IQOS opportunity in the U.S. market.”

While we saw the potential Altria-Philip Morris International tie-up as offering obvious and straight-forward cost and revenues synergies (merger terms aside), the terms of the merger weren’t popular in the eyes of the market (meaning the post-merger equity ownership was seen as unfavorable to PM shareholders). Shares of Philip Morris International have moved significantly higher since the news broke that the potential tie-up wasn’t going to happen (which had happened before the firm’s earnings release).

Concluding Thoughts

We continue to like Philip Morris International as a quality high-yield play with good dividend coverage in a low interest rate environment. Strong pricing power enables the firm to offset sales declines of its traditional cigarette volumes as the company waits for its alternative smoking offerings (like IQOS) to represent a bigger chunk of company-wide sales. Please note that foreign currency headwinds remain significant, but manageable.

Tobacco Industry – BTI MO PM SWM VGR

Related smoking: IMBBY, JAPAY, GLLA, VAPE

Marijuana stocks: ACB, ACNNF, APHA, CGC, CRON, HEXO, STZ, TLRY

Related ETFs: MJ, YOLO, ACT, THCX, SOIL, CNBS, TOKE, POTX

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.