Image Shown: Shares of ConocoPhillips traded modestly higher on October 7 after announcing a significant dividend increase and plans for additional share buybacks in 2020. However, please note ConocoPhillips is still trading far below where it was at the start of 2019 as an abundance of supplies combined with deteriorating macroeconomic conditions to weigh negatively on expected future raw energy resource pricing.

By Callum Turcan

On October 7, shares of upstream super-independent ConocoPhillips (COP) traded up modestly after the company announced that it was boosting its quarterly dividend by 38% sequentially and would repurchase $3.0 billion worth of its shares in 2020. Management noted that the upsized dividend would cost an additional $0.5 billion on an annualized basis. Shares of COP yield just over ~3% on a forward-looking basis as of this writing.

Financial Overview

The free cash flows of price-taking firms like raw energy resource producers (ConocoPhillips intentionally doesn’t hedge a meaningful amount of its production as part of its corporate strategy) are quite volatile as one would expect. In 2018, ConocoPhillips generated ~$6.2 billion in free cash flow (net operating cash flows less capital expenditures) and spent $1.4 billion on its dividend payouts on top of $3.0 billion in share repurchases. However, please note that ConocoPhillips’ 2018 financial performance was supported by materially stronger raw energy resource prices than what the firm is currently facing going forward. Brent traded between $60-$70 per barrel for most of 2018, and now front-month Brent futures are trading below $60 per barrel. Additionally, Brent is in backwardation, meaning the futures curve is downward sloping (investors expect oil prices to continue weakening going forward as of this writing).

Management is targeting $3.5 billion in share repurchases this year, which will drop back down to $3.0 billion in 2020 as mentioned previously. ConocoPhillips annualized dividend payouts are now expected at a bit under ~$2 billion going forward. The company generated $2.4 billion in free cash flows during the first half of 2019. On an annualized basis, that would fall a tad short of covering both its expected dividend payouts and share repurchases this year. More importantly, if raw energy resource (specifically oil) prices don’t recover, ConocoPhillips’ future free cash flows would likely come under fire thus weakening its dividend coverage.

Our Dividend Cushion ratio stands at 2.9x given ConocoPhillips’ impressive deleveraging efforts over the past few years and considering the sharp reduction in its quarterly payout back in early 2016. ConocoPhillips’ dividend has not yet recovered to pre-cut levels (the company’s current quarterly payout is $0.42 per share versus $0.74 per share before the payout cut).

Let’s talk about ConocoPhillips’ impressive deleveraging efforts over the years. Inclusive of short-term debt, the firm’s net debt load stood at $8.25 billion at the end of June 2019, down materially from $23.6 billion at the end of 2016. That was the product of major cost cutting initiatives (i.e. ending deepwater exploration efforts), divestments (from Alberta’s oil sands patch to the North Sea to various conventional plays in the Lower 48 US states and elsewhere), and most importantly, a heavy focus on free cash flow generation (flexing capital expenditures down as needed to preserve its financial position).

We really like ConocoPhillips’ deleveraging efforts, but we caution that even with all of this great work in mind, its future financials will still be negatively influenced by lackluster raw energy resource pricing. Whether it’s liquefied natural gas, crude oil, natural gas, natural gas liquids, or condensate, an abundance of supplies combined with rising fears over the trajectory of future demand growth is placing a tremendous amount of pressure on expected future raw energy resource prices.

Louisiana’s “Emerging” Austin Chalk Play Is a Dud

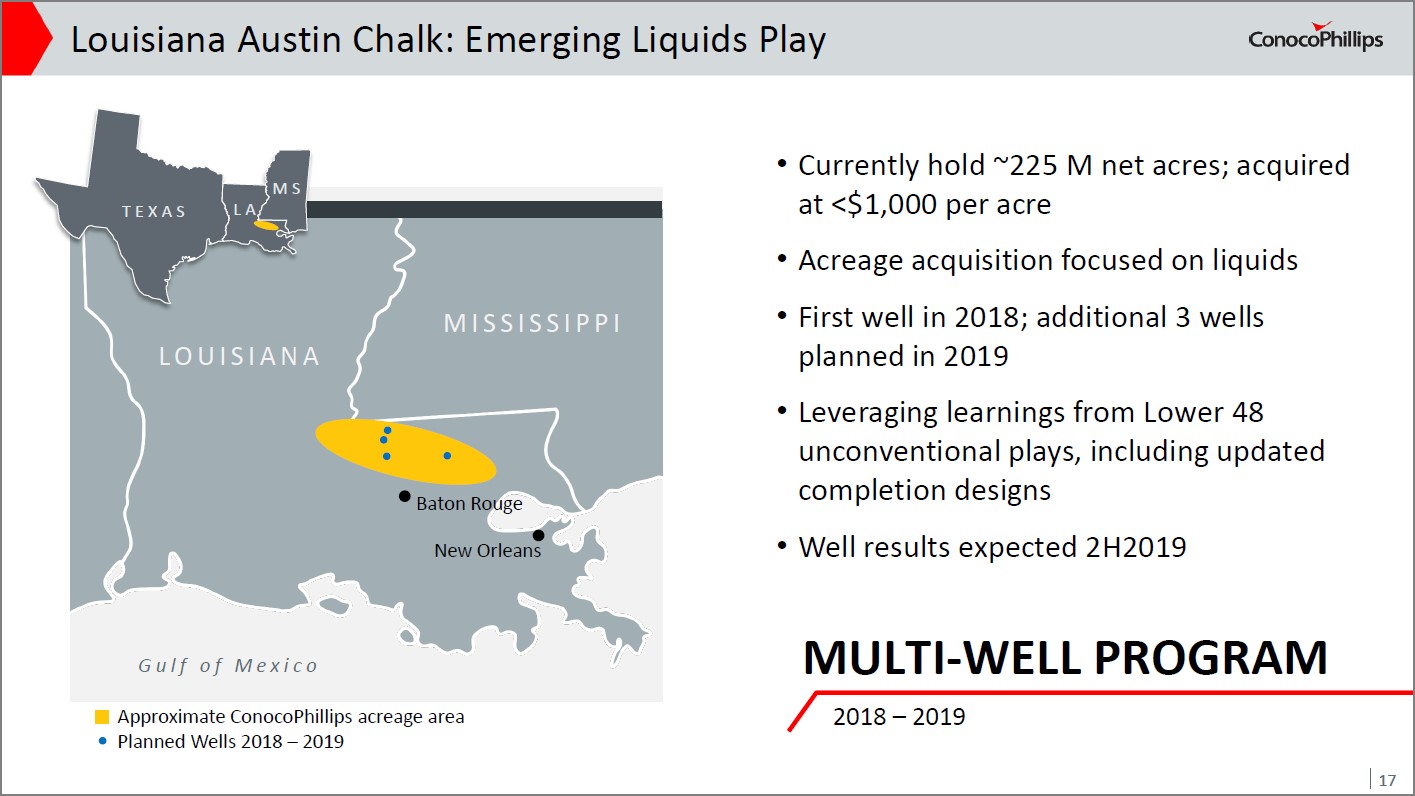

We would like to highlight that the potential for widespread upstream development opportunities in what is known as Louisiana’s “emerging” Austin Chalk play appear to be non-existent. Simply put, the play is a dud. For reference, there is a quality Austin Chalk play in the US, but that unconventional upstream opportunity is situated in southern Texas alongside the better known Eagle Ford play.

ConocoPhillips and others in the industry, like EOG Resources Inc (EOG) and Marathon Oil Corporation (MRO), had talked up Louisiana’s Austin Chalk play in the recent past as potentially being another quality unconventional opportunity, effectively equating the Louisiana part of the play to the Texas portion. Back in the 1990s, conventional upstream attempts (meaning fracking wasn’t used during the well completion process) to unlock raw energy resources from Louisiana’s Austin Chalk play proved ineffective. The unconventional upstream industry, utilizing hydraulic fracturing and horizontal drilling, tried to prove the play was viable in the latter part of the 2010s.

Fast forward to today and ConocoPhillips is looking to unload the asset due to high water cuts and lackluster production results. The firm is doing a better job pumping out water from Louisiana’s Austin Chalk play than crude oil. Conversely, ConocoPhillips’ large Eagle Ford/Austin Chalk operation in Texas continues to churn out sizable oil volumes at a relatively low cost of supply (for unconventional upstream operations).

ConocoPhillips is reportedly seeking to divest its entire ~234,000 net acre position in the Louisiana Austin Chalk play, but we caution that any price the firm receives will likely be very low. This entire endeavor is a write-off in our view; the remaining value of the asset is negligible (ConocoPhillips has likely sunk around a few hundred million in total into acquiring a position in the area, expanding that position, and attempting to prove the play).

Image Shown: While ConocoPhillips acquired a sizable position in Louisiana’s Austin Chalk play for relatively cheap, that investment turned out to be a complete dud and the company is now seeking to sell off its entire position in the “emerging” play. We doubt the firm will get much for the asset if a bid does materialize. Image Source: ConocoPhillips – May 2019 IR Presentation

Concluding Thoughts

Our fair value estimate for ConocoPhillips stands at $67 per share, well above where COP is trading as of this writing. However, ConocoPhillips’ Valuentum Buying Index stands at 3 given its weak technical performance and other factors (the upstream industry is a tough one to operate in), so we are staying away from the name. The upstream oil & gas industry is a victim of its own success, and until the supply paradigm shifts, we are generally staying away from the space (downstream, midstream, and fully integrated companies in the energy industry offer more compelling investment opportunities in our view).

Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Related: ARMCO, USO, OIL, XLE

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. BP plc (BP) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.