Image Source: Intuitive Surgical Inc – IR Presentation

Competition is heating up in the medical robotics space, an area of the medical device industry Intuitive Surgical (ISRG) is a clear leader in with its Da Vinci system installed in ~5,000 hospitals and other medical centers around the world (approximately 60% of Intuitive Surgical’s installed base is in the US). Intuitive Surgical’s business model is built around charging healthcare providers an upfront fee along with additional charges for single use instruments which creates strong reoccurring revenue streams. The Da Vinci system is a robot-assisted surgical device that has been shown to meaningfully improve patient outcomes, seen through lower levels of blood loss and shorter hospital stays across multiple different types of surgeries (general surgeries, thoracic surgeries, urology surgeries, and more).

New Market Entrants

Medtronic PLC (MDT) seeks to launch its own robot-assisted surgery device for soft tissue surgeries, aimed not at stealing market share from Intuitive Surgical’s existing customers (no easy feat given that the upfront cost of ~$0.5-$2.0 million per Da Vinci system on top of needing to retrain surgeons on how to use a new system) but winning over new customers that have yet to adopt medical robotics systems like the Da Vinci. Medtronic’s new offering isn’t expected until 2021 at the earliest and the company plans to utilize the same business model as Intuitive Surgical’s given the success the market leader has had with winning over recurring business. Additionally, Medtronic intends to price its offering competitively, potentially below the Da Vinci system, to hit the ground running when the yet-to-be-named medical robotics offering is launched commercially.

Privately-held CMR Surgical seeks to launch its Versius robot-assisted surgery device relatively soon, starting with sales in Europe and Asia before expanding to other parts of the world. A Series C fundraising round that CMR Surgical announced raised approximately USD$0.25 billion in September 2019 is expected to help finance the imminent launch of the Versius offering. Unlike Intuitive Surgical and Medtronic, CMR Surgical is opting for a subscription based model.

Intuitive Surgical has time before CMR Surgical starts moving in on its home turf where the company has a massive scale and installed base advantage, but international growth at Intuitive Surgical will become harder as new players enter the arena. Companies seeking to move into the medical robotics industry need to do more than just compete on price; they need to showcase why/how their robotics technology can improve patient outcomes better than their peers while being able to do so at an effective price point. We see patient outcome improvements representing the key differentiator in the long term for sales of robot-assisted surgery devices, with pricing concerns coming in a close second (i.e. an upfront cost of $50 million is likely out of reach of most hospitals and medical centers in the world) keeping in mind healthcare budgets on an international basis are significantly smaller on average than those in North American, European, and East Asian markets.

Valuentum’s Discounted Cash Flow Model

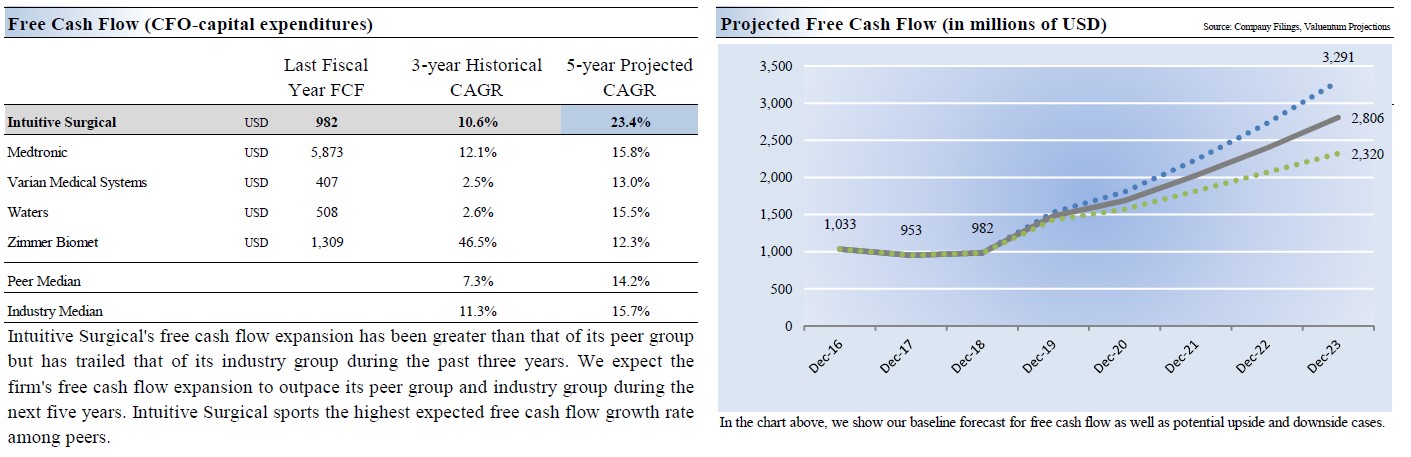

We recently updated our valuation of Intuitive Surgical, increasing our fair value estimate of ISRG from $390 per share (as of the February 2019 update) to $429 per share (as of the September 2019 update) To see more, check out Intuitive Surgical’s 16-page Stock Report here—->>>>. At the top end of the fair value estimate range, we value shares of ISRG at $507 per share, below where shares are trading at as of this writing (~$514 per share). While we are very optimistic on Intuitive Surgical’s ability to grow its free cash flows, depicted in the graphic down below, we caution that competitive pressures are rising at a time when the market has already fully priced in ISRG’s strong growth trajectory.

Image Shown: Intuitive Surgical’s business model allows for meaningful free cash flows, which we see as expanding significantly over the next five years. However, we caution that this upside is already fully reflected in Intuitive Surgical’s stock price.

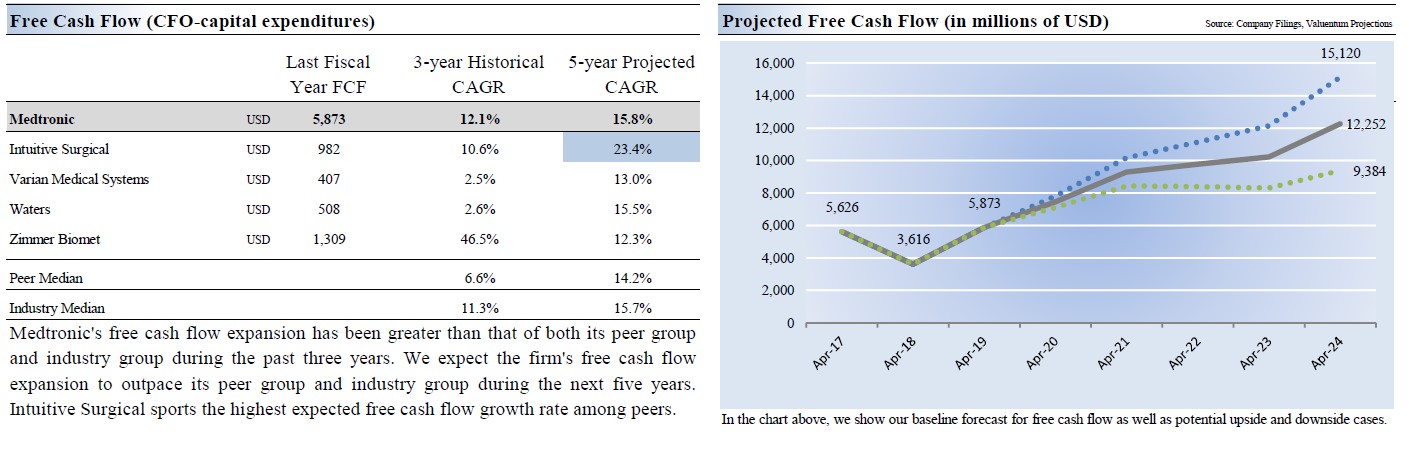

Intuitive Surgical does not currently pay out a dividend. Medtronic does, and shares of MDT yield 2.0% as of this writing. We recently raised our fair value estimate for MDT to $101 per share, with the top end of our fair value estimate range standing at $119 per share. As Medtronic trades near $106 per share as of this writing, shares seem fairly valued with room for modest upside if its entrance into the robot-assisted surgery device space works out favorably. As with Intuitive Surgical, we like Medtronic’s free cash flow growth prospects as you can see in the picture below. Strong free cash flows are responsible for Medtronic’s solid 2.1x Dividend Cushion ratio. To see more, check our Medtronic’s 16-page Stock Report here—->>>>

Image Shown: Demographic shifts in developed markets and rising access to quality healthcare options in developing markets underpins Medtronic’s promising free cash flow outlook.

Concluding Thoughts

We aren’t adding Intuitive Surgical or Medtronic to our newsletter portfolios as we prefer Johnson & Johnson (JNJ) and the Health Care SPDR (XLV) ETF as ways to play rising healthcare expenditures worldwide, both of which are included in our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. The medical robotics industry is a quality space to operate in, however, but establishing a serious presence in the highly regulated and very competitive space is no easy task. We continue to watch Intuitive Surgical and Medtronic closely.

Medical Devices Industry – EW ISRG MDT VAR WAT ZBH

Related – JNJ XLV

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and Health Care SPDR (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.