Shares of Zimmer Biomet are trading on lofty expectations and investors may be in for a shock should Zimmer Biomet continue to underperform during the second half of 2019. Foreign currency headwinds continue to grow as seen through the strength of the US Dollar Index during the third quarter of 2019. We like Zimmer Biomet’s deleveraging activities but think its share price has gotten ahead of itself given these rising headwinds, lack of top line growth, and deteriorating net operating cash flows. We are staying away from Zimmer Biomet.

By Callum Turcan

Zimmer Biomet (ZBH) makes medical devices and shares of ZBH yield 0.7% as of this writing. The company as it stands today was created through Zimmer Holdings acquiring Biomet in 2015 in a cash and stock deal valued at ~$14 billion. Zimmer Biomet designs, manufactures, and markets orthopedic reconstructive devices, dental implants, sports medicine, biologics, and related surgical equipment. During the firm’s second quarter 2019 earnings release published July 26, management altered full-year guidance for Zimmer Biomet in ways that masks the pressures the company’s financials have faced during the first half of 2019.

Analyzing Latest Guidance Changes

Previous guidance for 2019 called for -0.5% to 0.5% annual revenue growth assuming a 100-150 basis point headwind from foreign currency headwinds. Here it’s worth highlighting the materially adverse impact a strong US dollar is having on top line (and ultimately bottom line) performance of many US-based companies. Now management expects the foreign currency headwind to come in at 125-175 basis points in 2019; however, Zimmer Biomet still raised its revenue growth guidance to flat to 0.5% growth.

Non-GAAP revenue was up 1% on a constant currency year-over-year basis during the first half of 2019, but down 1.5% on a GAAP basis when including foreign currency headwinds. It’s a little odd that management guided for stronger top line growth while assuming a larger foreign currency headwind considering the relatively weak sales performance during the first half of the year. Not out of the question by any means, but suspicious.

Zimmer Biomet’s first half sales performance was positively affected by favorable volume/mix which added 360 basis points to its revenue growth on a year-over-year basis this year. Price reductions shaved 260 basis points off of its revenue growth during this period. That’s on top of foreign currency headwinds reducing revenue growth by 250 basis points during the first half of 2019, resulting in a 1.5% sales decline on a GAAP basis. Should foreign currency headwinds abate somewhat as expected, Zimmer Biomet would come closer to achieving its annual revenue growth trajectory in 2019. That being said, the US Dollar Index (DXY) continued to strengthen during the third quarter of 2019 while deteriorating macroeconomic data indicates achieving top line growth through other means will be a tougher task going forward.

Management lowered Zimmer Biomet’s full-year adjusted (non-GAAP) operating profit margin expectation to 27.0-27.5% from 27.0-28.0% previously, while also lowering its expected adjusted tax rate by 50 basis points. Peculiarly, however, the company raised its full-year adjusted (non-GAAP) diluted EPS guidance to $7.75-$7.90 from $7.70-$7.90 previously.

We’ll cover this in more detail in a moment, but please note Zimmer Biomet is currently engaged in meaningful deleveraging activities and hasn’t been repurchasing a significant amount of its stock recently. That means the company’s upwardly revised adjusted diluted EPS forecast for 2019 is entirely based on slightly stronger revenue growth (a forecast that looks a tad overly optimistic given weak first half performance and rising foreign currency headwinds) and a lower adjusted tax rate offsetting the negative impact of a lower expected operating profit margin. In particular, the lower adjusted expected tax rate is quite convenient and could be viewed as management front-loading certain tax shielding strategies in a bid to preserve Zimmer Biomet’s perceived near- and medium-term outlook.

Keeping all of this in mind, please note that at Valuentum we place a great emphasis on the cash flow statement. While income statements need to be prepared in line with GAAP or IFRS guidelines and must reflect a reasonable estimation of the firm’s financial performance, at the end of the day, income statements are just estimations (i.e. depreciation expense is an estimation based on the expected useful life of an asset). By placing a greater focus on analyzing the cash flow statements of publicly traded companies, investors reduce the chance that they might miss the forest for the trees (i.e. the sea of adjustments Zimmer Biomet’s 2019 guidance comes with).

Analyzing Cash Flow Performance

From 2016-2018, Zimmer Biomet’s free cash flows rose from $1.1 billion to $1.3 billion while its annual dividend payout stood at ~$0.2 billion during this period. Zimmer Biomet’s quarterly dividend per share has been held flat at $0.24 since early-2016 as management pivoted towards serious deleveraging activities. While the company spent $0.4 billion repurchasing stock in 2016, there were no material repurchases in 2017 or 2018. This strategy has yielded serious results and we appreciate management’s commitment to deleveraging efforts.

At the end of 2014, Zimmer had a net cash position of $0.3 billion. By the end of 2015, Zimmer Biomet’s modest net cash position had flipped to a substantial net debt position of $9.9 billion due to its transformative acquisition. Fast forward to the end of 2018, and that net debt position had been whittled down to $8.4 billion as free cash flows were directed towards retiring debt.

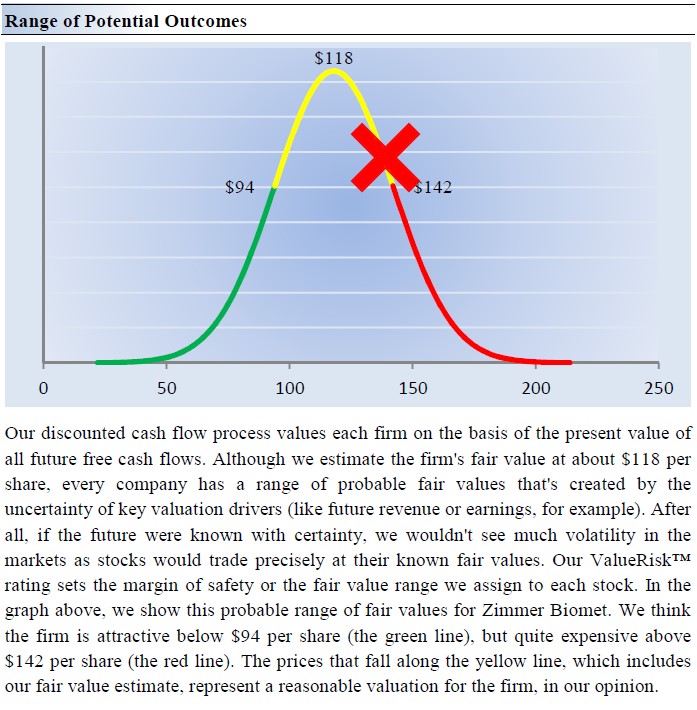

Management has been able to keep the momentum going in 2019, with caveats. Zimmer Holding’s net debt load fell marginally to $8.3 billion by the end of June 2019. However, we caution its net operating cash flows came in at only $0.6 billion during the first half of the year. During the same period the prior year, Zimmer Holding’s generated $0.9 billion in net operating cash flow. While the company remained comfortably free cash flow positive during the first six months of 2019, please note that free cash flow growth on an annual basis will be hard to achieve. That’s particularly noteworthy because Zimmer Holdings is trading at ~$136/share as of this writing, right up near the top end of our fair value estimate range (that was recently updated). Shares of ZBH have exhibited strong technical performance in 2019. Should Zimmer Holding’s falter during the second half of the year (meaning the expected recovery management is aiming for doesn’t materialize), shares may get seriously punished as a result.

Image Shown: Shares of ZBH are trading near the top end of our fair value estimate range as of this writing, as indicated by the red ‘X’ along the yellow line.

Concluding Thoughts

There are a lot of moving parts with Zimmer Biomet’s guidance, but declining free cash flow performance so far during 2019 is raising a red flag. Shares of the company are trading on lofty expectations and investors may be in for a shock should Zimmer Biomet continue to underperform during the second half of 2019. Foreign currency headwinds continue to grow as seen through the strength of the US Dollar Index during the third quarter of 2019. We like Zimmer Biomet’s deleveraging activities but think its share price has gotten ahead of itself given these rising headwinds, lack of top line growth, and deteriorating net operating cash flows. We are staying away from Zimmer Biomet.

Please note that we recently updated our models for the medical devices industry, and readers can access Zimmer Biomet’s new 16-page Stock Report here—->>>>

Medical Devices Industry – EW ISRG MDT VAR WAT ZBH

Related – JNJ

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) is included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.