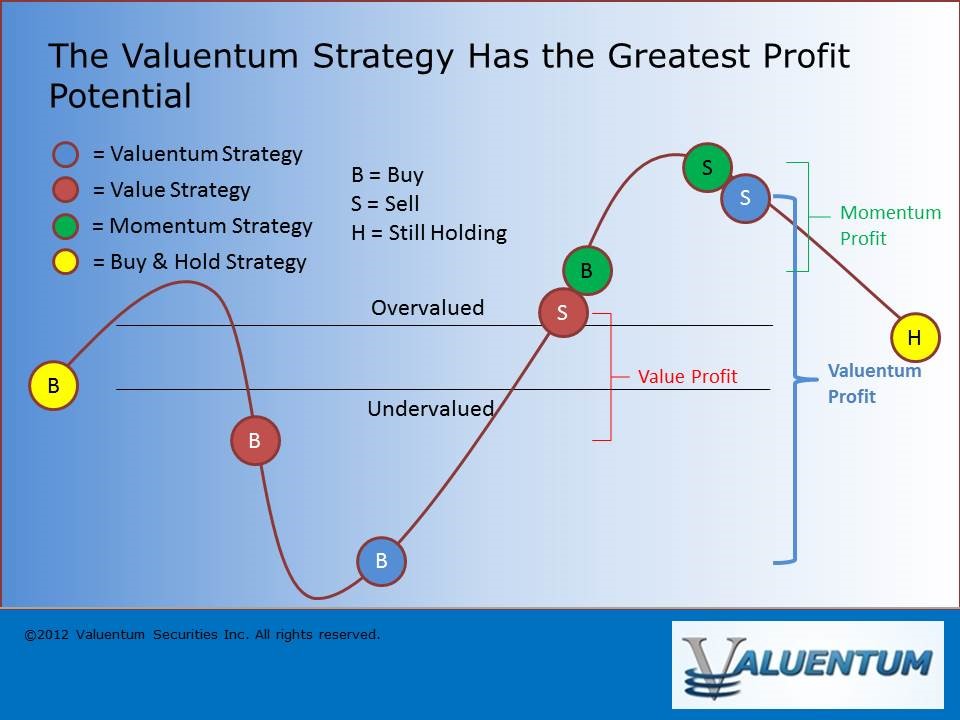

Let’s talk Cardinal Health, Hanesbrands, Ford and Verint in this piece. Our best ideas are ideas in the newsletter portfolios. Unlike other widely followed strategies, the Valuentum strategy likes to capture the entire pricing cycle on an idea. We don’t “operate” in ideas only below the ‘undervalued’ line, but we like to let our winners run to when they are overvalued and showing signs of technical/momentum deterioration.

By Brian Nelson, CFA

The most important quality of a Valuentum investor is patience. Once we add an idea to the newsletter portfolios, we don’t remove it once it starts to approach the lower bounds of the fair value estimate range. We generally don’t remove it at our fair value estimate either, and we often let the idea run to the high end of our fair value estimate range and sometimes beyond that.

We like to add companies to the newsletter portfolios when they are undervalued and when their share prices are “going up,” and we like to remove companies from the newsletter portfolios when their share prices are overvalued and “going down.” So where are our best ideas? Well, they are in the newsletter portfolios. While we consider ideas that register a 9 or 10 on the Valuentum Buying Index, or whose stocks are undervalued and “going up,” not all of them make the cut for newsletter inclusion.

The Valuentum process is rather simple in that respect. We’re not just operating only in the ‘undervalued’ territory, as “selling out” when a stock starts to approach the lower end of the fair value band will just truncate any additional return and cause tax consequences and turnover (commissions). We like to focus on capturing the entire pricing cycle. This is what we’ve said for years, that our favorite ideas are always included in the newsletter portfolios. The newsletter portfolios put our methodology to practice.

That said, we produce reports on hundreds and hundreds of companies, and we pay close attention to a great many more. While our favorite ideas that make the cut into the portfolios are distilled from a very large universe, we think a very important and valuable part of your membership involves our work on companies that don’t make the cut, too. In this piece, per members’ request, let’s talk Cardinal Health, Hanesbrands, Ford, and Verint.

Cardinal Health

Cardinal Health (CAH) looks cheap, trading significantly below our estimate of its fair value, but we’re not biting. Shares have been in a strong downtrend since the beginning of 2016, and we’d only consider them if they were to break out, which would likely require a move to the mid-$60s to close the gap down in May 2018. We’ve said this time and time again, and we continue to reiterate that generic price deflation and now the opioid crisis have dampened our enthusiasm greatly. We also took a pass on 9-rated Amerisource Bergen (ABC) for similar reasons. Cardinal trades in the high-$40s at the moment.

Hanesbrands

We removed Hanesbrands (HBI) from the Dividend Growth Newsletter portfolio in February 2018 when shares were ~$20. The name simply lost its appeal to us at that time, and just like we steered clear of Cardinal Health, despite its undervaluation, we removed Hanesbrands before further declines were experienced. Hanesbrands has been in a defined downtrend since 2015, and while the firm has had a few false breakouts during the past few years, we’ve grown less fond of its business model over time. Hanesbrands is gone from the portfolios, and we’re not looking back; there are simply better ideas out there.

Ford

There is just way too much “hair” on this name. Unfortunately for the existing situation for Ford (F) shareholders, most of its competition had significant obligations wiped out during the Financial Crisis. Though Ford did a great job avoiding collapse like its peers during late last decade (preserving shareholder capital at the time), it does retain a higher cost structure as a result. We prefer General Motors (GM) instead, as we think Ford’s 6.5% dividend yield speaks of tremendous risk more than tremendous opportunity. General Motors sports a 4.1% dividend yield as it trades at only ~5-6 times forward non-GAAP earnings-per-share expectations. We like GM over Ford.

Verint

Image shown: Verint was a controversial name that worked out well.

We did a great job with our call on Verint (VRNT). Added to the Best Ideas Newsletter portfolio in April 2017, the company rose to ~$60 per share before we unloaded it for a nice “gain.” Shares have come in quite a bit since we decided to remove them, but we couldn’t be more pleased with the result. Unlike Visa (V) or Facebook (FB) or companies that we feel very comfortable with (those that are underpriced, have strong technicals, generate strong free cash flows, have solid net cash positions, and possess huge competitive advantages), Verint was not one that we felt comfortable to let run, and it was the right move (shares closed at ~$43.75 September 26). But why weren’t we comfortable at the time? Quite simply — rapid price-to-fair value convergence and a comparatively weaker business model than our other favorites. We’re just not looking back.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.