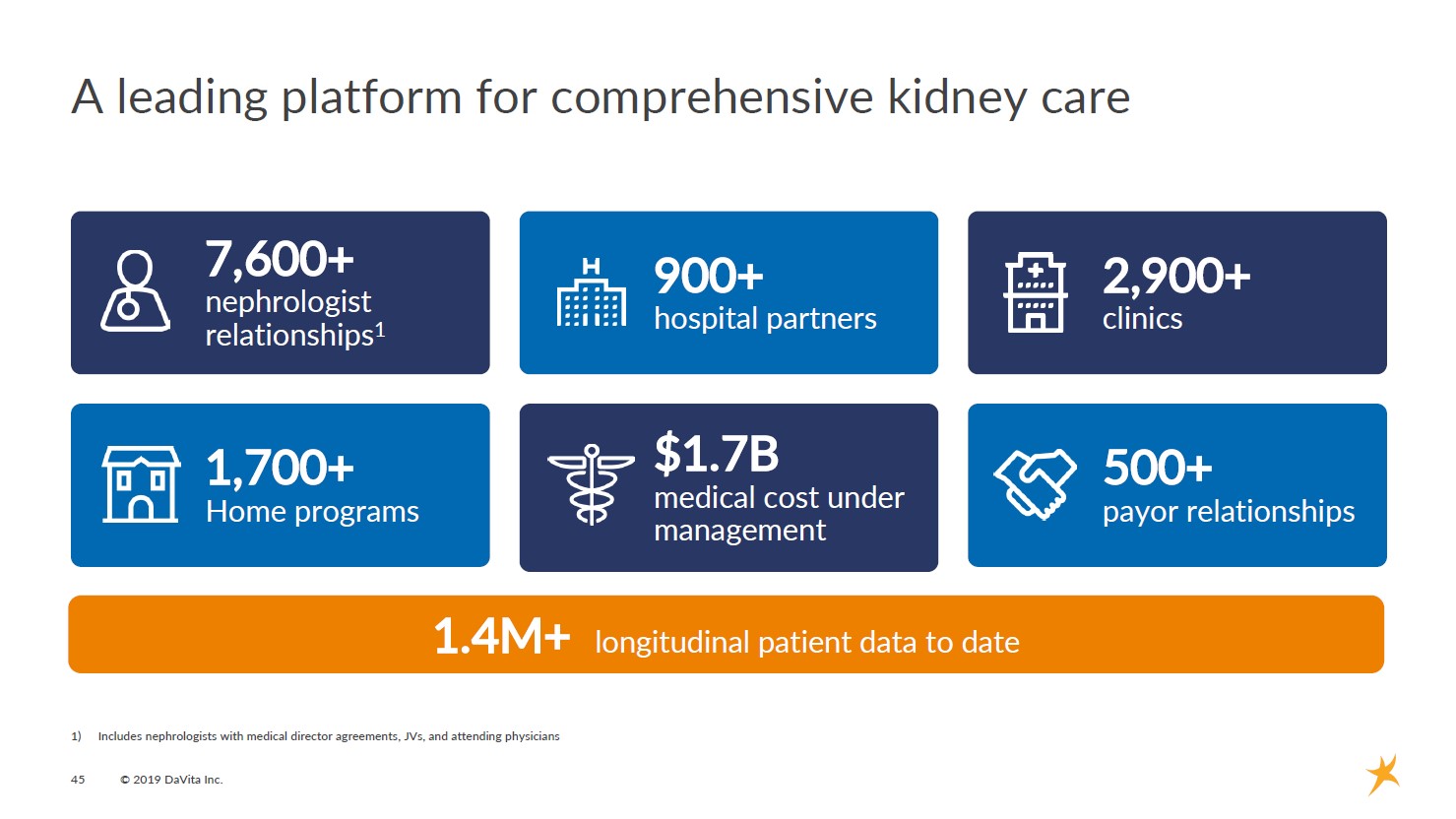

Image Shown: DaVita Inc is a midsized kidney dialysis company with strong free cash flows. However, the company is coming under fire from famed short seller Jim Chanos who recently threw shade at Warren Buffett. Image Source: DaVita Inc – IR Presentation

By Callum Turcan

Fabled short seller Jim Chanos was in the news on September 19 when he announced he was short DaVita Inc (DVA), a kidney dialysis company, at the Delivering Alpha conference. What made this news particularly noteworthy comes down to Berkshire Hathaway Inc (BRK.A) (BRK.B) having a significant stake in DaVita. We must stress here that Berkshire’s ~24% equity stake in DaVita’s outstanding shares isn’t needle moving; the stake is worth ~$2-2.5 billion. Warren Buffett didn’t make this particular investment choice according to CNBC; investment manager Ted Weschler made the decision to take a stake in DaVita. We continue to like Berkshire as one of our top holdings in the Best Ideas Newsletter portfolio, and we don’t think this news materially changes our thesis.

The Allegation

In summary, Mr. Chanos thinks DaVita is playing dangerous games by pushing patients from Medicare/Medicaid insurance plans to private Obamacare plans to increase reimbursements (meaning private insurers, and not the federal government programs, pick up the tab). That’s on top of DaVita, one of the largest donors to American Kidney Fund, allegedly using that charity to help cover some of the higher commercial costs by having the charity contribute donations to the Obamacare exchanges to cover some of those expenses. Finally, this has culminated into a recent lawsuit from one of DaVita’s biggest customers, Blue Cross of Florida owned by Anthem (ANTM), which is suing over fraud and other allegations.

Anthem alleges DaVita conspired with American Kidney Fund to increase costs by having patients that would have normally been covered by Medicare/Medicaid get covered through Blue Cross Blue Shield of Florida and Health Options instead (together known as “Florida Blue”). This is quite the allegation, and Mr. Chanos threw shade at Mr. Buffett during his presentation, questioning why a leading insurer would be affiliated with DaVita in the first place. Florida Blue alleges that DaVita in one year alone contributed $120 million to the American Kidney Fund and generated $450 million in operating income from patients with commercial insurance. In its lawsuit, Florida Blue is seeking compensation and for the courts to force DaVita to change its business practices.

Shares of DaVita have steadily shifted lower over the past few years, and with the Anthem lawsuit looming large, the trajectory of its stock price will likely be heavily influenced by its ongoing legal troubles and the increased scrutiny over its business practices. Jim Chanos had some choice quotes during the conference including:

“It’s always interesting in my world when one of your biggest customers is suing you for fraud… Most dialysis patients are old and less affluent and qualify for Medicare and Medicaid in the vast majority of cases… What DaVita is trying do is push those patients into, ironically, more expensive insurance contracts through the Obamacare exchanges… They then turn around and charge the commercial payer three to four times what they get from Medicare and Medicaid… So, they are donating to the charity [the American Kidney Fund]; the charity is then paying the premium into the Obamacare exchange; then they’re charging the insurers 3x-to-4x…”

Finally, he dug into Berkshire by noting it’s “…a very bad look for an insurance company like Berkshire Hathaway to be promoting a company that I think is running an insurance scam.”

We want to caution that Berkshire’s equity stake in DaVita was acquired back in 2011 and that it doesn’t appear Berkshire’s insurance businesses have suffered due to that equity stake. We will be monitoring the situation closely going forward, but for now, the downside risk to Berkshire appears limited to the value of its stake in DaVita’s equity and nothing more. It’s highly unlikely in our view that customers and enterprises seeking insurance policies would blame Mr. Buffett for the problems at a different company he isn’t actively engaged with.

Digging into DaVita

After doing some digging, we found that the majority of DaVita’s patients are covered by some form of Medicare, Medicaid, or both. Here’s what its 2018 Annual Report had to say:

“Although Medicare reimbursement limits the allowable charge per treatment, it provides industry participants with a relatively predictable and recurring revenue stream for dialysis services provided to patients without commercial insurance. For the year ended December 31, 2018, approximately 89.6% of our total dialysis patients were covered under some form of government-based program, with approximately 74.8% of our dialysis patients covered under Medicare and Medicare-assigned plans.”

That doesn’t mean Jim Chanos is correct or incorrect but making money from Medicare/Medicaid via reimbursements from the Centers for Medicare & Medicaid Services is tough. In October 2018, DaVita settled with the DOJ for $270 million “for providing inaccurate information that caused Medicare Advantage Plans to receive inflated Medicare payments.” There’s a history of DaVita playing fast and loose with the rules.

DaVita’s free cash flows stood at $0.8 billion in 2018 (DaVita’s free cash flows over the past three full fiscal years have averaged just under ~$1.0 billion). The company does not pay out a common dividend at this time and has opted instead to repurchase a material amount of its stock each year (just over ~$1.0 billion per year on average over the past three full fiscal years).

As it relates to DaVita’s balance sheet, the company was sitting on $3.6 billion in cash, cash equivalents, and short-term investments as of June 2019 (we aren’t including restricted cash here) versus $9.0 billion in total debt (inclusive of short-term debt). The company completed the $4.3 billion sale of its DaVita Medical Group unit to Optum, a unit of UnitedHealth Group Inc (UNH), in June 2019 for $3.8 billion in net cash proceeds. That will put downward pressure on its free cash flows in the medium-term as the unit generated an annualized $0.2 billion in net operating cash flow during the first half of 2019.

We caution DaVita has $3.6 billion in debt coming due within a year, roughly equal to its total cash and cash equivalent position. DaVita’s large net debt load is a concern but manageable as its free cash flows have been quite strong of late. We wouldn’t normally be worried of its ability to take advantage of the lower interest rate environment and roll that burden over via refinancing. However, that assumes nothing materially changes to its financial performance due to a change in its business practices or ability to work in America’s healthcare industry. While a global entity with operations in Poland, Malaysia, China, Brazil, and elsewhere, America is essential to DaVita’s financial performance.

Concluding Thoughts

There’s clearly a viable business here given DaVita has a lot of customers and significant free cash flows, but how much the firm is charging for its services (particularly in America) and who ends up ultimately getting billed has raised suspicions. We will be monitoring the situation going forward and want to stress once again that Berkshire’s exposure to this news is much smaller than Mr. Chanos is implying in our view. Members looking to read more about why we continue to like Berkshire as a top Best Ideas Newsletter portfolio holding should check out Berkshire Hathaway Gets Ready to Put Part of Its Large Cash Pile to Use—->>>>

Health Care Services Industry – DVA EHC HCA UNH UHS

Related – BRK.A BRK.B

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.