We continue to like Microsoft in our Dividend Growth Newsletter portfolio and think the firm is well positioned to ride out any storm that may arise due to the synchronized slowdown in global economic growth. As a true free cash flow king sitting on a pile of (net) cash, there’s a lot to like about Microsoft’s income growth story.

By Callum Turcan

On September 18, Dividend Growth Newsletter portfolio holding Microsoft Corporation (MSFT) announced it was increasing its per share dividend by 11% on a sequential basis, good for forward-looking yield of 1.4%. Microsoft’s dividend coverage is great, and we give the firm a Dividend Cushion ratio of 4.0x which supports our income growth thesis. The company generated $38.3 billion in free cash flow in fiscal 2019 (ended June 30), up from $32.3 billion in fiscal 2018, while spending $13.8 billion on its dividends. Add in a net cash position of $61.6 billion (largely a product of $133.8 billion in cash and cash equivalents sitting on its balance sheet) at the end of June 30 and Microsoft can clearly navigate any slowdown in the global economy while still rewarding income growth seeking investors.

Microsoft also announced a new $40.0 billion buyback program with no expiration date, continuing its trend of material annual repurchases as expected. For reference, Microsoft spent $19.5 billion on buybacks in fiscal 2019, up sharply from $10.7 billion in fiscal 2018. We think buybacks are a good use of Microsoft’s free cash flows given that the top end of our fair value estimate range stands at $166/share and in light of Microsoft’s strong operational performance indicating shares could test the upper bounds of that range. MSFT trades at ~$141/share as of this writing.

In other news, Indian entertainment company Eros’ (EROS) subsidiary Eros Now (an over-the-top video platform) and Microsoft announced a tie-up on September 19. Eros is collaborating with Microsoft’s Azure to build a next generation online video platform that will better enable the firm to distribute video entertainment to consumers across the globe (particularly in South Asian markets). That includes leveraging the Azure Content Delivery Network, adding voice-command capabilities to the video platform, and utilizing analytics (such as Azure AI and Cloud Data Warehousing solutions) to create personalized content recommendations. While in some markets, including the US, many of these options are already ubiquitous that isn’t the case elsewhere. Microsoft had this to say about the collaboration;

“India is one of the fastest-growing digital entertainment and media markets worldwide, driven by the growth in online video content. AI and intelligent cloud tools will be the next drivers of the media business and will impact everything from content creation to consumer experience. We are very excited to work with Eros Now to redefine the online video watching experience for consumers.”

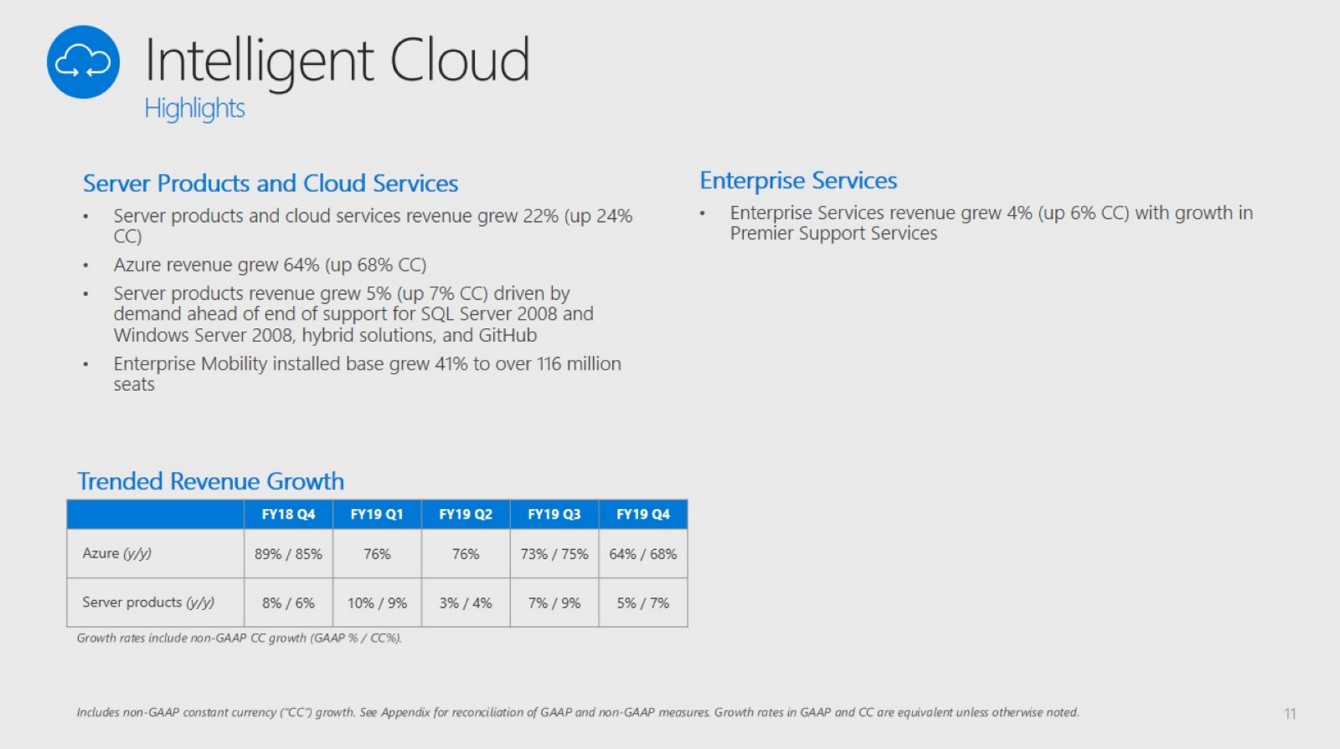

We really like Microsoft’s growth runway, and this is one of many examples of how the company continues to reach deeper into markets with very promising economic growth and development trajectories to augment its free cash flow upside. Microsoft’s Intelligent Cloud division has been performing very well as you can see in the graphic below, aided by Azure continuing to deliver high double-digit revenue growth rates (currency headwinds, courtesy of a strong US dollar, were material but manageable during the second half of fiscal 2019).

Image Shown: Growth at Microsoft’s Intelligent Cloud division is heavily supported by sales growth at Azure. Image Source: Microsoft – IR PowerPoint Presentation

Concluding Thoughts

We continue to like Microsoft in our Dividend Growth Newsletter portfolio and think the firm is well positioned to ride out any storm that may arise due to the synchronized slowdown in global economic growth. As a true free cash flow king sitting on a pile of (net) cash, there’s a lot to like about Microsoft’s income growth story.

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Microsoft Corporation (MSFT) and Oracle Corporation (ORCL) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.