Image Source: FedEx Corporation – IR Presentation

By Callum Turcan

Global logistics and shipping giant FedEx Corp (FDX) reported first quarter earnings for its fiscal 2020 (ended August 31) on September 17 that underwhelmed, sending shares sharply lower (down almost 13%) on September 18. FedEx reduced its fiscal 2020 guidance and management made sure to call out what the company sees as its main problem, trade wars and the dynamic effect that is having on global shipping volumes. Here’s what management had to say (emphasis added):

“FedEx is lowering its fiscal 2020 earnings forecast as the company’s revenue outlook has been reduced due to increased trade tensions and additional weakening of global economic conditions since the company’s initial fiscal 2020 forecast in June. The company’s revised outlook also reflects increased FedEx Ground costs and August’s loss of FedEx Ground business from a large customer. In addition, the FedEx ETR is now expected to be 24% to 26% before the year-end MTM retirement plan accounting adjustment, due to lower-than-expected earnings in certain non-U.S. jurisdictions.

FedEx now forecasts earnings of $10.00 to $12.00 per diluted share before the year-end MTM retirement plan accounting adjustment, and earnings of $11.00 to $13.00 per diluted share before the year-end MTM retirement plan accounting adjustment and excluding TNT Express integration expenses. The capital spending forecast remains $5.9 billion.”

While parting ways with Amazon (AMZN) was cited as a factor in this weakness, we think the real problem comes down to the pressures at its FedEx Express segment (which primarily includes its air freight and logistical hub operations).

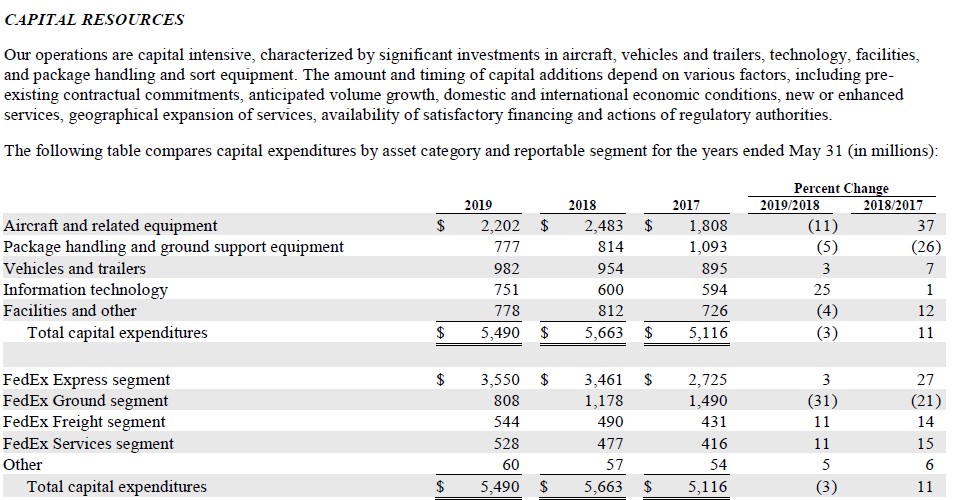

Capital Expenditure Commentary

FedEx’s business is capital intensive as planes, logistics hubs, and last-mile vehicle fleets (vans, trucks, etc.) aren’t cheap and require a lot of upkeep. In fiscal 2019, FedEx allocated $5.5 billion towards capital expenditures, which is forecasted to rise by $0.4 billion or 9% this fiscal year. Management didn’t change FedEx’s capital-expenditure guidance for fiscal 2020 during its latest earnings cycle. Over the past three full fiscal years, FedEx’s annual capital expenditures have averaged $5.4 billion.

Capital expenditures are ticking up in fiscal 2020 for several reasons. For starters, FedEx Express is spending ~$1.5 billion over several years materially expanding its Indianapolis Hub and another ~$1.5 billion over several years modernizing its Memphis World Hub. Management expects capital expenditures at FedEx Express will rise in fiscal 2020 on an annual basis due to those investments and its ongoing aircraft fleet modernization programs. At FedEx Ground, capital expenditures are expected to increase this fiscal year due to additional trailer purchases and land acquisitions. Pivoting to FedEx Freight, capital expenditures are also set to increase this fiscal year due to investments in equipment, trailers, vehicles, and technology that are expected to create efficiency improvements.

Image Shown: Purchasing aircraft and the related equipment represents a large chunk of FedEx’s annual capital expenditures. Image Source: FedEx – Fiscal 2019 Annual Report

Back in May 2016, FedEx announced that it had completed its purchase of TNT Express, giving it access to an extensive European road network and bolstering its air freight operations. While integration costs have been higher-than-projected, and the process itself hasn’t gone as smoothly as initially hoped, FedEx is still on track to achieve material pre-tax synergies that will drive incremental operating profit. However, exogenous headwinds have clearly gotten in the way of that trajectory.

Managing Margins

At the start of January 2019, new shipping rates went into effect. The shipping rates charged by FedEx Express, FedEx Ground and FedEx Home Delivery increased by an average of 4.9% while FedEx Freight shipping rates increased by an average of 5.9%. We caution that if events in the Middle East, with an eye towards Saudi Arabia (KSA) and Iran, spiral out of control and raw energy resource prices start rising considerably (putting a lot of upward pressure on petroleum product prices), that could pressure FedEx’s margins if additional shipping rate increases aren’t pursued. Please note that wholesale kerosene prices in the US have held up well since 2015, even in the face of a relatively low global oil price environment, in part due to strong aviation demand and refining constraints (kerosene represented just a tiny portion of the domestic refined product volumes in 2018 on a relative, or per refined barrel, basis).

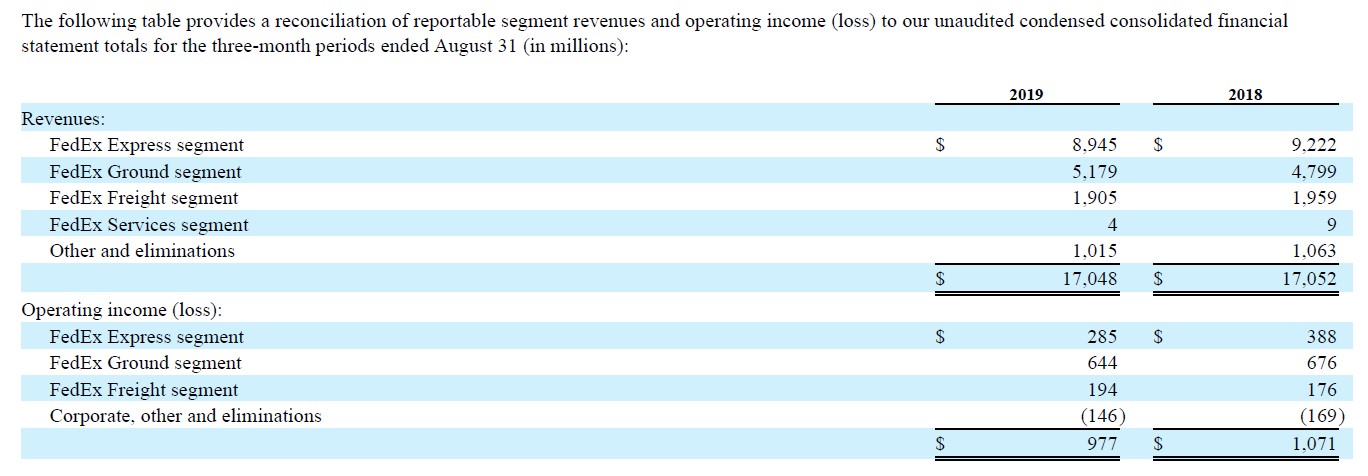

As you can see in the graphic below, the segment operating margins at FedEx Express aren’t great. During the company’s latest quarterly conference call with investors management was asked a question regarding FedEx Express’ low margins. Management responded by highlighting how there are tremendous synergies between FedEx’s three main segments, and that “…80% of our customers buy all three of the services” which can be seen in part through the stronger segment operating margins seen at FedEx Ground and FedEx Freight.

Image Shown: A breakdown of the different revenue generation and margins across FedEx’s three main segments. Note the relatively low margins seen at FedEx Express and the relatively higher margins seen at FedEx Ground and Freight on a segment basis. Image Source: FedEx – First Quarter Fiscal 2020 10-Q

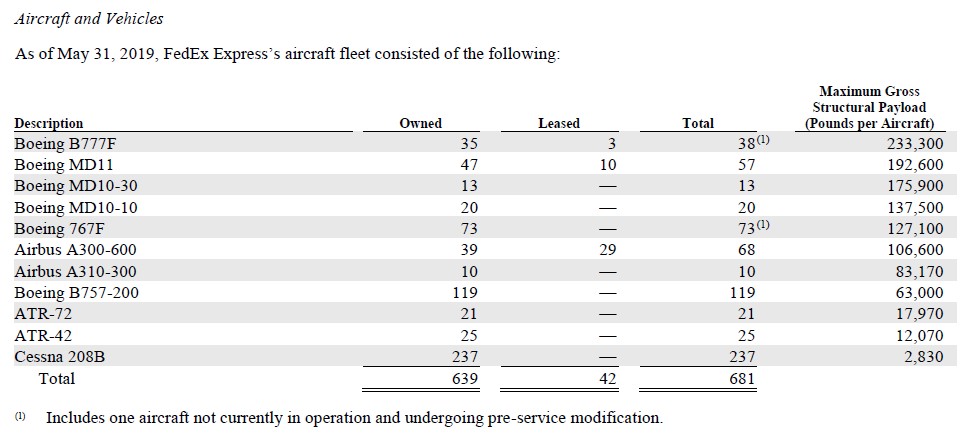

Management was adamant during the call that the three segments, working in unison, are worth investing more in due to the synergies that each operation spawns in terms of both reducing costs and drumming up more business. FedEx intends to continue forward with its aircraft modernization process and the related capital expenditures that come with such an endeavor. The graphic below highlights FedEx’s aircraft fleet as of May 31, 2019 (the end of its fiscal 2019). A lot of these planes are Boeing Company (BA) aircraft. FedEx operated roughly 91,000 vehicles in total (including 27,000 owner-operated vehicles that support TNT Express) at the end of fiscal 2019.

Image Shown: FedEx’s aircraft fleet consisted of 681 planes at the end of May 31. Image Source: FedEx – Fiscal 2019 Annual Report

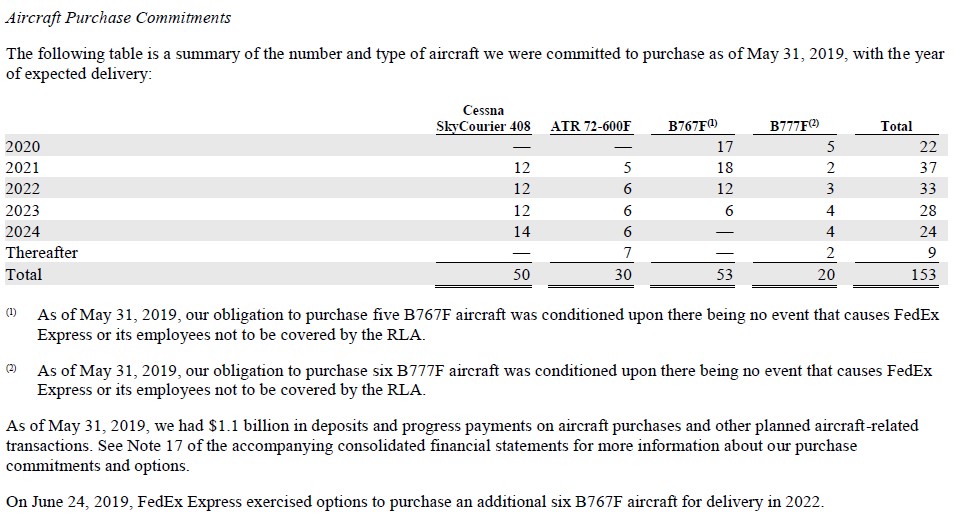

Down below is a look at FedEx’s aircraft purchase commitments as of the end of fiscal 2019. Note that these purchase commitments come with hefty future capital expenditures. FedEx had a net debt load of $16.4 billion at the end of August 31.

Image Shown: FedEx has agreed to acquire a material amount of additional aircraft through 2024 as it continues along with its fleet modernization programs. Image Source: FedEx – Fiscal 2019 Annual Report

Concluding Thoughts

As a capital intensive business operating in a cyclical industry, FedEx is stuck in a bind. Either pursue its drive for greater efficiency, greater scale, and (in theory) greater profits in the future while acknowledging that significant headwinds in the short- to medium-term will pressure free cash flows at a time of significant capital investment, or attempt to scale back which hollows out the core of management’s capital allocation strategy. Please note FedEx’s future aircraft purchase commitments make cutting capital expenditures by a meaningful amount a significantly harder task, reducing its financial flexibility. Management has opted to push forward into the fray. We are remaining firmly away from FedEx at this time.

Members interested in reading more about FedEx and its peer United Parcel Service Inc (UPS) should check out —->>> A Tale of Two Package Delivery Companies

Air Freight & Logistics Industry – CHRW EXPD FDX ODFL UPS

Related: IYT BA EADSY

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.