Image Shown: Shares of Target Corporation (TGT) leapt higher on August 21 on the back of its strong performance during the second quarter of FY2019. In particular, the retailer’s comparable same store sales growth was quite impressive given the hard comparison period, with e-commerce and same-day fulfillment leading the way.

By Callum Turcan

On August 21, Target Corp (TGT) reported very strong second quarter FY2019 earnings (three months ended August 3) that sent shares up ~20% on the trading session. For starters, comparable store sales growth clocked in at 3.4% year-over-year and was up 9.9% on a two-year basis (adding comp growth from the second quarter of 2018 and 2019 together). That indicates this was much more than just a one-off surprise but the beginning of a promising growth trajectory. E-commerce sales rose by 34% year-over-year in the second quarter which added 180 basis points to comp sales growth. Same-day fulfillment services played a key role in bolstering Target’s sales, adding 150 basis points to its comp growth rate on a year-over-year basis. Shares of TGT yield 2.6% as of this writing.

Earnings Overview

Target’s e-commerce strategy, built around same-day delivery/pick-up for groceries (an offering enhanced by its 2017 purchase of Shipt for $550 million), is working. Management plans to roll out Target’s new private-label food brand Good & Gather next month that could keep the momentum going. By the end of 2020, there will be more than 2,000 Good & Gather branded products available both in-store and for same-day delivery including ready-made pastas, granola bars, dairy products, produce, sparkling water, and much more. The company noted:

Developed by Target’s internal team, Good & Gather products have passed rigorous quality and taste tests, are made without artificial flavors and sweeteners, synthetic colors and high fructose corn syrup*, and are backed by a money-back guarantee. The assortment will include new and trend-forward products such as avocado toast salad kits and beet hummus alongside everyday staples such as milk, eggs and cheese…

Good & Gather will phase out Target’s existing Archer Farms and Simply Balanced food brands and reduce the number of product offerings under the Market Pantry brand, simplifying the food and beverage shopping experience.

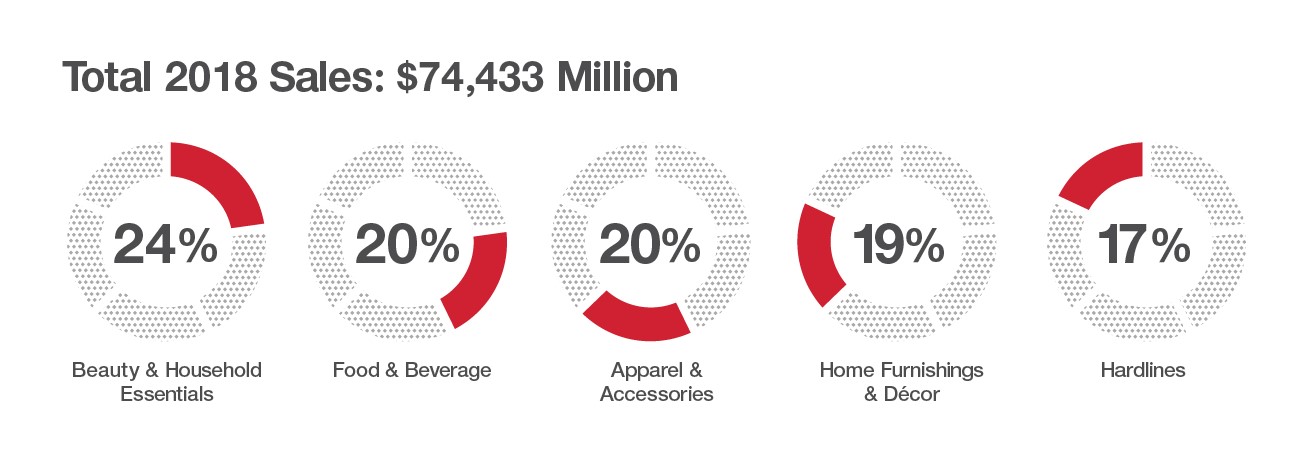

Considering Target’s ability to strategically place these goods front and center on its e-commerce website and in prime grocery aisle locations (made possible through Good & Gather phasing out existing brands), management appears confident in the upcoming launch. Please note that roughly one third of Target’s FY2018 sales came from owned and exclusive brands according to its 2018 Annual Report. Furthermore, food and beverage items represent one fifth of its sales based on its FY2018 performance as you can see in the graphic below.

Image Shown: A breakdown of Target’s revenue by product category. Image Source: Target – 2018 Annual Report

Guidance Boosted

Target’s impressive performance last quarter gave management the confidence to raise the retailer’s full-year guidance for FY2019. Now Target expects to post $5.90 – $6.20 in adjusted (non-GAAP) EPS in FY2019, up from $5.75 – $6.05 previously, with year-over-year comp growth expected at 3.4% during the second half of the year (in-line with Target’s second quarter performance).

During the second quarter, Target’s GAAP gross margin expanded by ~30 basis points year-over-year while its GAAP revenue grew by almost 4% to $18.4 billion. GAAP operating income rose by 17% year-over-year to $1.3 billion while its GAAP operating margin jumped up by ~80 basis points. Margin expansion was made possible through strong comp growth allowing for better pricing power, very modest growth in G&A expenses, and ultimately top-line growth considering Target has considerable fixed costs.

The company ended August 3 with $11.5 billion in total debt versus $1.7 billion in cash, giving it a sizable net debt position. That’s why Target earns a Dividend Cushion ratio of 2.1x (was 1.9x), and not something stronger given its significant free cash flows. During the first six months of FY2019, Target generated $1.4 billion in free cash flow while spending $0.7 billion on dividends and another $0.7 billion on share buybacks. We think Target should focus more on debt reduction and less so on share repurchases given how late we are in the business cycle, regardless of how well its e-commerce segment has been performing as of late.

After updating our model following the report, we now assign shares of Target a fair value estimate of $91 (was $86), with a fair value range of $73-$109 per share (was $69-$103 per share), indicating Target is fairly valued as of this writing even after the rally on August 21.

Our Thoughts

Down below is a concise summary of our thoughts on the strengths of Target’s dividend, from our two-page Dividend Report that can be accessed here:

“Dividend Aristocrat Target has made a few moves in recent years. It sold off its US consumer credit card portfolio, its pharmacy/clinic operations to CVS Health Inc (CVS), and abandoned its expansion efforts in Canada outright. We think such moves may make the retailing giant too dependent on the US consumer, and the company may come to regret these decisions in the coming decades should organic growth start to disappoint. Digital initiatives have been paying off, but online competition remains heated. It has a net debt position, but its A credit-rating and free cash flow generation remain fantastic. We doubt there’s much to challenge Target’s 45+ year annual dividend growth streak.”

On the flip side, here are what we view as Target’s potential weaknesses, particularly as it relates to its dividend policy (from our two-page Dividend Report):

“Target will have its hands full in coming years as it deals with online competition and rising input/labor costs, but its free cash flow generation remains impressive, averaging $3.6 billion during the past three fiscal years (2016-2018), well in excess of yearly cash dividend obligations (~$1.3 billion). Net debt of ~$9.9 billion at the end of the second quarter of FY2019 (inclusive of short-term debt) is certainly manageable after considering its free cash flow generating capacity, and while we’d like to see a net cash position from the company, its financial health is solid. The company continues to buy back stock, using capital that could otherwise go to securing a stronger payout, but it has been growing its dividend every year since 1971. It’s hard not to like that consistency.”

Concluding Thoughts

It’s easy to see why shares of Target surged on August 21, but we are still staying away from the name as the company appears fully valued as of this writing. We prefer discount retailer Dollar General Corporation (DG), which is included in our Best Ideas Newsletter portfolio, and are letting that holding run higher. Strong performance out of Target and other major US retailers like Walmart Inc (WMT) indicate that while headwinds are forming, the US economy remains strong for now (more on that here).

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR FRED PSMT

Other: JD, AMZN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.