Image Source: Owens-Illinois Inc – IR Presentation

By Callum Turcan

Owens-Illinois Inc (OI) is a global manufacturer of glass packaging products, and we see the firm as a major beneficiary of the shift in consumer preferences towards non-plastic packaging options for health and environmental reasons. As of this writing, shares of OI yield 1.9% on a forward-looking basis after management initiated a new dividend policy that saw common quarterly payouts commence in 2019. While Owens-Illinois’ share price below $11/share, as it is at the time of this writing, appears cheap at first glance because shares are trading at a steep discount to our $17 per share fair value estimate, we caution that its technicals are telling another story. Investors were spooked after the company cut guidance during its second quarter 2019 earnings report released July 31. Additionally, Owens-Illinois is highly levered, and that poses a major risk to its future financial performance. We are staying far away from this company as it looks like a Value Trap.

Image Shown: Shares of OI were hammered after the company cut guidance during its second quarter 2019 earnings report.

Overview

During the second quarter of 2019, Owens-Illinois reported a 40 basis point drop in its GAAP gross margin on a year-over-year basis while its top line moved marginally lower. Part of this decline appeared to be due to Owens-Illinois moving deeper into the premium beer and spirits bottling space in Europe, and away from the lower margin food and wine categories. That pivot created complexities in the firm’s European operations, putting downward pressure on its gross margins in the short-term, but management remains very optimistic that this pivot will result in significantly stronger margins over the long term. Along with other strategic changes, such as upgrading its factories and implementing a standardized work system across its asset base, management expects to see improvements in Owens-Illinois’ financial performance by the end of 2019.

We are very supportive Owens-Illinois upgrading and enhancing its European operations, part of a bigger story that involves the company targeting meaningful operating margin expansion. We expect meaningful operating margin expansion over the coming years (versus Owens-Illinois’ historical performance in 2017 and 2018). In the second quarter and first half of 2019, Owens-Illinois reported a modest year-over-year reduction in its SG&A expenses. Additional cost savings measures have been implemented in 2019, such as salaried employee buyouts in the US, to keep the momentum going. From the first half of 2018 to the first half of 2019, the company’s operating margin (defined as ‘earnings from continuing operations before income taxes’ plus ‘interest expense, net’ dividend by revenue, all on a GAAP basis) expanded by ~90 basis points.

In the US, Owens-Illinois is contending with structural declines in beer sales (particularly at big brands that were formally a staple of US consumption habits) so the company invested in new production capabilities to allow the firm to cater towards growing markets. That, too, created complexities in its manufacturing operations and pressured its margins, but management sees that dissipating as well, aided by volume growth and a better product mix.

Guidance Cut and a Mountain of Debt

Owens-Illinois expects to generate $260 million in adjusted free cash flow in 2019, down from prior guidance calling for $400 million in adjusted free cash flow. Management also lowered the firm’s adjusted EPS estimate for 2019 down to $2.40 – $2.55 from $3.00 previously. Part of this is due to the aforementioned strategic shift and the related investments in new production capacity and capabilities, and part is due to uncertainties in the global macroeconomic picture. Capital expenditures were revised upwards to $450 million – $475 million, from $340 million previously, which represents the main reason why adjusted free cash flow guidance for 2019 was cut.

Investors were clearly spooked after the guidance cut, which was announced during Owens-Illinois’ second quarter earnings report, and shares of OI have sold off since (down by more than a third in August as of this writing). We would like to highlight how OI’s weak technicals seem to be about more than just one poor earnings report. The market is clearly signaling that investors expect a combination of exogenous (slowing global economic activity) and internal factors (hefty net debt load, guidance cut) will pressure Owens-Illinois’ future financial performance.

At the end of June 2019, Owens-Illinois had a net debt load of $6.0 billion inclusive of short-term debt. Please note that’s on top of its long-term asbestos liabilities. That’s enormous for a company with a $1.6 billion market capitalization as of this writing and annual free cash flows in the few hundred million. Moody’s Corporation (MCO) rates Owens-Illinois’ corporate family credit rating at a speculative Ba3 and we can see why. At the beginning of July, Owens-Illinois acquired a glass packaging facility in Mexico from Anheuser-Busch Inbev NV (BUD) for just under $0.2 billion. While “incremental synergies are anticipated” this deal showcases how acquisitive habits can continue even for heavily indebted enterprises when capital markets are supported by a low interest rate environment.

Additionally, Owens-Illinois’ initiated a dividend in 2019, which consumed a marginal amount of free cash flow during the first half of the year ($16 million). We think deleveraging efforts should take center stage as we are seeing signs of global economic activity slowing down significantly. If fears were to grow that Owens-Illinois is at serious risk of getting locked out of capital markets, that could see shares of OI get crushed. Management is pursuing “tactical divestitures” to “free up cash” to allow Owens-Illinois to delever, and free cash flows should be strong enough to lend further assistance. Here’s what management had to say during Owens-Illinois’ second quarter 2019 earnings conference call:

“We are also pursuing a balanced capital allocation strategy. Recent actions include investing in key growth initiatives like brownfield expansions in Colombia and France as well as in MAGMA. Likewise, we initiated a dividend and refinanced our debt to optimize the balance sheet. Tactical divestitures will free up cash to reduce debt and focus on core operations. We currently expect progress on divestitures will be announced later in 2019. We believe this strategy and these actions are exactly the right areas of focus. However, it will take some time to fully realize their value. Meanwhile, our current performance is not acceptable.”

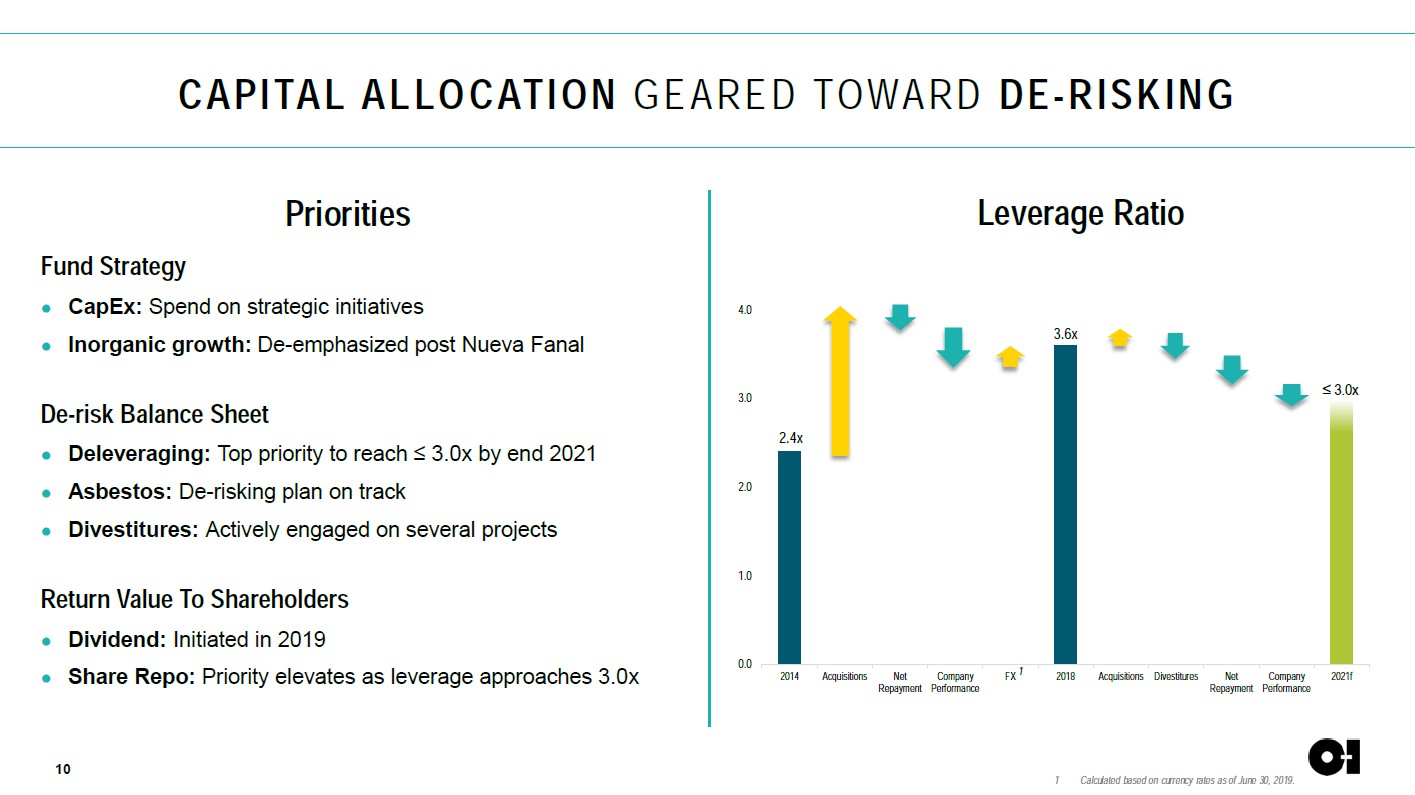

Volume expansion, cost reductions, strategic shifts towards higher margin categories, and divestments could enable Owens-Illinois to get on top of its leverage problem. More recent refinancing activities indicate a willingness from capital markets to continue working with the company. Owens-Illinois’ net debt to EBITDA ratio stood at ~6x at the end of June 2019. For any entity, especially a glass bottle manufacturer, that’s unsustainable in the long run. Management is targeting a leverage ratio below 3.0x by the end of 2021. We’ll see if Owens-Illinois gets there. The company repurchased $38 million of its stock during the first half of 2019, and we think management should instead direct that cash towards deleveraging efforts.

Image Shown: Owens-Illinois is targeting meaningful deleveraging efforts over the next few years, but that conflicts with its new dividend policy and planned share buybacks. Image Source: Owens-Illinois – IR Presentation

How We View Owens-Illinois

Here’s a concise summary of our thoughts on Owens-Illinois from our 16-page Stock Report covering the name (that report can be accessed here):

“Owens-Illinois is the world’s leading glass-packaging maker and serves many of the most well-known brands. The firm boasts a broad geographic footprint, and its scale of operations offers a number of cost advantages. It has a #1 position in Europe and a #1 position in North America. The company was founded in 1903 and is headquartered in Ohio.Owens-Illinois is expecting key earnings headwinds to turn to tailwinds in the back half of 2019. Sales volumes growth is expected to turn positive thanks to higher production volumes as capacity expansion come on-line, and currency headwinds are expected to dissipate.

We don’t think the market is giving Owens-Illinois enough credit for its cost-cutting efforts. It continues to optimize assets in Europe and generate structural cost reductions in North America. We’re not particularly fond of its balance sheet, however, and its Ba3 credit rating supports this notion. General economic slowdown concerns in Europe could impact its operations in the region.

We think there are a number of key trends that make Owens-Illinois’ business model resilient. For one, consumers generally prefer glass for taste, health, sustainability, and quality reasons. The rising middle class in emerging markets should also support expansion. The firm has a #1 position in Brazil and a leading position in Southeast Asia.In the period 2019-2021, Owens-Illinois expects sales volume growth of 10%, driven by ascribable opportunities. Its segment operating profit margin is projected to expand by a full percentage point over the period, and while adjusted earnings per share are expected to grow at a ~10% CAGR.”

Furthermore, we are neutral on the containers and packaging industry. This isn’t the best industry to invest in due to exposure to fluctuations in raw material prices and the capital-intensive nature of the space, but it isn’t the worst space either as scale provides meaningful competitive advantages in an industry where factories must operate continuously to remain profitable. Owens-Illinois has upgraded some of its facilities to become flexible factories and it’s targeting additional upside by expanding its European operations. That includes a ~$60 million investment announced in March 2019 that will be going towards its plant in Gironcourt, France, which will add another furnace to the company’s operations there. Management expects the project will be completed by early-2020.

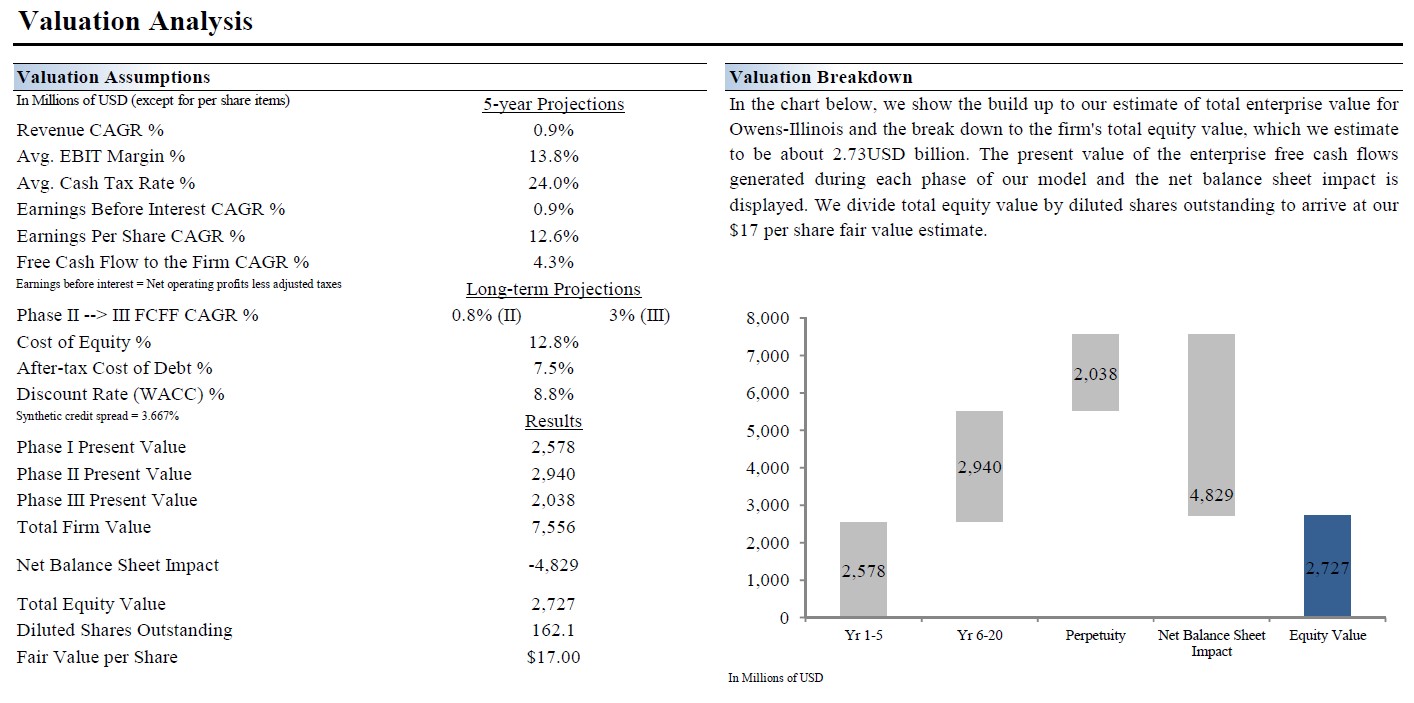

Down below is a look at our valuation analysis covering Owens-Illinois, from our 16-page Stock Report. Note how its balance sheet weighs heavily against the intrinsic value of the company’s equity.

Image Shown: A breakdown of our valuation analysis concerning Owens-Illinois, from our 16-page Stock Report.

Concluding Thoughts

Due to Owens-Illinois’ onerous leverage, guidance cut, and signs that the global economy is slowing down, we are staying far from the name. While shares of OI trade decently below the low end of our fair value estimate range we caution that the market is likely right on this one. Owens-Illinois is another example of a Value Trap.

Packaging & Containers Industry – ATR BLL BMS CCK OI PKG SEE SLGN TUP

Alcoholic Beverage Industry – BUD SAM BF.B STZ DEO TAP

Nonalcoholic Beverages Industry – KO CCEP KDP MNST FIZZ PEP

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.