Image Source: Microsoft Corporation — IR Presentation

We remain very optimistic on Microsoft’s future dividend growth trajectory, and we would like to note the upper end of our fair value estimate range stands at $154 per share of Microsoft. The market at-large seems largely supportive of Microsoft’s latest earnings, and so are we.

By Callum Turcan

Microsoft Corp (MSFT) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio, and the company reported solid fourth-quarter FY2019 results on July 18, sending shares higher by a couple percent the next day. Revenue rose 12% year-over-year, a growth rate that moves up ~200 basis points when excluding negative foreign currency headwinds, while Microsoft’s adjusted non-GAAP EPS climbed 21% to $1.37. Microsoft’s adjusted EPS growth rate would have been ~300 basis points higher, if not for a strong US dollar, but even so, these are great results.

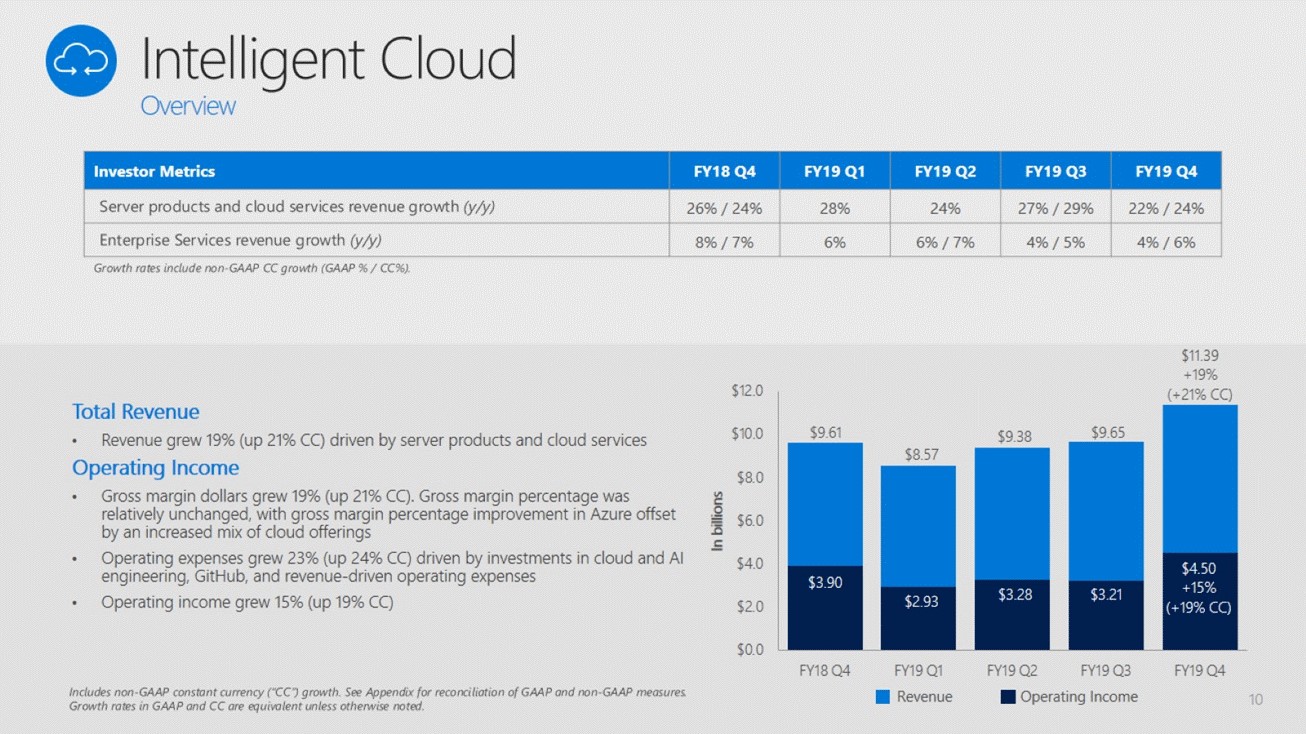

‘Intelligent Cloud’ and ‘Productivity & Business Processes’ each posted double-digit sales growth rates year-over-year, while Microsoft’s ‘More Personal Computing’ segment saw just 4% year-over-year revenue growth. Microsoft bills itself as the largest provider of commercial cloud services in the world. CEO Satya Nadella mentioned during the conference call that Azure was the first to move into Africa and the Middle East, at least in terms of having a serious data center presence in those regions, highlighting the long-term view Microsoft is taking when it comes to laying down the foundation for its future growth trajectory. Here is a quote from Mr. Nadella:

“We are building Azure as the world’s computer, addressing customers’ real-world operational sovereignty and regulatory needs. We have 54 data center regions, more than any other cloud provider, and we were the first in the Middle East and in Africa. Azure is the only cloud that extends to the edge – spanning identity, management, security and infrastructure. This year, we introduced new cloud-to-edge services and devices – from Azure Data Box Edge, to Azure Stack HCI, to Azure Kinect – bringing the full power of Azure to where data is generated.”

Further, Microsoft’s CFO Amy Hood mentioned that:

“In FY19, we closed a record number of multi-million dollar commercial cloud agreements, with material growth in the number of $10 million plus Azure agreements. Commercial bookings growth was significantly ahead of expectations, increasing 22% and 25% in constant currency, driven by strong renewal execution and an increase in the number of larger, long-term Azure contracts.

As a result, our contracted not recognized revenue was $91 billion, up 25% year over year, reflecting our continued momentum and growing long term customer commitment. We expect to recognize approximately 50% of this revenue in the next 12 months… Commercial Cloud revenue was $11 billion, growing 39% and 42% in constant currency. Commercial cloud gross margin percentage increased 6 points year over year to 65%, driven again by significant improvement in Azure gross margin.”

Cloud-fueled growth is expected to keep driving Microsoft higher with management forecasting that double-digit revenue growth will continue in fiscal year 2020. Margin expansion is also greatly appreciated as Azure realizes economies of scale and continuous improvements through the implementation of AI technology. Microsoft’s growth story is heavily weighted toward how well it does with commercial businesses (i.e. retail chains and restaurants) and large enterprise-sized entities (i.e. national governments), with the goal being to secure a long-lasting relationship built on recurring revenue streams.

Strength at the firm’s Microsoft 365, the “productivity cloud” offering, was key to its strong fiscal 2019 performance as the company targets growth in the healthcare, hospitality, retail, and customer service industries. From collaborative business setting offerings like Microsoft Teams to AI generated business intelligence insights to the Office apps we all use today, management sees Microsoft 365 offering a lot of upside for both customers and Microsoft’s financial performance.

Microsoft ended fiscal year 2019 with $133.8 billion in cash and cash equivalents plus short-term investments on hand, good for a net debt position of $61.6 billion (inclusive of short-term debt). One of our favorite things about Microsoft is its rock-solid balance sheet. Dividend payments must compete with net debt for uses of cash as it relates to future capital allocation priorities, but if the company in question has a large net cash position, its balance sheet can be a source of funds for future payouts. Microsoft’s Dividend Cushion ratio stands at 3.6x, providing for tremendous dividend coverage and a great dividend growth trajectory.

Large net cash positions can also be used to fund major and potentially transformative acquisitions, like Microsoft’s $26.2 billion purchase of LinkedIn in 2016. Revenue from that division grew by 25% year-over-year during the fourth quarter of fiscal 2019, driven by record levels of engagement. Microsoft is using LinkedIn to further solidify itself as the business world’s leading provider of all things software, with an eye on recruitment from an HR perspective as it relates to leveraging social media for useful commercial uses.

For the full year, Microsoft generated $52.2 billion in net operating cash flow, up 19% versus fiscal 2018 levels. Capital expenditures, defined as ‘additions to property and equipment,’ totaled $13.9 billion allowing for $38.2 billion in free cash flow in fiscal 2019. That easily covered $13.8 billion in dividend payments, with another $19.5 billion allocated towards share repurchases, all of which were covered by free cash flow. Going forward, dividend increases will have to compete with share repurchases, but Microsoft is truly a free cash flow generating machine.

We remain very optimistic on Microsoft’s future dividend growth trajectory and would like to note the upper end of our fair value estimate range stands at $154 per share of Microsoft. The market at-large seems largely supportive of Microsoft’s latest earnings, and so are we.

Software Industry – ADBE ANSS AZPN ADSK DDD EBIX FFIV INTU MANH MSFT OTEX ORCL RHT CRM SAP SPLK SNCR

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Microsoft Corporation (MSFT) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.