We don’t find Goldman to be very attractive trading above its tangible book value when its return on capital barely clears its cost of capital in the 10th year of a bull market.

By Matthew Warren

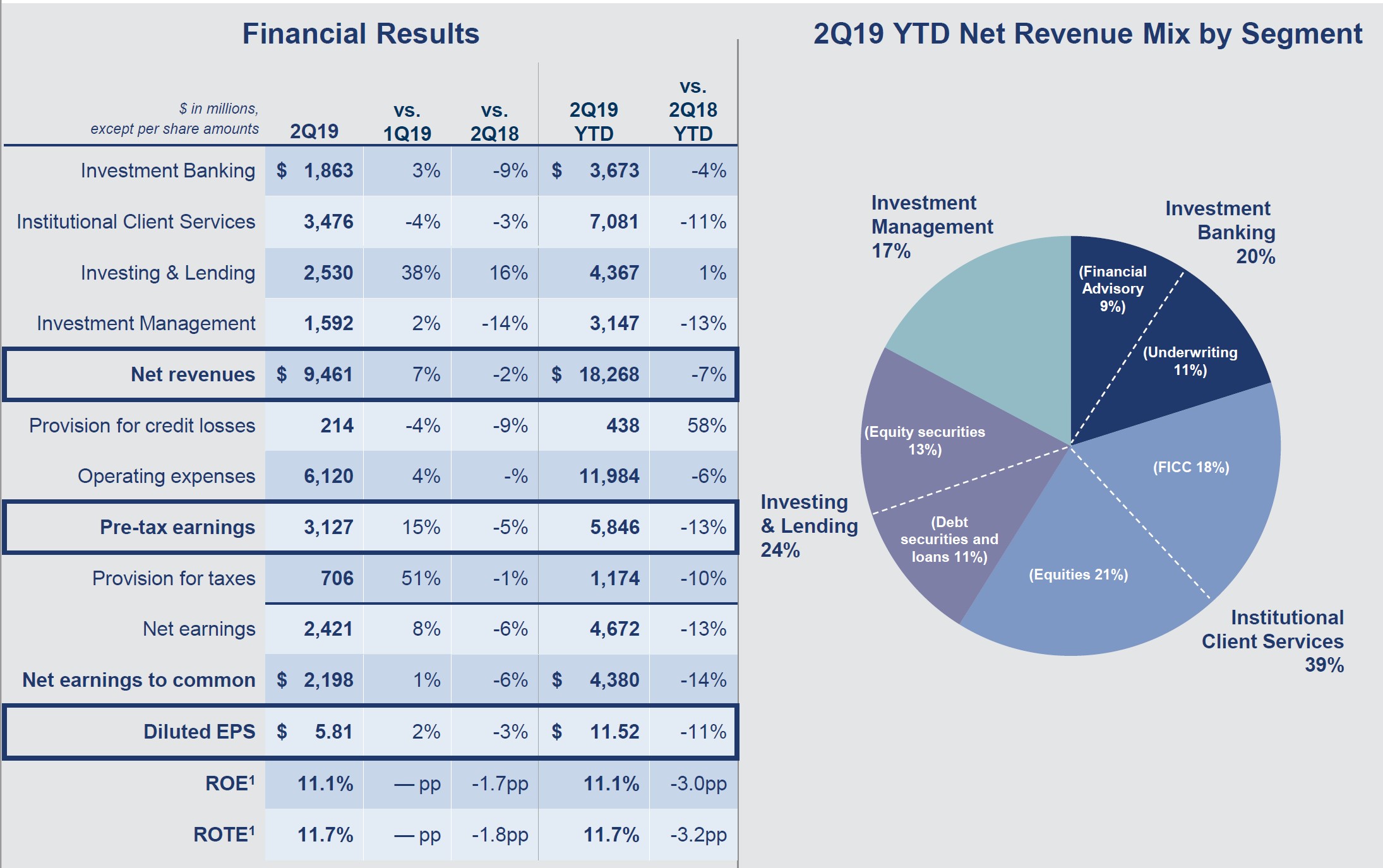

Goldman Sachs (GS) reported second-quarter 2019 results July 16, with net revenues down 2% to $9.46 billion and diluted earnings per share down 3% to $5.81, which was well ahead of Wall Street consensus for $5.03. As you can see in the below graphic, the Investing & Lending segment was the star in the quarter with revenue up 16% versus last year. This is because the quarter included approximately $500 million of net gains from investments that went public during the quarter.

We would also note that the Institutional Client Services business with revenue down only 3% seems to have held up better than some peers in a tougher environment as compared to the bright environment this time last year. The outperformance especially came in equities and with “low-touch” customers. Goldman seems to be taking share with this sub-group of clients.

Image Source: Goldman Sachs 2Q2019 Earnings Presentation

While management called out that current investments in platforms such as Marcus and the upcoming Apple (AAPL) card launch dragged ROE by about 60 basis points in the quarter, the return on tangible equity of only 11.7% still speaks volumes. Goldman is one of the strongest investment banks and securities dealers on the street, but the firm is barely able to earn above the cost of capital. It is cold comfort that some (especially European) competitors are losing money or earning substantially below the cost of capital.

The truth is that the global investment banking and securities trading markets are oversaturated with competition. Unless and until there is a rationalization of competition in these spaces–which provide a disproportionate share of earnings–Goldman will continue to suffer from volatile and middling return earnings streams. We don’t find Goldman to be very attractive trading above its tangible book value when its return on capital barely clears its cost of capital in the 10th year of a bull market.

Related: XLF

—–

Matthew Warren does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.