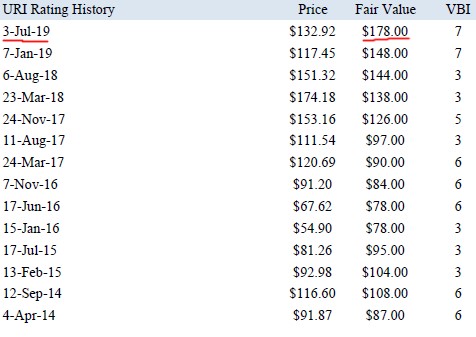

Image Shown: We increased our fair value estimate for United Rentals in early July 2019.

By Callum Turcan

We recently increased our fair value estimate for United Rentals Inc (URI), the largest equipment rental company in the world. The company has been a key beneficiary from the secular shift away from customer ownership to the rental of construction and industrial equipment. United Rentals has a heavy presence in America and Canada, along with a limited footprint in Europe.

Management is guiding for United Rentals to generate $1.3–$1.5 billion in free cash flow in 2019 before taking special items into account (particularly expenses incurred integrating recent acquisitions into company-wide operations). That should enable United Rentals to pursue both its deleveraging goals while also moving forward with its ongoing share buyback program.The company doesn’t pay out a common dividend at this time.

Reducing Leverage

On June 3, United Rentals lowered its targeted leverage ratio from 2.5x–3.5x previously to 2.0x–3.0x, with leverage defined as net debt to adjusted EBITDA. At the end of March 2019, United Rentals had a leverage ratio of 2.9x and management seeks to lower that down to 2.5x by the end of this year. We are very supportive of its deleveraging strategy and its lower leverage target.

At the end of the first quarter of 2019, United Rentals had less than $0.1 billion in cash on hand versus $0.9 billion in short-term debt and $10.7 billion in long-term debt, good for a net debt load of $11.6 billion. The company has non-investment grade credit ratings (BB/Ba2), usually referred to as speculative or “junk” because there is a good deal of risk in those debt securities. Having a speculative credit rating poses a potential downside risk if credit markets tighten.

In April 2019, United Rentals issued out $0.75 billion in 5.25% Senior Notes due 2030 to retire $0.85 billion in 5.75% Senior Notes due 2024. Part of that process involved United Rentals borrowing $0.15 billion from its senior secured asset-based revolving credit line, which is referred to as its ABL facility. That revolver had $1.5 billion in outstanding debt at the end of March 2019, with $2.2 billion in remaining borrowing capacity net. Management’s deleveraging strategy might see the company use future free cash flows to pay down its ABL facility later this year, reducing debt while maintaining access to liquidity as that revolving credit line doesn’t mature until 2024.

Considering United Rentals doesn’t currently pay out a common dividend, management can directly allocate expected free cash flows towards share buybacks and deleveraging. By the end of the first quarter, United Rentals had repurchased just under $0.65 billion shares via its ongoing $1.25 billion buyback program according to management commentary. Additionally, management reaffirmed the company’s commitment to completing those repurchases by the end the year. That indicates another $0.6 billion in buybacks are planned for the remainder of 2019, which should leave enough room for meaningful deleveraging efforts.

Please note that United Rentals has completed four repurchasing programs since 2012. Companies that have historically engaged in share buybacks are more likely to do so in the future, especially as that’s a key part of United Rentals’ Total Shareholder Return strategy. We see shares of URI (trading at ~$133 per share as of July 7) currently sitting well below our Fair Value Estimate of $178 per share, so arguably these buybacks are creating shareholder value but keep in mind that in order for deleveraging gains to be maintained, management will need to keep repurchases within free cash flows going forward.

Quality Shareholder Value Generator

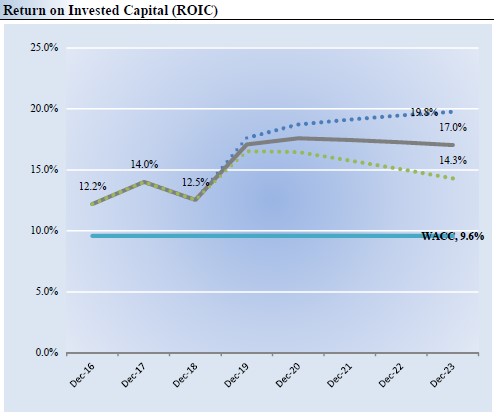

We would like to highlight that United Rentals is a quality shareholder value generator. Over the past three full fiscal years, United Rentals’ ROIC ex-goodwill has exceeded its estimated WACC by 330 basis points, and we project that the firm’s ROIC ex-goodwill will exceed its estimated WACC by 770 basis points over the next five years. That earns United Rentals a Good ValueCreation rating and an Attractive Economic Castle rating.

United Rentals’ ability to successfully integrate new acquisitions into its own operations has been key, as the company is a prolific acquirer and utilizes scale to enhance its margins. Targeting growth in specialty rental markets such as pump solutions, tool solutions, trench safety, and power & HVAC is expected to continue driving United Rentals’ margins higher (we forecast that the company’s operating margins will expand by over 300 basis points in 2019 versus 2017 levels). Down below is a visual representation of how these endeavors are impacting United Rentals’ expected ROIC ex-goodwill, from our 16-page Stock Report covering United Rentals that can be accessed on its ticker page.

Image Shown: We expect United Rentals’ ROIC ex-goodwill will climb materially from historical levels as the company targets growth in higher-margin rental markets while also leveraging ever-expanding economies of scale.

Acquisitive History

Last year, United Rentals purchased BakerCorp, “a leading multinational provider of tank, pump, filtration and trench shoring rental solutions for a broad range of industrial and construction applications,” for $715 million in cash. Management is targeting $19 million in direct cost synergies relating to corporate overhead redundancies and shared services. BakerCorp’s operations were situated across 46 locations in America and Canada at the time the deal was announced, along with 11 in Europe (France, Germany, the UK, and the Netherlands), which supported the needs of the company’s 4,800 customers. That deal closed in July 2018.

In September 2018, United Rentals announced it was acquiring BlueLine Rental for $2.1 billion in cash. BlueLine Rentals, at the time, was billed as one of the ten largest equipment rental services in North America with “over 50,000 customers in the construction and industrial sectors.” Specifically, BlueLine Rentals likes to cater to “mid-sized and local accounts” in North American markets. At the time the deal was made public, BlueLine Rental’s operations were supported by 114 branch locations in America (across 25 states), Canada, and Puerto Rico.

Management is targeting $45 million in direct cost synergies relating to redundancies in corporate overhead and by deploying methods used at United Rentals to BlueLine’s rental practices. Furthermore, the combined rental company’s spending synergies are expected to save United Rentals an additional $15 million on procurement costs. That deal closed in October 2018.

United Rentals forecasts that its revenue will grow to $9.15–9.55 billion this year, up materially from $8.05 billion in 2018. Acquisitions are responsible for some of that growth, but note United Rentals’ adjusted pro forma rental revenue was up over 7% year-over-year in the first quarter. Management stated that “the company realized broad-based growth across its geographic markets and vertical end-markets on both an actual and pro forma basis” in the first quarter of 2019.

Macro Risks

Readers should note that the rental and leasing industry is not a group we are normally fond of, far from it. This is a tough space to operate in. Here’s a concise summary of our thoughts on the matter, from Untied Rentals’ 16-page Stock Report:

“The highly fragmented and competitive US rental/leasing industry include entities that rent construction/industrial equipment, firms that lease household durable goods products, and companies that offer car/truck rental services. Equipment rental firms are tied to the cyclical construction/industrial end markets, car rental revenue is levered to on-airport (air travel) demand, while lessors of household durables are tied to housing and consumer confidence trends. Some firms may gain advantages via large/diverse rental fleets and significant purchasing power, but we don’t like the structure of the group.”

Scale and deleveraging efforts are appreciated, but please note that United Rentals is very exposed to the state of the North American economy (and to a lesser extent, Europe’s). Exogenous risks combined with a hefty net debt load represents a powerful potential downside risk (i.e. the recent US-China trade truce dissolves and the resulting trade war helps bring down global GDP growth to a level where North American economic activity contracts, which in turn reduces equipment rental demand and ultimately results in United Rentals’ financial performance weakening hampering deleveraging efforts, under such a scenario).

Concluding Thoughts

United Rentals is supported by strong free cash flow generation, a growing top line, expanding margins, its push into specialty rental markets, expected synergies, and ever-growing economies of scale. Focusing on deleveraging and integration efforts will be management’s main focus in the medium-term, keeping in mind United Rentals remains exposed to exogenous risks, potential downsides that are exacerbated by its large net debt load. We’re not adding the company to any newsletter portfolio at the moment, but we are keeping URI on our radar. If the US Fed does engage in a series of interest rate cuts, which we suspect is likely, that should materially behoove United Rentals’ financial status as future refinancing activities are made easier. Shares of URI are trading at ~$133 on July 7, well below our Fair Value Estimate of $178 per share.

Rental and Leasing Industry – Avis Budget (CAR), Public Storage (PSA), Ryder System (R), AMERCO (UHAL), United Rentals (URI)

Other: MGRC, RCII, TGH

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned in the article but does own shares of Public Storage (PSA). Public Storage is included in the simulated High Yield Dividend Newsletter portfolio. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.