Image Source: United Technologies Corporation – IR Presentation

By Callum Turcan

On June 9, United Technologies Corporation (UTX) and Raytheon Company (RTN) agreed to a merger of equals that if approved, will create a new giant in the aerospace & defense world. The combined company will sell anything from Patriot surface-to-air missile systems to national governments to power generation and cyber protection products for commercial aircraft. United Technologies and Raytheon hope that as a combined entity, the new company will have the scale required to be truly competitive in the commercial aerospace industry while maintaining the status of a reliable defense contractor.

Both CEO’s went on CBNC together to defend the deal and explained it as “complementary” to highlight the limited amount of overlap between the two businesses and the large number of jobs the combined company plans to create in America, largely to appeal to President Trump and domestic regulators. The company will be renamed Raytheon Technologies Corporation and is expected to be headquartered in Boston, Massachusetts. While the deal is forecasted to close during the first half of 2020, we caution that any major defense/aerospace merger is likely to receive a lot of scrutiny from federal regulators and other relevant government bodies (such as the Department of Defense).

Greg Hayes, currently CEO of United Technologies, is expected to be CEO of Raytheon Technologies and will also eventually take over the role of Executive Chairman from Tom Kennedy, who is currently CEO of Raytheon. Tom Kennedy is expected to become Executive Chairman of Raytheon Technologies for two years after the deal closes, before giving the role to Greg Hayes, largely for continuity purposes.

Image Shown: The proposed pro forma operating segments of Raytheon Technologies. Image Source: United Technologies – IR Presentation

Pro Forma Financials

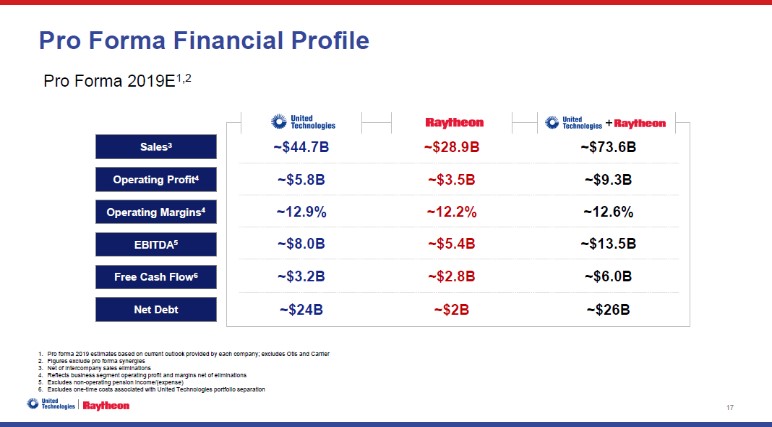

United Technologies and Raytheon expect the combined company will have $73.6 billion in sales this year on a pro forma basis, keeping in mind United Technologies plans on spinning off its Otis (makers of elevators and escalators) and Carrier businesses (provider of HVAC systems, and fire safety & security products) next year. On a pro forma basis, the combined entity is expected to have ~$26.0 billion in net debt at the time of closing. Management is targeting an investment grade credit rating within the ‘A grade’ range.

Assuming the deal goes through as planned, keeping in mind there are plenty of regulatory hurdles to vault first, shareholders of United Technologies will own 57% of Raytheon Technologies and shareholders of Raytheon will own the remaining 43%. Note that the spin-off of Otis and Carrier are happening before the proposed all-stock merger. Here is a key excerpt from the press release:

“Under the terms of the agreement, which was unanimously approved by the Boards of Directors of both companies, Raytheon shareowners will receive 2.3348 shares in the combined company for each Raytheon share. Upon completion of the merger, United Technologies shareowners will own approximately 57 percent and Raytheon shareowners will own approximately 43 percent of the combined company on a fully diluted basis. The merger is expected to close in the first half of 2020, following completion by United Technologies of the previously announced separation of its Otis and Carrier businesses. The timing of the separation of Otis and Carrier is not expected to be affected by the proposed merger and remains on track for completion in the first half of 2020. The merger is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.”

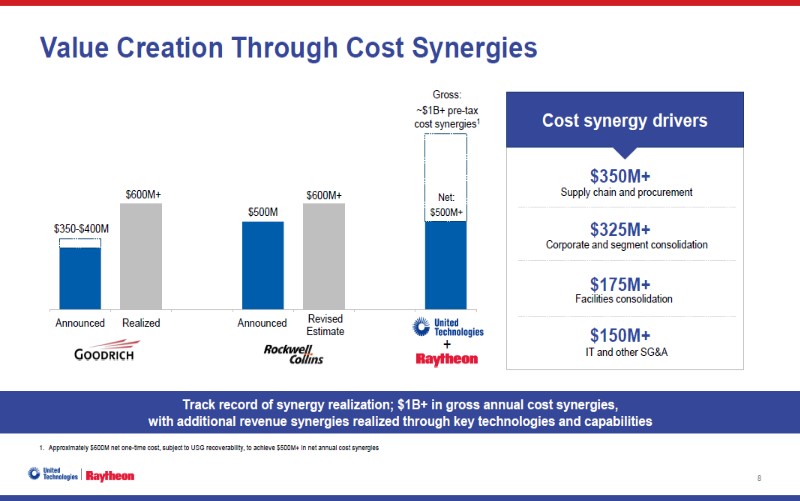

Back in November 2018, United Technologies had just completed its acquisition of Rockwell Collins. That deal bulked up United’s aerospace division and at the time of completion, was expected to generate $0.5 billion in run-rate pre-tax cost synergies within four years. Now Raytheon Technologies will be targeting $1.0 billion in gross annual cost synergies within four years of the United-Raytheon deal closing. Those synergies are expected to be generated through supply chain improvements, corporate consolidation, facilities consolidation, and IT/SG&A overlap. United and Raytheon mentioned in the press release that “approximately $500 million in annual savings [would be] returned to customers” in a bid to get regulators to support the proposed transaction.

Image Shown: Cost synergies underpin part of United Technologies’ acquisitive strategy, as economies of scale enables the firm to better control its supply chain while consolidation efforts keep costs contained. Image Source: United Technologies – IR Presentation

United Technologies and Raytheon intend on consolidating some of their divisions into larger, more streamlined entities to boost efficiency and cut costs. Raytheon’s businesses will be consolidated into two entities; Space & Airborne Systems and Integrated Defense & Missile Systems. Those two segments will join United Technologies’ Collins Aerospace and Pratt & Whitney segments to form the four pro forma segments of Raytheon Technologies. Corporate consolidation offers a clear line-of-sight on cost savings and we are supportive of moves that keep costs contained and management teams focused. Shedding Otis and Carrier represent a key part of this strategy, so going forward, Raytheon Technologies will be a commercial aerospace and defense contractor, not an industrial player with far-flung operations.

Below is a look at the pro forma financials of the proposed defense & aerospace giant. In particular, note that the firm is expecting to generate $6.0 billion in pro forma free cash flow this year. Strong free cash flow generation combined with the strength of Raytheon’s balance sheet (lowering the relative pro forma net debt load of the combined entity), expected cost synergies, and potential revenue growth is what will underpin Raytheon Technologies’ future shareholder return program.

Image Shown: Raytheon Technologies is expected to be very free cash flow positive on a pro forma basis. Image Source: United Technologies – IR Presentation

By 2021, Raytheon Technologies is forecasted to generate $8.0 billion in pro forma free cash flow. That free cash flow will fund the firm’s $18.0-20.0 billion shareholder return program over the 36 months following the closing of the deal, which includes both dividends and share buybacks. In order to keep shareholders happy, often management teams need to tout major shareholder return programs when pursuing transformative deals like this.

Hurdles to Vault

There are clearly a lot of different interests United Technologies and Raytheon must appease to get this deal done including: the Department of Defense, various US federal regulators, President Trump, shareholders of UTX and RTN, and (to a lesser degree) its commercial aerospace clients. It’s a balancing act for sure.

For instance, management is championing both job creation (combined, both companies expect to create 20,000 jobs in America over the coming years) and cost synergies (which usually involves redundancy-related layoffs) at the same time. Another example involves management highlighting the expected cost savings for the company’s customers (indicating a willingness to sell products for less, relatively speaking) while also noting the benefits from largess (economies of scale as it relates to cost control measures is one thing, but this deal will also give the new entity much more pricing control when it comes to dealing with its big clients, especially in the commercial aerospace industry).

In our view, one of the most important aspects of whether this transaction goes through as proposed comes down to how President Trump receives news of the deal. So far, he has expressed reservations regarding how the merger would impact competition. A large part of this deal rests on United Technologies and Raytheon only having to divest a small amount of their pro forma businesses, allowing for the expected synergies. Honeywell International Inc (HON) tried to buy United Technologies back in 2016, but due to the operational overlap, the new entity would have had to divest a material amount of its operations to comply with regulator’s concerns. Those divestments, at least in the view of United Technologies, would have ruined any potential synergies the Honeywell-United Technologies deal might have yielded. If United Technologies and Raytheon can’t sell President Trump on the deal, then it’s chances of getting approved drops considerably, in our view.

Concluding Thoughts

United Technologies and Raytheon joining forces, as proposed, makes a ton of sense. Its businesses do appear largely complementary, with minimal overlap, allowing for serious cost synergies without (in theory) raising the ire of regulators to the degree that could derail such a deal. That being said, sometimes consolidation in strategic industries is seen as unwarranted or unwanted given the size of the Department of Defense’s budget and the high barriers for entry in the commercial aerospace arena. It’s quite possible that federal regulators and other relevant parties decide to kill the deal in order to keep the space more competitive (at least in terms of the number of firms competing in the market).

If this deal does go through, as proposed, the pro forma company should realize material cost synergies enabling significantly stronger free cash flow generation in the future. Shares of UTX have posted lackluster performance over the past five years while RTN was on a tear until 2018. This is largely why United Technologies wants to pursue a transformative merger while spinning off Carrier and Otis; something needs to change. For Raytheon, the pro forma company should be better positioned to navigate the financial volatility involved when seeking to secure new major defense contracts by having a large commercial aerospace division. We’ll see how this transaction plays out over the coming months. The initial reaction from Wall Street wasn’t overly optimistic, but these are early days.

Aerospace & Defense – Prime: BA, FLIR, GD, LLL, LMT, NOC, RTN

Aerospace Suppliers: ATRO, HEI, HXL, SPR, TDY, TXT

Related: GE, RYCEF, RYCEY, EADSY

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.