Image shown: Mortgage REITs have held up better than master limited partnerships (MLPs) since mid-2015, but they haven’t exactly done well. For income investors, they may be the lesser of the two pain areas, but we’re still not really excited about them.

By Kris Rosemann

“The fundamental point remains sound: these are highly-levered, risky entities that depend on a number of factors beyond their control to generate profits.” – Kris Rosemann

The Yield Curve Curve Is A Key Driver

The mortgage REIT (mREIT) industry is not easy for many to understand, and even a great understanding of the space may not lead to investment success either. Many have stated that this area is not one in which individual investors should dabble, and we generally agree. For one, the success of an mREIT, as they are called, depends heavily on its ability to acquire assets (agency securities) at favorable spreads over borrowing costs, which can rise materially in the event that short-term interest rates increase or the market value of its investments decline. What many missed years ago was the the impact of rising interest rates on the group’s book value, where other comprehensive losses (OCL) overwhelmed any gross operating returns to drive book values lower.

Similar to other financial-oriented entities, mREITs are heavily dependent on short-term interest rates, which impact borrowing costs, while longer-term rates on mortgage backed securities often are a key source of their interest income. The spread between the two is the entity’s profit generating mechanism, or net interest margin (NIM), and mREITs typically use leverage (“lever up”) in attempt to maximize the profitability of this spread. In isolation, the current flattening/inversion of the yield curve would be detrimental to the spread these entities depend on to generate income, as mortgage rates have a tendency to move roughly in tandem with long-term Treasury yields.

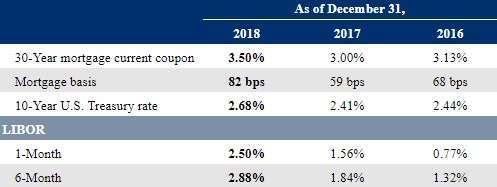

Image Source: Annaly Capital Management 2018 10-K

The image above shows developments in yield spreads in recent years, which have generally improved. However, the rising interest rates that have accompanied these spreads also impact the value of an mREIT’s underlying book of business, which is marked-to-market as an adjustment called other comprehensive losses (OCL). In some ways, when an mREIT benefits in one area of its business, the other area may suffer: widening spreads help NIMs and gross return on equity, but rising interest rates can impact the book value of its business. How the yield curve looks and the trajectory of interest rates are the key variables behind an mREIT’s operation, and both are notoriously difficult to forecast. Mortgage REITs then throw tons of leverage on top of the business model, too. Can you say risky?

That said, the Fed seems to be taking a pause when it comes to short-term rate hikes, and this may be a good thing assuming that spreads don’t further tighten, but the long end of the curve isn’t factoring in as much inflation as we would like to make the mREIT business model really fire on all cylinders. Inflation is a core component of interest rates and higher inflation expectations over the long haul would drive interest rates at the long end of the curve higher. Perhaps the true blessing for mREITs in the Fed pausing is that other comprehensive losses (OCL) on their book of business may turn into other comprehensive income in the coming periods, and this may help book value a bit, driving some capital appreciation in excess of the dividend payment.

Economic Variables Do Not Change in Isolation

As previously mentioned, the increasingly dovish stance taken by the Fed with respect to further interest rate increases is generally a positive for the group, as immediate upward pressure on short-term rates directly from the Fed appears to be non-existent at this juncture. Lower benchmark interest rates are a positive for the book value of mREITs due to inverse relationship of discount rates, which are influenced by interest rates, and the value of the securities these entities hold on their books. The borrowing end of mREITs’ interest rate spread may be settling in near current rates, too, depending on how demand for short-term fixed income vehicles develops in the near future. Inflation expectations then become critical.

On the other end of the interest rate spread for mREITs sit yields on mortgage-backed securities and other real estate backed vehicles, and a healthy housing market and strong mortgage credit performance are supporting the health of this factor of the group’s net interest margins. While the 10-year US Treasury yield, which currently sits below the 3-month Treasury yield, often provides a reasonable basis for the directional moves of mortgage rates, the correlation is not perfect. For example, in 2018, the spread between the 30-year agency mortgage-backed security and the 10-year US Treasury yield widened as a result of increased volatility in the capital markets and the Fed’s balance sheet runoff.

How this spread between long-term Treasury yields and mortgage will behave in the future is subject to a number of factors, not the least of which is the Fed’s balance sheet runoff plans. The ongoing reduction of securities, including Treasury bonds and mortgage-backed securities, held on the Fed’s balance sheet, which is currently expected to continue through September of this year, could put upward pressure on rates of both long-term Treasury bonds and mortgage-backed securities as a flood of both could temporarily oversupply the market’s appetite for either group.

However, if current demand for the safety of 10-year Treasury bonds remains, the spread between long-term Treasury yields and rates on the meaningfully more-risky mortgage-backed securities could follow a similar trajectory as that of 2018. In this respect, a flattening, or even inverting, yield curve does not necessarily spell disaster for mREITs in itself, but the risks are certainly present for net interest margins to face pressure should mortgage-backed security rates decline meaningfully. However, these rates are inherently difficult to predict due to uncertainty surrounding their average lifespan, relatively high credit risk, and risks related to prepayments, which can be exacerbated in times of declining interest rates, in addition to the ties of mortgage rates and underlying interest rates.

Net Asset Value and Interest Rate Sensitivity

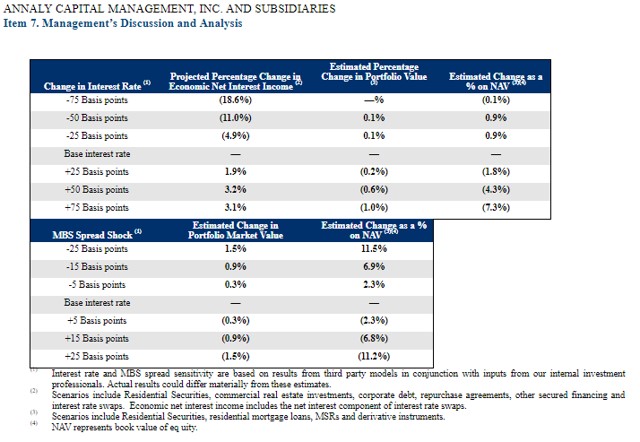

As can be seen in the image below, mREITs’ net asset value (NAV), portfolio market value and net interest margin are sensitive to minor changes in mortgage-backed securities rates and interest rates, with the former having a more meaningful impact on asset and portfolio value. While a short-term upward shock in the mortgage-backed security rates, which could materialize as a result of ongoing Fed runoff and the market’s lack of appetite for risky securities, may impact net asset value in the short term, it could open mREITs up to the possibility of wider spreads on longer-duration assets as the current credit tightening cycle appears to be winding down.

Image Source: Annaly Capital Management 2018 10-K

As we mentioned previously, perhaps the most important driver behind changes in an mREIT’s net asset value is other comprehensive income/(loss), or OCI, and changes in OCI include net unrealized losses on investments marked to market. In 2018, mREIT bellwethers Annaly Capital Management (NLY) and AGNC Investment Corp (AGNC) reported other comprehensive losses of $854 million and $598 million, respectively, as interest rates faced upward pressure throughout the year. Annaly Capital’s $2 billion in reported losses on available-for-sale securities in the year was partially offset by reclassification adjustment for net losses included in net income, while AGNC reported a total loss on investment securities of more than $1 billion due to unrealized losses on investment securities measured at fair value through net income and losses on sale of investment securities in 2018.

Conclusion

While there appears to be some relatively positive developments for mREITs in the group’s near-term outlook, mortgage markets are inherently difficult to predict. The opaqueness of this market only adds to the interest rate and substantial leverage risk associated with mREITs. For example, as of the end of 2018, Annaly and AGNC reported leverage ratios of 7x and 9x, respectively. Though their respective definitions of economic leverage and tangible net book value “at risk” leverage ratio may vary slightly, the fundamental point remains sound: these are highly-levered, risky entities that depend on a number of factors beyond their control to generate profits.

Though we prefer to avoid the risks related to exposure to any one individual equity within the mREIT group, diversified exposure to the space might make sense in the context of a high yield income portfolio. We include the Global X SuperDividend ETF (SDIV) in our simulated High Yield Dividend Newsletter portfolio, which includes ~20% exposure to the mREIT space as of the end of 2018, and no one holding accounts for more than ~1.2% of the fund’s net assets. According to the ETF’s home page, its annual distribution yield currently sits at 9.4%, and its distribution is paid monthly.

Related ETFs: MORL, REM, XHB, ITB, MORT, DMO, PKB, TSI, PGZ, JLS, NAIL, CMBS, FMY, HOML, JMT, LMBS, MBSD, HOMZ

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.