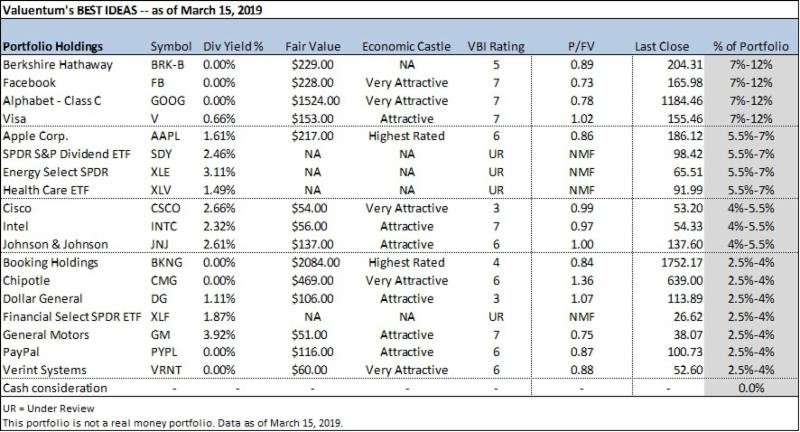

No change to simulated newsletter portfolios. Clarification: On March 15, we sent out an alert for the Dividend Growth Newsletter portfolio removing Novartis (NVS) and adding to the Health Care Select Sector SPDR Fund (XLV), the latter now in the 5.5%-7.5% weighting bands, a combination of its prior weighting and the new additional weighting.

By Kris Rosemann and Brian Nelson, CFA

Whether it’s the 24-7 business news channel or the up-to-the-millisecond charting functionality that is causing it, your competition is news-driven. For example, we often receive a lot of questions on stocks at the time when they are falling precipitously. This is not the time to do the homework.

It could simply be because the investor is holding the stock and wants an update, but you should already know what to think before good news or bad news happens. This is a critical part of investing. Knowing what to do under various scenarios is part of having an in-depth thesis to an investment.

I think it’s important to understand what we think falling stock prices mean, too, and it often doesn’t mean shares are cheaper, or your interest should grow in companies dropping like rocks. Thinking about stock prices in the following way may completely change how you view investing and significantly improve your performance while helping to avoid value traps. From our book Value Trap: Theory of Universal Valuation:

Wall Street tends to want to buy low and sell high, but it may pay no mind to what a declining stock price may actually imply, a declining value, too. Many believe that just because a stock is falling in price, the stock is cheaper, but that doesn’t have to be the case. The stock’s value could have fallen even more. Stock prices that are going up, on the other hand, imply market backing and the belief that their intrinsic values were also higher. Investors should therefore prefer appreciating stocks because it means that the market believes they should be valued higher, it stands to reason.

The vast majority of the marketplace simply doesn’t think like this (they want to buy stocks on the way down!), and it may be no surprise that this might be why they are doing so poorly. In recent history, for example, an estimated 84%-92% of large-cap managers, mid-cap managers, and small-cap managers lagged their respective benchmarks over a 5-year period ending 2017, while 92%+ of managers lagged their respective benchmarks over a 15-year period ending 2017. A lot of the mainstream techniques of active management is not working. Your competition is failing.

Not Biting on Deluxe, Roku or Tivity; We Still Love Apple

With that said, let’s talk about a few stocks across our coverage universe. We’ve lowered our fair value estimate for Deluxe (DLX) after reducing top-line expectations and raising our cost of capital assumption. As the company’s highest-margin segment, ‘Direct Checks,’ continues to be mired in secular decline, its overall operating margin performance is being pressured, and higher shipping and material costs are not helping matters. The company is working to become the best at helping small businesses and financial institutions grow, and M&A activity should be expected as it works to that end.

Shares are currently trading in the lower half of our fair value range, but we’re not too fond of the company’s current organic growth opportunities (and its shares have been under pressure). The company has been able to deliver relatively consistent cash flow from operations in recent years, but the lack of meaningful growth opportunities and the likelihood of its debt load continuing to increase (long-term debt grew to $911 million from $665 million in 2018, and it recently expanded its credit facility) as it works to capture inorganic growth opportunities keep us uninterested in shares at this time. You can access our updated report at Deluxe’s stock landing page here.

We wanted to comment briefly on Roku (ROKU). As you are aware, the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio are already fully-invested, and they have a rather large tech weighing, so we’re not going to be adding the company. That said, the company is one for the radar, as much as Netflix (NFLX) is one to watch. Both companies are fast-growers, plays on next-generation entertainment, and not generally that profitable. Roku, for example, is targeted to lose $80-$90 million in 2019 on roughly flat EBITDA performance. The company could certainly be a strong performer in coming years, but we think the range of outcomes is still far too great for our taste. We’re putting this one in the “too hard” bucket for now. We may add coverage in the coming months, however.

We’re also taking this time to notify you that we’ve updated our report and fair value estimate on Tivity Health (TVTY). The company made a very unpopular deal to acquire Nutrisystem in December, and while we think the stock has been unduly punished as a result, we’re still not interested in shares. Remember–dividend growth considerations aside, for ideas in the Best Ideas Newsletter portfolio, when we’re considering a new add, shares must be generally undervalued on a discounted-cash-flow basis, on a relative (behavioral) valuation basis, and its share price be on an upward march. While shares of Tivity look very cheap at the moment, we remain on the sidelines. A more extensive write up of our thoughts on this company can be found here.

Last but not least, how about Apple (AAPL). This workhorse idea of both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio is now approaching $200 per share again. Have you fired everybody that said to sell it at $140 per share in January of this year? We continue to expect good things from Apple, and our fair value estimate stands at ~$220 per share. We couldn’t be more pleased with how things are going. Our latest performance update for the Best Ideas Newsletter portfolio can be found here. In case you missed the latest edition of the Best Ideas Newsletter, the March edition, it can be downloaded below.

Thank you for reading!

Image shown: Valuentum migrated to a weighting range format for the Best Ideas Newsletter portfolio ideas beginning in 2018.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann and Brian Nelson do not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.