Let’s take a look at some of the top stories surrounding the markets, including the potential for escalating US-EU trade tensions, Kraft-Heinz’s not so shocking dividend cut, and Stamps.com’s free fall.

By Kris Rosemann

While equities continue to display optimism over US-China trade talks, concerns surrounding potential tariffs on autos from the European Union are mounting. Retaliatory measures on ~$22.7 billion of US products from the EU are reportedly already being prepared, and companies such as Caterpillar (CAT) and Xerox (XRX) are among those expected to be targeted by the retaliation. Europe is currently facing potentially slowing economic growth, and weakness in industrial production in the region has not gone unnoticed, “In The News: European Growth Concerns…”

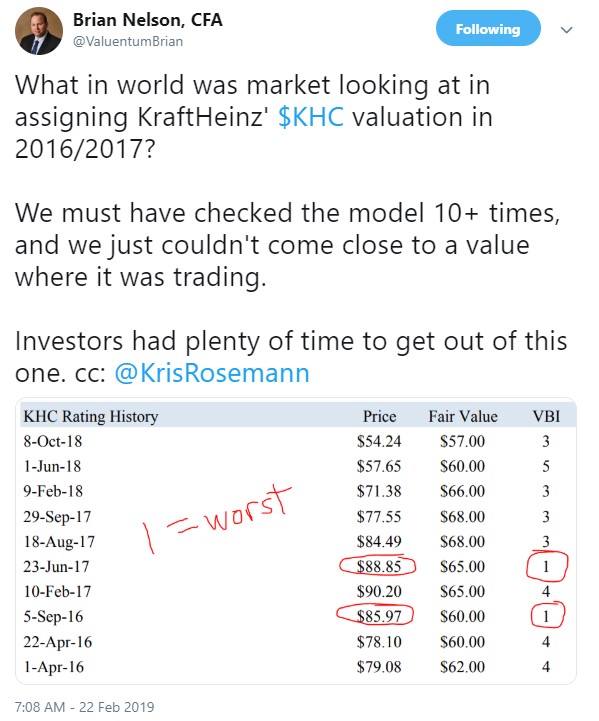

Shares of Kraft Heinz (KHC) are facing tremendous selling pressure after it shocked the market with the announcement of massive impairment charges on intangible assets related to prior acquisitions, the disclosure of an SEC probe into its accounting policies, and slashing of its quarterly payout by 36%.

Image Source: @ValuentumBrian on Twitter

The company registered a 1 on the Valuentum Buying Index multiple times in the past, and its Dividend Cushion ratio was -0.1 prior to the reduction of the payout. We were never comfortable with Kraft Heinz, and free cash flow trends have been quite volatile in recent years. Changing consumer tastes may have ultimately led to the significant reduction in brand power for what were once some of the most recognizable names in the packaged food space, but the strategy of loading up on debt to consolidate brand equity was proven ineffective as the company placed emphasis on cutting costs ahead of maintaining brand power.

Meanwhile, shares of Stamps.com (STMP) are in free fall after it announced that it will no longer have an exclusive partnership with the USPS, which brought with it significantly lower near-term revenue guidance. The company pointed to the significant financial and regulatory burdens the USPS faces, which materially impact its ability to react to changing market dynamics. Management touts the long-term potential of a growing relationship with Amazon (AMZN) as part of a multi-carrier solution, but near-term pain is to be expected. We plan to update our fair value estimate for both Stamps.com and Kraft Heinz shortly.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.