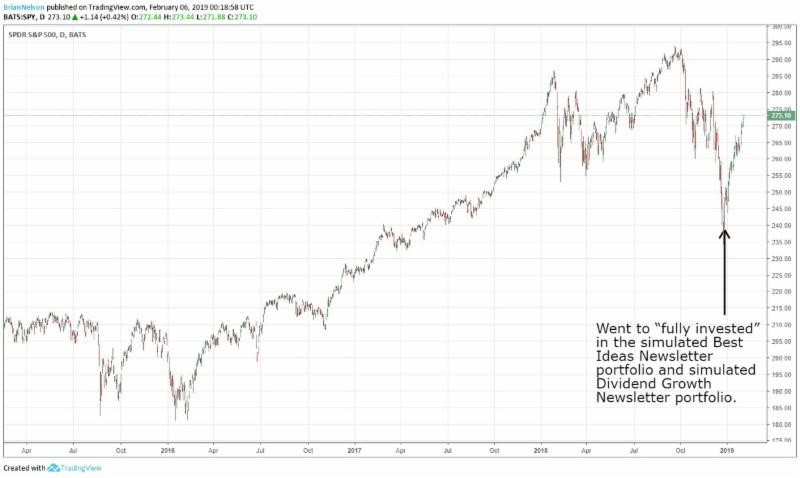

Image shown: The S&P 500 (SPY) performance and the timing of when we went to “fully invested” in the simulated newsletter portfolios, the Best Ideas Newsletter and Dividend Growth Newsletter.

No changes to simulated newsletter portfolios.

By Brian Nelson, CFA

Hi everyone!

Trust you are doing great. Here’s what you need to know about the broader market backdrop.

1) We’ve been expecting a more dovish Fed as the yield curve continues to threaten material inversion. We doubt the Fed will materially and purposefully invert it. The behavioral risks of actually causing a recession by doing so are too great. That means yield-oriented equities may continue to breathe a sigh of relief. This is good for ideas in the simulated Dividend Growth Newsletter portfolio and simulated High Yield Dividend Newsletter portfolio.

2) We went to “fully invested” in both the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio on December 27 (just about at the bottom). You know that while there was some luck to the timing, we work incredibly hard, and I’d like to believe that sometimes you make your own luck. After all — we were working hard during the Christmas holiday.

I feel it important to remind you sometimes what drives our company. For starters, neither Valuentum, nor Kris, nor I have exposure to any ideas on the site. We’re completely independent. This means that you get the real deal, our real authentic opinion. That means we do well only when you do well. Why is this important to talk about? Well, I need you to understand why we’re excited when things work out.

When we release a notification that we’re going “fully invested” in the newsletter portfolios, for example, and it works out, we’re not bragging. It means we’re excited for you. When Facebook (FB) surges after we “add” to it, and when Alphabet (GOOG, GOOGL) does well, both rated 10 on the Valuentum Buying Index, I’m happy for you. (By the way, Kris wrote up Alphabet’s quarter here.) As many of our members continue to reiterate, it really does take just one or two ideas to really make a membership worthwhile.

I appreciate a healthy degree of skepticism. In fact, I welcome it. But you know that the simulated newsletter portfolios are doing great, and you know that a process must be systematic in order to be repeatable. You saw how our methods can safeguard your portfolio when we ditched Kinder Morgan (KMI) and General Electric (GE) a few years ago. We talk a lot about that in our new book, Value Trap: Theory of Universal Valuation. Purchase a copy from Amazon here. Don’t forget to leave a review, too!

So how can you fit a service in your processes like ours that has a good handle on the market movements, has done very well with long ideas — Visa (V) has been one of our best — and that can identify situations where equities may very well collapse, all the while providing independent valuations of stocks updated quarterly. It’s a dream come true for any investor, right? The bottom line is that you keep your membership. Even if you are an indexer or quant or financial advisor that doesn’t do stock selection, you should keep the membership. There is so much value!

We’re at an interesting time in the history of finance. As my book, Value Trap notes, the capital asset pricing model (CAPM) has failed, the traditional quant value factor has failed, the size factor has failed in live, walk-forward tests. We’ve rewritten the arithmetic of active management to the investor level. More and more we continue to see work that debunks the efficient markets hypothesis. Articles and researchers continue to view investing through these lenses, however. Finance is stuck.

What’s worse, most of finance has been trained on the failed processes of yesteryear, and it will be hard for them to implement ways to look at things differently. But maybe that perspective isn’t quite accurate. John Burr Williams’ wrote the Theory of Investment Value in 1938, Benjamin Graham’s landmark works pre-date modern finance, and Warren Buffett has all but shown that enterprise valuation and assessing business models is simply par for the course to have any sort of chance of achieving long-term outperformance. Maybe it’s actually more accurate to say that finance needs to get back to the “right” ways of doing things.

That’s where Valuentum comes in. As I talked about when I wrote up my tribute to Jack Bogle, everything I do (everything our team does) is based on candor. If we don’t like what we see, you’re going to hear about it. Please don’t take it personally. I’d hate for a financial advisor to cancel their membership just because I mention that some advisors may too reliant on indexed products and highlight some of the conflicts of interest associated with the AUM business model. Let’s work together. At the end of the day, if you’re on our website, it means you’re a truth seeker, and I applaud you for that. You’re also looking to keep the money you make, with emphasis on keep.

Last week, we received some really good news that nearly had me tearing up. Enterprise Products Partners (EPD) stated that it will start to lean more toward reporting free cash flow for investors. The road to help investors in the midstream space was a long one in this endeavor. As you’ll read in Value Trap, we did our best to help the individual investor, and it means the world to me to see our efforts lead to something as noble as better information and improved transparency.

I think I need to tell you something, and I hope that you can help me solve this problem. Sometimes I get a lot of questions about how frequent our reports are updated. Some years ago, I made the decision for our team to update them when material events warrant or on a quarterly basis. It saddens me greatly that some of our dear visitors to the website don’t understand that if we have to update the reports more frequently, it might mean that we just got our valuation incorrect. We include real-time charting information on each company’s landing page, and valuations shouldn’t change that often.

One of the things that I’m sure you appreciate is how complex but yet how simple the Valuentum methodology truly is. For example, we can go into tremendous detail as in our book Value Trap, or we can keep things really, really simple in explaining our methodology. For example, we like stocks that are undervalued as their prices are appreciating, and we don’t like stocks that are overvalued as they are going down. It’s really that simple, but boy look at the book Value Trap. There’s a lot that goes into this simplicity.

So what should we talk about today? For starters, our best ideas are always included in the simulated newsletter portfolios. We try to make these newsletter portfolios as easy to follow as possible, and generally speaking, even if you miss our notification emails, you probably won’t miss much in a few days or two. We try to keep everything simple. We also pride ourselves on transparency. You can dig into our assumptions behind every fair value estimate.

Sometimes I think we’re too transparent though. Remember — markets are based on forward-looking expectations, not on last year’s historical measures. We can’t get bogged down on 2015’s return on invested capital calculation. Next year is 2020! If you’re spending all of your time evaluating historical numbers, you’re not going to approach the concept of intrinsic value, which is based in part on future expectations of enterprise cash flows, and you’re likely going to be very disappointed.

But there is something else that I want you to know about simplicity. It can also be dangerous. When Nobel laureate William Sharpe wrote the Arithmetic of Active Management, a simple weighted average of the investor return would have revealed that the average active investor can outperform, net of fees. You can read Value Trap on how I offered this brand new perspective.

It would take 25 years though! Finance does not change fast. There’s too much inertia at work, and too many counting on the status quo, whether it is right or wrong. My goodness — there are not growth and value stocks, but undervalued, fairly valued and overvalued stocks. Things have gotten so off course in finance that when someone tells the truth, sometimes investors simply can’t believe it.

As Value Trap reveals, there is even more concern about simplicity when it comes to valuation multiple analysis or the dividend payment. For example, trading stocks on the basis of P/E ratios or P/B ratios or even EV/EBITDA ratios is speculation, and a company’s dividend is a symptom of intrinsic value, not a driver behind it. Valuentum is going to tell you how it is. That’s all we can do. It’s why I believe we’ve been able to do so well.

It’s hard to evaluate a service like Valuentum that does so much. I understand. We have the Best Ideas Newsletter, the Dividend Growth Newsletter, the High Yield Dividend Newsletter, the Exclusive publication. We have the DataScreener, the Ideas100, the Dividend100. We calculate fair value estimates on hundreds of stocks. Our work on dividend health is second to none with the Dividend Cushion ratio, and we’ve been doing this for the better half of a decade now–all in full transparency.

I dedicated my book to our loyal members. Some of them have been around since the very first year of our company, and it truly means the world that you’re still here. In this age of information overload, I’m just glad that you found us because you truly have a chance to get great information and to learn about investing. We have tons of research on the efficacy of the Valuentum Buying Index rating, the Dividend Cushion ratio, the simulated Best Ideas Newsletter portfolio, fair value estimates and beyond!

At Valuentum, we’re leaders in this industry. But what does that mean? Well, we didn’t do market research and say, “our target market is such and such.” Instead, we set out and said: “this is how to win at investing,” and we built a company around it. That takes a tremendous amount of character and integrity. We weren’t just fitting “some” need. We’re actually trying to help investors!

The Valuentum methodology didn’t exist before we put it into place, and we’ve tested it in walk-forward fashion, and it has done incredibly well. Strong performance in the simulated Best Ideas Newsletter portfolio, solid performance in the simulated Dividend Growth Newsletter portfolio and not one dividend cut in all the years! Not one dividend cut for an income idea in the Exclusive, and not one dividend cut in the simulated High Yield Dividend Newsletter.

I had a chance to watch some films from the 1930s this weekend. Many tuned into the Super Bowl, but I was studying history. I watched a 1931 film, 10 Cents a Dance, about how Monroe Owsley’s character got into a lot of trouble because he chased a hot stock tip. Don’t be that person. Don’t get swayed by conflicted research on other websites and in the news, and please don’t confuse authority and expertise with “skin in the game.” If someone owns a stock and writes about it, you should be more skeptical of the work, not less. It’s backwards today. Don’t fall for it.

You simply need to diversify, too — 15 to 25 securities at the minimum, and this is the equity sleeve! There are other asset classes that should be considered as well, depending on your personal goals and risk tolerances. But don’t go completely on the other side of the spectrum either. Don’t be overly skeptical of all of active management.

You know for every dollar of underperformance, there is a dollar of outperformance. Everyone cannot underperform, and you know that Valuentum is on the right track when we’re doing value investing better than most any value investor, and we’re adding a technical and momentum overlay that includes the valuable “information contained in stock prices.”

I do think publishing is a dying business. When you think about what intelligent readers have been reading these past 40 years, much of it has been indexing and if not, quantitative research. Something like 90% of active fund managers are now underperforming after fees during these past 15 years, and nobody seems to think that it’s the research that’s failing them. They’ve now come up with the idea that active managers are just too smart to outperform. Do you believe that? Perhaps that’s all that ego can accept.

The reality is that alpha has moved to another part of the corporate equity market, and I would not be surprised if it has moved into your pockets, particularly if you are following the principles of Warren Buffett and reading our work. For years, the finance industry has been “sold” on the idea that fund managers cannot win. But did you know that active fund management is about 15% or so of the corporate equity market. That’s it. All that attention for just 15%.

I think you’re the ones that are winning, and I’m very proud to be a part of your research efforts. You see the value of our offering. Some research providers make you pay extra for research and newsletters. You get our research and newsletters as one, and you can even add additional newsletters, too. I look at the prices of what some services charge for really basic stuff — $199/month, $150/month. We’re building and updating hundreds of discounted cash-flow models, and much much more.

I want to continue to remind you that Visa is our top-weighted idea in the simulated Best Ideas Newsletter and that we continue to be huge fans of Facebook and Alphabet. Stocks are cash-based sources of intrinsic value. How you feel about a company or what you think of a company does not impact its intrinsic value. Love or hate Facebook, the stock is really, really cheap. Xilinx (XLNX) is one of our favorite ideas in the simulated Dividend Growth Newsletter portfolio. Higher yields can be found in the High Yield Dividend Newsletter.

Being an investor means covering all the bases, evaluating all probabilities and positioning portfolios appropriately. If you think about our decision to go to “fully invested” even as we grew more concerned about price-agnostic trading, that’s how winners win. It’s capturing “alpha” on the slide, locking it in, and then re-adjusting the strategy with one’s finger on the put-option trigger. It’s being able to hold two contradictory thoughts at the same time, and positioning the portfolio appropriately to capture both. That’s investing.

Now on to the questions. Where are our archived VBI ratings? For the past several update cycles, they are included in the quarterly DataScreener, which is part of the financial advisor level membership plan. For all of our archives, we make that available in our quant package. When is the next edition of the Exclusive to be released? Saturday, February 9th. Is it feasible to provide a VBI number for the market? Yes, our team is working on doing this more systematically, but you can approximate the S&P 500 price-to-fair value ratio with information from the DataScreener, and overlay that with a technical/momentum assessment. It captures both enterprise valuation and technical/momentum considerations, as in the VBI, itself.

We’re still working our way through earnings reports, but we’re not making any changes to the simulated newsletter portfolios at this time. We expect to have a multitude of earnings commentary available soon, and I’ll send you an email tomorrow regarding it. Thank you, as always, for reading! I continue to be very appreciative of your interest, and I hope that you and your portfolio doing well. For new visitors, if you really want to learn how to think about investing, read Value Trap and let’s talk. There’s no better way to learn than to have a great intellectual conversation. Always my very best!

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.