Image Source: Novartis fourth quarter presentation

European pharmaceutical giant Novartis had a busy year in 2018 on its quest to renew its focus on medicines, and management is excited about its future growth trajectory. We continue to like its free cash flow generation and dividend growth potential.

By Kris Rosemann

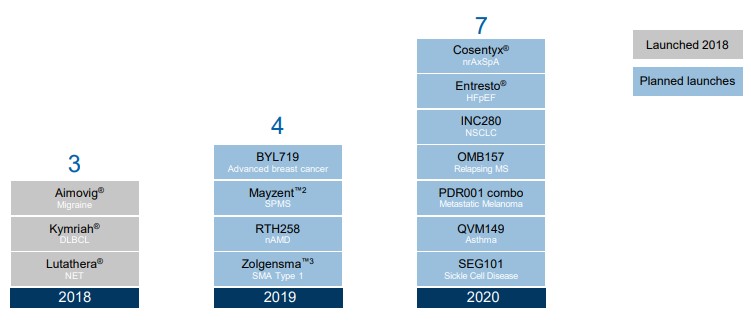

2018 was a busy year for simulated Dividend Growth Newsletter idea Novartis (NVS), which reported fourth quarter results January 30. The company completed a strategic review resulting in the planned first half 2019 spin-off of its Alcon division, it agreed to sell its Sandoz US oral solids and dermatology portfolio, it sold its stake in the GlaxoSmithKline (GSK) consumer healthcare joint venture for $13 billion, and it invested in long-term growth drivers such as the acquisition of AveXis gene therapy. Four of Novartis’ drugs surpassed the $1 billion annual sales mark for the first time in 2018, giving it fifteen in total in its ‘Innovative Medicines’ division, and three more potential blockbusters were launched in the year in Lutathera (oncology), Aimovig (migraines), and Kymriah (oncology).

Net sales as reported at Novartis in the fourth quarter rose 3% on a year-over-year basis, or 6% in constant currency, as impressive volume growth of 9% was partially offset by a two percentage point drag from pricing and one percentage point of negative impact from generic competition. Key drivers of volume growth in the quarter were Cosentyx (psoriasis), Entresto (heart failure), its ‘Oncology’ division, and Alcon.

Operating income as reported was decimated in the fourth quarter by restructuring and impairment charges and the impact of M&A activity, but core operating income advanced 5% as higher sales in ‘Innovative Medicines’ and gross margin expansion across all divisions were partially offset by growth investments such as those in AveXis. Core operating margin expanded 50 basis points in the period on a year-over-year basis to 25.5%. Core earnings per share advanced 3% in the fourth quarter from the year-ago period to $1.25 as growth in core operating income was weighed down by the divestment of core income from the GlaxoSmithKline consumer healthcare joint venture.

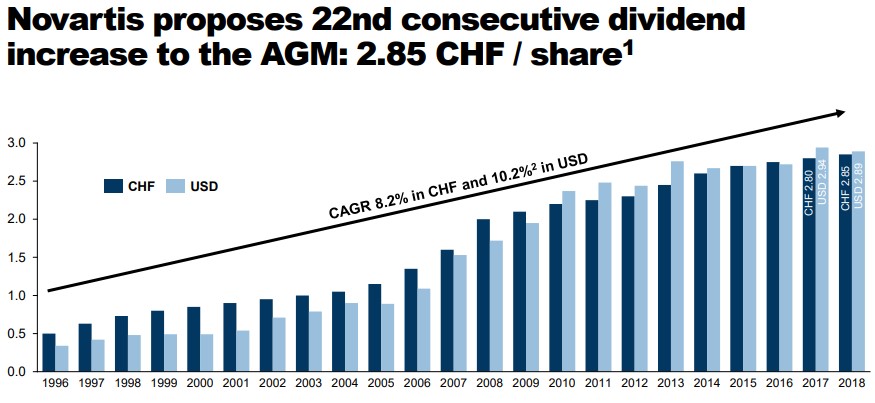

In the fourth quarter and full year 2018, Novartis showcased its traditional free cash flow generating prowess as the measure rose ~17% and ~11%, respectively, both on a year-over-year basis. The full year measure came in at just over $10.9 billion, which was more than sufficient in covering cash dividends paid of ~$7 billion in the year, as cash flow from operations advanced to $14.3 billion from $12.6 billion in 2017. The company ended the year with a net debt position of $16.2 billion (consisting of ~$32.1 billion in total debt and nearly $16 billion in cash), and it maintains an ‘A’ credit rating (A1/AA-). At last check Novartis’ Dividend Cushion ratio was a solid 1.7, and shares yield ~3.4% as of this writing, though management proposed a 2% annual dividend hike in its home currency, the Swiss franc. The increase would mark the 22nd consecutive annual dividend increase in its home currency.

Novartis is calling itself a new focused medicines company, a transformation that will be complete following the Alcon spinoff and Sandoz US oral solids and dermatology business divestiture, and it expects this new group of businesses to deliver mid-single digit net sales growth in 2019 on a constant currency basis. Its ‘Innovative Medicines’ business is anticipated to grow net sales at a mid-single-digit rate in constant currency, while the remaining Sandoz business is expected to realize sales roughly in line with that of 2018. Group core operating income in 2019 is projected to rise at a mid- to high-single-digit rate, which should continue to benefit from expectations for ongoing operating margin expansion in ‘Innovative Medicines,’ but these targets may be subject to change if a generic competitor for Gilenya enters the market.

Not only do we continue to like Novartis’ income generating potential for shareholders, but its pipeline continues to progress nicely. Management expects the solid momentum of 2018 to accelerate in the next two years a it has 10+ potential blockbuster launches planned for 2019-2020.

Image Source: Novartis fourth quarter presentation

We continue to highlight shares of Novartis in the simulated Dividend Growth Newsletter portfolio. Shares are trading just above our fair value estimate of $82 per share, but if management is able to deliver on its high expectations for blockbuster drug launches, the upper bound of our fair value range may very well be within reach. There are certainly headwinds in place, including intensifying generic competition, general pricing pressure in the pharmaceutical space, and execution risk related to its ongoing portfolio transformation, but if Novartis continues to deliver from its ‘Innovative Medicines’ pipeline, we expect it to realize its solid long-term dividend growth potential for shareholders.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.