Image Source: Netflix quarterly report

Netflix continues to grow its subscriber base and pump out compelling content for audiences. However, its substantial cash burn will not subside in the near term, and its sizable debt load continues to grow.

By Kris Rosemann

Our opinion of Netflix (NFLX) remains unchanged. The company has some attractive qualities, but they are buried underneath a mountain of financial obligations. Management continues to point to the social relevancy of its programming, but we continue to point to its sizable cash burn. We understand the thought process behind Netflix publishing the notable increases in Instagram (FB) followers of the talent of its original content in its fourth quarter earnings release January 17. If it can continue to “be a launching pad for talent,” then the company should continue to be able to create compelling content at relatively low costs thanks to the ability to take a cast of lower-level talent and make them relevant in today’s social media drive culture.

However, we don’t necessarily follow the thought process as to why this should be a focal point of its earnings release, and Instagram followers of rising stars in Netflix’s original content creations won’t matter if the content itself does not continue to deliver over the long term. Paid subscribers matter, Instagram followers do not. We also are not getting caught up in the debate over whether Netflix is properly measuring the number of times its original content is being viewed on its platform. Valuentum members should be well aware that viewer numbers are not what drives value, and we need look no further than the dot com bust for tangible evidence of this.

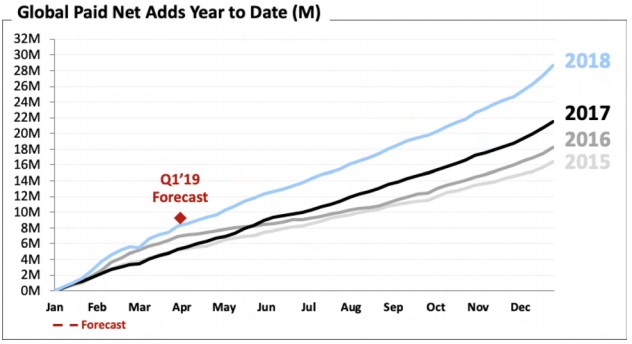

What we’re focused on at Netflix, in addition to its impressive growth in paid subscriber count — which came in at 139 million at the end of 2018, up 9 million and 29 million from the start of the fourth quarter and 2018, respectively — is its significant cash burn and rapidly rising debt load. Nevertheless, we do note that the company’s annual revenue advanced 35% on a year-over-year basis in the full year 2018, and operating profit nearly doubled to $1.6 billion. Operating margin for the year expanded nearly 3 percentage points to just under 10.2%, and we continue to highlight the potential for operating leverage to have a significantly positive impact on Netflix’s business as it remains on the path to achieving increasingly attractive economies of scale.

Despite the progress it is making on the operating line, Netflix’s cash burn continues at a staggering rate. In 2018, free cash flow came in at roughly negative $3 billion, and the company expects 2019’s cash burn to be similar to 2018 before improving each year after that (assuming no material transactions). This growth is dependent upon continued operating margin expansion, and the company is targeting a 13% operating margin for 2019. Subscriber growth and price increases should provide growth in this area, but the company’s operating margin can be lumpy from quarter to quarter as marketing costs and number of titles launched can vary.

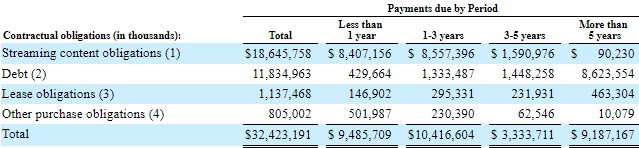

An improvement in free cash flow generation at Netflix could go a long way in mitigating the risk of the company’s massive and mounting financial obligations. Long-term debt rose to ~$10.4 billion at the end of 2018 from ~$6.5 billion a year earlier (cash and cash equivalents rose by just under $1 billion), and streaming content obligations rose to $19.3 billion at the end of the year from $18.6 billion a quarter earlier and $17.7 billion a year earlier. We eagerly await the release of the company’s 10-K for a closer look at its year-end figures, but the image below shows its contractual obligations for the years ahead as of the end of the third quarter of 2018.

Image source: Netflix third quarter 10-Q

Competition is only beginning to ramp up for Netflix, and the company must contend with competitors from a number of angles as it works to maintain consumer attention and increase penetration of screen time. In the US it estimates that it earns ~10% of television screen time, but these figures are inherently difficult to predict. Netflix must compete with all forms of entertainment, and its own vertical, streaming digital content, is only going to get more crowded. Amazon Prime (AMZN) is noteworthy competitor, and Disney (DIS) and AT&T (T) plan to launch competitive streaming platforms in the next year or so.

Licensing agreements between Netflix and Disney and AT&T’s WarnerMedia will be an interesting sticking point when these competing services are launched as Disney has already stated plans to pull content from Netflix. Anecdotally, after its agreement to license the TV series “Friends,” which is owned by WarnerMedia, Netflix recently paid more than three times its previously agreed upon annual fee to continue streaming the show.

All things considered, we are not interested in shares of Netflix at the moment. Its cash burn, massive and growing financial obligations, and rising levels of competition are more than enough to offset the attractiveness of its improving operating leverage and economies of scale. We currently value shares at $277 each.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.