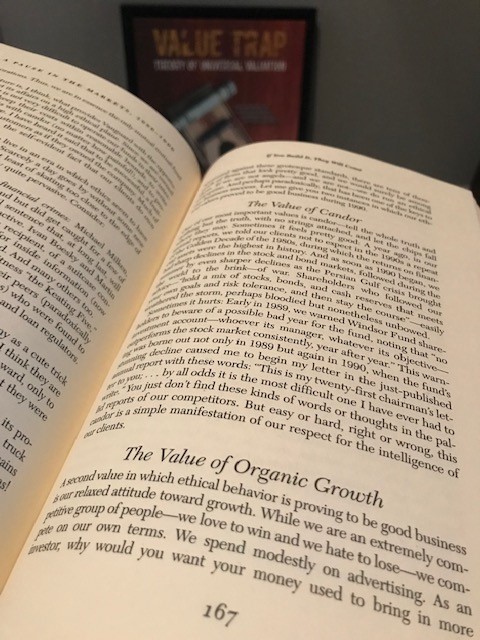

Image shown: Page 167 of Jack Bogle’s text Character Counts. Background: The cover of Value Trap.

No Changes to Simulated Newsletter portfolios

Brian Nelson, CFA

By now, I’m sure you’ve heard the news.

Vanguard’s founder John C. Bogle passed away. I never met Jack. Many others that knew him personally can describe him much better than me. There are probably dozens of books written about him, too. I’ve watched a few of his speeches through my computer screen, and while I’ve certainly read a lot of his work and a lot about him, Jack wrote a book that inspired me greatly.

If you’ve read my text Value Trap, you know the book wasn’t Common Sense on Mutual Funds. I think some of the concepts in Common Sense are somewhat misleading to investors, from how total return is derived from Bogle’s syllogism, but that’s not important right now. The book that I am talking about is Character Counts, the Creation and Building of The Vanguard Group.

While many may have been strangely inspired to get into this business by Oliver Stone’s movie Wall Street in 1987 or the Wolf of Wall Street in 2013, it was Jack Bogle’s book Character Counts that inspired me. After reading that book, I even drew up a business plan for my own asset management firm. Someday, I, too, may manage money, and I believe the time is getting closer and closer to do so.

There is one small subchapter in Character Counts, two paragraphs in all, called “The Value of Candor,” and I’d like to reproduce some of it here. On page 167, Jack wrote: “One of our most important values is candor-tell the whole truth and nothing but the truth, with no strings attached, and let the chips fall where they may.” If there has been one line that has defined every step of the way at Valuentum, it has been this one. Our firm lives by candor, for better or worse.

Jack was philanthropic. He often donated part of his salary to charities while working at Vanguard, but Jack made his money in this business, too. His net worth has been estimated at $80 million, a stash of wealth very few in the world will ever grow to accumulate. Vanguard’s business model was saving people from fees. Such a business model didn’t lend itself to collecting a lot of them, so there may not have been an avenue to attain billions in net worth, in any case. It may have been the way Jack wanted it-to make tens of millions and leave his mark on the industry. He was wildly successful in this respect.

Jack Bogle has made the jobs of financial advisors across the country easier and more profitable. By investing in index funds and not spending as much time with stock selection or selecting managers, advisors can spend more time accumulating assets and serving more clients. Jack saved tons and tons of investors billions of dollars in fees, but in many cases, those savings may not have always made it to the end client. Some advisors still may charge 1%-2% on assets under management just to hold those index funds that Jack created.

Bogle believed “advisors are destined to charge hourly or retainer fees, like lawyers and accountants.” There are tons of advisors that are adding tons of value (e.g. building customized solutions, pursuing and studying stock selection to explain value principles to clients, striving to generate excess returns while taking on less risk), but there are others that hold index funds and reap the spread in doing so. Bogle’s work in the financial industry remains unfinished, and it is the responsibility of the next generation to carry the torch. Let us all rise.

History, not our contemporaries, will judge Jack Bogle. Today, the stock market may be better off because of the index fund, but even Jack speaks of how indexing has become “bastardized.” There are an estimated 70 times more stock indexes out there than stocks, themselves, and the number of ETFs continues to grow, estimated at more than 5,000 today. These are not better investment options for retirees. These are just more options, and many of them aren’t backed by much more than a backtest and fuzzy logic. Wall Street has always been good at creating products.

When asked if indexing has gotten out of hand, Bogle has stated “unequivocally yes…it’s a little bit of Dr. Frankenstein…some kind of monster was built out of what I created.” In many respects, indexing may be responsible for permanently changing the definition of investing into the concept of speculation, as many today may not even care to know the difference. Buying ETFs that are based on certain themes isn’t investing, per se. It’s speculating on the future price performance of a basket of stocks, and most of the time, it is done so without any consideration of price and estimated fair value. This might be better described as gambling.

Jack Bogle’s ideals transcend beyond mutual funds. Investors deserve to get more of their savings. He has often said that “you get what you don’t pay for.” Today, there are advisors that index and charge exorbitant fees for the advice. The industry is better than this, and I don’t think the DOL Fiduciary Rule or the SEC’s Best Interest Rule comes close to addressing the real issue that investors are facing today: “roughly 90% of wealth management clients are not fully aware of what they pay.” The industry needs more fee transparency. I’ve written to the SEC on this topic. My open letter can be downloaded here.

I never met Jack, and I wish I could have. Though we have different beliefs, I feel like we are similar in so many ways. The grit he showed in building an index fund could only be viewed as inspiration behind our grit in standing up for investors when we made our call in MLPs some years ago. The word “candor” is something that governs everything we do at Valuentum, and everything I do in my life. At Valuentum, we’re going to tell you how things are exactly how we see them and let the chips fall where they may. It’s not easy to do this as a publisher, when many just want to hear what they want to hear.

As my book Value Trap reiterates, indexing and theme-based ETF proliferation have gotten out of control. Jack has stated that a world in which everyone indexes would become “chaos” and “catastrophe,” and while it’s a given not everyone will index, what are the chances of price-agnostic trading (quant and indexing) completely overrunning value-conscious trading, causing levels of market volatility not ever witnessed before. I believe this is a non-zero probability that can impact each and every one of our lives. The good thing, however, is that the future is what we make it. The debate today is not about active or passive or keeping costs on mutual funds low, but how we can ensure a healthy market structure for posterity and how investors can continue to get more of what is theirs, after advisor fees. There is still work to be done.

Thank you, Jack for taking us this far. You will never be forgotten. God bless.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.