Traditional retail continues to face pressure via the shift of consumer shopping habits to online retailers, and the 2018 holiday season was indicative of this trend. Let’s take a look at the holiday updates of a number of key players.

By Kris Rosemann

Disappointing holiday sales reports have not been uncommon thus far in early 2019 with household names such as Macy’s (M), Kohl’s (KSS), and Nordstrom (JWN) all facing pressure as a result of holiday season reports coming in below prior expectations. JC Penney (JCP) was the beneficiary of clearing low expectations in its 2018 holiday update as comparable store sales continue to slide and the company remains focused on optimizing inventory and liquidity.

The group may benefit in the near term from the liquidation of Sears, but the once-prominent retailer’s bankruptcy filing is a stark reminder of the necessity for traditional brick-and-mortar operators to innovate and evolve alongside changing consumer shopping habits. Unfortunately, this may very well mean higher levels of investments in omni-channel capabilities, and margin contraction may be an unavoidable reality for many, especially after considering recent upward cost trends in areas such as transportation of goods and labor.

The rising tide of strength in consumer spending, which may very well face pressure in the near term as concerns over the US-China trade dispute, stock market volatility, the lapping of US tax reform, and political gridlock, has lifted the boats of traditional brick-and-mortar retailers relative to the pain felt across the space in recent years, but the threat of e-commerce has never been higher. Online holiday sales advanced 16.5% in 2018 over 2017, according to Adobe Analytics, while overall sales for the 2018 US holiday shopping season up roughly 5.1% according to a report from Mastercard.

Nordstrom’s 1.3% year-over-year comparable sales growth rate in the nine-week period ending January 5, results released January 15, was a disappointment relative to its expectation for ~2% growth over the full fiscal year 2018, and Full-Price comparable sales performance was the key area of disappointment. The measure came in at 0.3%, which pales in comparison to its 1.9% growth rate through three quarters in fiscal 2018 and was largely due to soft traffic. Off-Price comparable sales growth came in at 3.9% in the nine-week holiday season, a level consistent with year-to-date trends and company expectations, and digital sales in the holiday season leapt 18% from the year-ago period and accounted for 36% of total sales.

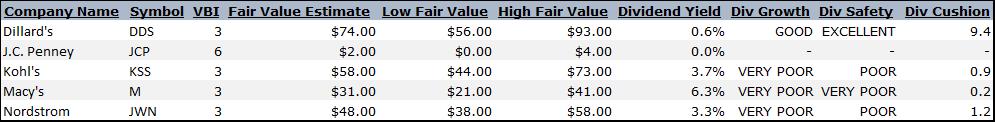

Management adjusted its full year fiscal 2018 guidance to account for higher markdowns taken during the holiday season and expectations to reposition inventory by the end of the fiscal year. Gross margin has faced pressure more recently due to the higher mix of off-price sales, and the company now expects earnings per diluted share to be around the low end of its prior guidance of $3.27-$3.37. Our fair value estimate for Nordstrom currently sits at $48 per share, and its Dividend Cushion ratio is 1.2, highlighting the long-term challenges its business is facing. Shares currently yield ~3.3% as of this writing.

Kohl’s reported comparable sales growth of 1.2% for the nine-week 2018 holiday season that ends January 5, results released January 10, but the figure was a material disappointment relative to the 6.9% comparable sales growth reported in the comparable year-ago period despite consumer confidence remaining strong. Nevertheless, management points to positive transaction growth and double-digit digital sales growth as reasons for optimism moving forward.

Kohl’s now expects fiscal 2018 diluted earnings per share to be in a range of $5.50-$5.55 compared to prior guidance of $5.35-$5.55, excluding charges related to debt extinguishment and other non-recurring chares related to voluntary debt redemption. Our fair value estimate for shares of Kohl’s is $58 each, and its Dividend Cushion ratio is just below parity at 0.9. Shares yield ~3.7% as of this writing.

Macy’s may have turned in the most disappointing holiday sales update of the major department stores January 10 as comparable sales on an owned plus licensed basis advanced 1.1%, which marked its second consecutive year of positive holiday season comparable sales growth. Double-digit growth in its digital business was a bright spot for the company, but it noted that early strength in the holiday season centered around Black Friday and Cyber Monday waned in mid-December and did not return to management’s anticipated patterns until the week of Christmas. We’re watching the promotional environment, which had appeared to wane to a degree alongside strength in consumer confidence more recently, surrounding Macy’s and its peers closely.

Macy’s adjusted a number of guidance measures for its fiscal year 2018, including net sales now projected to be roughly flat compared to fiscal 2017 levels (was up 0.3%-0.7%), and comparable sales growth on an owned plus licensed basis is now expected to be ~2% compared to prior expectations for 2.3%-2.5% growth. Diluted earnings per share excluding one-time events guidance now comes in a range of $3.95-$4.00, down from previous guidance of $4.10-$4.30. We’ve lowered our fair value estimate for shares to $31 each, and the company’s Dividend Cushion ratio leaves a lot to be desired at 0.2. If the company continues to face material margin pressures in addition to muted top-line growth, the bottom end of our fair value range may be a more appropriate estimation of its intrinsic value. Shares yield ~6.3% as of this writing, and the outsize yield is indicative of mounting long-term risks facing the company.

All things considered, we’re not interested in adding exposure to the department store space, even if consumer confidence does not face any form of pressure moving forward. The proliferation of e-commerce is only beginning, and we’re not comfortable looking to any of the industry participants for income generation given the uncertainty facing spending levels amid muted top-line growth prospects.

Retail – Multiline: DDS, JCP, JWN, KSS, M, SHLD

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.