Image Source: Author’s Calculations and SEC Filings

ConocoPhillips appears poised to grow its dividend thanks to a materially healthier balance sheet and an improving free cash flow profile. Volatile energy resource pricing will always be a long-term risk to the payout, but the near term looks bright for the upstream oil major.

By Callum Turcan

ConocoPhillips (COP) may present a strong dividend growth opportunity as it appears set to build upon its current 1.8% dividend yield. First, let’s cover exactly what forced the company to cut its dividend a few years back, and then dig into the potential drivers for dividend growth in the coming years.

ConocoPhillips spun-off its downstream division and a large part of its midstream operations from its upstream business in 2012. The rationale behind such a move was that the sum of the parts were worth more than the whole, as this type of business maneuver assumes there are hidden assets within a company’s portfolio that would be valued at a much higher price if those operations weren’t buried deep within a 10-K filing. Another key consideration was due to the tax advantages of structuring the ownership of midstream assets under a master limited partnership.

However justified this decision may have been at the time, it left ConocoPhillips exposed to volatile market forces beyond its control. Prior to the separation, Conoco’s upstream division had a natural hedge through its downstream division. If oil (or to a lesser extent natural gas) prices (USO) tanked, Conoco could recoup some of those losses via stronger performance at its refining business thanks to higher cracking spreads, but that dynamic disappeared as the company headed into the oil price rout of 2014–2017.

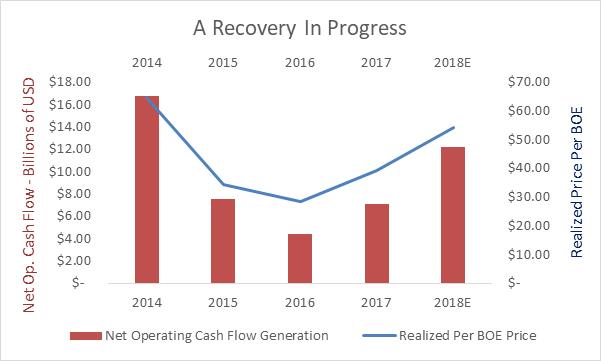

When Brent and West Texas Intermediate tanked from over $100/barrel to around $30-$40 per barrel by early-2016, ConocoPhillips’ cash flow generation followed suit. In 2014, Conoco generated $16.7 billion in net operating cash flow. By 2016, that had dropped to just $4.4 billion. The image below offers a good snapshot of how the change in Conoco’s realized prices for its hydrocarbon output (measured in barrels of oil equivalent) is largely responsible for the changes in its net operating cash flow generation. The company’s estimated 2018 results are an extrapolation based off Conoco’s performance during the first three quarters of this year and are for illustrative purposes only.

Source: Author’s Calculations and SEC Filings

As ConocoPhillips’ cash flow moved precipitously lower, so did its dividend. In early-2016, Conoco cut its dividend for the first time in over two decades, pushing its annual payout down to $1 per share from $2.96 per share. This was a necessity as the firm was hemorrhaging cash and had to choose between paying out cash to shareholders or investing in the business to maintain its production profile. Upstream firms have a base level of capital expenditure that needs to be spent in order to maintain output levels, so Conoco decided to preserve its business profile at the expense of income-minded investors. Valuentum members should be all too familiar with this story as the Dividend Cushion ratio was ahead of the curve in highlighting the risks of Conoco’s payout at the time; the company’s Dividend Cushion ratio sat at negative 1 at the time of the cut, “The Dividend Cushion, ConocoPhillips Cuts!“

Thanks in large part to the oil market recovery, Conoco has been able to start growing its dividend once again. The firm recently boosted its annual payout by 7% to $1.22 per share, and an argument can be made for there being additional payout increases on the horizon.

Financial Overview

During the first three quarters of 2018, Conoco generated $9.2 billion in net operating cash flow and spent $5.1 billion on capital expenditures, which amounts to free cash flow generation of just over $4 billion. This free cash flow was more than sufficient in covering cash dividends paid in the period of $1.0 billion, while share buybacks checked in at $2.1 billion. Debt reduction activities are largely being funded through divesture proceeds, which will be covered later in this piece.

Conoco has issued guidance for capital spending and share buybacks in 2018 at $6.1 billion and $3 billion, respectively, which indicates roughly $1 billion will be spent on each activity during the fourth quarter. Assuming oil prices hold relatively steady and free cash flow follows suit, the company should continue to have ample coverage of its payout with internally generated cash flow.

A combination of production growth, lower interest payments resulting from a decreased debt load, and a reduced share count may all be expected to help make dividend increases in the near term more viable, but the volatile nature of energy resource pricing cannot be ignored and will always pose a threat to the long-term health of Conoco’s dividend. However, management is quick to note that it expects to be able cover sustaining capital spending and its current dividend with cash flow from operations at oil prices at or below $40 per barrel, and it expects to return 20%-30% of cash flow from operations to shareholders annually. We’re expecting healthy free cash flow generation to drive dividend growth in the near term, and the company’s Dividend Cushion ratio currently sits at a robust 4.6.

Production Growth

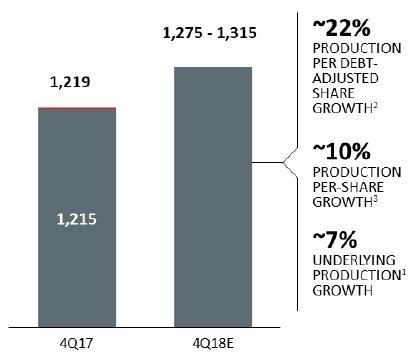

Conoco produced 1,224,000 barrels of oil equivalent per day during the third quarter of 2018, which excludes its Libyan operations due to the volatile nature of output in that region. Adjusting for asset sales and bolt-on acquisitions, this was up 6% versus last year’s third quarter levels. As shown in the image below, management expects growth to continue into the fourth quarter.

Image Source: ConocoPhillips

As an aside, Conoco stands to gain from an improving Libyan situation via its stake in the Waha Concession. During the third quarter of 2018, Conoco produced 37,000 BOE/d net out of Libya.

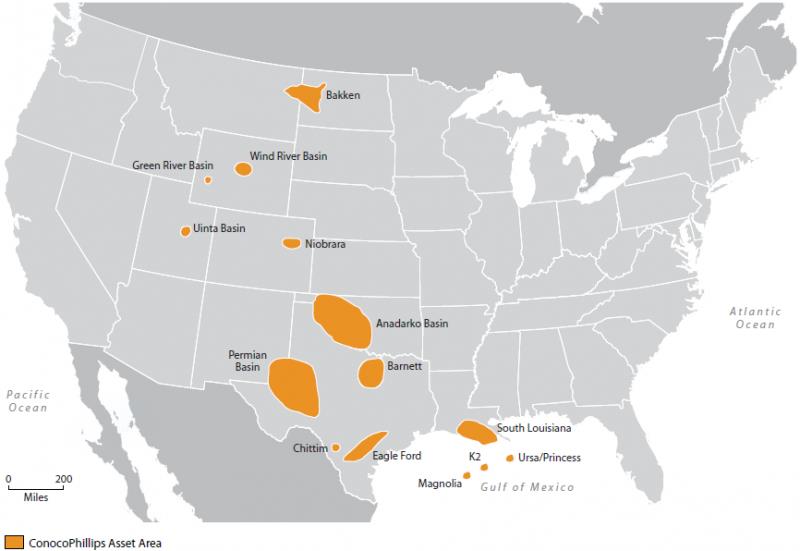

Investors need look no further than ConocoPhillips’ Big Three unconventional assets–its positions in the Eagle Ford, Bakken, and Permian Basin plays–to find the drivers of production growth. Production from this division increased by 48% year-over-year to 313,000 BOE/d during the third quarter of 2018, offsetting losses from mature field declines elsewhere.

After the completion of the Bakken Pipeline project in 2017, which really is a two-part endeavor (the Dakota Access Pipeline and the Energy Transfer Crude Oil Pipeline), North Dakotan oil production is finally able to fetch prices close to WTI as upstream players in the region now have greater access to Gulf Coast, Midwestern, and East Coast markets. This reduced the differential Bakken oil fetches versus WTI, vastly improving incremental well economics in the crude-rich play. While forced to become a Tier 2 play back when regional oil differentials were fluctuating around $10-15/barrel, the Bakken has since become more of a Tier 1.5 play (behind the Eagle Ford, Permian, and STACK plays) now that this pipeline network is operational.

The operator of the Bakken Pipeline system, Energy Transfer LP (ET), is considering expanding the capacity of this takeaway option. Being able to reach out-basin markets is essential to supporting upstream players operating in North Dakota, which is crucial for ConocoPhillips as it considers the Bakken one of its main growth engines. Conoco had a 630,000 net acre position in the Bakken at the end of 2017 and is currently running four rigs in the play (assuming management kept Conoco’s 2018 drilling activity flat versus 2017, as the company doesn’t always update investors on its drilling activity levels).

The real giant of Conoco’s unconventional division is its Eagle Ford position, as it represents nearly half of its Big Three output. While Conoco’s acreage position was only 230,000 net acres in size at the end of 2017, these acres are located in the core of the play. ConocoPhillips has a major leasehold position in DeWitt County, Texas, which is core Tier 1 Eagle Ford acreage and home to some of the most prolific onshore wells in the world outside of the Middle East. The company also has a sizeable position in Karnes and Live Oak counties in Texas.

ConocoPhillips operated six rigs in the Eagle Ford last year and that figure most likely grew to seven rigs this year, as management shifted capital away from the Permian Basin and towards the Eagle Ford. This decision was based on the at times massive Midland-WTI differential (oil in the Permian Basin sells for significantly less than crude in Cushing, Oklahoma) and the nice premium Gulf Coast crude oil fetches over WTI (oil in Louisiana sells for a lot more than oil in Cushing). Eagle Ford oil output has access to Louisiana Light Sweet pricing, which trades at a premium to WTI due to Louisiana Light Sweet being heavily influenced by Brent.

During ConocoPhillips’ second quarter 2018 conference call management noted:

“With wider differentials in Midland, we’re taking advantage of our flexibility and stronger LLS pricing in the Gulf Coast to shift an unconventional rig in the Delaware Basin to the Eagle Ford. And we’re also laying down our one conventional rig in the Permian Basin.”

Expect ConocoPhillips to keep cranking its Eagle Ford production higher over the coming years, especially when these barrels can fetch a $6-9/barrel premium over WTI.

Over the long haul, Conoco has big plans for its Permian position as well. With 1 million net acres in the Permian Basin, Conoco has plenty of unconventional opportunities to capitalize on once more pipeline takeaway capacity is built out (which will bring down the Midland-WTI differential). Only 134,000 of those net acres are prospective for unconventional opportunities in the Delaware Basin, one of the major oil & gas producing sub-basins within the Permian. The company may only be running one rig on its acreage as things stand today, but that could easily be flexed upwards as market conditions dictate.

Conoco’s Delaware Basin position is centered around Culberson and Reeves counties in Texas, and Eddy and Lea counties in New Mexico. This is core Tier 1 acreage that is extremely valuable, but Conoco doesn’t want to bring wells online in a play where the average realized oil price is materially below WTI ($5-15/barrel depending on the month). While the firm could still earn a very generous return on its investment if it decided to develop this acreage, ConocoPhillips has opted to play the long game.

Going forward, continued production growth from ConocoPhillips’ Big Three unconventional division will not just offset output losses elsewhere but should enable strong company-wide growth over the coming years. All three of those plays yield wells with a high oil mix.

Image Source: ConocoPhillips

Less Debt, Fewer Shares

As the energy resource pricing downturn got underway, ConocoPhillips was forced to turn to debt to cover its cash flow outspend as operating cash flow was outstripped by hefty dividend payouts and a large capital expenditure budget. The need for funds pushed Conoco’s long-term debt load to $26.2 billion by the end of 2016 from $22.4 billion at the end of 2014. Unsurprisingly, this led to meaningful increases in its interest expenses.

After high-grading its portfolio by shedding various assets, including a vast amount of its oil sands operations, its San Juan Basin unit, and assets in Southeast Asia, ConocoPhillips directed most of those cash proceeds to debt reduction. The company has pocketed almost $15 billion in divestment proceeds over the past two years.

At the end of the third quarter of 2018, Conoco had less than $15 billion in long-term debt outstanding, a target it achieved 18 months ahead of schedule, and it is on track to save around $0.5 billion per year in interest expenses compared to 2016 levels. ConocoPhillips’ materially lower debt load has helped boost its Dividend Cushion ratio, and the reduction in its debt servicing costs only adds to the resiliency of its bottom line, regardless of the volatility of energy resource pricing.

Another driver of Conoco’s per share dividend growth comes from its materially reduced share count. Conoco spent $3 billion buying back shares in 2017 and plans to spend a similar amount reducing its share count this year. Next year, management has indicated Conoco will spend around $2 billion buying back shares, and the repurchases won’t end there as it recently increased its repurchasing authority to $15 billion, which represents roughly 20% of its total shares outstanding as of the end of the third quarter of 2016. While we view buybacks at current prices as roughly value neutral given that shares are trading near the midpoint of our fair value range, the materially reduced share count will lower the hurdle that ConocoPhillips must clear in future dividend increases.

Summary

ConocoPhillips has plenty of free cash flow generation, is growing its underlying production base, has an extensive growth runway in the shale patch, has a significantly smaller debt burden than the recent past, has materially lowered interest expenses, has a significantly smaller share count, and the oil market’s recovery may very well still be ongoing. While ConocoPhillips yields only 1.8% as of this writing, we expect that to grow over the coming years as management directs larger amounts of its rising internally-generated cash flow to patient investors.

Oil & Gas – Major: BP, COP, CVX, RDS, TOT, XOM

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.