Image Source: Gilead Sciences’ third-quarter earnings presentation

Gilead Sciences continues to battle challenges in the HCV market, but its HIV product sales grew nicely in the third quarter. Management remains optimistic regarding the potential of its cell therapy treatment, headlined by Yescarta.

By Kris Rosemann

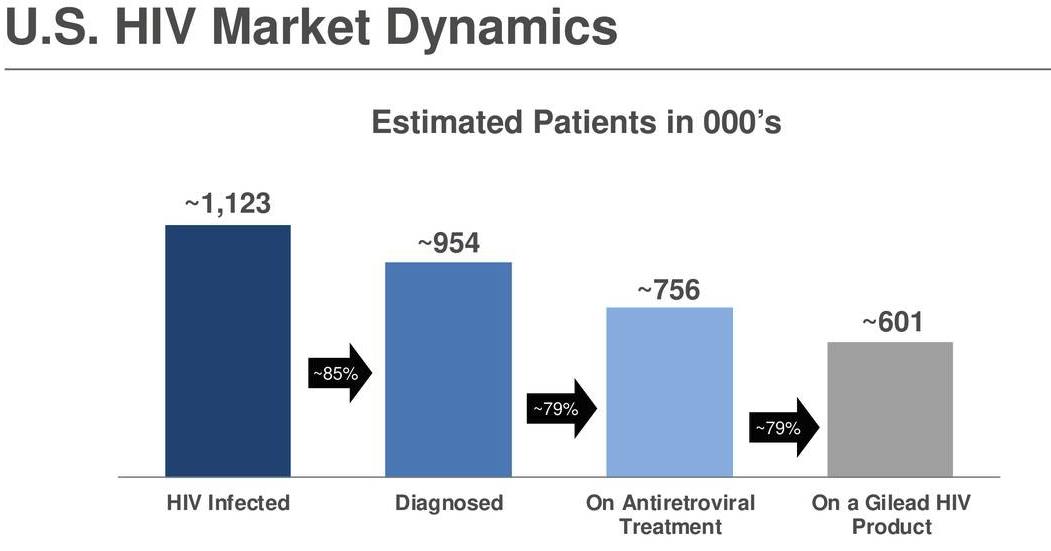

Simulated newsletter portfolio idea Gilead Sciences (GILD) turned in a better than expected third-quarter report after the close October 25, though its top line continues to face pressure as its HCV products sales fight rising levels of competition. Total revenues fell to ~$5.6 billion from $6.5 billion in the year-ago period as HCV product sales declined to $902 million in the period from $2.2 billion in the third quarter of 2017. HIV product sales climbed 10.6% on a year-over-year basis to more than $3.7 billion thanks to solid growth in the US (where it holds notable market share), the ongoing uptake of Genvoya and Odefsey, and the adoption of Biktarvy, but increased generic competition in Europe negatively impacted HIV product sales in the region.

Gilead’s HCV product sales decline remains in line with its expectations, and the company plans to launch generic versions of Epclusa and Harvoni in the US in January 2019 via a new subsidiary, Asegua Therapeutics, which is expected to increase price transparency, reduce out-of-pocket patient expenses, and open up its HCV medicines for access for Medicaid patients. The company is encouraged by the progress it is seeing with cell therapy drug Yescarta, which turned in $75 million in sales in the third quarter, and the drug was approved in Europe in the quarter after being approved in the US roughly one year ago.

Gilead’s bottom-line continues to face pressure as well, and R&D and SG&A expenses both grew in the third quarter on a year-over-year basis due in part to higher spending to support growth following the purchase of Kite Pharma in October 2017, which brought the aforementioned Yescarta into its portfolio. As a result, non-GAAP operating margin fell to 55.9% from 63.6%, and non-GAAP diluted earnings per share fell to $1.84 in the quarter from $2.27 in the comparable period of 2017.

We’re patiently awaiting the release of the company’s 10-Q to get a better look at its cash flow statement and balance sheet, but management reported a decline in its cash, cash equivalents, and marketable securities to $30.8 billion at the end of the quarter from $31.7 billion one quarter earlier. It lists total adjusted debt at $27.5 billion, and its adjusted debt-to-adjusted EBITDA ratio is ~2.55x as of the end of the third quarter. Operating cash flow came in at $2.2 billion for the quarter, while cash dividends paid in the period were $742 million, which means that Gilead’s capital spending would have to rise significantly from the first half of the year ($509 million in the first and second quarters combined) to come close to not covering dividend obligations.

Management raised its full-year 2018 top-line guidance following the third quarter, and it now expects net product sales to be $20.8-$21.3 billion, compared to $20-$21 billion previously. All other guidance, aside from expected effective tax rate, was unchanged. We expect to continue highlighting Gilead Sciences in the simulated newsletter portfolios as its solid 3.3 Dividend Cushion ratio pairs nicely with its ~3.2% dividend yield, and shares are trading near the lower bound of our fair value range as of this writing.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.