Part of what we take pride in at Valuentum is telling things how they are. If things are going great, we let you know. If things aren’t going as good as they could be, we don’t hold back. In the year of crypto and cannabis, 2018 hasn’t been the best year for the simulated Best Ideas Newsletter portfolio, but it hasn’t been bad either.

By Brian Nelson, CFA

We wrote up an extensive piece on the background of the simulated Best Ideas Newsletter portfolio earlier this year, and we encourage everyone to have a read of that here (pdf). We made some changes to the goals of the newsletter portfolio prior to the beginning of this year. For starters, we lengthened our time horizon, and we no longer pay attention to the yearly price moves of the simulated newsletter portfolio both on an absolute basis and relative to the broader market. We think this will help us better target long-term capital-appreciation considerations, while still optimizing the points at which we consider adding ideas to the simulated portfolio via the Valuentum Buying Index. Remember, when it comes to the Valuentum Buying Index, we only consider 9-10s and 1-2s to be highly material. The “big middle,” as we describe it can sometimes have noise.

We’re not exactly happy with how things have transpired in the simulated Best Ideas Newsletter so far in 2018, and we hit a very high-profile setback with Facebook (FB). Frankly, we can’t believe how the market has soured on its prospects, and we’re even a bit puzzled by management almost purposefully hurting its own stock on the second-quarter conference call. Through the summer, Facebook had been a big winner on the year, despite the Cambridge Analytica debacle, but guidance for the next couple years, as outlined in the second-quarter call, sent many investors running for cover. Frankly, however, the guidance wasn’t that bad, still implying considerable earnings expansion in coming years. Sell-side analysts are now throwing in the towel on the company, too, as it just looks bad to defend it now that it has caught the ire of public opinion given alleged data misuses. I can’t begin to tell you how frustrated I am — Facebook had been a top idea, and we highlighted it big time. I’m beyond upset by its performance. I’m sorry.

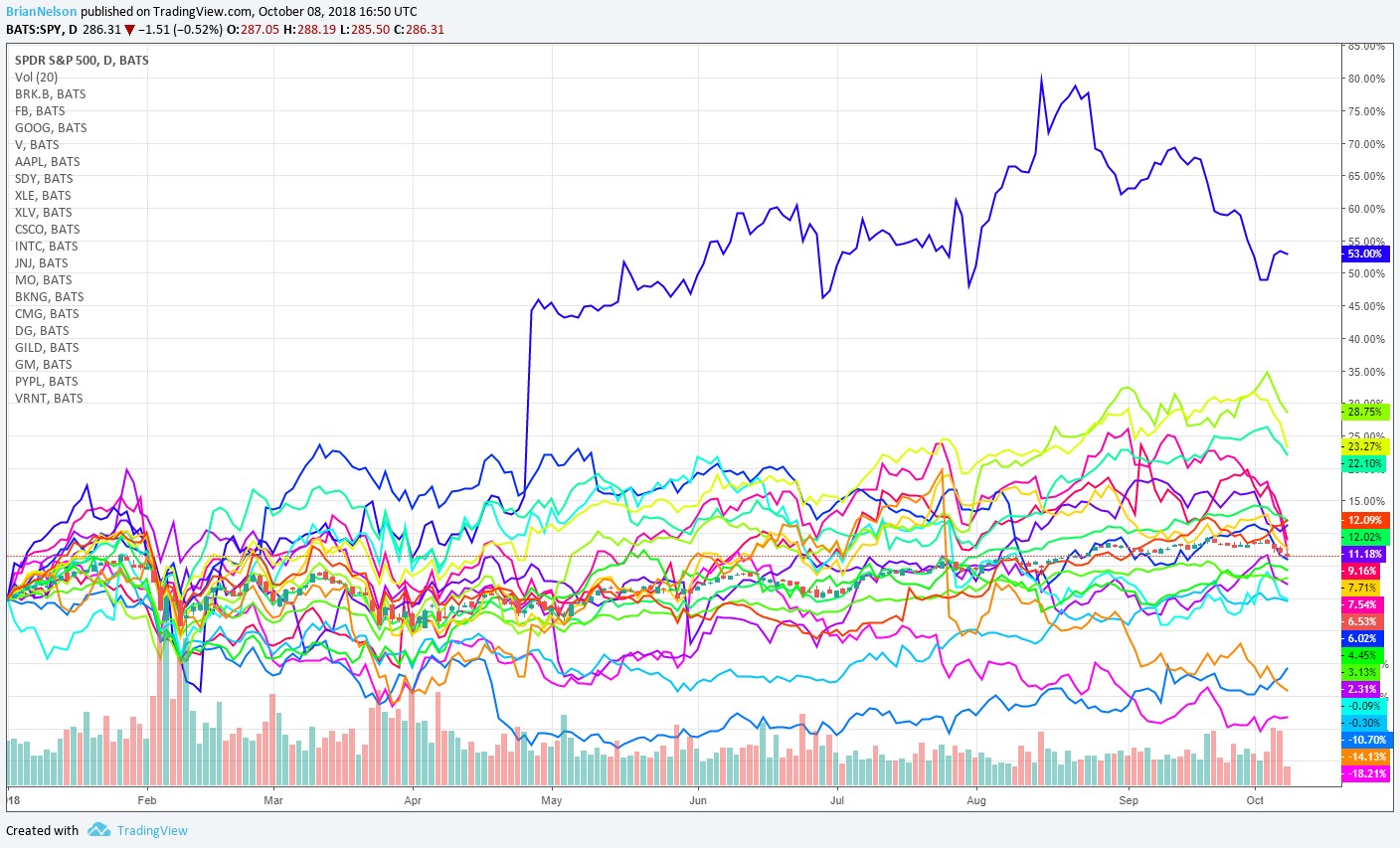

The squiggly-line mess in the image above is the performance distribution of ideas in the simulated Best Ideas Newsletter portfolio since the beginning of 2018, with the share price of the S&P 500 SPDR (SPY) as the candlestick pattern. Chipotle (CMG), the best performer out of the bunch so far in 2018, was added to the simulated newsletter portfolio in April, so its comparisons aren’t apples-to-apples, but it has advanced modestly since it was added. Apple (AAPL) and Visa (V) have powered ahead this year. These two companies are among the highest-weighted ideas in the simulated newsletter portfolio, so while there are a number of underperformers, the higher-weighted ideas tend to deflect much of their weakness. Apple, Visa, and Cisco (CSCO) are all beating the market’s return by a factor of 3-4x this year.

Other ideas are also doing well. Alphabet (GOOG), PayPal (PYPL), Verint (VRNT), Dollar General (DG), the Healthcare Select SPDR (XLV), and Berkshire Hathaway (BRK.B) are doing quite well. Also positive on the year are Booking Holdings (BKNG), Gilead (GILD), SPDR S&P Dividend ETF (SDY), and the Energy Select SPDR (XLE). Johnson & Johnson (JNJ) and Intel (INTC) are about flat on the year thus far, while aside from the high-profile turn in Facebook, Altria (MO) and General Motors (GM) are the only meaningful losers with double-digit declines on the year. But both Altria and GM pay out lofty dividend yields, and we think GM remains considerably undervalued on the basis of our enterprise discounted cash flow process. Altria has been one of the best performing companies during the past several years, too, so we can’t possibility be disappointed in the pullback by the tobacco giant during 2018.

All in, our best of the best in Apple and Visa are doing extremely well so far in 2018, but it is understandable that we also had Facebook near the top of our idea list, so we’re disappointed in that idea, especially given how much time we highlighted it as one of our favorites. Nobody is more disappointed than me, particularly given the attention that we gave it. That said, a handful of others besides Apple and Visa are outperforming, and many more are positive on what could still become a difficult year. Altria has given back but a fraction of its massive gains in recent years so far in 2018, which might have been expected, and while we can blame tariff-related costs and potential trade troubles with China for problems at GM, we think the stock is flat-out cheap, and it pays a lofty dividend. We just hope you’re not evaluating our service on some bad luck with Facebook this year. We’ve done so many things right for so long.

That said, I have to say that things aren’t going that bad in the simulated Best Ideas Newsletter in what might be described as the year of crypto and cannabis — and especially given the strength of the Best Ideas Newsletter publication in prior years. Remember — our team develops enterprise discounted cash flow models for every company in our coverage universe, and we use a comparison between that price and value to assess whether a market mispricing may exist. This is the primary consideration – price versus the value estimate. We only view the highest (9-10) and lowest ratings (1-2) on the Valuentum Buying Index as material considerations, and we’ve lengthened our time horizon in the simulated Best Ideas Newsletter prior to the beginning of this year, consistent with some of its goal changes.

The fair value estimate and fair value range are critical considerations in idea generation, and both it and the Valuentum Buying Index are independent to a company’s dividend policy and strength, which we measure with respect to the forward-looking Dividend Cushion ratio. Once you get an understanding of our respective methodologies, you can get more out of the fair value estimate (value), fair value range (risk), and Dividend Cushion ratio (financial strength of dividend) than pretty much any text that we can write. We also only like stocks that are “going up,” a condition that implies a strong market backing. Prices contain valuable information. The fair value estimate is the conclusion to any and all financial research, and the Dividend Cushion ratio is a forward-looking consideration of the financial health of any payout. The simulated newsletter portfolios also emphasize diversification, highlighting 15-20+ ideas at any given time.

Let’s finish out 2018 on a solid note. From strength to strength! Thank you.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.