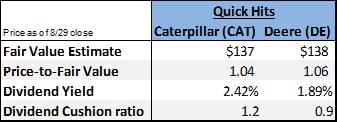

Caterpillar and Deere serve notoriously cyclical end markets, but both companies appear to be quite optimistic with their near-term outlooks, even as trade issues weigh on their international operations. Shares of Cat yield ~2.4%, while shares of Deere yield ~1.9%.

By Kris Rosemann

Caterpillar Raises Guidance Despite Tariff-Related Costs

With trade issues casting a shadow of uncertainty for a number of multinational corporations, stocks such as Caterpillar (CAT) have attracted a notable amount of negative attention. Caterpillar’s operations source material amounts of inputs that are subject to tariffs, and the company serves markets and regions that may be most impacted by global trade tensions. Caterpillar is taking the pressure in stride, however.

During in its second quarter report, released July 30, Cat raised its 2018 adjusted profit per share guidance to a range of $11.00-$12.00 from $10.25-$11.25 despite the assumption of $100-$200 million in tariff-related costs in the second half of the year in addition to higher freight costs that are expected to persist. The driver of the increased guidance is management’s confidence in the continued strength in its business, as well as planned price hikes to partially offset the impact of the tariffs.

Construction Demand Driven By Oil & Gas, Housing, and Transportation

Cat’s notoriously cyclical end markets already have some observers concerned it may be hitting a demand peak. Management believes otherwise, however, as order rates and its backlog remain strong, especially in the North American onshore oil and gas, including pipelines, and mining spaces, the latter of which remains in the early stages of recovery as demand for aftermarket products has progressed to new equipment. Other areas of demand strength for Cat include North American nonresidential construction, rail, and marine markets.

Rival Deere (DE) is also seeing strength in oil and gas investments, as well as US housing and global transportation, helping drive demand for its construction equipment. In its fiscal third quarter earnings presentation (pdf), the company raised its near-term expectations for GDP growth, housing starts, construction and transportation investment, and crude oil prices. Oilfield contractors are driving backlogs through 2019, and management is confident that ongoing US housing demand will keep earthmoving equipment sales solid in the near term.

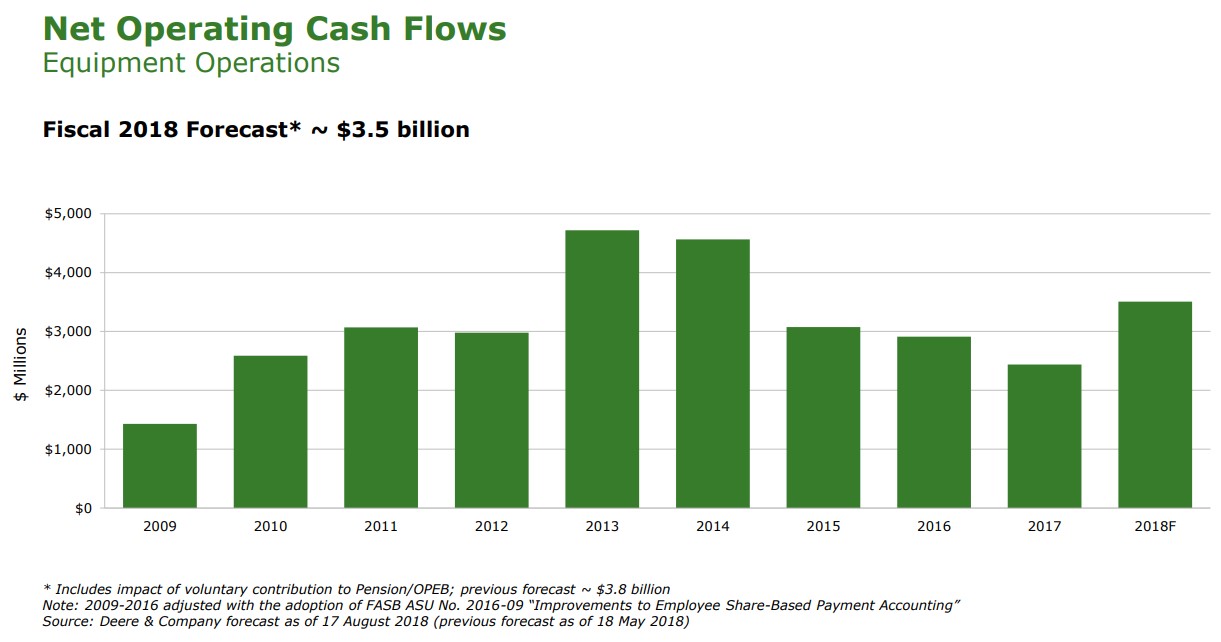

Image shown: The cyclical nature of Deere’s operating cash flow.

Deere’s Ag Markets Holding Up

Deere also faces challenges as an equipment provider to the global agriculture markets, many of which have been caught up in the midst of the ongoing trade war. Nevertheless, it has experienced solid replacement demand for large equipment in its ag markets, and farmers have shown a willingness to invest in higher productivity enabled by Deere’s latest technologies. Notably, Phase 1 of its early order programs in the US and Canada are up compared to last year despite largely-negative farmer sentiment. However, that sentiment and how ag equipment markets react to it are likely to be dynamic as we move forward in global trade negotiations.

Drought conditions in many ag producing regions of the world are somewhat helping US farmers battle the headaches tariffs have brought, particularly in corn and wheat. European agriculture equipment sales for Deere are expected to be strong in the near term, but sales in Asia are expected to be roughly flat over the course of fiscal 2018 despite strength in India. Sales of tractors and combines in South America are being negatively impacted by drought conditions experienced in Argentina in the first half of the year, offsetting solid industry fundamentals in Brazil.

Overall, Deere expects ‘Ag and Turf’ segment sales to be up 15% in fiscal 2018. Deere also raised its company-wide bottom-line guidance after its fiscal third quarter, results released August 17, and it now expects net income of $2.36 billion (up from $2.3 billion), and net sales are expected to grow ~30% in the year thanks in part to its recent acquisition of Wirtgen in its ‘Construction and Forestry’ segment.

Wrapping Things Up

We continue to like Caterpillar and Deere as strong companies, even with concerns that a demand peak has cropped up more recently. While we’re not sold on an organic demand peak being a near-term hindrance for the construction or agriculture markets, uncertainty related to geopolitical issues and trade policies are not to be taken lightly, even as we applaud companies like Caterpillar and Deere in hurdling the obstacles presented by politicians and legislators around the globe. Shares of Cat yield ~2.4%, while shares of Deere yield ~1.9%.

Agricultural Machinery: AGCO, CAT, CNHI, DE, HEES, MTW, RBA, TEX

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.