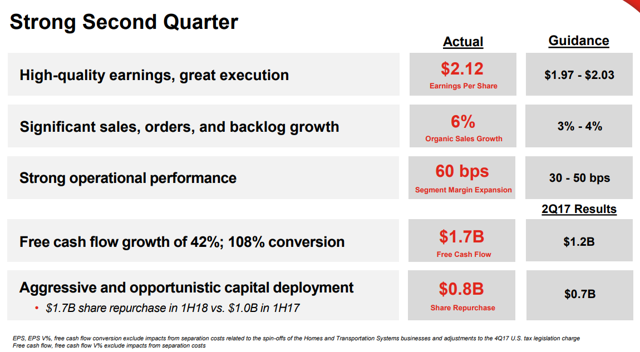

Image Source: Honeywell

It has been a long time since we explained to readers what we look at in stocks, and it’s probably a good time for a quick refresher. At Valuentum, we think a comprehensive analysis of a firm’s discounted cash flow valuation, relative valuation versus industry peers, as well as an assessment of technical and momentum indicators is the best way to identify the most attractive stocks at the best time to consider buying.

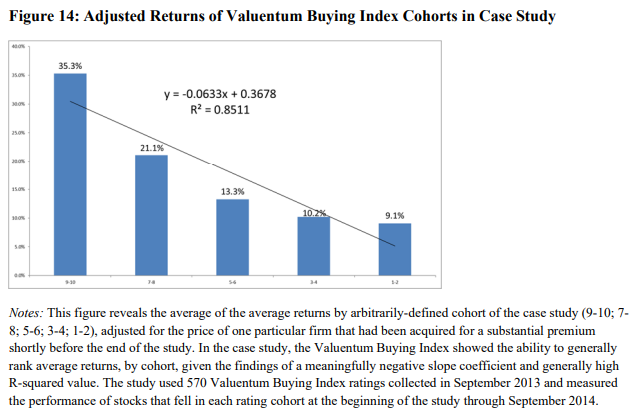

We think stocks that are cheap (undervalued) and just starting to go up (momentum) are some of the best ones to evaluate for addition to the simulated newsletter portfolios. These stocks have both strong valuation and pricing support. Said differently, both the market likes the stock, and we like the stock. This process of combining value and momentum within stocks culminates in what we call our Valuentum Buying Index, which ranks stocks on a scale from 1 to 10, with 10 being the best.

At the methodology’s core, if a company is undervalued both on a discounted cash flow basis and on a relative valuation basis, and is showing improvement in technical and momentum indicators, it scores high on our scale. Honeywell (HON) registers a 4 on the Valuentum Buying Index rating system, which in part reflects our view that shares are fairly valued on a discounted cash flow basis. We’re generally neutral on the company’s relative valuation, and while we’re not ultra-bullish on the company’s technical and momentum indicators, they are not that bad.

Our process suggests not to expect much from Honeywell in coming periods, but the company has done incredibly well, and momentum in its business remains strong. On August 23, the company raised its full-year earnings per share guidance a nickel, to the range of $8.10-$8.20 per share. The company’s plans to spin-off its Transportation Systems business and Resideo Technologies (its Homes and ADI Global Distribution business) remain on track, too. Here is where you are can learn more about how companies that have registered a 4 on the Valuentum Buying Index have performed in subsequent periods, “Value and Momentum Within Stocks, Too (pdf)“

Honeywell At A Glance

• Honeywell is a conglomerate operating in the following areas: aerospace, automation and controls solutions, performance materials and technologies, and transportation systems. Its aerospace products are used on virtually every aircraft, and its warehouse automation business is gaining steam. The company was founded in 1920 and is based in New Jersey.

• For an industrial giant, Honeywell generates nice margins. Its ‘Performance Materials and Technology’ segment boasts its highest profit margins in the low- to mid-20% range, followed by its ‘Aerospace’ segment in the low 20% range. It is working to optimize fixed costs in its manufacturing and logistics facilities.

• Honeywell’s long-term financial targets include 3%- 5% annual organic sales growth, 30-50 basis points of margin expansion per year, EPS growth greater than peers, a cash conversion rate greater than 100%, and the maintenance of investment grade credit ratings. Management is also targeting dividend growth in-line with earnings growth.

• Honeywell boasts a strong Dividend Cushion ratio of 2.7, and management is targeting dividend growth in-line with earnings growth. Here’s more of what we say about Honeywell in its Dividend Report:

Key Strengths

Honeywell pays a strong and competitive dividend, with a yield that makes its Dividend Cushion ratio a tough one to pass up. Management continues to target high ROI capital spending as it pursues key process initiatives and productivity improvements, a healthy combination for ongoing segment margin expansion. We’re huge fans of its commercial original equipment and aftermarket business in light of the massive backlogs at the airframe makers, and there’s not much that looks poised to derail Honeywell’s dividend strength, at least in the near term. The executive team’s ‘growth through acquisitions’ has served the company well during this economic cycle, and it plans to grow the dividend at a rate above that of earnings per share.

Potential Weaknesses

The first thing that comes to mind with respect to Honeywell’s dividend resiliency is the threat that comes with serving cyclical end markets. Though the company is well diversified across the industrial economy and commercial aerospace may be in a prolonged upswing, a downturn is inevitable. Most of its businesses look to perform well in 2018, though UOP may face pressure as a result of challenges in the energy markets. Foreign exchange headwinds may slow the pace of revenue expansion, but free cash flow generation remains robust. Honeywell has made three rather large acquisitions recently (Elster, Sigma Aldrich, and Satcom1), but the dividend remains a priority in management’s aggressive capital deployment strategy, in our view.

Conclusion

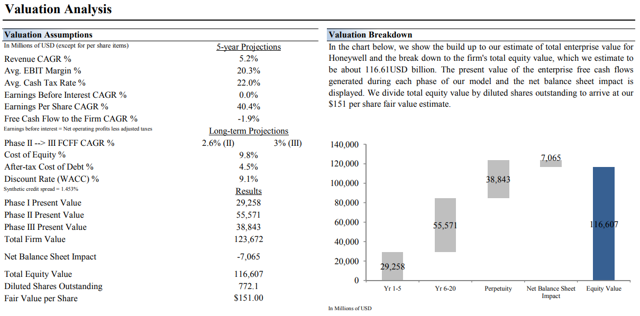

Image Source: Valuentum

We like Honeywell a lot. Given how terrible General Electric’s (GE) fundamentals have been during the past year or two now, Honeywell is among our favorite industrial ideas, right up there with Boeing (BA). The company’s dividend growth looks solid, and we’re excited about the spin-offs and what they imply with respect to long-term shareholder value creation. We value shares north of $150 each. Shares yield 1.9% at the time of this writing.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Majority shareholder of Valuentum Elizabeth Nelson has exposure to Honeywell in her retirement account. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.