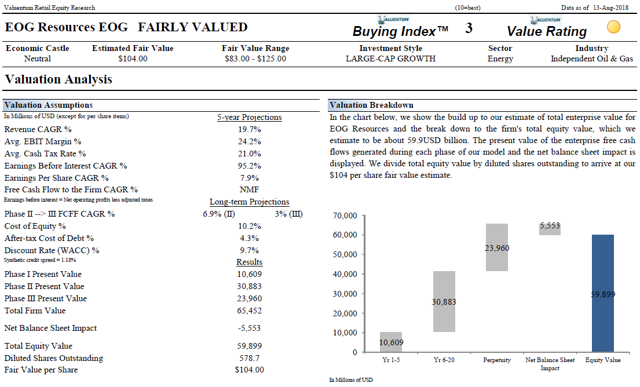

Image Source: Valuentum. In the above image, we show how we derive our $104 fair value estimate for EOG Resources.

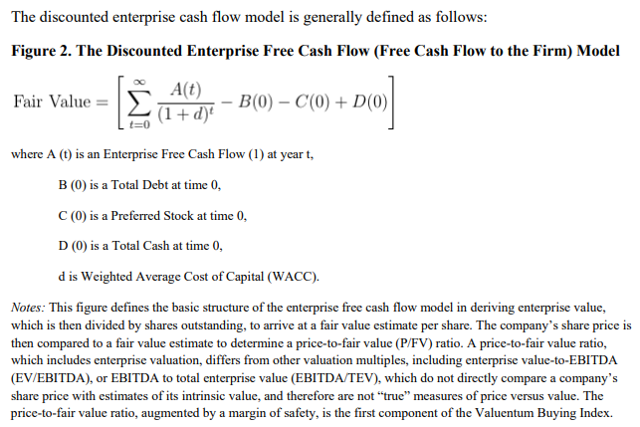

For those that know us, you know that we like to look at stocks as though they are pieces of a business. As with the investing greats Benjamin Graham and Warren Buffett, we think each share of stock has something called intrinsic value. What we do each and every day is to strive to calculate what we think is an appropriate estimate of a company’s intrinsic value because we want to have a reasonable basis to derive what an investor might be willing to pay for shares. We’ve had a lot success with intrinsic-value investing during the past several years, and we think it is helpful for readers to know that our primary efforts in equity analysis are dedicated to getting our estimates of a company’s fair value range as “correct” as possible. Here’s the basic construct of the enterprise discounted cash flow model that we use to value roughly 1,000 companies on a systematic basis.

Image Source: How Well Do Enterprise-Cash-Flow-Derived Fair Value Estimates Predict Future Stock Prices? – And Thoughts on Behavioral Valuation (pdf)

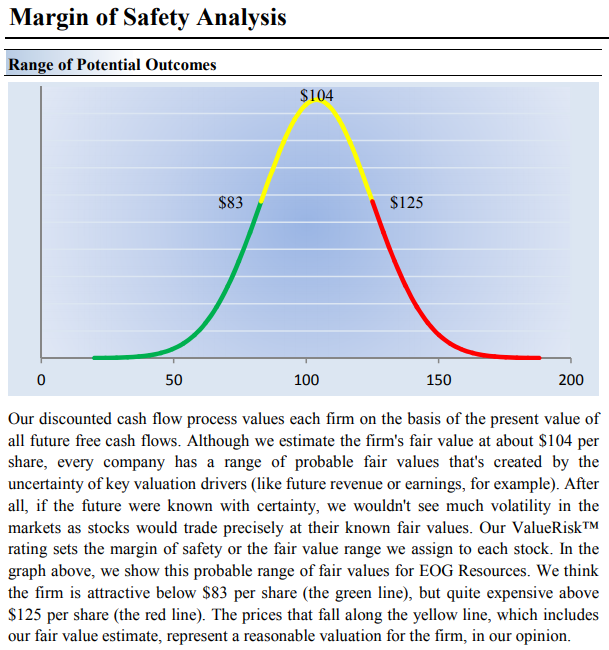

When it comes to EOG Resources (EOG), we’re looking at the company’s business fundamentals, but most importantly, how those business fundamentals translate into future free cash flows and an estimate of intrinsic value. We spend almost all of our time thinking through the company’s fundamentals and how they impact the upside and downside cases of intrinsic value estimation. Since future free cash flows can only be estimated (and the future is not yet written), we assign each company a fair value estimate range, which helps inform the reader when the odds may best be in their favor to consider an investment opportunity.

At the moment, we value EOG Resources at about $104 per share, so with shares declining to $115 from over $130 recently, we’re not at all surprised by the recent move downward. We’d only grow truly surprised by the pricing action if EOG Resources fell outside our fair value estimate range, meaning that we could still rationalize a valuation as high as $125 per share (the high end of the fair value estimate range), implying upside to shares under more optimistic assumptions. We showcase our fair value estimate range in the image below, and we’d think shares would be quite the bargain under $83 each. The market might agree.

EOG Resources At A Glance

• EOG operates primarily in the US, Canada, Trinidad, UK, China, and Argentina. The firm is the largest crude oil producer in the South Texas Eagle Ford Shale and North Dakota Bakken, which should drive significant reserve and production growth. EOG has a prudent focus on return on capital employed and expects the metric to return to 10%+ in 2018.

• Collapsing crude oil prices put EOG on the defensive. The company was able to reduce its all-in reserve replacement costs per BOE by 43% from 2013 to 2017 (to $8.71 from $15.23) and is expecting further reductions in 2018 thanks in part to its focus on premium drilling.

• EOG boasts the highest production per employee in its peer group, giving it a labor efficiency advantage. A shift to focus on premium drilling (to 90%+ of total wells expected in 2018) is expected to drive capital efficiency, and management expects 2018 US crude oil production growth to be 17%-19% over 2017. Free cash flow of $1.5+ billion is expected in the year assuming $60 oil prices.

• EOG expects to generate positive free cash flow at $50/bbl oil prices in 2018, which should put it in a position to strengthen its balance sheet and potentially grow the dividend in the year. Management anticipates a ~5% reduction in completed well costs and a ~7% reduction in cash operating expenses.

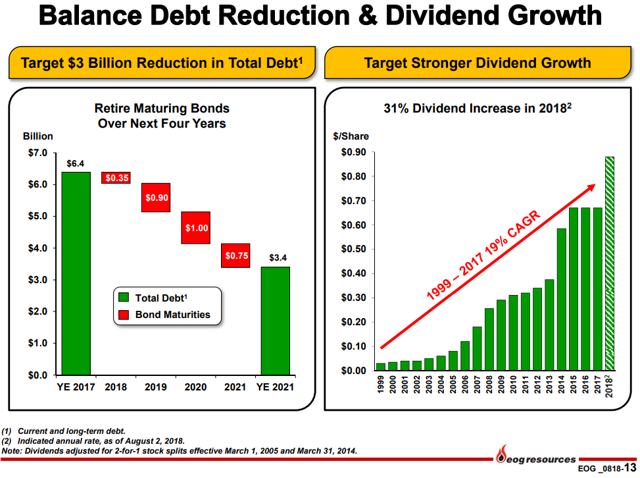

• EOG’s total debt outstanding was roughly $6.4 billion at the end of 2017 for a debt-to-total capitalization ratio of ~25%. On a net debt basis, the company’s leverage is slightly better at ~$5.6 billion. The firm is in better shape than some of its peers, but its net debt load shouldn’t be ignored.

Image Source: EOG Resources

• Volatile crude oil prices ground EOG Resources’ dividend growth plans to a halt, but this has changed more recently (see image above). Its yield isn’t a head turner, however, at ~0.8%. Here’s more of what we say about the company’s dividend health in our Dividend Report:

Key Strengths

EOG Resources’ operations are highly cyclical. The company is working to prop up free cash flow through capex reductions in light of the decline in operating cash flow due to suppressed energy prices. EOG’s total anticipated capital expenditures for 2018 is $5.4- 5.8 billion, still lower than 2014 levels of $8.6 billion but significantly higher than 2016 levels of ~$2.6 billion. The company is on track to continue reducing cash operating costs per BOE (targeting a ~7% reduction in 2018), while targeting a return to meaningful production growth. EOG boasts one of the stronger dividends among its peers, which is not saying much, especially when considering the size of its yield. We like its position as an industry leader in return on capital employed.

Potential Weaknesses

The most critical risk to the EOG’s dividend potential is the possibility of another material leg down in crude oil prices. Management is working to combat this by reducing well costs and improving well productivity, which it has been effective at in recent quarters. Net cash from operations has been volatile of late, but material capital spending cuts have helped in this area. EOG’s total debt outstanding, ~$6.4 billion as of the end of 2017 equating to a debt-to-total capitalization ratio of ~25%, weighs on its Dividend Cushion ratio. Although we’re modeling slower growth in the payout, the firm’s yield and uncertain operating environment leave a good deal to be desired.

• The latest read at EOG is quite good. The company upped its dividend to $0.22 per share on a quarterly basis, revealing a near-19% increase from the prior dividend. Its second-quarter report also showed a nice beat on both the top and bottom lines. We’re optimistic about its Powder River Basin Mowry and Niobrara Shale Plays. How could we not be excited about CEO Bill Thomas saying that “The EOG machine is firing on all cylinders.” Isn’t that cool?

Conclusion

Image Source: EOG Resources

There’s a lot to like about EOG Resources, and we are pleased to see its dividend growth back on track. The company is a self-proclaimed leader in return on capital employed, and it’s hard to argue with its low-cost position. We also like that management is focused on deleveraging and is looking to shed $3 billion in total debt over the next four years. Though we think EOG Resources is at the high end of the risk scale given its exposure to the volatile energy resource environment and that its operations are stacked with leverage, we don’t think the market is pricing shares too aggressively. EOG Resources is one of our favorite independent energy plays, but again, it is not without significant operational and financial risk. For dividend-oriented investors, its yield isn’t that enticing…yet.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.