Image Source: Nevro Investor Relations

Underscoring the volatile nature of small-cap healthcare companies, shareholders at Nevro are going through a rough period of volatility as it attempts to carve out a larger share for its proprietary pain relief products.

By Alexander J. Poulos

Key Takeaways

The small-cap medical device market remains a volatile area of the market.

Volatility pertaining to the patent estate of Nevro’s Key SCS products has led to a wild ride for shareholders.

We have identified some key personnel issues that make us uneasy towards the future path of the company.

We feel the path forward remains challenging as we wait for a new sales leader to emerge.

Introduction- Who is Nevro?

Nevro (NVRO) is far from a household name. The company is an innovative small-cap healthcare device producer with a focus on bringing relief to its patients suffering from chronic pain via the utilization of drug-free therapies. Nevro produces a complete line of neuromodulation devices–implantable devices that are designed to block the pain impulses from the lower extremities with its key product focusing on spinal cord stimulation (SCS). The thesis is if the patient cannot feel the innervation of the nerves, or to a lesser extent than before, the device is providing “relief,” thus lessening the need for chronic medications, which is more often than not opioids. Opioid abuse has risen to an epidemic level in the US, with a critical need arising to find alternative methods to treat those with chronic pain. We feel the neuromodulator market is part of the solution; thus, our continued profiling of Nevro.

Sales

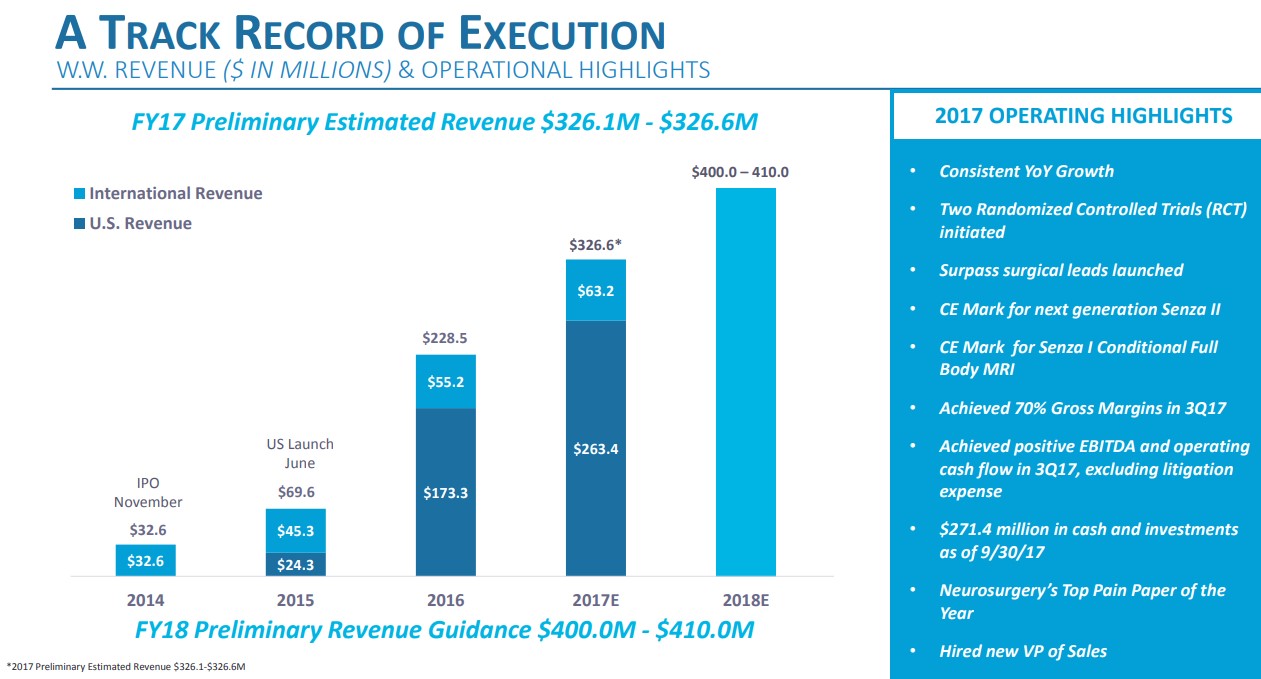

In our view, the main metric to evaluate young, upstart companies such as Nevro is their ability to ramp sales as the upstart nature of the enterprise will often preclude profitability. The thesis remains: as sales ramp higher, the company in time should realize economies of scale, which should allow profits to increase, thus enhancing overall profitability. The sales ramp post the November 2014 IPO remains positive, as recorded sales in 2015 ($69.6 million) accelerated to its current full year 2017 ($326.7 million), a very impressive rate thanks in large part to the overall neuromodulator market growing at a double-digit clip.

Upon a cursory glance at the revenue growth metric, the growth thesis remains intact as the sales ramp remains impressive. However, not all is right at Nevro as underlying growing pains have begun to emerge. Nevro has cycled through two VP of sales, a critical position for the company as a steady hand to guide sales growth is imperative for future growth. We continue to be perplexed by the sudden termination of James Alecxih, the recently-installed Vice President of Worldwide Sales. Alecxih’s tenure at Nevro was a remarkably brief 8-months adding doubt to the stability of the management team as a bit of a revolving door at VP of sales has emerged.

The surprise July 13th 8-K post rattled the nerves of shareholders as Nevro sold off over 12% on the news. Nevro’s revenue recognition remains lumpy with exaggerated post earning moves as the company’s inability to hit sales targets continues to weigh on investor sentiment. We find it particularly perplexing that the VP of sales position remains a proverbial revolving door with Alecxih serving as the second VP of sales in roughly a one-year time span with the announcement of previous VP Michael Enxsing is no longer with the company as of July 5, 2017, 8-K filing. The uncertainty over who will replace Alecxih along with which direction the sales team focus will take post the announcement of a new hire continues to weigh in investor enthusiasm.

Patent Litigation

Nevro remains locked in a heated litigation battle with far superior capitalized medical device behemoth Boston Scientific (BSX) over the patent estate covering Nevro’s paresthesia free spinal cord stimulator (SCS) suite of products. The litigation battle is a high-stakes affair for Nevro as an invalidation of the patent estate would, in our view, irreparably harm the company as the better-capitalized players can devote far more resources coupled with leveraging long-standing physician relationships to muscle Nevro out of the marketplace. The share price of Nevro plunged over 30% in early trading on July 25 based off a report the Court had invalidated a portion of Nevro’s IP estate setting of a selling cascade with Nevro at one point quoted below $36 per share a level last seen in the companies infancy in 2015.

Nevro issued a press release later in the day on July 25th detailing the Court’s decision to uphold a portion of the IP estate, which the management team at Nevro, believes will preclude Boston Scientific from entering the marketplace with a similar spinal cord stimulator device that operates between the 1.5 kHz and 100 kHz spectrum in the United States. Management’s confidence in its patent estate was validated a few days later via a press release in which Boston Scientific conceded to the Court it has no intention to release an SCS system in the US, thus removing a potential competitor from the market.

Path Forward

In our view, Nevro remains at the crossroads as the company dodged an existential death blow to its patent estate. However, the Court win should not be viewed as an “all clear” signal as additional well-heeled competitors such as Abbott Labs (ABT) St Jude division offer competitive products. We suspect the sales traction difficulty revolves in large part to the smaller size of Nevro which inherently brings up trust issue with the physicians who decide which product suite they will train and utilize in operations. Nevro has its work cut out for it to establish a brand name, which may help assuage concerns physicians may have concerning durability, support, quality, and reputation that may be preventing greater uptake of the product.

Our Take

Our enthusiasm for Nevro has waned considerably in light of the revolving door in the critical sales leadership position. We find the lack of cohesion between upper management and the VP of sales as particularly troubling as we get the distinct feeling the company is adrift currently as it seeks a new sales leader to help drive sales and arrest the disturbing pattern of having to consistently lower sales guidance.

In light of recent developments, most notably the Boston Scientific litigation quasi-victory, we believe the optimal outcome for current shareholders is a takeout of the company as Nevro would be easily integrated into a much larger sales organization in a similar manner as arch-rival St Jude was acquired by Abbot Labs. The most logical candidate remains Boston Scientific, though there are no assurances an acquisition will materialize at this time or ever. We rate Nevro as high-risk speculative stock with warts beginning to appear pertaining to the original thesis. We have no plans to add the company to the simulated Best Ideas Newsletter portfolio.

December 10, 2017: Follow Up on Loxo Oncology, Clovis Oncology, and Nevro

May 31, 2017: Nevro: An Exciting But Risky Medtech Idea in the Early Stages of Its Growth

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent healthcare and biotech contributor Alexander J. Poulos does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.