Former simulated Dividend Growth Newsletter portfolio idea Medtronic turned in a strong fiscal 2019 first quarter earnings report August 21 as organic revenue advanced nicely.

By Kris Rosemann

Medical device giant and former simulated Dividend Growth Newsletter portfolio idea Medtronic (MDT) released its fiscal 2019 first quarter report August 21, revealing solid revenue growth on a comparable constant currency basis, which adjusts for the divestiture of its Patient Care, Deep Vein Thrombosis, and Nutritional Insufficiency businesses, of 6.8% from the year-ago period. Solid double-digit top-line growth in Pain Stim and Neurovascular and Neurosurgery were key drivers in the quarter in its ‘Restorative Therapies Group’ segment, which turned in its best organic growth in segment history, and its ‘Diabetes’ segment drove revenue growth of 26.3% on a constant currency basis thanks in part to ongoing patient demand for its MiniMed 670G insulin pump system.

Image source: Medtronic earnings presentation

Medtronic was also able to drive operating margin expansion of roughly 80 basis points from the year-ago period while still growing R&D spending thanks in part to company-wide cost savings initiatives in SG&A and a favorable currency impact. Non-GAAP diluted earnings per share grew 9% on a year-over-year basis in the quarter when adjusting for the divestiture and currency exchange rate changes. The company’s operating cash flow more than doubled in the period to $1.7 billion, helping drive free cash flow to $1.4 billion from $459 in the first quarter of fiscal 2018. Cash dividends paid in its fiscal first quarter came in at $677 million, and Medtronic was able to lower its net debt position to $14.2 billion from $14.5 billion at the beginning of fiscal 2018 and $19.7 billion at the end of fiscal 2017. Its Dividend Cushion ratio currently sits at 2.2, and shares yield ~2.1% as of this writing.

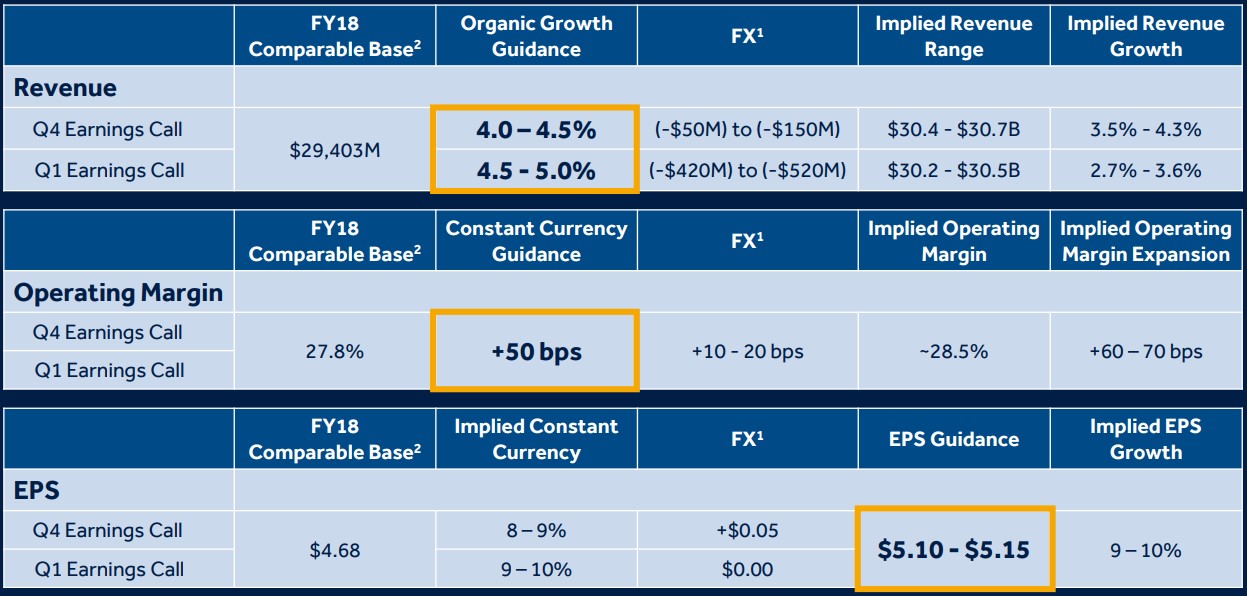

Management noted that its strong fiscal first quarter resulted in it growing its markets and driving share gains across multiple businesses, which gave it the confidence to raise its full year organic revenue growth target to 4.5%-5% from 4%-4.5%. The company maintained its diluted non-GAAP earnings per share guidance range of $5.10-$5.15, and it remains focused on driving free cash flow growth to boost capital returns to shareholders and reinvestments in future growth. Medtronic repurchased $824 million worth of its shares in its fiscal first quarter, pushing its capital returned to shareholders to $1.5 billion in the period. Management is not backing down from its shareholder friendly ways, but buybacks may not be the best use of capital at this juncture given our opinion of its valuation. Shares are currently trading just above our fair value estimate of $91.

Image source: Medtronic earnings presentation

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.