Image Source: Facebook’s second-quarter slide presentation

We were blindsided by Facebook’s outlook, and so was the market. Nobody feels worse about the Facebook idea than we do. Not only was Facebook a top weighting on the Valuentum Buying Index, but it also grew to a rather large position in the simulated Best Ideas Newsletter portfolio. We added Facebook to the simulated Best Ideas Newsletter portfolio at $112.10 in January 2016, and a good portion of its outsize returns have been eroded since its peak at ~$220. We still like shares, but for the company to return to top-rated status, the market would have to get behind it in the form of an advancing stock price.

By Brian Nelson, CFA

We wrote up Facebook’s second-quarter results and covered its disappointing outlook in our July 26 note, “Facebook Wounds Self-Inflicted, Margin Guidance Issued to Ease Political Pressure,” and we don’t intend to recap that piece in this one. Please be sure to read that note. In short, the executive team at Facebook caught investors by surprise when it reported lower-than-expected second-quarter results and gave forward guidance that shook the confidence of many investors:

Turning now to expenses; we continue to expect that full-year 2018 total expenses will grow in the range of 50% to 60% compared to last year. In addition to increases in core product development and infrastructure, this growth is driven by increasing investment in areas like safety and security, AR/VR, marketing, and content acquisition. Looking beyond 2018, we anticipate that total expense growth will exceed revenue growth in 2019.

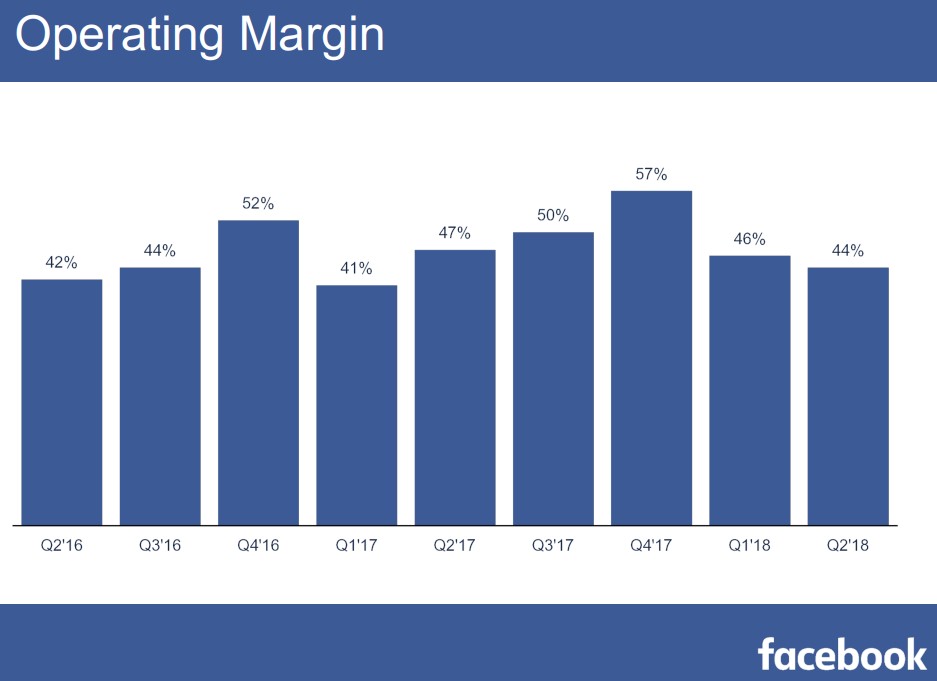

Over the next several years, we would anticipate that our operating margins will trend towards the mid-30s on a percentage basis. We expect full-year 2018 capital expenditures will be approximately $15 billion, driven by investments in data centers, servers, network infrastructure, and office facilities. We plan to continue to grow capital expenditures beyond 2018 to support global growth and our ongoing product needs (source: Facebook’s second-quarter 2018 conference call).

We maintain our view that shares of Facebook are underpriced. We now assume revenue growth will fade to 12% by Year 5 in our valuation model, and that the company’s operating margin will fade to 35% over the same time (its operating margin was 44% in the second quarter). We use a near-9% cost of capital assumption to discount future free cash flows, and we’re modeling $15+ billion in capital spending in the out-years. The low end of our fair value estimate range is ~$190, which itself is a far cry from where shares are currently trading ~$170.

We’re not happy to have been blindsided by management guidance that we think may turn out to be overly conservative, as the management team is under considerable public and Congressional pressure, in our view. Our updated fair value estimate is $236 per share, and Facebook’s Valuentum Buying Index rating is now a 6. We continue to like shares, but we’d like to see market support behind them as evidenced by an advancing stock price. Facebook’s updated 16-page report is now available for download. Shares were first added to the simulated Best Ideas Newsletter portfolio in January 2016 at ~$112.

Related: TWTR, SNAP, SOCL

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.