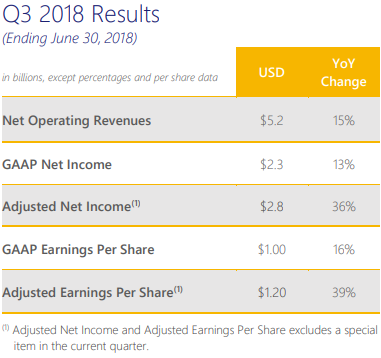

Image shown: The share-price performance of Visa (V) and PayPal (PYPL), top chart, since PayPal split from eBay (EBAY), relative to S&P 500 (SPY), bottom chart.

Simulated Best Ideas Newsletter portfolio ideas Visa and PayPal both had their calendar second quarter results impacted by one-time items, but we continue to like these strong companies that operate in the very attractive financial technology services industry.

By Kris Rosemann

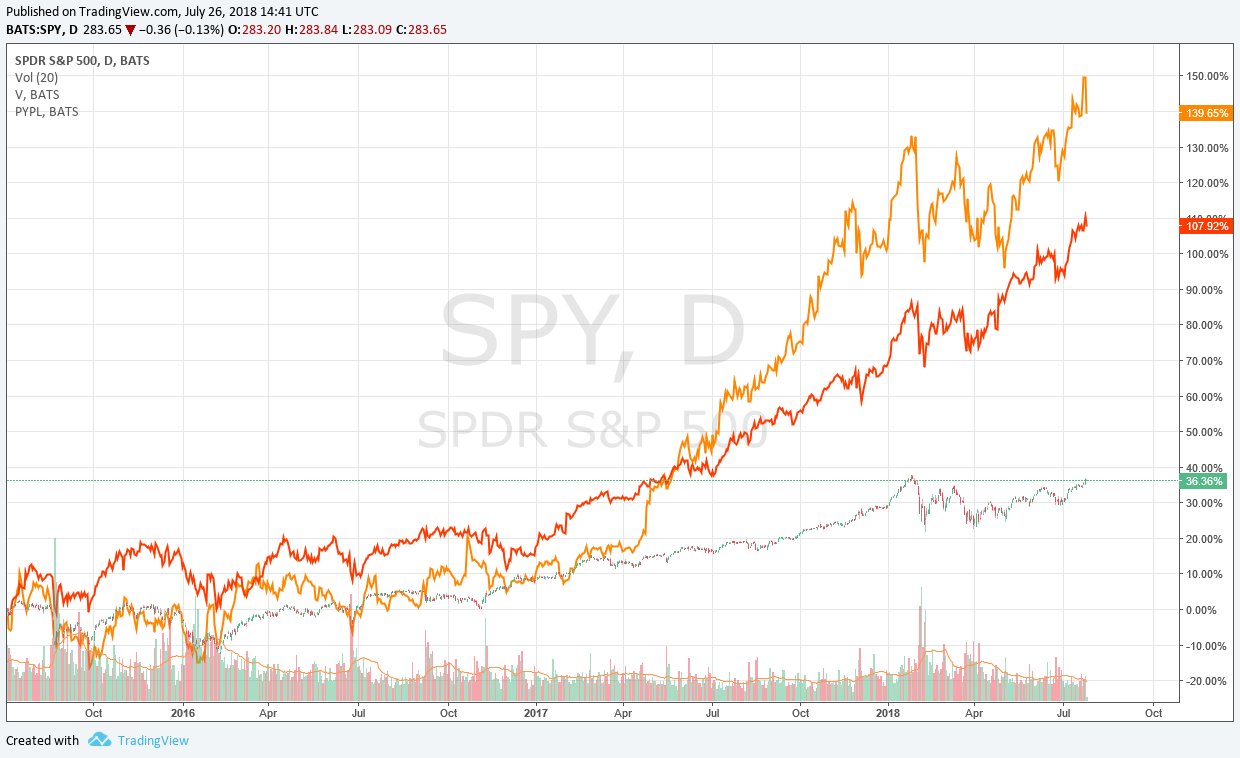

Visa’s Fundamentals Rock Solid; Litigation Impacts Quarterly Results

Simulated Best Ideas Newsletter portfolio idea Visa (V) turned in a solid fiscal third quarter report after the close July 25 as net operating revenue grew 15% from the year-ago period and adjusted net income leapt 36%. However, a $600 million litigation provision weighed down GAAP bottom-line numbers as GAAP net income advanced 13% on a year-over-year basis. Though its net cash position on the balance sheet is no longer, the company’s asset-light business continues to throw off tremendous levels of free cash flow, turning in $8.7 billion in free cash flow through nine months in fiscal 2018, a 47% increase from the comparable period of fiscal 2017.